COVID-19 Bulletin: June 5

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Positive unemployment news and hope for a continued curtailment of oil production sent prices higher in early trading, with the WTI up 4.4% to $39.07/bbl and Brent up 5.2% to $42.07/bbl.

- OPEC+ will meet tomorrow to formalize an extension of current supply quotas through July.

- With the International Energy Agency projecting an 8% drop in fossil fuel demand this year, some experts are concerned that fossil fuels may be reaching the point of “terminal decline,” which could force a devaluing of reserves.

Supply Chain

- U.S. rail traffic fell 17.3% in the week ended May 30 compared with the prior-year period, less than the 20.1% four-week average decline.

- Some ocean shippers are purposely slowing travel speeds and extending routes around Africa to reduce costs and provide short-term storage to retailers facing low demand and cash strains.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

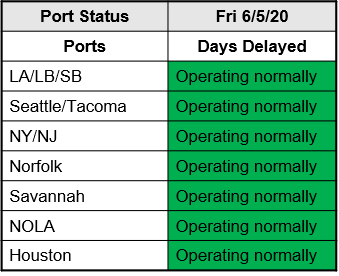

- Ports are operating normally:

Markets

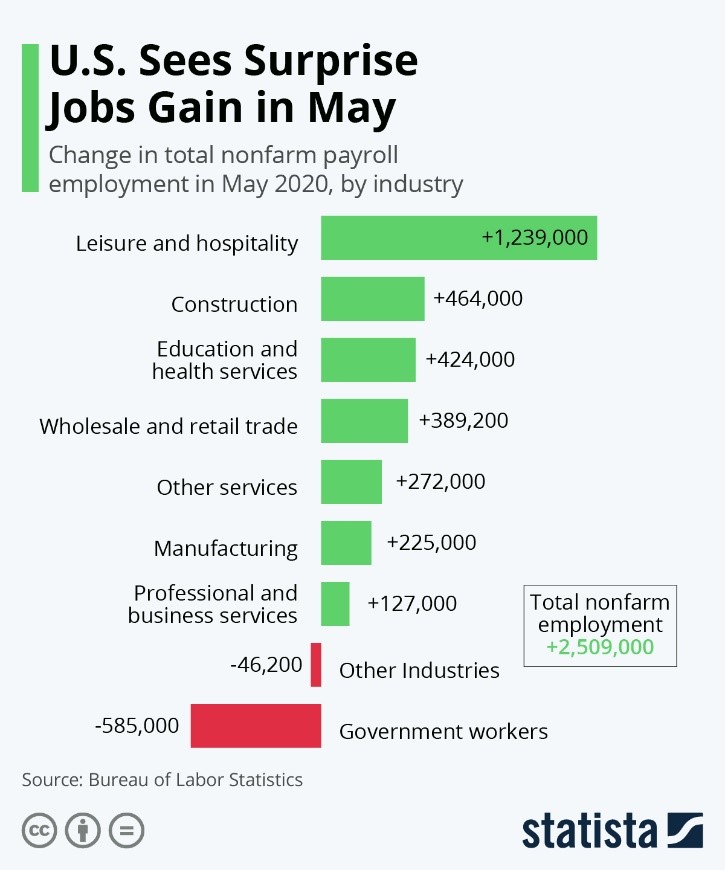

- Defying predictions of further deterioration, the unemployment rate fell to 13.3% in May as 2.5 million jobs were added by reopening businesses:

- Employment levels increased across industries and markets.

- The jobs picture improved for whites and Latinos but deteriorated for African Americans and Asians.

- Employment levels improved for men and women, but more women remain unemployed.

- The U.S. trade deficit rose 16.7% in April to $49.4 billion; imports fell 13.7% and exports shrank 20.5%, both monthly records.

- People are using their retirement savings as financial lifelines, presenting the twin risks of selling assets at depressed values and impairing long-term retirement prospects.

- The U.S. Department of Health and Human Services issued guidelines to healthcare laboratories aimed at gathering demographic and other information on testing results.

- The U.S. Central Bank’s expansion of credit guarantees to companies is drawing criticism for its lack of conditions as some large companies are borrowing money to maintain dividends while laying off employees.

- Ford will extend work-at-home for most salaried workers until at least September, while salaried workers for Fiat Chrysler Automobiles have begun returning to work.

- Big cities could face permanent income tax hits if companies embrace permanent work-from-home arrangements; Ohio is reconsidering a law that allowed cities to continue collecting income taxes from employees working from homes during the COVID-19 crisis.

- The flexible office space market, struggling with a drop in rental income, could experience a surge in demand if companies shift from long-term leases to more flexible options.

- TSA screening procedures continue to evolve in response to COVID-19:

- Passengers may now carry-on up to 12 ounces of hand sanitizer.

- They must hold their boarding passes to avoid contact with TSA agents.

- They can wear face masks but may be asked to lower them for ID purposes.

- TSA Precheck passengers may face blended security lines.

- The deadline for requiring Real IDs has been extended by a year to October 1, 2021.

International

- The European Central Bank nearly doubled the scale of its asset purchase program, boosting it to $1.35 trillion euros. European stocks jumped on the news.

- Spain, which saw its mortality rate spike 155% in early April, extended its state of emergency until June 21.

- Major investors from around the world urged Europe’s leaders to use its pending rescue program as a “once in a lifetime” opportunity to advance environmental and climate change initiatives.

- With Hispanics disproportionately impacted by the early waves of U.S. job losses, Central American nations are suffering from the drop in remittance income. Remittances globally could fall by $100 billion this year, threatening living standards and credit ratings in some of the most vulnerable nations.

- The approach of winter in Latin America is raising fears of accelerated rates of COVID-19 infection, as the virus appears to spread at maximum speed in cooler temperatures.

Our Operations

- Our Healthcare team, in collaboration with Plastics News, will host a webinar on materials selection for medical applications on June 11. Click here to register.

- Our Business Development Market Managers are available for videoconferences with clients seeking advice on material selection, manufacturing, regulations and other aspects of specialty markets:

- To schedule a meeting regarding Automotive, contact Market Manager Matt Zessin.

- For Color & Compounding, contact Market Manager Scott Arnold.

- For Electrical & Electronics, contact Market Manager Carlos Aponte.

- For Healthcare, contact Global Healthcare Manager Josh Blackmore.

- For Wire & Cable, contact Director Todd Waddle.

- For 3D Printing, contact Market Manager Haleyanne Freedman.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.