COVID-19 Bulletin: September 1

Good Afternoon,

More news relevant to the plastics industry:

Supply

- Brent crude briefly rose above $46/bbl yesterday, a five-month high, on strong demand in China and a weakening U.S. dollar.

- Crude prices were higher in early trading today, with the WTI at $43.07/bbl and Brent at $45.85/bbl.

- Natural gas prices retreated 6% yesterday before partially recovering on expectations of cooler weather. The price was at $2.60/MMBtu in early trading today.

- The recovery in U.S. gasoline consumption has fizzled over the past two months, portending obstacles for oil prices and the economic recovery.

- In the wake of Hurricane Laura, the following companies issued force majeure notices in the past two days:

- Chevron Phillips on PE products

- Sasol on PE products

- Westlake on PE products

Supply Chain

- A heat wave will drive the heat index above 110° F along the Louisiana coast, complicating the area’s recovery from Hurricane Laura and creating dangerous conditions for citizens who remain without power.

- Typhoon Maysak brushed Japan with hurricane-force winds and is expected to escalate to the equivalent of a Category 4 hurricane as it aims for landfall in South Korea.

- Japan, India and Australia agreed to work together to improve supply chain resilience in the Indo-Pacific region to counter China’s dominance.

- Amazon received FAA approval to fly its Prime Air drones, which are intended to deliver light packages in low population areas within 30 minutes.

- We anticipate the Labor Day holiday will cause roadway congestion this weekend and early next week, impacting trucking capacity, pricing and performance. Clients are urged to schedule shipments early this week.

- The Commercial Vehicle Safety Alliance has scheduled its (USA/CAN/MEX) Roadcheck for September 9 to 11 — we expect this to reduce capacity and service levels for the week.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

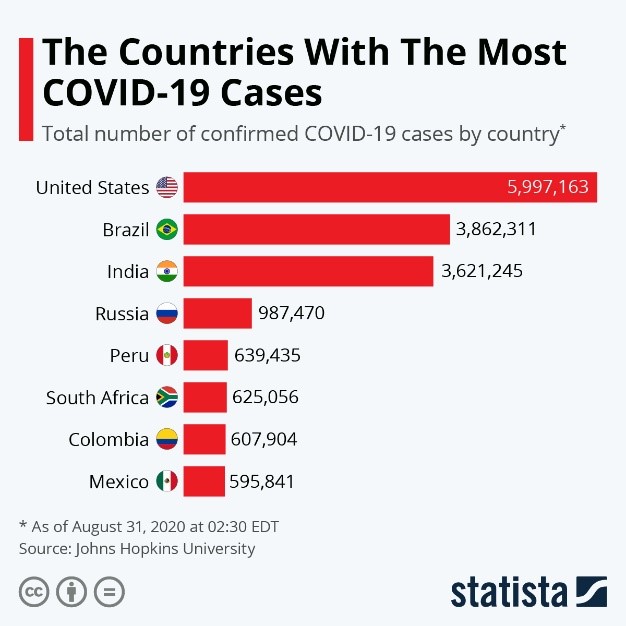

- COVID-19 infections in the U.S. surpassed 6 million, while deaths approached 184,000 this morning.

- More than half of U.S. states have testing positivity ratings above the CDC’s recommended 5% threshold.

- The dollar dropped in value to the lowest level in two years, prompting a rise in commodity prices.

- Forty states have signed up to provide $300 supplemental unemployment benefits under the White House’s recent executive order; however, the benefits are expected to provide only four to five weeks of relief by the time they take effect.

- Many companies are reluctant to implement the White House’s deferred tax program due to the administrative burden and concerns they could be on the hook if employees don’t repay what are essentially interest-free loans in 2021.

- The pandemic has prompted a mass migration in the U.S., as relocations from crowded Northeast regions and cities to the Sunbelt and suburbs has created a surge in relocations after they hit an all-time low in 2019.

- New home sales rose 13.9% from June to July, driven by low interest rates and pent-up demand, underscoring the uneven nature of the recovery.

- Chicago faces a $1.2 billion budget deficit in 2021 due to the pandemic and resulting collapse of the economy.

- New York City delayed laying off 22,000 workers as the mayor seeks approval to borrow money to help close a projected $9 billion revenue gap over the next two years.

- MBA grads face a barren job market this year as companies cut back their recruiting.

- A recent Gallup poll reveals that half of Americans fear a health issue could force them into bankruptcy.

- Absent more government rescue help, a wave of small business failures is looming this autumn as current federal aid programs expire and colder weather curtails outdoor dining and other activities.

- Bankrupt JCPenney faces possible liquidation after negotiations to sell itself to two mall property landlords collapsed.

- Landlords collected 77% of retail rents in July as retail eviction proceedings rise in courts throughout the country.

- Zoom Video Communications reported a quadrupling of sales and a doubling of earnings per share in its second quarter, driven by remote work and learning.

- Delta and American Airlines joined United in eliminating change fees.

- Ford plans to cut 1,000 salaried jobs as part of a sweeping restructuring.

- BMW plans to cut 125 salaried jobs due to weak conditions in the U.S. market.

- Two self-driving vehicle services are installing UV light emitters in their shuttles to protect passengers from COVID-19 and other bacteria.

International

- India’s economy shrank by nearly 24% year over year in the second quarter. With nearly 70,000 new COVID-19 cases reported yesterday, the country will soon displace Brazil with the second highest number of infections globally behind the U.S.

- Russia proceeded to reopen schools as its COVID-19 infections topped 1 million, becoming the fourth country with more than a million cases.

- Germany raised its forecast for 2020 GDP from a contraction of 6.2% to a 5.8% contraction, benefiting from improving domestic growth as opposed to its historic reliance on exports.

- The U.K. Purchasing Managers Index rose to 55.2 in August, the highest since 2014, as factories ramped up production.

- Car sales in France fell nearly 20% in August, erasing most of their gains from the prior two months and raising concerns about Europe’s fragile economic recovery.

- Global COVID-19 cases topped 25 million.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.