COVID-19 Bulletin: October 7

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The American Petroleum Institute reported a larger-than-expected inventory build for last week, which sent crude prices lower late yesterday.

- Crude prices were weaker in early trading today, with WTI down 2.7% at $39.57/bbl and Brent down 2.2% at $41.70/bbl. Natural gas was 0.8% higher at $2.54/MMBtu.

- As companies, such as BP and Shell, begin planning for a shift to renewable energy, Saudi Aramco plans to boost oil production capacity even as prices are lower.

- Canada-based oil refinery operator Irving Oil ended a deal to purchase North Atlantic Refinery Limited, an idled 135,000 barrels-per-day refinery in Newfoundland.

- Oil production in the Permian Basin, which supplies almost 40% of all oil and 15% of natural gas production in the United States, is struggling to recover from a drop in demand.

- Carbon prices jumped 4% yesterday after the European Parliament announced proposals to toughen Europe’s carbon reduction goals as part of the Green Deal, a comprehensive initiative under negotiation aimed at dramatically reducing carbon emissions.

- Deloitte estimates that a preponderance of the 107,000 lost oil and gas jobs this year will not begin to come back before late 2021.

- Construction equipment company Caterpillar is acquiring the oil and gas division of Scotland-based Weir Group, a provider of oil and gas drilling equipment and services, for $405 million.

- The government in Ottawa will release a list of banned single-use plastics in Canada today and plans to designate plastics as a toxic substance, a blow to the country’s petrochemical industry and Alberta’s initiative to establish a recycling hub.

Supply Chain

- After surging to Category 4 strength, Delta weakened to a Category 3 hurricane before striking Mexico’s Yucatan Peninsula early today. It is expected to accelerate back to Category 4 strength as it aims for the U.S. oil producing region along the Gulf Coast on Saturday.

- BP and BHP have begun evacuating employees from their offshore platforms along the Gulf Coast.

- California’s first “gigafire” — a fire covering more than one million acres of land — is about 59% contained, authorities say.

- A consortium of 17 major trading and shipping companies pledged to cut carbon emissions by 50% by 2050.

- Three-quarters of restaurant operators say DoorDash, the largest third-party food deliverer, has allowed them to reach more customers.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- New COVID-19 cases in the U.S. topped 41,000 yesterday, pushing total infections in the country above 7.5 million.

- COVID-19 infections are trending higher in 27 states this week.

- Six U.S. states reported record COVID-19 hospitalizations, prompting Wisconsin and New York City to increase restrictions on indoor gatherings in some areas.

- North Dakota now has the highest infection rate per capita in the nation.

- A Coast Guard admiral tested positive for COVID-19, forcing the U.S. Joint Chiefs of Staff into quarantine.

- A cocktail of antibodies given in COVID-19 treatment to the U.S. president has drawn support and hopeful words from Bill Gates.

- The president is the ninth head of state to contract COVID-19:

- COVID-19 could reduce male fertility, according to a new study out of Israel.

- On Tuesday, the White House approved Food and Drug Administration guidelines for assessing potential COVID-19 vaccines.

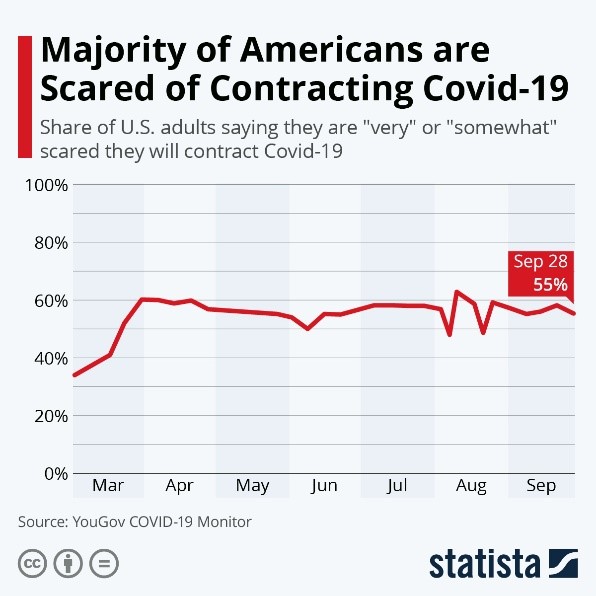

- A majority of Americans are fearful of contracting COVID-19:

- The White House has ended talks with lawmakers on another COVID-19 stimulus package until after the November 3 election.

- Prior to the announcement, the Federal Reserve chairman suggested more stimulus may be the safest route to prop up the U.S. economy, which has recovered faster than expected but is still reeling from the pandemic.

- Record imports ahead of the holidays led to a $67.1 billion U.S. trade deficit in August, the largest monthly deficit since 2006.

- Job openings fell 0.3% in September, indicating a slowing jobs recovery.

- The White House is curbing H1-B visas for highly skilled workers. Under the new rules, a third of current H1-B workers in the U.S. would have been denied visas.

- Holiday season retail traffic could be down as much as 25% as more and more shoppers turn online to buy. In addition, shoppers may want to avoid the packed crowds of Black Friday due to COVID-19.

- Major airports are signing with XpressCheck to provide rapid COVID-19 testing that can deliver results in 13 minutes. Chicago’s O’Hare International Airport may have the service by the holidays.

- Boeing has dropped its 10-year forecast for commercial aircraft demand by 11% from a year ago, saying most of the company’s deliveries will be for fleet replacement rather than fleet growth. In the first half of 2020, Boeing’s sales fell by 26%.

- Private jet traffic is expected to return to pre-pandemic levels by mid-2021, but sales of private jets will not return to 2019 levels until 2025, according to a Honeywell survey.

- The world’s three top plastic consumers — Coca-Cola, Nestle and PepsiCo — are struggling to meet repeated promises of higher levels of recycled plastic content in their products.

- Consumer brands companies seeking to replace single-use plastics with paper face a challenge: making paper perform like plastic.

- The pandemic is prompting fast food companies to innovate their drive thru lanes for the first time since creation of the drive thru.

- A Cisco survey shows more than half of companies have plans to shrink their offices as more and more employees turn completely remote.

- New iPhones with 5G capabilities are expected to be unveiled at an Apple event on October 13.

International

- The U.S. is looking at ways to economically cooperate with Japan, Australia and India, partly to push back against China’s economic assertiveness.

- A computer glitch may have prevented authorities from tracing up to 50,000 people who might have been exposed to COVID-19 in England.

- In Iceland, one of the most successful countries in blocking the spread of COVID-19, new restrictions were instituted after an increase in daily cases.

- The government of Italy is stepping in to assist the country’s supply chain, helping small and medium-sized businesses retrieve sales and sourcing from abroad.

- Youth unemployment in Asia’s fastest-growing economies is soaring, as many young people work in sectors most affected by COVID-19.

- The World Trade Organization expects a 9.2% drop in global merchandise trade from 2019.

- The International Monetary Fund said the global economy is performing better than earlier expectations but predicted a “long ascent” to full recovery.

Our Operations

- On Tuesday, M. Holland announced a new partnership with JL Goor Materials, a polymer distribution company headquartered in Dublin, Ireland. The agreement provides access to M. Holland’s Mtegrity™ products in Ireland and the U.K. Read more about the partnership here.

- 3D Market Manager Haleyanne Freedman and Jacob Fallon, Braskem’s Technology Engineer for 3D Printing, co-hosted a webinar on Polypropylene Advancements in 3D Printing earlier today. Learn more here.

- Stop by M. Holland’s virtual booth at IWCS to meet our team of Wire & Cable experts. The M. Holland team is exhibiting October 15-16 from 8-1 pm ET. Click here to learn more.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.