COVID-19 Bulletin: October 22

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Energy prices were higher in mid-day trading today, with the WTI at $40.70/bbl, Brent at $42.51/bbl and natural gas at $3.05/MMBtu.

- After falling in August, Mexican and Brazilian demand for U.S. oil remained flat in September and October. Before the pandemic, Latin America was a stronghold for U.S. oil exports.

- Demand for jet fuel on the U.S. West Coast is picking up after a rebound in commercial and cargo flights, a small boost for oil producers.

- Brazil’s Petrobras raised its estimate for 2020 production by 2.5% to 2.84 million bpd.

- The U.S. added sanctions to service providers and funders of the Nord Stream 2 gas pipeline from Russia to Europe. The move is part of the U.S.’s efforts to halt construction of the Russia-backed pipeline.

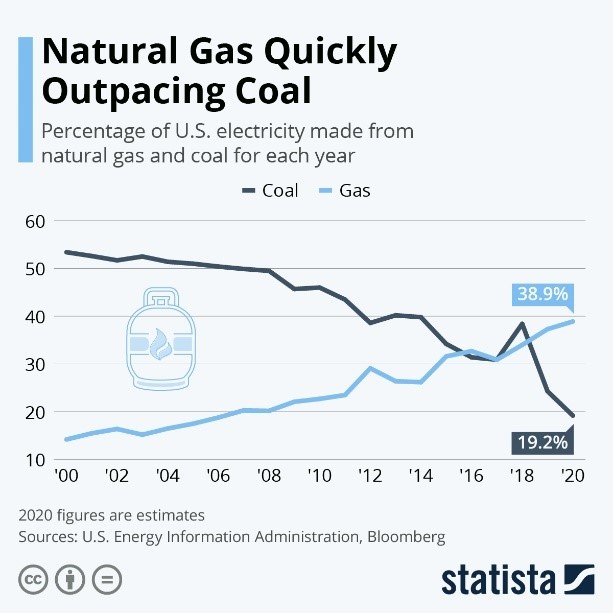

- Natural gas continues to gain at the expense of coal in the U.S.:

- A clean energy company plans to install 50 solar-powered electric vehicle charging stations in San Diego, reducing the installation time from months to minutes by avoiding the electric grid.

- Scientists have discovered a method to convert plastic waste into hydrogen and carbon nanotubes using microwaves.

- Machine learning and artificial intelligence may enable advancements in plastics design, including products that will readily degrade after use and super strong materials.

Supply Chain

- Epsilon accelerated at record speed into a Category 3 hurricane and is expected to brush Bermuda today.

- An oversupply of diesel and kerosene is being used to make fuel for the shipping industry. The new blends raise concerns, however, about the quality of the fuel and its affect on engines.

- In its quarterly reports, Apple revealed its intent to bring semiconductor supply chains to the U.S. with the help of incentives from Congress. The company’s shifting supply chain is creating boomtowns in rural Vietnam.

- Amazon has invested $100 million in new infrastructure in Mexico, including new fulfillment centers in Monterrey and Guadalajara and 12 new delivery stations.

- Amazon is expanding pick-up options for Amazon Prime members, offering free one-hour pick-up at all its Whole Foods stores.

- Wales is nationalizing its struggling rail industry, which has been crippled by the pandemic.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- COVID-19 infections in the U.S. rose yesterday by 62,735, while deaths rose by 1,124.

- COVID-19 cases are rising in 75% of the country, CDC officials said Wednesday.

- Idaho, Nebraska, Rhode Island, North Dakota and South Dakota have the fastest rising COVID-19 per capita infection rates. Virginia, Louisiana, Oklahoma, Hawaii and Washington, D.C. are making the best progress stemming the pandemic.

- New York reported its highest daily COVID-19 count — 2,000 cases — since May, as the state again struggles with rising hospitalizations and virus hotspots.

- Wisconsin recorded its highest one-day total of COVID-19 deaths on Wednesday, along with 4,205 new cases.

- Iowa reported a record number of COVID-19 cases, deaths and hospitalizations.

- COVID-19 hospitalizations in the U.S. are at their highest since August 22 — 39,230.

- The CDC has broadened its rule for someone considered to be a “close contact” of a person infected with COVID-19. The new definition is someone who spent at least 15 minutes within six feet of an infected person over a 24-hour period.

- With Pfizer and Moderna set to release results of COVID-19 vaccine trials in the coming weeks, the FDA is meeting today to discuss a plan for recommending vaccines.

- Vaccine trials from AstraZeneca and Johnson & Johnson are set to resume after being halted last week due to patient illnesses. A patient died in AstraZeneca’s trial. However, the patient had not received the company’s vaccine shot.

- A 38-year-old woman with underlying medical conditions died from COVID-19 while on a flight from Las Vegas.

- First-time unemployment claims totaled 787,000 last week, the lowest new filings since mid-March.

- The Speaker of the House and the Treasury Secretary continue to negotiate an economic stimulus package, but hopes of having a deal in place before the November election are waning.

- A report from the Federal Reserve said the U.S. economy grew at a slight to modest pace in early fall, suggesting a slowdown in the recovery from the pandemic. Winning sectors included manufacturing, residential housing and banking.

- A Federal Reserve governor suggested there needs to be more federal spending on unemployed workers and hard-hit businesses.

- Morgan Stanley’s chief strategist said the U.S. economic recovery is “V interrupted” and predicted a slowing in the fourth quarter.

- Tesla reported a profit in the third quarter, marking the company’s fifth consecutive profitable quarter and first profitable year.

- Consumers interested in electric trucks have a growing selection of competitive models from traditional carmakers and startups.

- GM’s Cruise self-driving car affiliate will seek regulatory approval in coming months for a version of its Origin model with no steering wheel or pedals.

- Sam’s Club is deploying robotic floor scrubbers in all its 600 stores.

- Budweiser Brewing has eliminated the use of plastic rings and decreased the use of plastic shrink wrap in its portfolio of beers, a move saving hundreds of tonnes of plastic waste.

- Bacardi and Danimer Scientific have developed a biodegradable spirits bottle that will degrade in 18 months.

- Eaton is launching a metal 3D printing initiative in its Vehicles Group to reduce development time and improve efficiencies.

International

- Ireland became the first European country to reimpose a nationwide lockdown in response to rapidly rising COVID-19 infection rates. The lockdown will last for six weeks, with schools to remain open.

- Spain is the first western European country to record more than 1 million COVID-19 cases, a status shared by Argentina, Brazil, India, Russia and the U.S.

- Germany reported its first 10,000+ rise in new COVID-19 cases in one day. The country has registered 9,905 deaths.

- Brazil’s president spoke out against a China-developed COVID-19 vaccine that his government agreed to buy, suggesting the vaccine has not been thoroughly tested for use in preventing infections.

- The current foreign minister and former prime minister of Belgium has been hospitalized in intensive care with COVID-19.

- Germany’s health minister tested positive for COVID-19.

- The International Monetary Fund lowered its projection for economic growth in Asia this year to a negative 2.2% from its previous projection of a 1.6% contraction.

- India is reopening its borders to business travelers but not tourists in a bid to revive its struggling economy.

- Indonesia, with both the largest economy and highest number of COVID-19 infections in Southeast Asia, is considering reopening its borders.

- China will extend its ban on domestic and outbound tours through the winter to reduce the risk of COVID-19 spread.

- A McKinsey survey of small and medium-sized enterprises (SMEs) in Europe conducted before the recent resurgence in COVID-19 reveals that more than half of 2,200 respondents fear they will be forced to close in the next 12 months. SMEs employ half of Europe’s workforce.

- A consumer climate index in Germany fell more than expected this month, with half of respondents surveyed “concerned or very concerned” about their future.

- Unilever launched a trial in Britain to sell reusable bottles that customers can get refilled with shower gel, handwash, shampoo and conditioner, or laundry liquid if they bring them back to company kiosks.

- While many developed nations are instituting monetary easing to ensure economic liquidity, Turkey is expected to raise interest rates to support a collapsing currency.

Our Operations

- For registered attendees of the MAPP 2020 Benchmarking and Best Practices Conference, stop by M. Holland’s virtual booth and watch our recorded breakout session here.

- Global Healthcare Manager Josh Blackmore will be a featured speaker at the Plastics in Healthcare Virtual Edition, sponsored by Plastics News, October 26-30. The title of his talk: Applying the Lessons from the First Wave of COVID-19 to Successfully Navigate the Second.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.