COVID-19 Bulletin: May 20

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices continued their climb in early trading today, with the WTI up 3.4% to $33.04/bbl and Brent up 2.4% to $35.48/bbl.

- Oil prices are up 70% so far this month on encouraging signs that production cuts and increasing demand will tame a historic inventory glut.

- Dow, Inc. was taking emergency measures as floodwater from two collapsed dams flooded Midland, Michigan, threatening to inundate its headquarters and Midland industrial complex, which also houses operations for DuPont de Nemours, Inc. and Corteva, Inc.

- The International Energy Agency said new capacity for renewable energy will shrink 13% this year due to construction delays for wind and solar projects, the first decline in two decades.

Supply Chain

- Holding company Comcar, which owns five national transport companies employing nearly 1,000 truck drivers, filed for bankruptcy, extending the two-year recession in the industry that has witnessed hundreds of business failures.

- Industrial distributors may assume renewed importance as inventory buffers after COVID-19 supply chain disruptions.

- Many ports are extending bans on cruise ships, hampering the recovery for the industry and tourism.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

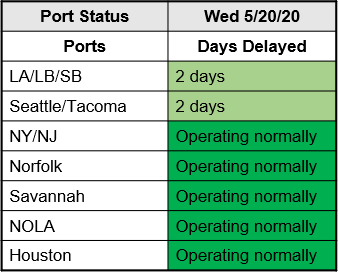

- U.S. ports continue to operate smoothly:

Markets

- The Congressional Budget Office projected that GDP will drop 11.2% this quarter compared with the first quarter, and the economy will shrink 5.6% this year. It expects the recovery to extend through 2021.

- In testimony before Congress yesterday, the Treasury Secretary differed with the head of the Federal Reserve, who pressed for additional federal aid to counter the shock of COVID-19, which poses a “risk of permanent damage” to the economy.

- U.S. housing starts fell 30.2% in April, the biggest monthly decline in five years.

- Home improvement spending by homebound consumers sent Lowe’s same-store sales up 12.3% and Home Depot’s revenues up a better-than-expected 7% in the first quarter.

- Despite the slide in housing construction, the industry may recover more quickly than after prior recessions because homeownership and construction activity were relatively low before COVID-19 struck.

- Pier 1 Imports, which filed for bankruptcy in February, abandoned reorganization efforts and will liquidate instead.

- Visa joined a growing list of companies allowing employees to work from home for the remainder of the year.

- Confirmed COVID-19 cases globally approached 5 million.

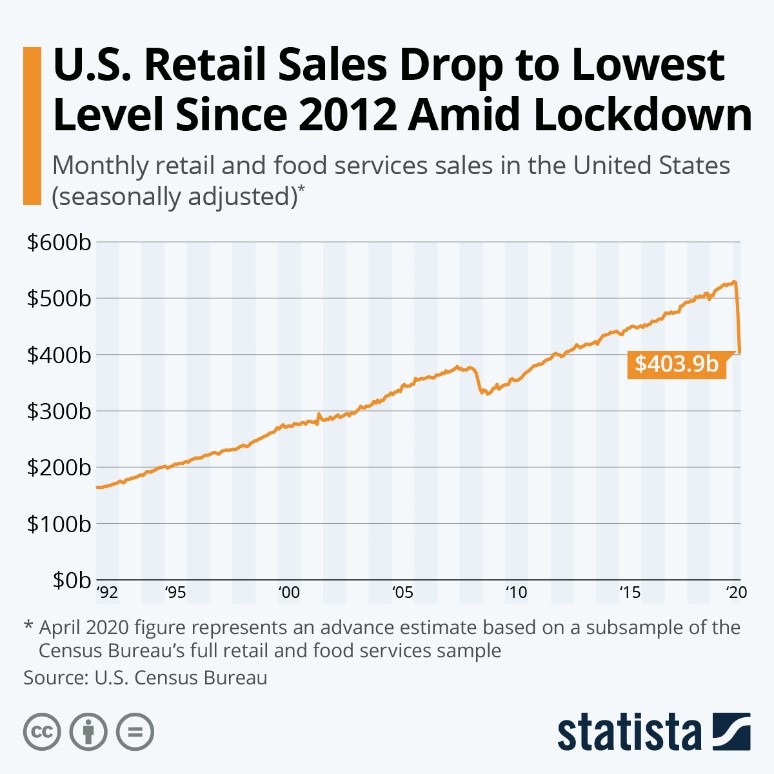

- Retail sales in April fell to their lowest level since 2012:

International

- With new cases in Mexico setting a daily record yesterday, many localities are ignoring the president’s call to reopen the economy.

- New COVID-19 clusters in China indicate the virus may be mutating, with some of those infected taking longer to exhibit symptoms and to recover.

- European countries are closely monitoring COVID-19 spread as they reopen, focusing on real-time indicators such as lines at doctors’ offices and surveys rather than lagging indicators including confirmed cases and death rates.

- COVID-19 is spreading rapidly beyond hot-spot cities in Latin America, stressing the region’s disparate healthcare systems.

- Brazil suffered its highest daily death rate on record, prompting the White House to consider a travel ban with Latin America’s largest nation.

- The U.S. and Canada extended restrictions on non-essential border crossings until June 21, the second such extension since the ban was imposed in March.

- India is considering imposing a 15% COVID-19 import tax on chemicals and petrochemicals, including plastics, that would extend through March 2021.

Our Operations

- We have consolidated our domestic and international import/export desks into a single International Logistics Group to better serve our growing International business unit.

- M. Holland Company has entered a distribution partnership with leading polyolefin producer Braskem to distribute a new line of innovative polypropylene filaments, powder and pellets for 3D printing.

- We distributed safety kits to our commercial teams this week for protection when making client and supplier visits as required.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.