COVID-19 Bulletin: July 30

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The WTI crude price was down 3.2% to $39.97/bbl in mid-day trading, while Brent was off 2.5% at $42.66/bbl.

- Total SE took an $8.1 billion impairment charge on energy assets, including $7 billion on Canadian oil sand investments, and reported a second-quarter net loss of $8.4 billion. Adjusted net income was better than expected, and the company is maintaining its dividend.

- Italy’s Eni reported a second-quarter loss and spending cuts and said it will peg its dividend to the price of Brent, resulting in a dividend reduction.

Supply Chain

- The pandemic has granted new pricing power to FedEx and UPS, whose rising parcel shipping rates are putting an additional squeeze on beleaguered retailers.

- UPS reported better-than-expected sales and earnings for the second quarter, with average daily volume up 22.8% and business-to-consumer shipments up 65.2%.

- In late June, FedEx reported that residential volumes were up 72% in its fiscal fourth quarter, though earnings were hurt by the higher expense of servicing such shipments and the cost of personal protective measures.

- We’re seeing delivery challenges with LTL shipments caused by labor shortages and operational delays from COVID-19 protocols now spreading to truckload shipping. Clients are advised to provide expanded lead times on orders to help assure delivery dates will be met.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- New jobless claims exceeded 1.4 million last week, the 19th consecutive week of 1 million-plus new claims.

- U.S. GDP contracted 9.5% in the second quarter, the largest quarterly decline on record.

- New COVID-19 infections yesterday surged back above 70,000.

- Texas passed New York in total number of COVID-19 infections, following California and Florida, to the top of the list of most impacted states.

- California, Florida and North Carolina set single-day records for COVID-19 deaths yesterday.

- The head of the CDC warned of evidence that the COVID-19 surge experienced in Sunbelt states is moving to the Midwest, with concerning rises in Indiana, Kentucky, Ohio and Tennessee.

- The Federal Reserve left interest rates unchanged and pledged continued diligence in supporting the economy. The head of the Central Bank said the recovery is slowing and the outlook will depend on controlling the spreading pandemic.

- Progress on a fourth economic recovery package appears stalled amid disagreements in the Senate and White House.

- The current Senate bill includes provisions to unify state and local tax rules so remote and gig workers are not taxed redundantly by two states.

- The White House is opposed to Senate efforts to include provisions allowing wages and expenses paid with Paycheck Protection Program loans to be deducted for tax purposes, creating uncertainty for small businesses that received loans.

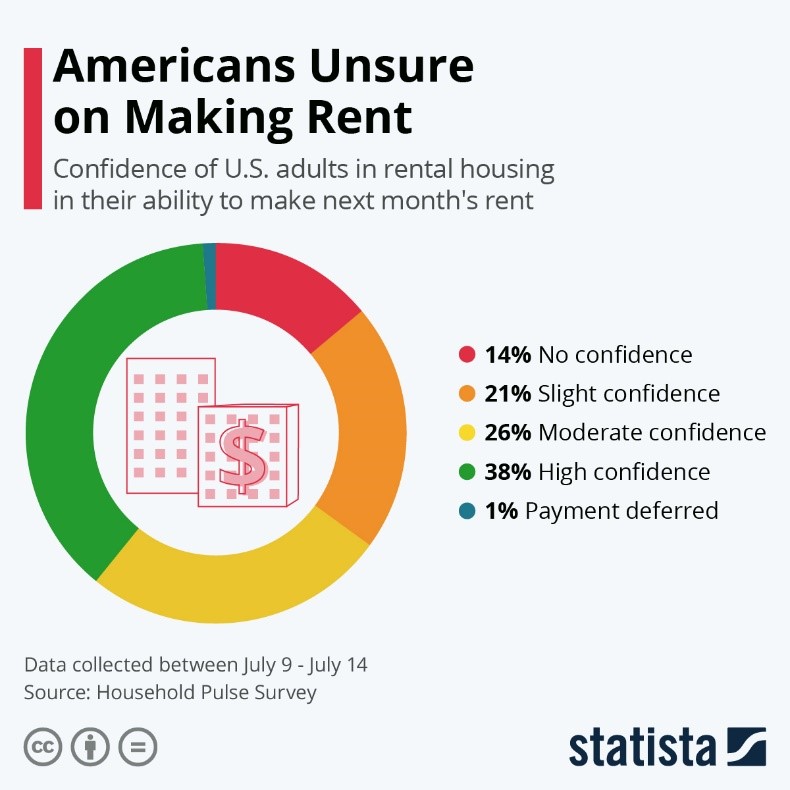

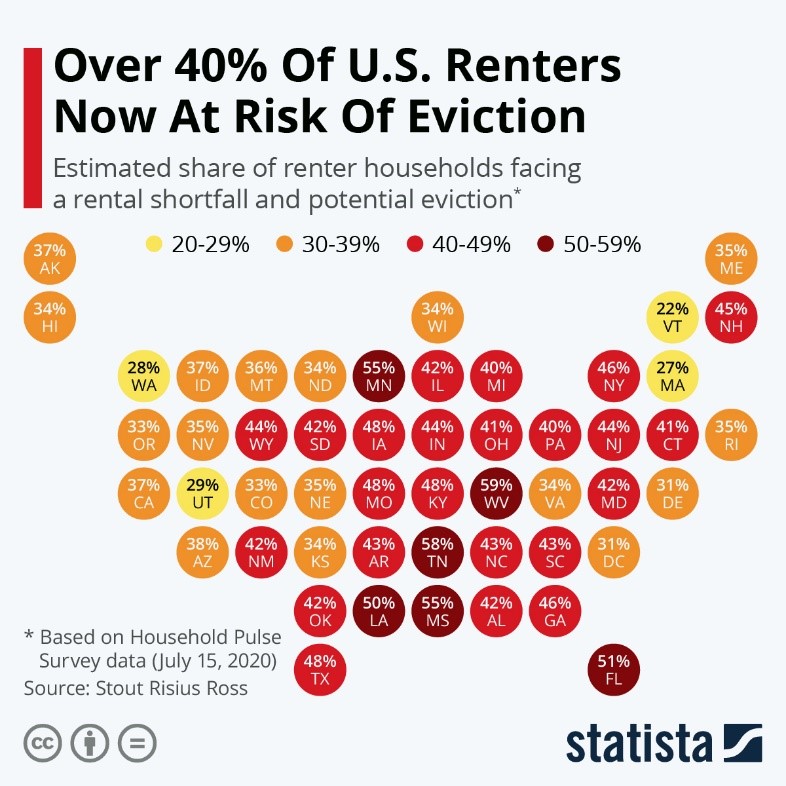

- With talks on a new economic recovery package stalled and prior programs expiring, many Americans are anxious about how they will pay the rent with over 40% of renters in danger of eviction:

- Goldman Sachs says the weak U.S. dollar could dampen cross-border M&A activity, making foreign investments more expensive for U.S. companies and highlighting economic concerns about U.S. investments for foreign firms.

- VW Group’s unit volume fell 35% in the second quarter; the company lost $2.8 billion and cut its dividend.

- Renault’s sales fell 35% in the first half, and the company reported a loss of $8.5 billion.

- Dunkin’ Brands is closing 800 restaurants this year, 8% of its total.

- In a further sign of changing retail business models, Best Buy and Kohl’s will join other major retailers in closing on Thanksgiving, which, along with Black Friday, marks the traditional start of the holiday buying season when stores lure crowds into their stores.

- Sustainability remains a pressing concern for Americans, despite the pandemic and recession.

- McDonald’s has introduced swimwear made of recycled plastic straws to promote its sustainability credibility in Europe.

- Low fossil fuel prices are hampering the growth of bioplastics.

- Tropical Storm Isaias, the season’s ninth named storm, strengthened in the Caribbean and appeared headed for Florida and the East Coast.

- U.S. deaths from COVID-19 passed 150,000 yesterday.

International

- Brazil opened its borders to foreign air travelers yesterday despite recording over 69,000 new cases and nearly 1,600 deaths, both daily records.

- The COVID-19 outbreak in Victoria, Australia, is worse than the first wave and providing a window into what northern counties could encounter when colder weather forces people indoors.

- In its mid-year projection, Japan’s government said it expects GDP to contract 4.5% this fiscal year, with a modest recovery next year. Ratings agency Fitch lowered the outlook for the country to Negative.

- Thailand’s Finance Ministry lowered its expectation for the economy, predicting GDP will contract by 8.5% this year.

- The U.K. extended the self-isolation period for those diagnosed with COVID-19 from seven days to 10 days based on growing evidence that people can remain infectious for up to nine days after symptoms are detected.

- Demand for single-use plastic bags has fallen 95% in the U.K. since the nation mandated a charge for them in 2015.

- More plastic bans are being imposed in China to curtail plastic pollution.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.