COVID-19 Bulletin: September 24

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices ended higher yesterday on a reported drop in U.S. stockpiles but are under early pressure today.

- In early trading, the WTI was at $39.58/bbl and Brent at $41.45/bbl.

- The natural gas price rebounded above $2 in early trading today, up 5.7% at $2.25/MMBtu.

- The Energy Information Administration said global oil markets will not return to balance until late in 2021.

- If “peak oil” has arrived, producing nations may be forced to compete to attract oil companies to invest, straining national and corporate alliances and changing industry dynamics.

- While renewables are expected to grow the fastest among energy sources this decade, natural gas should also continue to gain share over coal and oil as the preferred source for stabilizing electric grids.

- Total will close a refinery and storage facility near Paris and spend more than $580 million to replace it with facilities to produce clean energy and bioplastics.

- Total and Corbion plan to build a 100,000-ton-per-year PLA bioplastics plant in France through their PLA joint venture.

Supply Chain

- A high pressure weather system, or heat dome, is expected to build in the West this weekend, creating conditions conducive to more wildfires as firefighters continue to struggle to control dozens of blazes.

- The recent rise in manufacturing may be due in part to a rebuild of inventories drawn down early in the pandemic and economic shutdowns, providing a welcome but perhaps temporary boost to the economy.

- Trucking capacity remains tight throughout the U.S., and spot pricing remains elevated.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

- There were 37,330 new COVID-19 infections in the U.S. yesterday, down slightly from the prior day, but fatalities rose to 1,098.

- A study published yesterday of COVID-19 patients in Greater Houston suggests the virus is mutating, which could make it more contagious and complicate the development of a vaccine.

- The CDC reported that the median age of COVID-19 victims in the U.S. declined from 46 years in May to 37 years in July and 38 in August. Infections from June through August were highest in persons aged 20 to 29 years, who accounted for over 20% of all confirmed cases.

- The CDC issued guidance for celebrating the holidays, recommending small gatherings of known people, preferably held outdoors.

- Missouri’s governor, a vocal opponent of mask mandates, has tested positive for COVID-19, along with his wife.

- New unemployment claims remained stubbornly high last week, up over 4,000 from the prior week at 870,000.

- The U.S. Purchasing Managers Index slipped slightly to 54.4 in September from August, indicating the economic recovery is continuing but may be losing momentum.

- The Business Roundtable called for more federal economic aid and “comprehensive and coordinated efforts” to address the pandemic.

- A prominent economist warned of economic data pointing to a crash of the U.S. dollar in 2021 and growing risk of a double-digit recession.

- Nine thousand New York City employees will face five-day furloughs in coming months as the city wrestles with a $7 billion budget gap caused by the pandemic. The city is intensifying social distancing warnings in some neighborhoods experiencing spikes in infections.

- Undergraduate college enrollment dropped 2.5% this year, with an 11.2% drop in enrollment of non-resident aliens.

- Many colleges are waiving ACT and SAT testing requirements in their admission processes due to testing cancellations caused by the pandemic.

- Prominent CEOs have widely varying opinions of working from home.

- Most Google employees do not want to return to offices full time, prompting the company to explore permanent hybrid work-from-home models.

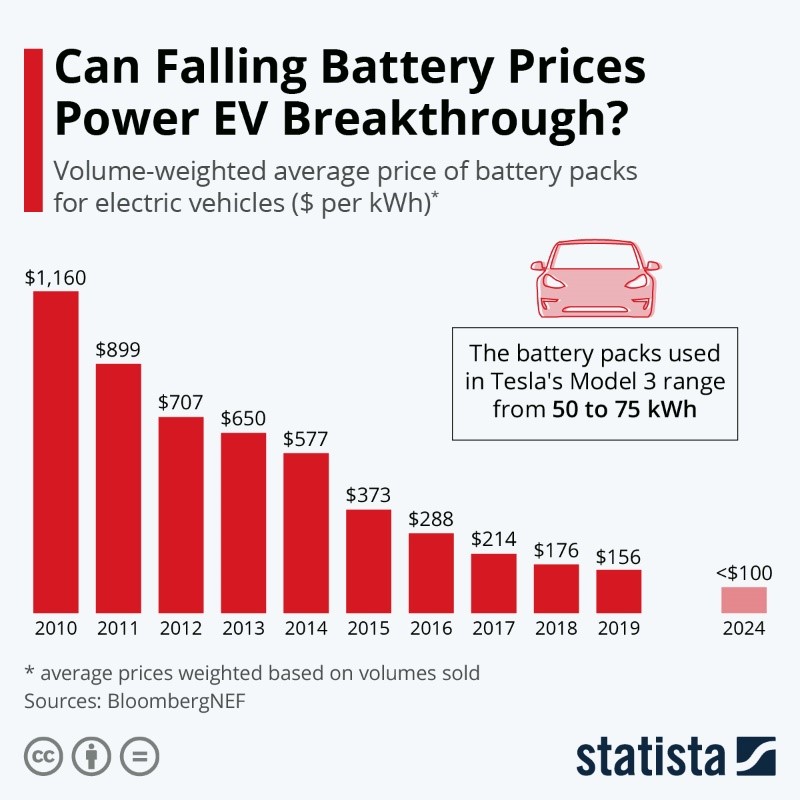

- California’s governor issued an order that will phase out internal combustion engines and ban the sale of gasoline-fueled cars by 2035, the first state to do so.

- Volkswagen unveiled its ID.4 electric crossover as it aims to take on Tesla in the U.S. market.

- Falling battery prices are making electric vehicles more competitive than internal combustion counterparts:

- General Mills, in reporting better-than-expected quarterly results and a dividend increase, continued to benefit from strong demand for packaged goods and has seen a 91% increase in 18- to 24-year-olds visiting its websites.

- Online sales of computers and consumer electronics will be up nearly 18% this year and comprise nearly half of all e-commerce sales.

- Bankrupt Chuck E. Cheese received court approval to spend $2.3 million to shred over 7 billion prize tickets as it plans to emerge from bankruptcy with touchless electronic ticketing.

- Disney is pushing out release dates for several highly anticipated movies by at least six months as theaters struggle to attract wary customers.

- New York’s Metropolitan Opera canceled its entire 218-performance season, the first lost season in its nearly 140-year storied history.

- The Biodegradable Products Institute released labeling and identification guidelines for compostable waste.

International

- Eleven of 15 countries with the highest COVID-19 death rates are in Latin America and the Caribbean as total infections in the region approach 9 million.

- Europe, experiencing a second COVID-19 wave, is focusing on localized restrictions rather than broad lockdowns to combat the virus.

- European Union lawmakers voted in favor of more taxes to pay off pandemic debt, including a possible tax on un-recycled plastics.

- Africa has outperformed other regions of the world in fighting the pandemic, with just 1.4 million infections among a population of more than a billion people, with the Africa Centres for Disease Control coordinating early interventions across its 55 member states.

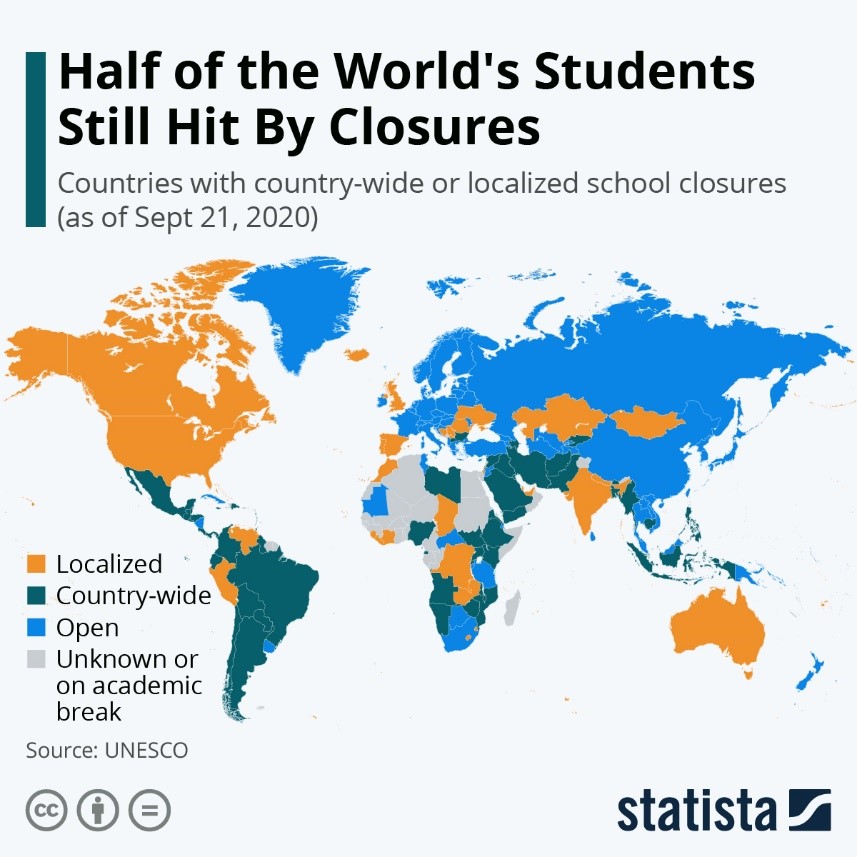

- Half of the world’s students remain impacted by school closures due to the pandemic:

- Economists are reconsidering projections for a continuing economic recovery in Europe, now weighing whether a second COVID-19 wave will trigger a double dip recession.

- Canada’s prime minister said the government will do “whatever it takes” to combat a second wave of COVID-19 gripping the country and painted a grim outlook for the remainder of the fall. Two opposition leaders did not attend the rare televised address because they are infected with the virus.

- Saudi Arabia is opening major mosques in Medina and Mecca, closed in March, as it strives to revive its economy.

- Turkey’s central bank raised interest rates in an effort to strengthen the country’s flagging currency.

- Lufthansa Airlines will begin rapid COVID-19 testing for passengers beginning in October.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.