COVID-19 Bulletin: June 29

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices were higher in late trading today with the WTI crude price up 3.4% to $39.80/bbl and Brent up 2.0% to $41.85/bbl.

- Fracking pioneer Chesapeake Energy filed for bankruptcy, the largest failure so far in the shale industry where up to 200 producers are vulnerable if oil and gas prices remain depressed.

- The COVID-19 infection surge in Texas has prompted many companies, including LyondellBasell and Shell, to return to work-at-home protocols and demonstrates the challenge of reopening offices during the pandemic.

Supply Chain

- The U.S. Postal Service will raise rates for international parcel shipments on July 1.

- Disinfecting robots using UV light and self-driving forklifts are among new innovations being developed for warehouses in the pandemic era.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

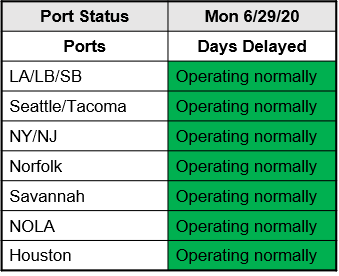

- Ports are operating normally:

Markets

- The COVID-19 pandemic intensified in the U.S. and globally:

- Global infections surpassed 10.1 million over the weekend, and deaths topped 500,000.

- Thirty-one U.S. states are experiencing rising daily infection rates, with only four states seeing declines.

- New daily cases in the U.S. exceeded 40,000 for the past three days; Friday saw nearly 46,000 new infections, a daily record.

- Daily new cases in Florida increased five-fold as the state joined Nevada and South Carolina in registering record new cases over the weekend.

- Texas, experiencing about 5,000 new infections a day, closed bars as hospitals there scramble to increase ICU capacity.

- Two-hundred-and-eighteen companies in the S&P 500 have withdrawn their earnings guidance due to the uncertainty of the pandemic.

- Private equity firms globally held a record $1.75 trillion in cash this month, but little of the trove is going to save struggling portfolio companies from bankruptcy court.

- In the shadow of the pandemic, companies — including BP, Solvay and Total — are evaluating and shedding underperforming and non-strategic brands.

- Pending home sales jumped a higher-than-expected 44.3% in May compared with April but remained 5.1% below May of 2019. A 15% increase was expected.

- Microsoft is permanently closing all its retail stores globally.

- Consumer product companies from automakers to restaurants have pared product and menu offerings due to demand and supply-chain challenges during the pandemic, changes that could become permanent.

- American Airlines followed United in announcing it will return to full flights, leaving Delta, Jet Blue and Southwest as major airlines not filling middle seats. American also signaled further staffing cuts may be required.

- California passed legislation to mandate a move to all electric or hydrogen powered trucks and vans starting in 2024.

- Start-up electric truck developer Nikola Corp. is selling $5,000 reservations to buy its Badger battery-powered truck even before it has a prototype or manufacturing partner for the vehicle.

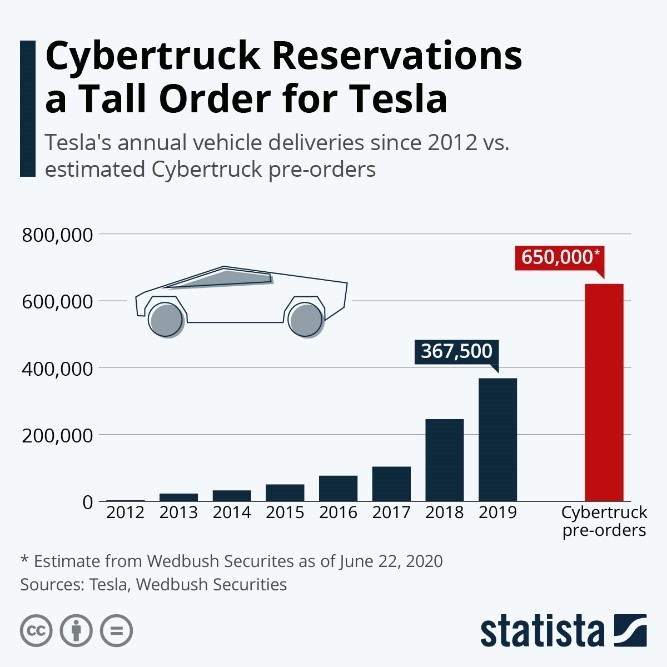

- Tesla has seen strong preorders for its electric truck:

- Start-up Relativity Space is using giant 3D printers to manufacture entire rockets, reducing the bill of materials from over 100,000 parts to about 1,000, bringing the manufacturing cycle down to 60 days, and employing nearly “lights-out” manufacturing during the pandemic.

International

- The U.S. is not among the 15 countries with which the European Union plans to end border travel restrictions.

- Mexico’s violent crime epidemic was spotlighted in the country’s capital city on Friday in a failed assassination attempt of the police chief by a drug cartel. He was wounded and three others killed.

- China sequestered 400,000 residents in a northern province to contain a COVID-19 cluster connected to its recent outbreak in Beijing.

- The COVID-19 recession is severely impacting Africa’s expanding middle class, which comprises about 14% of the continent’s 1.3 billion population, and could throw 8 million into poverty.

- World trade will fall 13.4% this year, erasing years of progress, as the pandemic exerts profound pressures on globalization, from the flow of trade to the movement of capital to infrastructure investment.

- Germany is banning several single-use plastic products effective July 3.

- Amazon’s Indian unit has eliminated the use of all single-use packaging in its fulfillment centers, replacing bubble wrap with paper cushioning and tapes with biodegradable alternatives.

Our Operations

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.