COVID-19 Bulletin: November 20

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The natural gas price fell 4.2% yesterday and is down 12% this month on warmer-than-expected weather. The price was 2.6% higher in late trading today at $2.66/MMBtu.

- Crude prices were higher in late trading, with the WTI up 1.0% at $42.17/bbl and Brent up 1.9% at $45.03/bbl.

- With lockdowns in the U.S. increasing, so is the surplus of oil at the key Cushing, Oklahoma, storage facility, where inventory levels are nearly back to April/May levels when oil futures collapsed into negative territory.

- As Middle East oil producers accelerate plans to diversify their economies, Saudi officials said they will wait until the end of the pandemic to review a controversial 15% value-added tax it imposed to offset the decline in oil revenue.

- Oil production in Libya, which was subject to a port blockade much of the year, have returned to pre-blockade levels and could increase further, upending prospects that OPEC+ will be able to lift current production curtailments in January as planned.

Supply Chain

- Boeing predicts a 60% expansion in global freighter fleets by 2040 to support increased international trade and e-commerce shipments. The expansion amounts to projected new deliveries of 2,430 all-cargo aircraft by 2039.

- Japan is providing $2.4 billion in subsidies to companies to bolster their supply chains and diversify away from China.

- DHL is testing four electric Class 8 freight trucks in Los Angeles, the company announced Tuesday. Developed by BYD Motors, the trucks reportedly can run all day on a single charge.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

- M. Holland published its view of how COVID-19 has disrupted the already complicated logistics network of plastics distribution. Click here to read our view on the future of logistics.

Markets

- The U.S. suffered a record 187,833 new COVID-19 cases yesterday with 2,015 deaths.

- With nearly 8,000 hospitalized patients, Texas is recruiting more medical staff for its overwhelmed hospitals, while some cities are closing public buildings for use as hospital beds and makeshift morgues.

- More than 90% of Californians are subject to a new stay-at-home order issued yesterday.

- In continuing news about therapeutics and vaccines:

- Pfizer will request emergency use authorization for its COVID-19 vaccination today.

- New data from AstraZeneca’s vaccine trials showed “promising immune responses” in elderly patients and older adults, with fewer serious side effects than in younger volunteers. A lead investigator for the vaccine said people will likely be able to try a different vaccine if their first shot doesn’t work.

- Moderna is readying production lines for its experimental COVID-19 vaccine, with manufacturing in Europe beginning as early as November.

- Rheumatoid arthritis medicine Actemra has been shown to help severely ill patients survive COVID-19, new trial results show.

- The World Health Organization found that antiviral drug Remdesivir is ineffective as a treatment for COVID-19.

- A Bloomberg measure of consumer sentiment hit its highest level since April this week, as households signaled more confidence on upbeat vaccine news.

- U.S. initial jobless claims rose by 31,000 last week to 742,000, a sharp week-over-week increase after several weeks of modest declines.

- Two Federal Reserve officials warned of a recession risk in coming months, calling for more fiscal stimulus, while the Secretary of the Treasury said he will let several current economic stimulus programs expire on December 31 and pulled back $580 billion of unspent funding from a central bank emergency lending program.

- Sales of previously owned homes unexpectedly rose to a 15-year high in October, while sales of existing homes rose 4.3% from September to October, the highest gain since 2006.

- The median down payment on a home reached $20,775 in the third quarter, the highest in at least two decades in the face of tightening credit standards and higher home prices.

- The average 30-year mortgage rate, meanwhile, declined week-over-week to 2.72%, the lowest in nearly 50 years, while U.S. mortgage debt rose to more than $10 trillion, a record.

- The CDC urged Americans not to travel for the holidays, slowing bookings and increasing cancellations for beleaguered airlines.

- U.S. retailers have missed a total of $52 billion in rent payments since the start of the pandemic, posing risks to businesses already struggling with decreased in-store sales and an unprecedented shift to e-commerce.

- Mazda overtook Lexus and Toyota for the top spot in Consumer Reports’ annual reliability survey. Ford luxury brand Lincoln fell to last on the list of 26 brands.

- Luxury watchmakers are shunning glossy packaging for alternatives using recycled or eco-friendly materials as sustainability becomes an element of chic.

- The dominant Swiss watch industry is headed for its biggest slump in nearly 80 years, evidenced by a 26% plunge in exports in the first 10 months of 2020.

International

- COVID-19 fatalities in Mexico topped 100,000, fourth highest behind the U.S., Brazil and India.

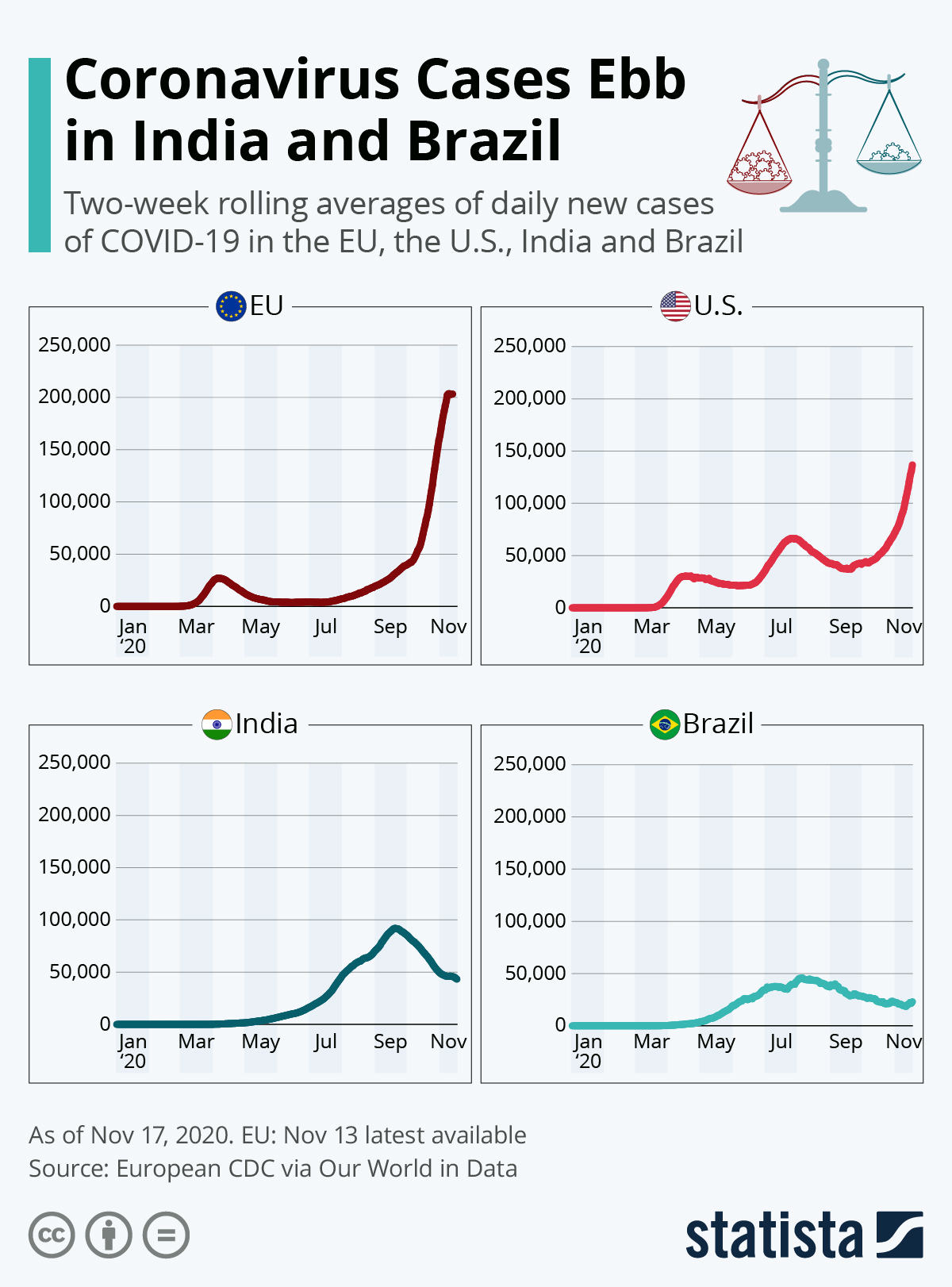

- As COVID-19 infections spike in the U.S. and Europe, they are falling in India and Brazil, which rank 2 and 3 for most infections globally:

- Russia reached the grim milestone of 2 million confirmed COVID-19 cases as has the 54-nation African continent.

- Japan set a daily record for new COVID-19 cases, reporting 2,179 on Thursday. Officials have so far not reissued restrictions on travel or business.

- Ireland’s controversial mink fur industry could be at an end, with officials ordering the nation’s three farms to cull their 120,000 animals over concerns of a mutated COVID-19 virus that first appeared in Denmark’s mink population.

- European Union officials are cautioning against Hungary’s use of an experimental COVID-19 vaccine developed by Russia, citing safety concerns along with potential damage in the public trust of future shots.

- With zero local transmissions reported for nine straight days, health officials in Singapore have indicated that restrictions could still be in place for a year or more to prevent another spread.

- The International Monetary Fund and Group of 20 member nations are warning that elevated asset prices could be veiling the true state of the global economy, where the economic rebound is threatened by surging COVID-19 cases and increased lockdowns.

- Brexit talks have stalled after an official heading Europe’s negotiation tested positive for coronavirus.

- With greater focus on low-emissions and electric vehicles, BMW is retooling its German factories to build electric cars while shifting production of combustion engines to Britain and Austria.

- U.K.-based electric vehicle startup Arrival will join the Nasdaq stock exchange in anticipation of mass production of an electric bus next year.

- Researchers in Brazil have developed a PVC film infused with silica and silver nanoparticles that they say can neutralize COVID-19 on food packaging in minutes.

Our Operations

- Our latest Founders Series video is a tribute to Joan Holland, co-founder and matriarch of M. Holland, who recently passed away. Watch the video here.

- M. Holland will be closed next Thursday and Friday for the Thanksgiving holiday.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- International: Director of Business Development Tracy Coifman.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.