COVID-19 Bulletin: September 28

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were higher in mid-day trading today with the WTI at $40.57/bbl and Brent at $42.23/bbl.

- The natural gas price was modestly lower in early trading today at $2.08/MMBtu.

- Devon Energy is negotiating to acquire competitor WPX, continuing a trend of consolidation in the shale industry as producers seek scale to counter pressures from the industry downturn.

- The Baker Hughes count of active oil rigs rose by 4 to 183 last week; active gas rigs rose by 2 to 78. The total rig count is down by 599 from a year ago.

- Despite high interest, bioplastics are only growing on pace with the plastics industry due to product limitations and capacity constraints.

Supply Chain

- Much of Northern California was under red flag warnings due to wildfires, as dry, windy weather stoked several existing fires and spawned new ones that burned tens of thousands of acres over the weekend. More than 3.6 million acres in the state have been scorched this fire season.

- With traditional insurers denying business interruption claims during the pandemic, Marsh & McLennan said the number of captive insurers it set up this year has tripled as companies seek protection against supply chain disruptions.

- As China pursues a policy of “domestic circulation” aimed at localizing supply chains and raising domestic consumption, many exporters find they are making products that domestic consumers don’t want.

- The European Union is considering including shipping under its Emissions Trading System, which would effectively impose a tariff on international carriers, prompting an outcry from foreign shipping companies.

- Two recent surveys highlight a continuing truck driver shortage that is escalating freight rates.

- Trucking capacity remains tight throughout the U.S., and spot pricing remains elevated.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

- Every Midwest state except Ohio is experiencing rising COVID-19 infections as the virus spreads to smaller communities, and 10 states recorded record daily infections during September.

- New COVID-19 infections in the U.S. averaged more than 40,000 a day in the past week.

- COVID-19 infections in 27 states are trending higher this week.

- Florida lifted most business and social distancing restrictions as it entered Phase 3 of its reopening.

- California’s top health official projected that COVID-19 hospitalizations in the state could rise by 89% in coming weeks.

- The surge in COVID-19 infections in Houston in June and July involved a mutation of the virus that is more infectious and potentially deadly, according to a study.

- The U.S. dollar was at a two-month high today amidst uncertainty about the global economic outlook and pending U.S. elections.

- Leaders in the White House and House of Representatives plan to renew discussions of a fourth-phase stimulus package this week.

- With millions unemployed and many small companies cutting healthcare coverage, up to 12 million people could lose their employer-based insurance by the end of 2020.

- With utility moratoriums expiring in many states, service cutoffs are rising for many facing financial distress during the pandemic.

- Durable goods orders rose 0.4% in August, well below analyst estimates of a 1.5% increase and gains made in the prior three months.

- Virginia’s governor and his wife tested positive for COVID-19.

- Corporate compliance officers face a host of new risks during the pandemic, from changing regulations to cybersecurity risks to supply chain changes to employee safety.

- Applications for tax ID numbers have risen to 3.2 million this year from 2.7 million in 2019 as entrepreneurs start new businesses at the fastest pace in more than a decade.

- Furniture maker Herman Miller is preparing for a surge in demand for office furniture from companies changing work configurations as they reopen offices.

- Clorox continues to add capacity to address shortages of cleaning products after increasing production capability by 50% so far this year.

- American Airlines tapped the federal government’s $25 billion loan program for struggling airlines, receiving $5.5 billion with the possibility of another $2 billion in October.

- Two studies suggest that long airline flights increase the risks of COVID-19 infection.

- Amazon will extend its annual Prime Day, postponed from July, to two days — October 13 and 14.

- Supermarkets and food distributors are building inventories in anticipation of a predicted surge in COVID-19 cases as the holidays approach.

- Campbell Soup and other companies are paring their product offerings, shifting production capacity to products especially high in demand during the pandemic.

- Technology company Continental has introduced a plastic shield adaptable to any passenger car to reduce risks of COVID-19 infection.

- 3D printing promises to extend beyond plastics in healthcare to bioprinting of organs and body parts.

- Google, seeking ways to attract and retain employees during the pandemic, will begin offering student loan assistance as a new benefit.

International

- Germany’s chancellor warned that the country could soon see more than 19,000 infections a day. Germany expects to borrow 6 billion euros more than planned in the fourth quarter to combat the pandemic.

- South Korea has performed the best among developing countries in combating and co-existing with COVID-19. The country recorded just 50 new infections yesterday, the lowest daily rate in more than a month.

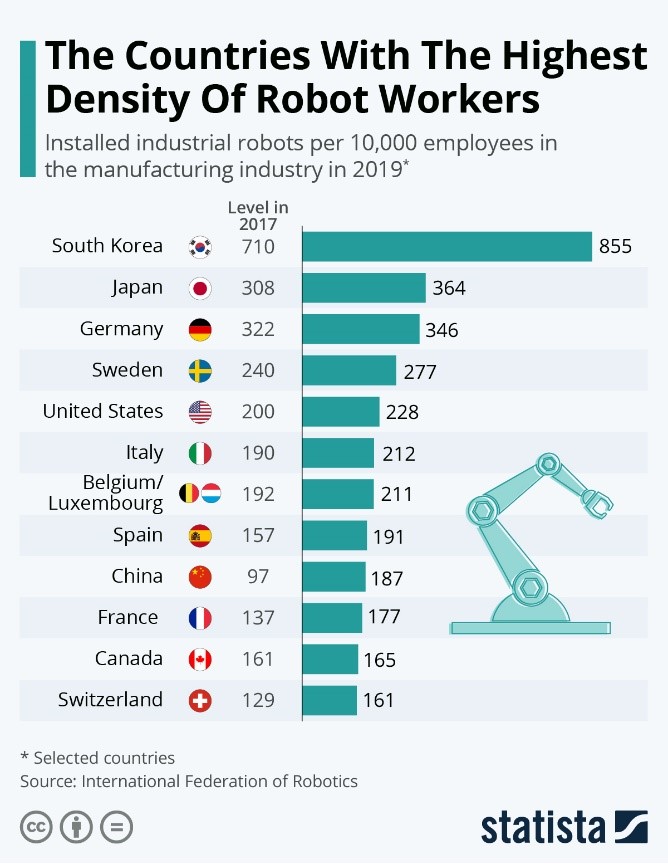

- South Korea has the highest utilization of production robots in the world:

- China’s middle class has begun shopping again as the nation’s economic recovery continues to spread beyond luxury goods. However, low-income and migrant workers still struggle.

- China’s economic recovery has propelled its currency to its biggest quarterly gain against the U.S. dollar since 2008.

- China’s commitment last week to achieve carbon neutrality by 2060 marks the fourth of the world’s six largest economies to establish goals for ending carbon emissions.

- China is curtailing imports of frozen goods from countries with high COVID-19 infection rates after pathogens were detected on food packaging on several occasions.

- Global office vacancies will not get back to pre-pandemic levels for five years, according to Cushman & Wakefield.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.