COVID-19 Bulletin: October 27

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Energy prices were higher in mid-day trading today, the WTI at $39.51/bbl, Brent at $41.22/bbl and natural gas at $3.02/MMBtu.

- A new report from the U.S. Department of Energy says oil and gas will likely continue to account for the majority of U.S. energy consumption in the next two decades, with natural gas helping pave the way toward a greater share for renewables.

- India’s oil and natural gas sector is likely to see investment upward of $206 billion over the next decade, the country’s prime minister said. A large share of the investment will go toward gas infrastructure such as liquid-natural-gas (LNG) capacity increases, pipelines and compressed-natural-gas (CNG) networks.

- U.K. armed forces ended a 10-hour standoff with hijackers of an oil tanker Sunday evening in the English Channel.

- BP reported its fifth straight quarterly loss, suffering from weak oil demand and pricing and a drop in refining and trading margins.

Supply Chain

- Hurricane Zeta struck Mexico’s Yucatan Peninsula as a Category 1 storm yesterday before heading for the U.S. Gulf Coast, where Louisiana, Mississippi and Alabama have issued hurricane warnings.

- Typhoon Molave is prompting officials to evacuate more than 1.3 million people in Vietnam.

- A fast-moving wildfire south of Los Angeles forced 70,000 people to evacuate late Monday evening. The fire has not yet been contained.

- Hurricane-strength winds buffeted Northern California, cutting power to over 1 million people.

- In a move to build up capacity for intermodal freight, the Port of Virginia is doubling the size of its on-dock rail yard.

- Warehousing and storage jobs have recovered past pre-pandemic levels, one of the few sectors experiencing job growth during the pandemic.

- Shipping company DHL Express hired thousands of new employees in preparation of a 50% increase in peak season volume compared to last year, citing higher levels of e-commerce shopping.

- Saab has resorted to insourcing some of the work performed by suppliers for the company’s aviation unit. Company leadership cited disrupted and unreliable supply chains that put profitability in doubt.

- Drone startups that assist in counting and managing warehouse inventory are attracting investment. The drones can fly through a warehouse collecting images of pallet locations, data from barcodes and inventory information.

- Hong Kong-based container line OOCL rebounded from a 4.6% decline in Q2 volume, posting an increase of 9.5% in Q3 along with a 16.3% bump in revenue. Most of the jump was due to higher volumes on trans-Atlantic routes.

- The U.S. trade war with China appears to have had little effect on growing trade deficits as importers turned from China toward similarly cheap imports from countries such as Vietnam and Mexico.

- Country delegates of the International Maritime Organization have agreed on draft measures to reduce carbon production in both ship infrastructure and ship operation; however, some industry experts say the measures are not stringent enough in addressing environmental concerns in the shipping industry.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. experienced 66,784 new COVID-19 infections yesterday, the highest infection rate for a Monday, when the count is suppressed following the weekend.

- The U.S. COVID-19 case count was up 24% last week and deaths were up 15%. Thirty-six states experienced rising infection rates for two consecutive weeks.

- Hospitalizations are up in 41 states this month with 22 states experiencing 50+% increases since the end of September.

- Fourteen states set new records for COVID-19 hospitalizations in the past week: Alaska, Arkansas, Iowa, Kansas, Kentucky, Montana, Missouri, Nebraska, North Dakota, Oklahoma, South Dakota, Utah, West Virginia and Wisconsin.

- Hospitalizations for non-COVID-19 illnesses, including heart attacks and strokes, are down measurably during the pandemic, suggesting people continue to avoid hospitals and defer health maintenance.

- COVID-19 infections in the military nearly doubled last week, with only the Navy flattening the curve.

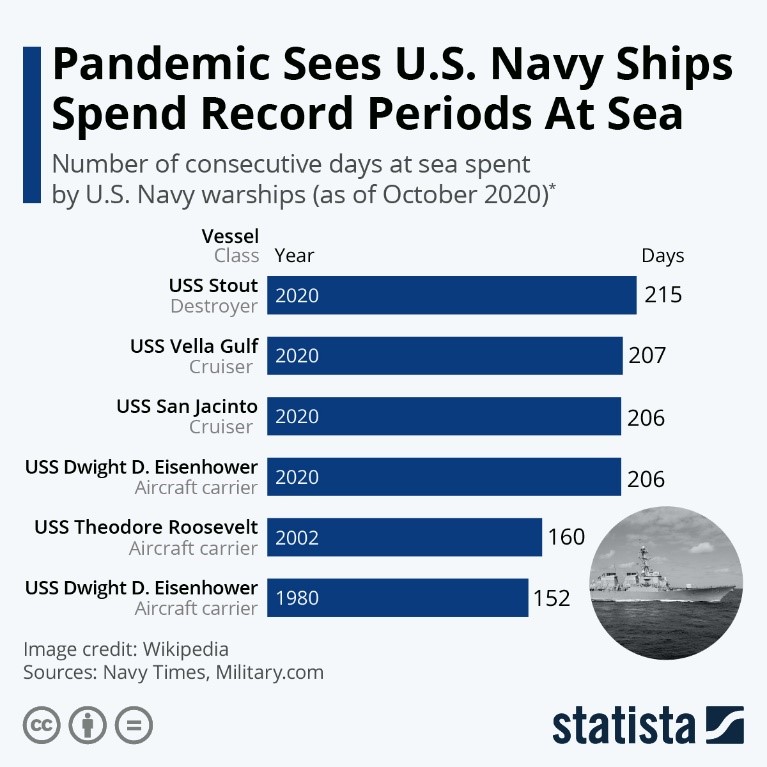

- Naval vessels are spending record periods at sea, avoiding port calls to reduce COVID-19 exposure:

- Texas surpassed California as the state with the most COVID-19 cases — more than 910,000.

- Los Angeles County hit a total of 300,000 COVID-19 infections yesterday, 100,000 more than Florida’s Miami-Dade County, which has the second highest case count. Los Angeles County accounts for 3.4% of all U.S. infections.

- North Dakota remains first in the country for most COVID-19 infections per capita. A top U.S. health official traveling to the state’s capital city said virus protocols there were the worst nationwide.

- Missouri, Kentucky, Utah and South Dakota are the next four states to get “surge” testing sites from the federal government, which help track asymptomatic infections that can wreak havoc in communities.

- Non-essential businesses in Newark, New Jersey’s largest city, are subject to limited hours of operation after an uptick in COVID-19 infections.

- AstraZeneca’s COVID-19 vaccine has shown promising results in immune responses of older adults and the elderly. Trials conducted in Britain could produce results by year’s end.

- Trials of an Eli Lilly antibody drug used to treat COVID-19 were stopped after researchers determined it was not helping patients.

- A study points to growing evidence that COVID-19 antibodies diminish over time in some recovered patients, making immunity finite and posing risks of multiple infections.

- The Speaker of the U.S. House and the White House’s Treasury Secretary failed to agree on a stimulus package in a call on Monday. The U.S. Senate adjourned for a pre-election break last night, killing any further hope of relief before next week’s election.

- Durable goods orders in the U.S. rose by a higher-than-expected 1.9% in September.

- U.S. business activity hit a 20-month high in October, evidenced by a Composite Purchasing Managers Index (PMI) rating of 55.5. A rating above 50 indicates growth in private sector output.

- Fewer major U.S. companies are defaulting on their debt than analysts’ predictions of several months’ ago, an indicator of a better-than-expected economic recovery.

- While home sales and prices continue to rise, the rental market is poised to be the next housing bust, with landlords facing record defaults amid eviction moratoriums.

- Toy makers continue to thrive during the pandemic with expectations of a strong holiday season ahead.

- Toy companies are striving to become more eco-friendly by reducing their use of plastics and increasing recycle content in both their packaging and products.

- By 2023, spirit-maker Bacardi plans to bottle all its brands in fully biodegradable plastic made with plant-based oils. The bottles are said to biodegrade in 18 months in compost, soil, fresh water and sea water.

- A Netflix show about home organizers has played a large part in a 16.8% spike in sales of The Container Store, highlighting the growing power of streaming-based retail.

- Harley-Davidson reported a 10% drop in motorcycle sales in the latest quarter, citing the pandemic for the decrease. In a 180-degree strategy shift, the company’s new chief executive is scaling back international sales efforts, shrinking domestic supply, and delaying or halting new models intended to appeal to young riders.

- Fatigue associated with health and job security concerns during the pandemic have diminished by half the average employee’s capacity to absorb change. A renewed focus on coaching and other “open source” approaches to support employees could help.

- As more states adopt recycling mandates, a growing group of plastics industry advocates are pressing the EPA for national standards for recycled content.

- The Wall Street Journal released rankings on the world’s top companies for sustainability leadership and practices. The top five are Sony, Philips, Cisco Systems, Merck and Spanish utility Iberdrola.

International

- Despite public resistance, many European leaders are considering lockdowns as the last resort to stem surging COVID-19 infections across the region.

- Some countries are reducing the time for self-quarantining to encourage greater compliance among those exposed to COVID-19.

- Russia imposed a national face mask mandate to stem the rise in COVID-19 cases.

- Retail sales in the U.K. fell at the fastest pace since June this month.

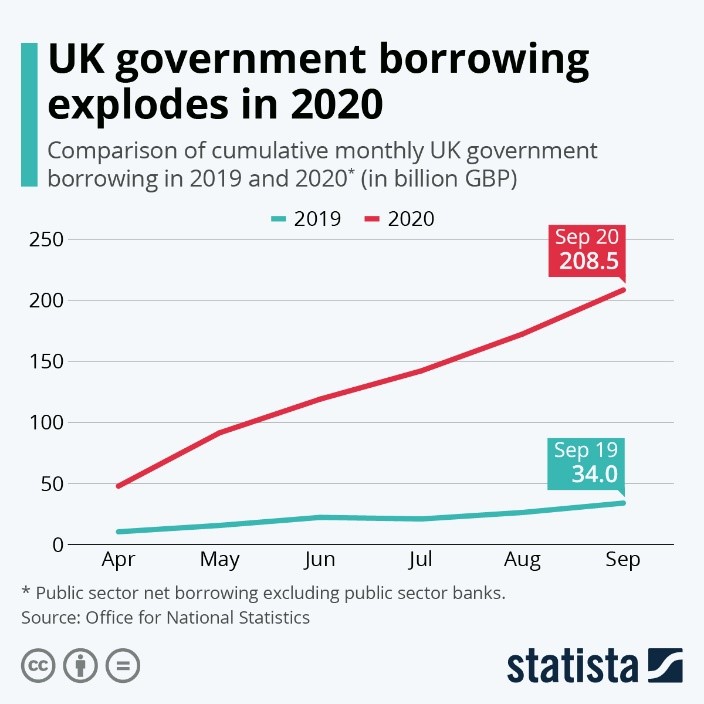

- Public debt in the U.K has soared this year as the government battles the pandemic and economic uncertainty surrounding Brexit:

- Marriages and births have plummeted in Japan during the pandemic, exacerbating a demographic crisis in the world’s most aged nation.

- China’s economy is expected to grow 2.1% this year, the lowest rate in 44 years, with an 8.4% rebound next year, according to a Reuters poll.

- China is $50 billion short on its commitment to buy $140 billion in specific U.S. agricultural, energy and manufactured goods, according to the terms of a trade deal between the two countries negotiated in January.

- South Korea emerged from recession in the quarter ending September 30, expanding by 1.9% from the second quarter on a surge in exports.

- An industry official said sales of new energy vehicles will make up half of total car sales in China by 2035.

- The International Union for Conservation of Nature called for “ambitious” steps to stem the flow of plastic waste into the Mediterranean Sea yesterday, noting that the equivalent of 500 shipping containers of plastic waste finds its way into the sea each year.

Our Operations

- Reminder: Daylight saving time takes effect this Sunday, November 1, at 2:00 a.m.

- Global Healthcare Manager Josh Blackmore will be a featured speaker on Thursday, October 29 at 10:00 a.m. ET during the Plastics in Healthcare Virtual Edition, sponsored by Plastics News. The title of his talk: Applying the Lessons from the First Wave of COVID-19 to Successfully Navigate the Second.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.