COVID-19 Bulletin: November 23

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

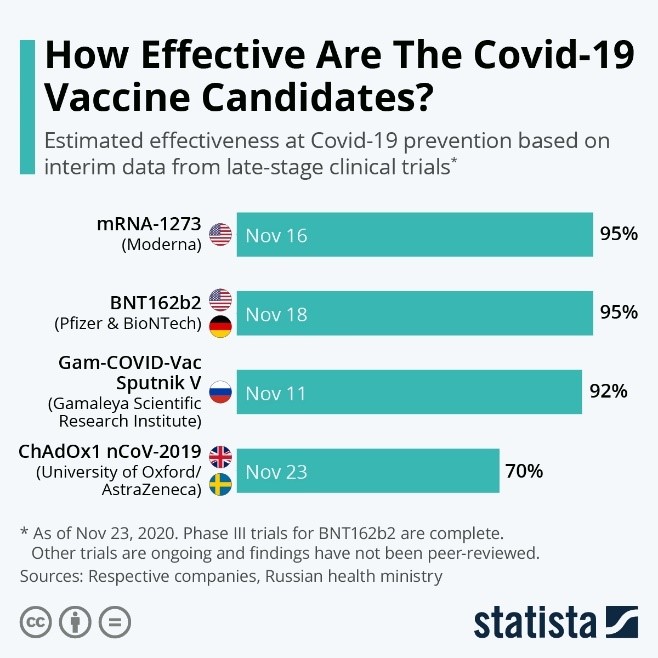

- Oil prices jumped to a 12-week high this morning on news of successful tests of a third COVID-19 vaccine. In early trading today the WTI was up 1.1% at $42.87/bbl and Brent up 1.5% at $45.611/bbl. Natural gas was 1.7% higher at $2.70/MMBtu.

- Shell announced it will downsize to six refining-chemical integrated parks in its post-pandemic plan to transition to lower-carbon and renewable energy, particularly hydrogen, in pursuit of its goal for net-zero emission by 2050.

- Pandemic-induced refinery closures have shut down 2 million bpd of refinery capacity in 2020, with a weak outlook for jet fuel and crude potentially keeping many of them closed for good.

- The International Energy Agency predicts China could overtake the U.S. in refining capacity as early as next year, a result of ongoing trends sped up by COVID-19.

- Canada’s Alberta Province has established a $30 billion incentive program, the Alberta Petrochemical Incentive Program, to bolster its position as a leading center for petrochemicals and energy production.

- INEOS Group is partnering with Hyundai to provide hydrogen to further the development and adoption of fuel cell technology for automobiles.

Supply Chain

- As the U.S. heads into the holiday season, major ports are seeing unprecedented bottlenecks from a collision of factors, including labor and equipment shortages along with record imports.

- The U.S. maritime regulator will investigate ocean carriers at several ports for sending back empty containers to Asia and blocking U.S. agricultural exports from crucial access to foreign markets.

- October was a boon for freight trucking, with the sector recording its first positive year-over-year change since 2018.

- A&R Logistics, the leading supply chain provider to the U.S. chemicals industry, announced it will raise driver pay 10% on January 1, the largest pay scale adjustment in its history.

- Inventories on automotive dealer lots are down 25% during the pandemic, a reduction that could be permanent as more consumers shop for vehicles online.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- With a record 195,000 new cases reported Friday, more than 12 million people in the U.S. have been infected with COVID-19, the highest in the world.

- Hawaii is the only state with declining infections.

- The U.S. has set records for hospitalizations each day since November 10, culminating in more than 83,000 on Saturday. Twenty-two percent of hospitals say they expect to experience critical staffing shortages in the next week.

- Despite the federal government’s recommendation to the contrary, more than a million people flew through U.S. domestic airports on Friday in the start of a holiday uptick in travel.

- Late-stage trial results show AstraZeneca’s COVID-19 to be as much as 70% to 90% effective in preventing infections without serious side effects. It is the third experimental vaccine to report similar results.

- U.S. regulators approved Regeneron Pharmaceutical’s antibody drug used to treat COVID-19 patients who aren’t hospitalized but are at high risk of developing severe symptoms.

- Moderna is expected to charge governments between $25 and $37 per dose and is edging closer to a deal to supply millions of doses to the European Union.

- The U.S. dollar fell to a two-and-a-half year low on positive vaccination news, dampening the currency’s status as a haven as the outlook improves for a global economic recovery.

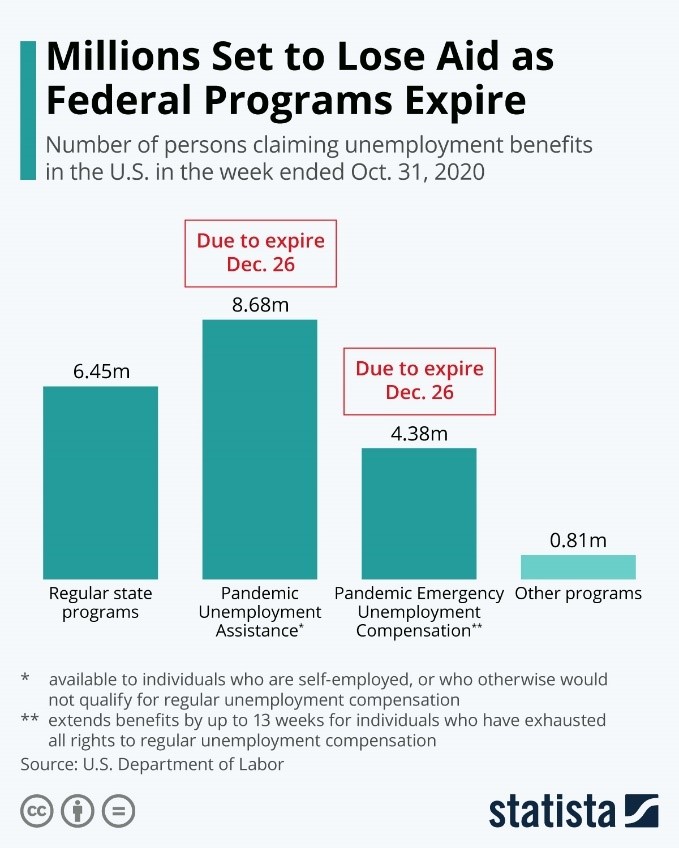

- A majority of unemployed in the U.S. face a loss of benefits the day after Christmas:

- Economists predict U.S. inflation could increase if a successful vaccine allows people to once again spend money on travel, restaurants and other services.

- Several large companies are resuming dividend payments that were halted in the spring, an encouraging signal of continued recovery.

- Some of the largest retail brands are cutting back on styles and colors to reduce “decision paralysis” that could hurt sales.

- At least 11 companies are vying to compete in the electric vehicle market with Tesla, the world’s largest EV maker with a stock market value greater than Toyota, Volkswagen, General Motors and Ford combined.

- GM is offering buyouts to Cadillac dealers reluctant to make the investment to support electric vehicles. Cadillac plans to launch its first all-electric model in 2022.

- The National Highway Traffic Safety Administration has ordered GM to recall 5.9 million vehicles because of faulty Takata airbags.

- Amazon has established a ubiquitous presence in the automotive industry, selling vehicles and parts, developing and utilizing electric vehicles, pioneering self-driving technology, and providing voice-command technology.

- The CDC is recommending that people continue to avoid cruise ship travel because of COVID-19 risks.

- ln an unexpected reversal of fortune, guitar maker Fender is expected to post record 2020 sales numbers after being forced to idle factories in the U.S. and Mexico in March.

- Emergency rooms are seeing record numbers of burn injuries as more people cook at home during the pandemic, with Thanksgiving expected to be the peak season for burns.

International

- South Korea’s greater Seoul area is imposing stricter social distancing rules, including closing bars and nightclubs, after more than 300 new cases were recorded five days in a row.

- More than 1,770 cargo workers at Shanghai’s main airport were herded together and detained for overnight testing after an outbreak of COVID-19 within the airport’s cargo unit.

- The U.K. will return to a regional three-tier restriction system after its national lockdown ends December 2.

- Japanese officials are considering attendance limits for sports and other large events after a spike in infections.

- In Europe, people over 60 make up more than nine in 10 fatalities from COVID-19.

- Canada extended its ban on non-essential border crossings with the U.S. until December 21.

- Nigeria, Africa’s largest economy, has dipped into recession territory after reporting a 3.6% decline in third-quarter GDP, following a 6.1% contraction in the previous quarter. The country is suffering from a loss of foreign-exchange earnings and government revenue due to collapsing oil demand.

- The G20 group of industrialized nations agreed to extend a freeze on debt-service payments from the world’s poorest nations until mid-2021.

- The European economy is again contracting due to renewed lockdowns, with the region’s Purchasing Managers Index (PMI) dropping from 50 in October, the threshold indicating economic growth, to 45.1 in November.

- The PMI in Germany slipped in November but remained in growth territory above 50 as a strong industrial sector offset declines in the services sector. In contrast, the PMI in France plunged to 39.9 from 47.5 in October, the third consecutive monthly decline.

- With a forecasted contraction in the fourth quarter, Italy’s economy is at risk of a second recession as cases rise and lockdown measures are reimposed.

- Danone, the world’s largest yogurt maker, is cutting 2,000 jobs due in part to a collapse of bottled water sales caused by restaurant closures during the pandemic.

- Malaysia, the global leader in rubber glove manufacturing, will temporarily close 28 Top Glove factories due to COVID-19 outbreaks.

- Led by Nestle, the U.K.’s three largest coffee pod brands are partnering to form a national recycling scheme, where consumers can drop the controversial single-use plastic pods into supermarket curbside collections or doorstep baskets for those grocery shopping online for home delivery.

Our Operations

- Our latest Founders Series video is a tribute to Joan Holland, co-founder and matriarch of M. Holland, who recently passed away. Watch the video here.

- M. Holland will be closed Thursday and Friday for the Thanksgiving holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.