COVID-19 Bulletin: June 22

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices were steady in early trading today, with WTI at $39.66/bbl and Brent at $42.07/bbl.

- The active rig count in the U.S. and Canada fell to a record low 266, the seventh consecutive week of decline.

- New Mexico, the third largest oil-producing state with 40% of state government revenue attributable to the oil industry, is slashing its budget due to the drop in oil prices and drilling activity.

- Houston experienced its highest number of new infections on Friday as the pandemic spreads in Texas.

- Saudi Arabia lifted its COVID-19 curfew after a three-month lockdown.

- The energy recession may not prompt the wave of merger activity that has occurred during past downturns because major players are gun shy after so many of the more recent deals have failed to meet expectations.

Supply Chain

- Employment among Class 1 railroads plunged nearly 17% in May from the prior-year period and 4.5% from the prior month.

- While the efficacy of global supply chains for manufactured goods is under examination due to the pandemic, globalization of services industries will likely accelerate in sectors such as information and communications technology, financial intermediation, insurance, and professional, scientific and technical services.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

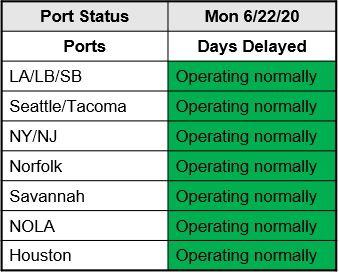

- Ports are operating normally:

Markets

- The World Health Organization warned that COVID-19 is entering a new, more dangerous stage after record new cases yesterday. The rise in cases is dimming hopes for a V-shaped recovery.

- Seven states registered record new COVID-19 cases last weekend as infections nationally increased at the highest pace since early May.

- The White House signaled that it is preparing for a possible second wave of COVID-19 in the fall.

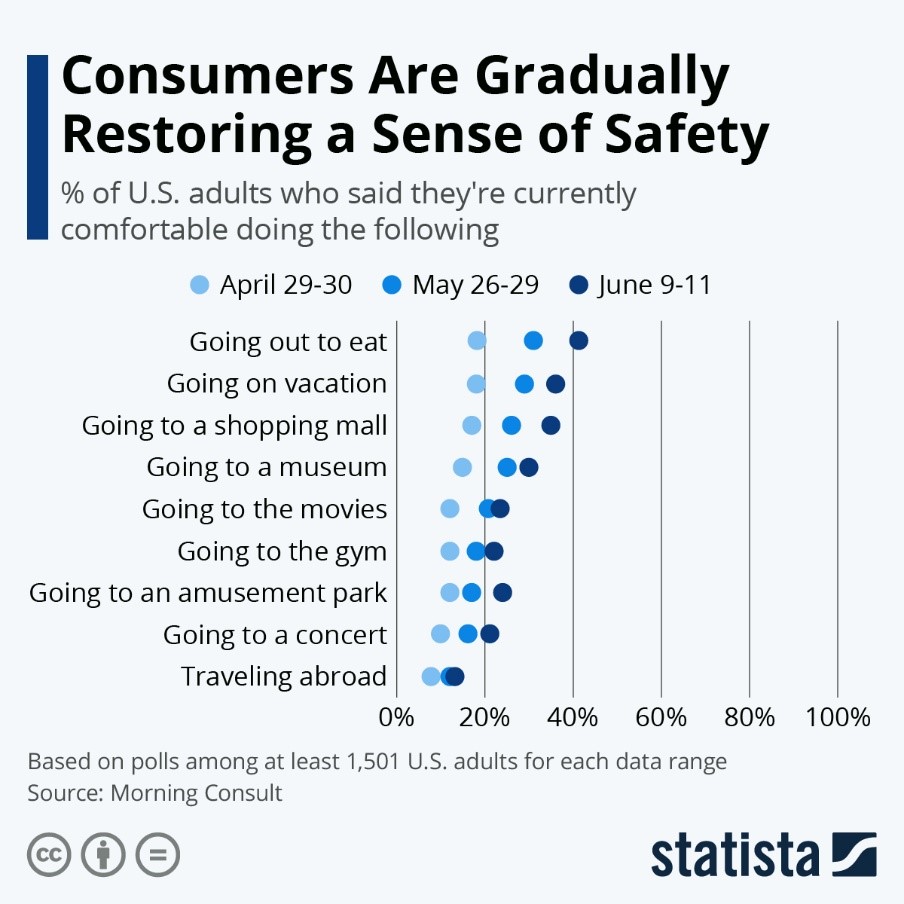

- U.S. consumers are gradually gaining more confidence about going out:

- U.S. companies repatriated $124 billion in foreign profits in the first quarter to mitigate liquidity strains from the COVID-19 crisis.

- S&P companies are sitting tight on their cash reserves as they wait for signs of a recovery in consumer spending. Meanwhile, major companies will raise a record $150 billion this quarter through bank borrowing, equity offerings and a wave of divestitures.

- The IRS expanded eligibility for $100,000 interest-free COVID-19 loans and distributions from IRAs and 401K accounts to those who have experienced a delay in returning to work, have had a job offer rescinded, or whose spouse lost a job.

- Fewer women between the ages of 25 and 54 are reentering the workforce because of the decline in more flexible service-sector jobs, posing risks to the recovery.

- Car buying online has been more successful than expected for many dealerships, prompting a permanent shift toward e-commerce in the industry.

- After using 3D printing to make molds for medical equipment in response to the pandemic, GM plans to expand its adoption to producing parts for automobiles.

- Sales of existing homes may have bottomed in May, down a more-than-expected 9.7% from April, as other indicators suggest a recovery is underway for the housing market.

- Home-mortgage delinquencies hit the highest level since 2011 in May.

- The risk of riding elevators for returning office workers can be minimized by limiting occupancy and use of masks.

- More than 100 health experts from 18 nations signed a statement expressing concern about the growth of single-use plastic products during the pandemic and offering assurance about the safety of reusable products.

- Total confirmed COVID-19 cases is approaching 9 million globally.

International

- Spain lifted its three-month state of emergency.

- Consumer confidence leaped higher in Canada as the economy continues to reopen.

- The virus reproduction factor in Germany rose to 2.88 on Sunday, well above the goal of 1.0, as the country experienced several local outbreaks.

Our Operations

- Our 3D Printing team has designed innovative tools to assist us in eventually reopening our offices, including a hands-free dispenser for hand sanitizer, a low-contact thermometer, and a multi-purpose tool for opening doors and completing other tasks.

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.