COVID-19 Bulletin: October 13

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Natural gas prices hit a two-year high yesterday due to weather-related supply disruptions and as cold weather approaches.

- The WTI crude price was at $39.99/bbl in early trading today, while the Brent was at $42.12/bbl. Natural gas was at $2.86/MMBtu.

- The International Energy Agency (IEA) estimates that global natural gas demand will see a drop of 3% in 2020, its biggest on record, and more than twice the demand slump after the 2008 recession.

- In a shift from its historic focus on fossil fuels, the IEA is promoting an aggressive shift to renewable energy to address global warming, warning that expenditures on alternative sources must rise substantially to adequately reduce carbon emissions.

- Yesterday, the IEA projected that global oil demand will not return to pre-pandemic levels until 2023 and “peak oil” will arrive within the decade.

- Solar generated energy met 100% of the needs of South Australia demand for the first time on Sunday.

Supply Chain

- Intermodal rail traffic rose 7.1% year-over-year in September, the one bright spot in an otherwise slow rail industry recovery.

- The average price per-mile on the U.S. truckload spot market was up 20.6% from July to the first week in October.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

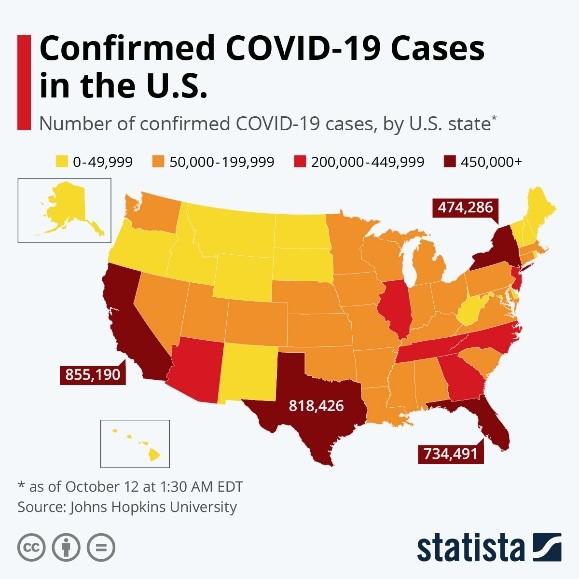

- COVID-19 infections in the U.S. topped 7.8 million yesterday, and deaths surpassed 215,000:

- Thirty-one states reported more COVID-19 cases last week than the week prior, with only Maine, Texas and Washington showing a downward trend. Thirteen states set records for seven-day average infection rates last week.

- Thirty-nine states have rising infection trends this week.

- The U.S. has the worst COVID-19 death rate among developed nations, in part due to the inconsistent implementation of social distancing guidelines and mask requirements.

- New research in the Journal of the American Medical Association suggests that U.S. COVID-19 deaths have been undercounted by up to a third.

- On Monday, Johnson & Johnson announced it would halt its vaccine trials after a patient developed an unexpected illness, details of which were not released.

- A Nevada man contracted COVID-19 a second time within two months while testing negative in between, adding to concern about the immunity developed after a first infection. In the U.K., a re-infected victim required hospitalization when his second infection proved more severe than the first.

- Home sales in August rose to their highest level since 2006, with year-over-year sales of existing homes up 10.5% and sales of new homes 4.8% higher.

- The unemployment rate in the hospitality industry is more than double the national level. Without further government assistance, industry leaders fear more than half of hotels will close within six months.

- Disney is restructuring its media and entertainment divisions to focus on streaming services. The company will create a single media organization responsible for content distribution, ad sales and Disney+.

- Personal computer shipments in the U.S. grew 11.4% in the third quarter, the first double-digit increase in a decade. Chromebook shipments increased 90%, driven by distance learning needs.

- At an online event today, Apple is set to reveal a 5G iPhone that is expected to deliver markedly faster internet speeds.

- Delta said the airline industry may not recover for two years or more as it posted a third-quarter loss of $5.4 billion.

- Southwest Airlines is taking advantage of the COVID-19 airline slump to expand into two of the U.S.’s biggest airports: Chicago’s O’Hare and Houston’s George Bush Intercontinental. The move will put greater competitive pressure on United Airlines and American Airlines.

- Bed Bath & Beyond is reducing inventory and closing stores across the country to free up cash after years of falling sales. The company plans to shutter 200 stores within two years.

- The COVID-19 pandemic is splitting the restaurant industry in two: on one side, large corporate chains using their size and expertise to gain customers and add stores; on the other side, local eateries struggling to remain open.

- A former U.S. treasury secretary estimates that the cost to the U.S. economy from COVID-19 will be four times worse than from the Great Recession. Half of the projected $16 trillion toll will come from lost gross domestic product, while half will come from physical and mental health losses.

- Tens of thousands of mink have died from COVID-19 infections on mink farms in Utah, Illinois and Wisconsin, while mink farmers in Denmark, the world’s leading exporter, have begun culling 2.5 million animals due to virus risks.

- Fed up with foggy glasses from mask wearing and irritated eyes from contact lenses after long hours of videoconferencing, people are turning to Lasik surgery, which is enjoying a spike in demand as the pandemic persists.

International

- China is testing 9 million residents in the coastal city of Qingdao after the country’s first locally transmitted COVID-19 infections in two months showed up there over the weekend. Nine cases were reported in the city Monday.

- Russia set new daily records for COVID-19 infections and deaths yesterday.

- The Netherlands has emerged as a COVID-19 hotspot with among the world’s highest infection rates. The Dutch government plans to impose restrictions, including the possible closing of restaurants, beginning this evening.

- Italy imposed new restrictions on restaurants and bars to stem a COVID-19 surge, including a midnight closing mandate and bans on outdoor gatherings after 9:00 p.m.

- Amid calls for stronger COVID-19 measures from scientists, the U.K. prime minister proposed closing bars and restaurants in high infection areas of the country.

- Health experts in Europe are bracing for a surge in hospitalizations, which abated during the summer as COVID-19 migrated to younger people, due to the second wave of infections and inter-generational spread.

- The pace of job losses in the U.K. set a record high in the three months ended August 31 and were five times analyst expectations due to the expiration of furlough protections and a faltering economic recovery.

- The European Union is proposing guidelines for border restrictions as countries reimpose limits on border crossings to stem rising COVID-19 infection rates.

- Automobile sales in China rose 12.8% in September compared with the year-ago period, the fifth straight month of rising sales.

- China’s exports rose a higher-than-expected 9.9% in September year-over-year, driven by medical equipment and work-from-home electronic products. Imports rose 13.2%.

- Retail sales in the U.K. rose 5.6% in September from the same time last year. The increase is attributed to COVID-19 stockpiling, early Christmas shopping and the reopening of schools.

- The Bank of England has initiated a “structured engagement” with commercial banks to gauge their preparedness for possible negative interest rates.

- Major central banks are printing money at high rates to counter the economic effects of the pandemic; assets purchased topped 13% in 2020 in the U.S., 12% in the European Community, 14% in the U.K., and 8% in Japan.

- Investor confidence in Germany fell to the lowest level in five months in September, plunging from 77.4 to 56.1, according to the widely followed ZEW index that measures the sentiments of top analysts and economists.

- China is testing a state-sponsored digital currency, distributing $1.5 million worth in a lottery for use at selected merchants in Shenzhen.

Our Operations

- Last week’s webinar sponsored by M. Holland and Braskem reviewed polypropylene advancements in 3D printing. Watch the recording here.

- Stop by M. Holland’s virtual booth at IWCS to meet our team of Wire & Cable experts. The M. Holland team is exhibiting October 15-16 from 8 am to 1 pm ET. Click here to learn more.

- Global Healthcare Manager Josh Blackmore will be a featured speaker at the Plastics in Healthcare Virtual Edition, sponsored by Plastics News, October 26-30. The title of his talk: Applying the Lessons from the First Wave of COVID-19 to Successfully Navigate the Second.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.