COVID-19 Bulletin: September 10

Good Afternoon,

We are mourning the passing of Joan Holland, 91, who co-founded M. Holland Company with her husband, Marvin, 70 years ago.

More pandemic news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were down more than 1% in early trading today, with the WTI at $37.53/bbl and Brent at $40.35/bbl.

- The natural gas price was down 2% at $2.36/MMBtu.

- The American Petroleum Institute said domestic crude inventories rose by nearly 3 million barrels last week, more than twice analyst estimates.

- Tankers are again being employed as floating storage for rising global crude inventories as demand stagnates.

- The U.S. Department of Energy reported that Hurricane Laura did extensive damage to the Strategic Petroleum Reserve site in West Hackberry, Louisiana, one of four such sites. The 8.2-billion-gallon site holds about 30% of the nation’s strategic crude reserves.

- Enterprise Products is canceling a planned pipeline intended to transport crude from Midland to refineries in Texas due to the downturn in the energy industry.

- Pemex has suffered 321 COVID-19 fatalities among employees and contract workers, more than any other company.

Supply Chain

- Nearly 200 wildfires scorched millions of acres across seven western states, fueled by hot weather and high winds.

- UPS plans to hire more than 100,000 seasonal workers in preparation for a surge in online holiday shopping.

- Kansas City Southern rejected a $20 billion takeover offer from a private equity group, ending talks for now. The Class 1 railroad reinstated earnings guidance in announcing improving tonnages.

- Parcel delivery companies are pressing for the rapid development of electric delivery vehicles as surging e-commerce creates demand pressure.

- The Commercial Vehicle Safety Alliance (USA/CAN/MEX) Roadcheck runs from yesterday through Friday — we expect this to reduce capacity and service levels for the week.

- Trucking capacity remains tight throughout the U.S., and spot pricing remains elevated.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

- Total deaths from COVID-19 surpassed 190,000 in the U.S. New cases nationally increased to 34,256 yesterday, about 10,000 higher than the previous day, while daily deaths more than doubled from 445 Tuesday to 1,206 yesterday.

- Fourteen states have rising infection trends this week.

- There were 884,000 new jobless claims last week, on par with the prior week but higher than economist estimates.

- Job openings increased a better-than-expected 10% in July, but the pace of hiring slowed, signifying a sluggish economic recovery.

- Amazon is holding a career day on September 16 as it seeks to fill 33,000 salaried and tech openings.

- More Americans are voluntarily leaving their jobs, an indication they are growing more confident about the employment market.

- New York City restaurants can commence limited indoor dining for the first time since mid-March.

- United Airlines is close to a deal with its pilots’ union that could reduce the number of announced layoffs by close to 3,000. The airline previously said it would reduce its workforce by 36,000 through voluntary severance, early retirement offers and forced reductions.

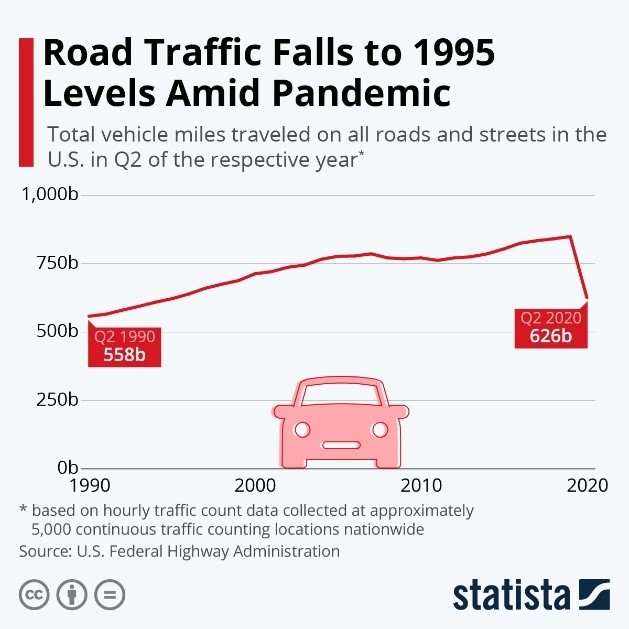

- U.S. road traffic fell to its lowest level in a quarter century in the second quarter.

- Toyota is investing $800 million to create the Woven Capital R&D fund to invest in autonomous vehicle technology and smart cities.

- California electric-vehicle startup Lucid Motors introduced its first production model sedan, the Lucid Air, which will go into production in 2021 and can go 517 miles on a single charge.

- Truck manufacturer Navistar reported a third-quarter loss on a nearly 45% drop in revenue. The company plans to make electric trucks at its San Antonio, Texas, site on the same assembly line on which it builds diesel trucks.

- JCPenney averted liquidation by striking a deal to sell its assets to property managers Brookfield Property Group and Simon Property Group for $1.75 billion.

- McDonald’s is partnering with TerraCycle to use its Loop circular service to test reusable hot beverage cups in the U.K. starting in 2021.

International

- Indonesia, which experienced record new COVID-19 infections Thursday, will reimpose social distancing restrictions in capital city Jakarta.

- The Bank of Canada kept interest rates near zero and said it will continue quantitative easing measures as it prepares for “a protracted and uneven recuperation phase” for the economy.

- Singapore Airlines, which flies only internationally and is currently operating at less than 10% of capacity, plans to cut 4,300 positions, or 20% of its staffing.

- European auto stocks are rising as consumers shift from air travel and mass transit to automobiles to reduce risk of COVID-19 infection.

- Electronic vehicles sales, though less than 5% of the global market, are outperforming sales of traditional automobiles during the pandemic.

- Luxury goods giant LVMH is backing out of its $14.5 billion deal, inked last November, to acquire Tiffany, citing tariff threats between France and the U.S. Tiffany sued to enforce the deal.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.