COVID-19 Bulletin: May 13

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices were down slightly in early trading today, with the WTI at $25.71/bbl and Brent at $29.91/bbl.

- The U.S. Energy Information Administration (EIA) lowered its demand projections for 2020-2021 but raised its price forecasts as global production falls. It expects Brent prices to average $34.13/bbl this year and $47.81/bbl in 2021, while WTI will average $30.10/bbl this year and $43.31/bbl next.

- OPEC also lowered its demand forecasts for 2020 and raised its forecast for production cuts.

- Oil demand may never return to pre-COVID-19 levels if work and lifestyle changes prompted by the pandemic become permanent.

- The cost of oil storage, which saw tanker rates surge from $30,000 a day to $200,000, is abating as output and inventories fall and consumption rises with economies reopening.

- The drop in gasoline consumption has contributed to an oversupply of corn used to make ethanol, prompting farmers to plant soybeans instead.

Supply Chain

- U.S. trucking companies cut nearly 90,000 jobs in April, and warehouse and storage companies cut nearly 75,000, while parcel delivery employment increased to accommodate a 49% increase in e-commerce sales.

- A move to regional supply chains prompted by the COVID-19 crisis could reverse China’s global manufacturing dominance.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

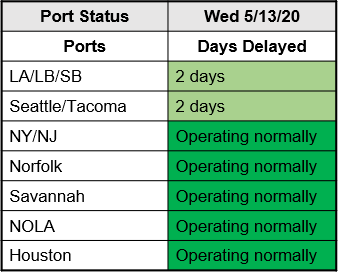

- U.S. ports continue to operate smoothly:

Markets

- Signaling a deepening recession, consumer prices fell 8% in April, the second consecutive monthly drop and the biggest decline since the Great Recession. Excluding food and energy, “core” inflation fell 4%, the largest drop on record.

- Grocery prices rose 2.6% in April, the largest monthly jump in nearly five decades.

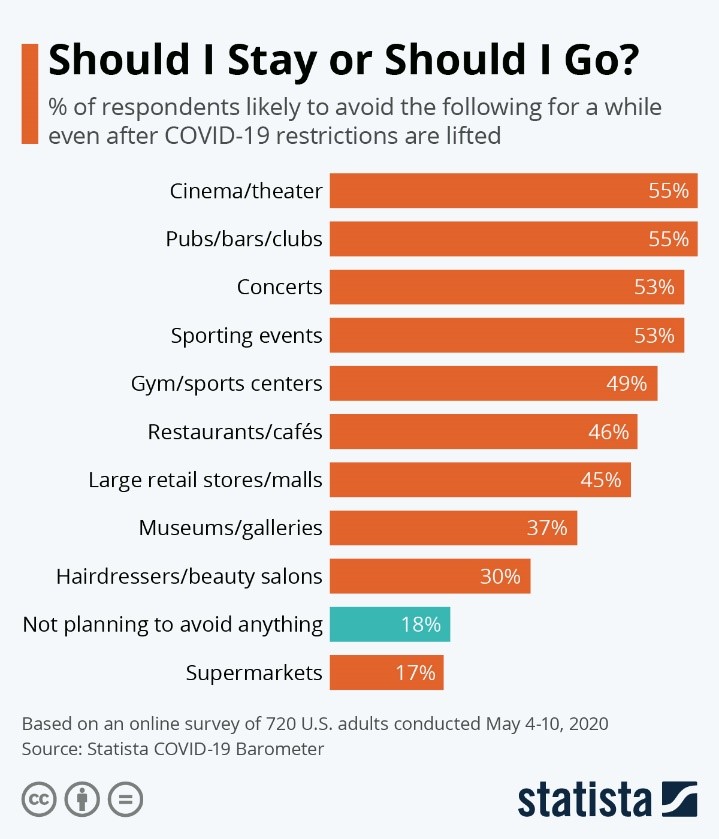

- A new poll indicates Americans are growing more pessimistic about when it will be safe to return to more normal lifestyles.

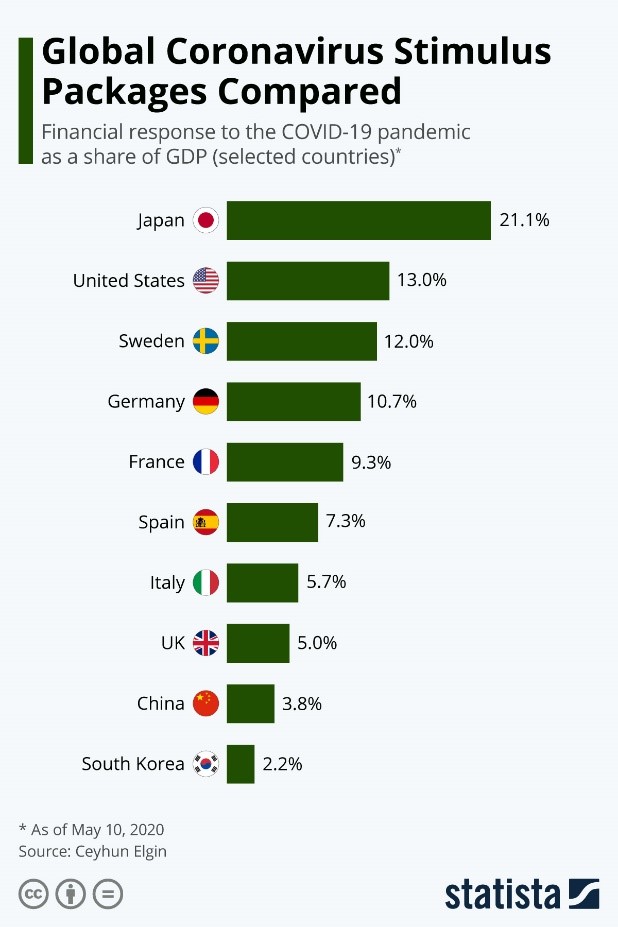

- A $3 trillion additional rescue package proposed by the House of Representatives includes more direct payments to individuals, extended unemployment benefits, relief for the U.S. Postal Service, and $1 trillion for state and local governments.

- The COVID-19 crisis could lead to permanent changes in home and apartment design, including more multi-use spaces, larger windows and doors for greater outdoor exposure, larger appliances for food storage, improved ventilation systems, and more technology for low-touch lifestyles.

- The global automotive industry, which already faced a 20% overcapacity challenge, may be entering a “Darwinian” period that will see plant closures, mergers, and an opening for electric vehicles and startups.

- Toyota projects its global sales will hit a nine-year low but expects to eke out a small profit in 2020. It anticipates sales will return to last year’s pace sometime in 2021.

- Setbacks and controversy are tempering hopes of a quick return to normalcy as states reopen:

- Top health officials testifying before the Senate warned that premature openings will lead to higher infection and death rates and economic setbacks.

- A key model projects 147,000 American fatalities from COVID-19 by the end of August, an increase of 10,000 from recent forecasts, because many states are reopening with infection rates still rising.

- While California lifts its lockdown, the state university system canceled live classes for the fall semester and Los Angeles County may extend stay-at-home restrictions through July.

- Pennsylvania’s governor threatened to withhold aid to counties that defy the state’s stay-at-home orders.

- Connecticut’s governor fired the state’s top health official, who has been criticized for a slow response to the pandemic.

- More than 100 million Americans have been freed from stay-at-home restrictions, while schools in all states will remain closed for the remainder of the school year.

- Confirmed cases of COVID-19 globally now approaches 4.3 million.

International

- With infection rates falling, the European Commission is beginning to reopen borders; Germany, the largest economy in Europe, hopes for free land border movement by mid-June.

Our Operations

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- We issued protocols for a resumption of limited client visits to our commercial and technical teams this week.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.