COVID-19 Bulletin: May 11

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices slipped in early trading today on concerns about COVID-19 flareups in several countries. Crude prices were down more than 2%, with the WTI at $24.19/bbl and Brent at $30.24/bbl.

- Gasoline prices continue to rise but could be on track for a W-shaped demand cycle if flareups of the virus force a return to social distancing.

Supply Chain

- Railroads suffered a 25% drop in rail carloads in April compared with the prior-year period, forcing them to reduce capacity.

- The U.S. will begin purchasing dairy, meat and produce as part of a $19 billion aid program for farmers, who have been slammed by supply chain disruptions due to COVID-19.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

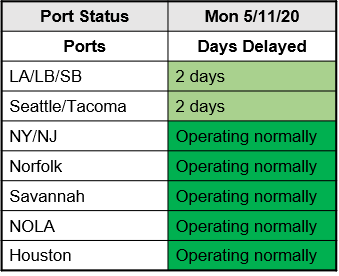

- U.S. ports continue to operate smoothly:

Markets

- The federal deficit in April, normally a month of surplus due to tax receipts, exceeded $700 billion.

- The pandemic has temporarily shuttered more than 260,000 retail stores, many of which may never reopen, threatening many iconic brands.

- Retailers most vulnerable to bankruptcy include many controlled by private equity firms that heavily leveraged their balance sheets.

- Temporary shutdowns for many factories are becoming permanent, with such prominent manufacturers as Caterpillar, Goodyear, Lenox, Polaris, and R.R. Donnelley announcing permanent closures of some sites.

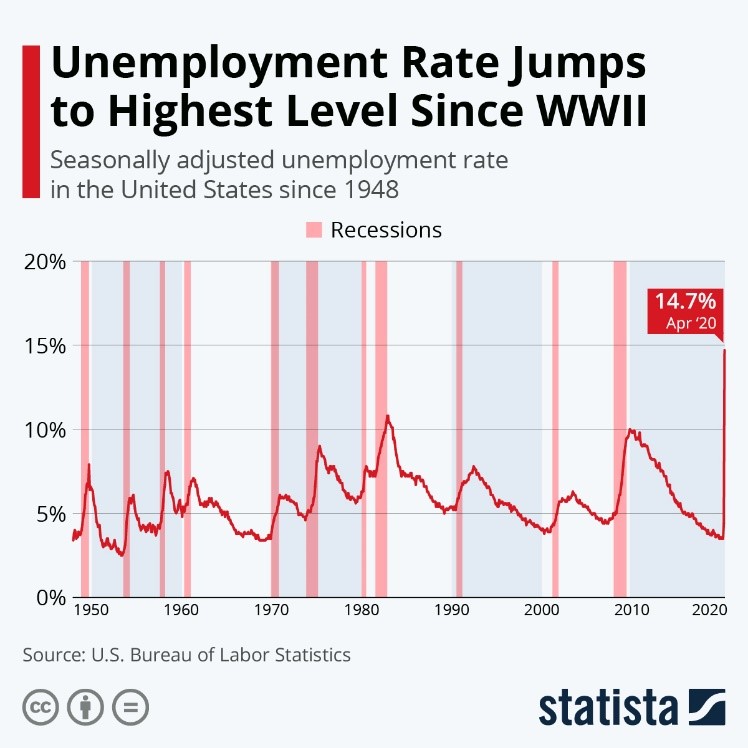

- The Treasury Secretary said that the “real” unemployment rate could be significantly higher than the 14.7% announced last week and that the official rate could rise to 20% this quarter.

- As the near-term economic fallout from COVID-19 worsens, the White House has begun talks with Congress about a fourth tranche of economic relief.

- COVID-19 has invaded the White House, with several staffers testing positive, despite rigorous testing protocols.

- General Motors resumed production at three plants today.

- Tesla sued Alameda County and threatened to relocate its lone assembly plant after the local government determined the car company is not an “essential” business allowed to reopen under California’s gradual lifting of lockdown restrictions.

- Employers are embracing new and unproven technologies to protect employees as they return to work, including temperature sensors, screening surveys, contact tracing apps, and wristbands that vibrate when workers get too close.

- PPP loans are proving to be less than ideal for many small businesses due to limitations on how the money must be spent, the depth and duration of the economic disruption, and their tax treatment.

- For many companies, reopening efforts are being complicated by employees who are reluctant to return to work due to health risks and enhanced unemployment benefits.

- While the Healthcare industry has been at the forefront in the COVID-19 response, the sector lost 1.4 million jobs in April due to suspensions of elective procedures, including dental and eye care.

- Laboratory tests suggest COVID-19 can survive several days on a plastic surface, giving a boost to single-use plastics from bags to utensils.

- Confirmed cases of COVID-19 globally now exceed four million.

- Forty-eight states are in some stage of reopening their economies.

International

- Great Britain, with the second highest death rate behind the U.S., is taking a cautious approach to reopening, allowing some people to return to work beginning today and imposing quarantines on travelers from abroad.

- Nations that seemed to have COVID-19 under control have been experiencing setbacks:

- China reported a flare up of COVID-19 cases near its border with Russia and a new case in Wuhan.

- South Korea closed more than 2,000 bars and nightclubs in Seoul after an outbreak of infections among patrons and will push back reopening schools, which was scheduled for Wednesday.

- After easing lockdown restrictions last Wednesday, Germany reported an increase in the infection rate.

- Ecuador, among Latin America’s smallest countries, has become the epicenter of the pandemic on the continent with the second highest confirmed case count behind Brazil.

- The COVID-19 crisis has driven relations between the U.S. and China, the world’s two largest economies, to a new low.

Our Operations

- We issued protocols for a resumption of limited client visits to our commercial and technical teams today.

- Our Healthcare team is offering video conferences for clients seeking advice on medical material selection, manufacturing and regulations. To schedule a meeting, contact Global Healthcare Market Manager Josh Blackmore.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.