COVID-19 Bulletin: October 1

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were off in early trading, with the WTI at $39.70/bbl and Brent at $41.82/bbl. Natural gas was higher at $2.56/MMBtu.

- For the first time since 1960, personal expenditures for electricity in the U.S. exceeded expenditures for gasoline.

- A recent further slump in air traffic has further eroded demand for jet fuel and exacerbated a glut of diesel fuel inventories.

- The Association of American Railroads said total rail traffic was down 2.1% last week year over year, with intermodal freight higher and carloads lower.

- Bank of America is bullish on hydrogen, predicting the fuel source is on the cusp of breakthroughs that will propel the industry to $11 trillion by 2055.

- Cambridge University pledged to divest all fossil fuel investments in its endowment fund by 2030.

- LyondellBasell announced ambitious sustainability goals, saying it will produce 2 million metric tons per year of plastic from recycled and renewable resources by 2030.

Supply Chain

- Wildfires have now burned more than 4 million acres in California, twice the previous record season, with another month of the season to go. Hot and windy weather is forecast through the weekend.

- According to the American Trucking Association, tonnage demand will rise nearly 5% next year, exacerbating a driver shortage and pushing costs higher.

- Occupancy of big box warehouses rose 51% in the first half of 2020, driven by online retailers expanding their order fulfillment capacity in the wake of the pandemic.

- Trucking capacity remains tight throughout the U.S., and spot pricing remains elevated.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

- There were 42,812 COVID-19 infections in the U.S. yesterday and 946 deaths.

- COVID-19 infections in 30 states are trending higher this week.

- COVID-19 cases rose in 27 states in September compared with August, with Wisconsin experiencing the largest increase — over 110%.

- There were 837,000 first-time jobless claims last week, down 36,000 from the prior week. Continuing claims fell by 980,000 to 11.8 million.

- Personal income fell 2.7% in August from the prior month with the expiration of supplemental unemployment payments. Consumer spending rose 1.0% month over month.

- Leaders of the White House and House of Representatives will meet today on a fourth stimulus package after the White House proposed a $1.6 trillion deal as a counter to the House’s $2.2 trillion proposal.

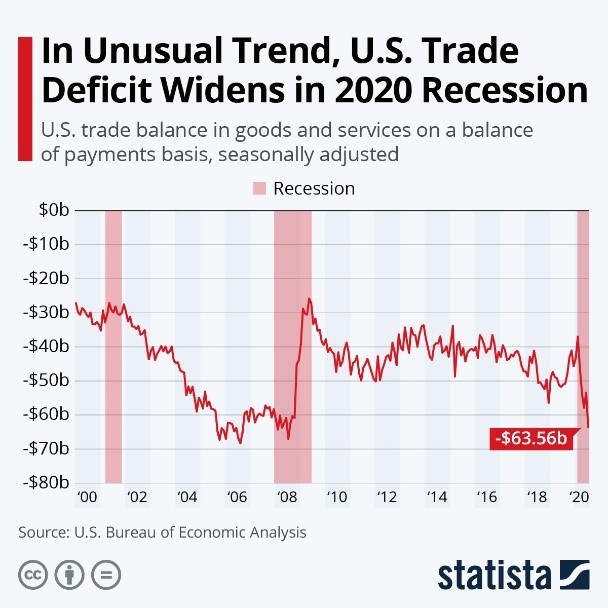

- In an unusual twist during the pandemic recession, the trade deficit has increased instead of decreased:

- Pending home sales rose a record 8.8% from July to August, fueled by low interest rates.

- A number of companies announced major staff reductions this week, indicating that job losses are escalating into higher wage positions:

- American Airlines and United Airlines announced late yesterday that they will proceed with previously announced furloughs of tens of thousands of workers beginning today.

- Goldman Sachs announced staff reductions, joining major banks globally that have cut nearly 70,000 positions so far this year.

- Allstate is laying off 8% of its workforce due in part to a drop in auto claims processing as people drive less.

- Disney’s announced layoff of 28,000 theme park employees suggests the leisure industry may not recover until there is a COVID-19 vaccine.

- Ford’s new CEO is wasting no time in shaking up the senior management ranks and restructuring operations.

- Healthcare insurers are scaling back full reimbursement for telehealth services, reinstituting copays that were waived early in the pandemic.

- The CDC extended its ban on cruises through October 31 in the wake of COVID-19 outbreaks on several recent cruise ships.

- Many young people, free to work remotely from anywhere, are “Covid road tripping,” leaving permanent dwellings for prolonged travel to different cities.

International

- China’s manufacturing recovery continued in September, when the purchasing manager’s index rose to 51.5 from 51.0 in August.

- Europe’s unemployment rate rose to 8.1% in July, the fifth consecutive monthly increase.

- Nations across Europe are reimposing restrictions in response to a spreading second wave of the pandemic.

- COVID-19 fatalities in India passed 100,000, third highest globally behind the U.S. and Brazil.

- Rwanda has achieved among the lowest COVID-19 infection rates in the world by mounting one of the most aggressive and technically sophisticated responses, including the use of drones and robots to enforce social distancing rules.

- Insolvencies are soaring globally during the pandemic:

- The U.K. ban on plastic straws, cotton buds and stirrers took effect today.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.