COVID-19 Bulletin: March 20

Good Afternoon,

We experienced our first suspended orders due to COVID-19, as automotive molders began to curtail production following the announced idling of most North American automobile facilities. Here’s more plastics-relevant news concerning the contagion:

Supply

- Oil prices (WTI) jumped 24% yesterday, the biggest one-day percentage gain on record, climbing above $25. The price remains near a 20-year low, down about 60% this year.

- The White House is mulling intervening in the Russia/Saudi oil price war, considering diplomatic efforts as well as potential sanctions against Russia.

- Texas energy regulators are considering production limits to help stem the oil price collapse.

- Shell Chemical Appalachia said Wednesday it would pause construction at its $6 billion petrochemical complex in Monaca, PA, to address health issues raised by the COVID-19 outbreak.

Supply Chain

- Our freight carriers are warning of possible delays due to shifting demand, closed delivery points and safety precautions required in the face of COVID-19.

- Food processors are scrambling to shift production from restaurant fare to grocery store-ready products, increasing demand for shrink-wrap and other plastic packaging and shifting demand for logistics companies.

- Port of Houston’s Barbours Cut and Bayport Container terminals reopened after officials determined exposure to an infected worker was limited.

- Our Gold Standard Distribution Center partners report minimal disruptions of operations due to COVID-19.

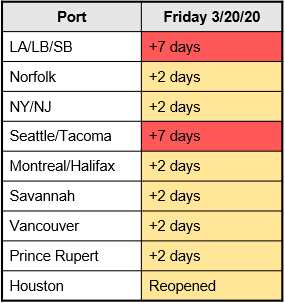

- Port congestion and associated container availability continue to cause delays in international shipments, both imports and exports. Following is the status of shipping delays at U.S. ports as of today:

Markets

- California imposed “shelter-in-place” rules statewide; Pennsylvania has followed suit, ordering the shutdown of “all non-life-supporting business;” New York State closed “non-essential” businesses and banned “non-solitary” outdoor activity; Illinois also announced today a “shelter-in-place” rule, where residents were ordered to stay at home through April 7.

- As states impose social distancing mandates, there is growing confusion about definitions, such as “shelter-in-place,” “essential” and “non-essential,” “non-life supporting” businesses, etc.

- Under pressure from authorities, Tesla closed its lone factory in Fremont, CA.

- Goldman Sachs estimates 2.25 million people filed for unemployment this week, a record.

- Housing construction in the U.S. is expected to drop due to international supply chain disruptions, delays in permitting and inspections, and cautious homebuyers.

- More companies and government entities are encouraging the use of single-use plastics as a hedge against COVID-19.

International

- Brazil and Colombia closed their borders to non-essential crossings, joining most other LATAM countries.

- Credit Suisse projects a 1.5% economic contraction for LATAM in 2020; Goldman Sachs lowered its 2020 economic projections for LATAM’s seven largest countries from modest growth to a 1.2% contraction; J.P. Morgan forecasts a 1% contraction in Brazil.

- A Covestro plant in Italy has declared force majeure.

- International shipping association BIMCO projects a steep drop in international freight rates from recent inflated levels due to slowing trade resulting from COVID-19.

Our Operations

- Today we are opening a COVID-19 landing page on our website, which will include a library of supplier status and business continuity letters.

- We are avoiding air shipments of samples overseas due to risk of airport shutdowns and flight delays.

- We have placed certain products imported from Asia on “commercial hold,” where we review each order relative to inventory levels, due to shipping delays on imports.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.