COVID-19 Bulletin: September 3

Good Afternoon,

More pandemic news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices dipped yesterday on concerns that maintenance at oil refineries will reduce crude demand in the near term.

- Crude prices were lower in early trading today, with the WTI down 2.0% at $40.69/bbl and Brent off 1.9% at $43.35/bbl.

- Saudi Aramco is delaying petrochemical projects and diversification plans to preserve cash.

- The global oil industry has an estimated 10% glut of refining capacity that will worsen as new refineries come onstream in China and the Middle East, putting older refineries in jeopardy, especially in Europe.

- NOVA Chemicals announced an alliance with Canada’s largest plastics recycler to increase the supply of post-consumer recycled (PCR) plastic for packaging.

Supply Chain

- Typhoon Maysak struck South Korea yesterday with 110 mph sustained winds, equivalent to a Category 3 hurricane.

- Tropical Storm Nana was expected to reach hurricane strength before striking Central America near Belize today.

- The August Logistics Managers’ Index (LMI) jumped from 63.0 in July to 66.0 in August, the highest reading in nearly two years. The LMI report highlights the dramatic contraction of transportation capacity and inverse increase in transportation prices.

- The European Union plans a more activist industrial policy to reduce the region’s dependence on some imported raw materials after supply disruptions caused by the pandemic.

- Kansas City Southern railway is the target of an $18 billion takeover bid by a private equity consortium.

- Warehouse workers, battered by COVID-19 and overwork during the pandemic, look ahead to the busy holiday season with trepidation.

- We anticipate the Labor Day holiday will cause roadway congestion this weekend and early next week, impacting trucking capacity, pricing and performance.

- The Commercial Vehicle Safety Alliance has scheduled its (USA/CAN/MEX) Roadcheck for September 9 to 11 — we expect this to reduce capacity and service levels for the week.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

- New COVID-19 infections fell below 40,000 yesterday.

- States experiencing rising trends for new COVID-19 cases this week declined to 21 from 28 yesterday.

- Iowa has become the nation’s COVID-19 hotspot, with cases up 50% in the past two weeks as schools reopen and the state resists mask mandates.

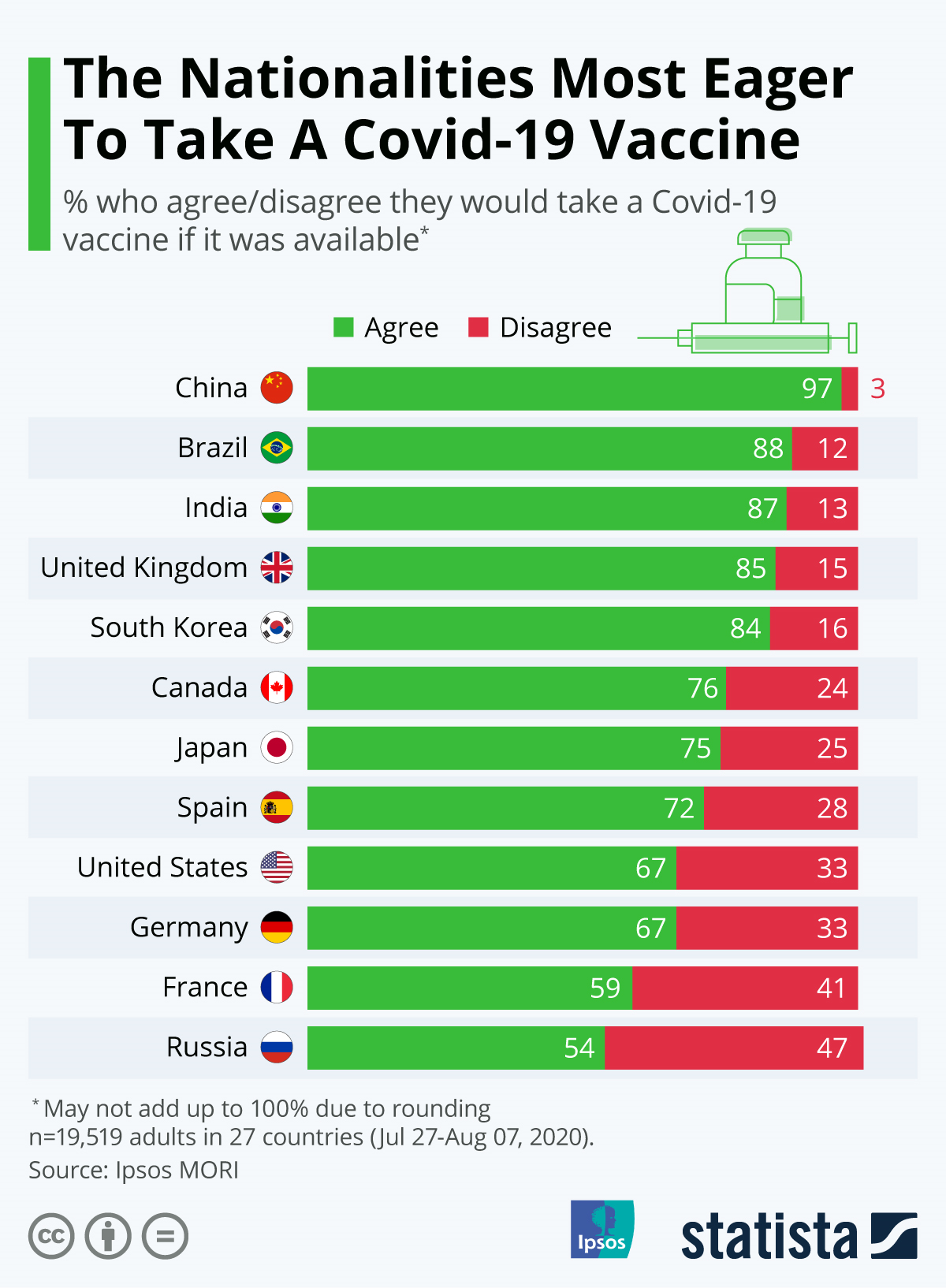

- Suspicion of vaccines could frustrate efforts to distribute an eventual vaccine.

- COVID-19 “long haulers” experience at least 98 disparate physical and mental complications from the virus long after testing negative.

- U.S. factory orders rose for the third straight month in July, up 6.4%.

- First-time jobless claims fell to 881,000 last week, lower than economists expected and the lowest weekly total of the pandemic.

- Private companies added 428,000 employees in August, according to ADP, less than half of what economists expected.

- In its latest Beige Book report, the Federal Reserve said the economic recovery slowed in August due to continued uncertainty about the pandemic.

- The federal deficit will top $3.3 trillion when the fiscal year ends at the end of this month, according to the Congressional Budget Office, with a $1.8 trillion shortfall expected in 2021. National debt now approximates GDP and is at its highest level since WWII.

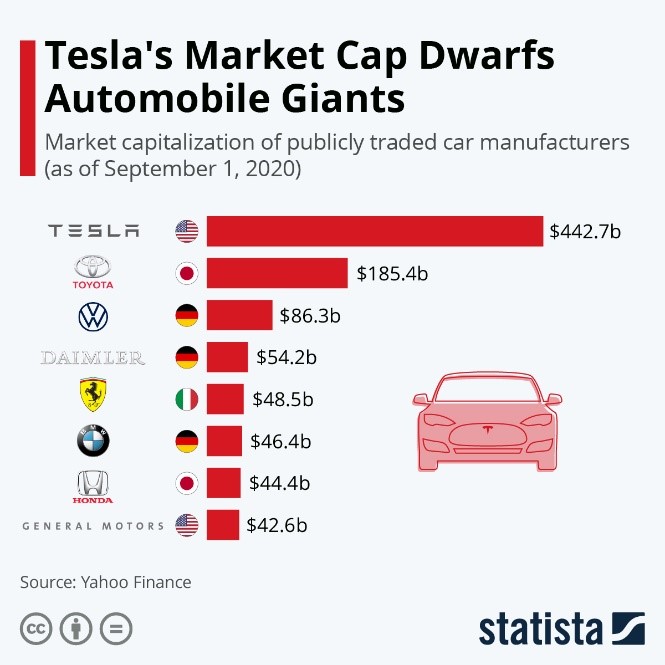

- GM and Honda entered an alliance to share platforms and technology in North America.

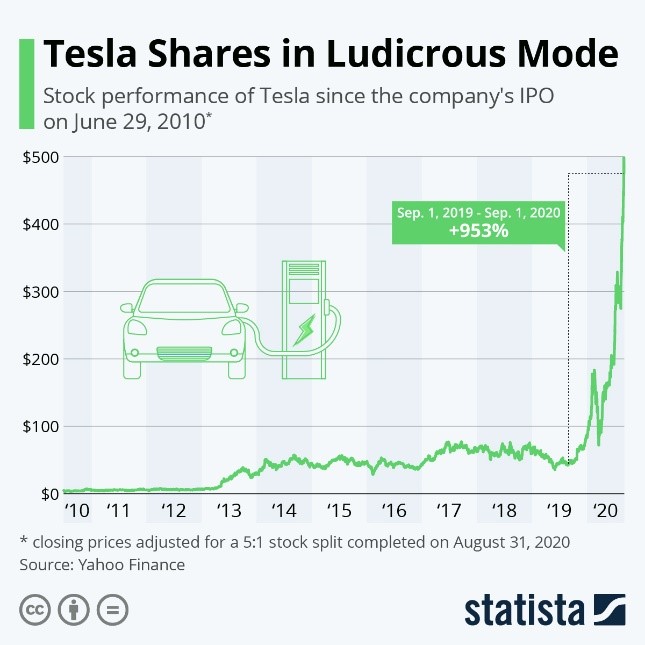

- Electric vehicle maker Tesla, the most valuable car company in the world, plans to raise $5 billion in public markets while its stock price is soaring following this week’s split.

- With no additional federal help for airlines in sight, United Airlines said it will furlough over 16,000 employees in October, fewer than earlier projected after many employees accepted reduced hours, voluntary severance and early retirement offers.

- With 80% of consumers having ordered groceries online since the pandemic, Whole Foods opened its first “dark” store in New York dedicated solely to home delivery.

- Tents, webcams and other safety gear are in high demand from reopening schools, with the average school district expected to spend $400,000 on pandemic defense.

- Lego sales jumped 7% in the first half of the year, with direct sales to consumers up 13% as families turned to toys for homebound entertainment.

- California’s legislature passed a bill, which the governor is expected to sign into law, mandating that plastic bottles must contain 50% recycled content by 2030.

- With less than 10% of plastic waste recycled in the U.S., the Recycling Partnership and the World Wildlife Fund have launched the U.S. Plastics Pact, a coalition of governments, companies and NGOs dedicated to making all plastic packaging reusable, recyclable or compostable.

- Some companies are employing digital technology to promote reusable plastics, such as IoT vending machines for dispensing products into reusable containers, reusable to-go cup clubs linked through the internet, and “buy anywhere, return anywhere” programs for returnable packaging.

- Heineken began producing beer in the Netherlands using 100% green energy, including contents and packaging, part of its effort to make the company fully circular by 2030.

International

- Yesterday, Indonesia reported a record high daily count of new infections and the highest daily death rate since July.

- Thailand reported a locally transmitted COVID-19 case yesterday, snapping a 100-day streak without an infection and casting doubt that border restrictions might be eased to revive the important tourism industry.

- Mexico has the highest rate of COVID-19 deaths among healthcare workers globally.

- The U.S. Federal Reserve’s policy statement last week favoring low interest rates over preemptively controlling inflation has put upward pressure on the euro, which strengthened to an all-time high Tuesday, up 8% since February against a basket of foreign currencies.

- The European Central Bank (ECB) expressed concerns that the strong euro could derail Europe’s economic recovery; the euro declined yesterday on speculation the ECB might pursue further monetary easing.

- China’s currency approached a 16-month high against the U.S. dollar today.

- France announced, “France Relaunch,” a $118 billion stimulus program to help revive the economy.

- European retail sales fell 1.2% in July; economists had expected a rise.

- Purchasing Manager Indexes in Italy and Spain fell below 50 in August, signaling a decline in economic activity after spikes in new COVID-19 cases in Europe.

- Italy’s former Prime Minister Silvio Berlusconi tested positive for COVID-19 yesterday.

Our Operations

- We will be closed next Monday for the Labor Day holiday.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.