COVID-19 Bulletin: January 7

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Special notice:

In-person components of NPE2021, scheduled for May 17-21, 2021, have been canceled due to risks associated with COVID-19 transmissions, the Plastics Industry Association announced Tuesday.

Supply

- Crude oil prices rose Wednesday on crude oil inventory draws of 8 million barrels for the last week of 2020, according to the Energy Information Administration. Oil prices were higher in mid-day trading today, with the WTI up 0.3% at $50.78/bbl and Brent up 0.3% at $54.45/bbl. Natural gas was 0.7% higher at $2.74/MMBtu.

- Dealmaking among oil and gas producers reached its highest yearly point in the fourth quarter of 2020 as pandemic-induced fallouts prompted more consolidations.

- The U.S. imported no oil from Saudi Arabia last week, the first time in 35 years.

- For the first time in its history, Exxon disclosed carbon dioxide emissions generated from its operations.

- Global banks are facing pressure to condition lending to the plastics industry on environmental support initiatives.

Supply Chain

- Dire predictions of port chaos in the U.K. have yet to materialize following the nation’s departure from the European Union on Jan. 1.

- Vietnam will spend up to $8.6 billion over the next decade to upgrade its ports to international standards and increase capacity.

- Canada/U.S. transportation company Pride Group Enterprises will purchase 6,320 all-electric delivery vehicles from Workhorse Group, vehicles with up to 150 miles of range that will be used for last mile deliveries.

- Canadian railway CN reported its 10th consecutive month of record grain and processed grain carloads.

- A new Labor Department rule makes it easier for businesses to classify workers as independent contractors, a win for ride-sharing and third-party delivery companies.

- Blockchain is expected to grow to a $3.5 billion component of supply chains by 2023 as businesses adopt the technology to improve efficiency and security.

- Logistics giant XPO is adopting virtual reality technology to help train LTL service center workers.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 253,145 new COVID-19 cases in the U.S. yesterday. Wednesday’s 3,865 fatalities set a new daily record, pushing total deaths above 361,000.

- Alabama, Idaho, Iowa, Pennsylvania and South Dakota reported seven-day COVID-19 positivity rates above 40%, a sign the virus is spreading more broadly.

- More than 50 people have been identified in the U.S. with a highly contagious mutation of COVID-19 first identified in the U.K.

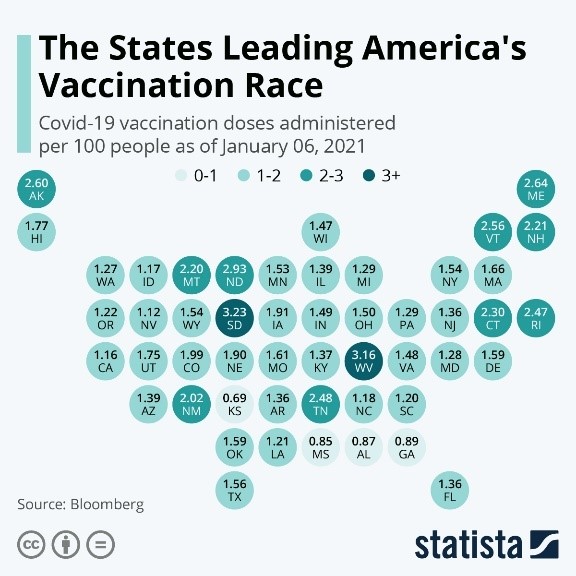

- South Dakota and West Virginia are leading the nation in administering vaccines.

- New York has tripled its rate of administered vaccines over the past few days as the state’s governor warns of potential supply issues. New York City is urging the governor to permit localities to expand vaccine distribution beyond healthcare workers to senior citizens, an effort to more broadly distribute vaccines after initially slow rollouts caused by strict rules.

- CVS expects to complete inoculations at 8,000 nursing homes across the country by Jan. 25.

- Nursing home staff show high levels of hesitancy to take a COVID-19 vaccine, delaying the rollout of inoculations at the nation’s long-term care facilities.

- COVID-19 vaccines have caused at least 29 severe allergic reactions to Americans, a small number that is still higher than the rate of allergic reactions to seasonal flu vaccines.

- Public health agencies and healthcare organizations are turning to hundreds of closed Sears department store locations across the nation as COVID-19 mass vaccination sites.

- Several indicators point to a sustained recovery in U.S. manufacturing, with new orders for U.S.-made goods increasing more than expected in November alongside continued investment in equipment.

- U.S. services companies showed the slowest growth in three months in December with IHS Markit’s sector index pegged at 54.8, down from 58.4 in November. Any reading above 50 indicates growth.

- U.S. private payrolls posted their first decline in eight months with job losses across all industries, data from ADP’s National Employment Report shows.

- First-time jobless claims in the U.S. were down by 3,000 last week to 787,000.

- One in four Americans pulled money from their savings in December, the most so far in the pandemic.

- Chief information officers were tasked with rapidly accelerating digital business components in 2020, sometimes squeezing years’ worth of shifts into just a few months in a rush to support virtual and e-commerce operations.

- Amazon will spend $2 billion to build affordable homes in Washington state, Virginia and Tennessee, where the company’s major employment hubs are located.

- Ford Motor Co.’s sales dropped a smaller-than-expected 10% in the fourth quarter, largely due to low inventory of a redesigned F-150 pickup. The company was surpassed by General Motors in the market for large pickup trucks for the first time since 2015.

- Walgreens is selling its pharmacy wholesale business amid increased competition from Amazon and rival CVS.

- COVID-19 case studies are beginning to make their way into MBA and other business school curriculums at U.S. colleges and universities.

- Carnival and Princess cruise lines extended their moratorium on cruises from U.S. ports into spring.

- Family Video, the last video rental chain in the U.S., is shuttering its remaining 248 stores after 42 years in business, citing the pandemic and growth in streaming video.

- U.S. retailer Tuesday Morning exited Chapter 11 bankruptcy with a loss of nearly 200 stores across the country.

- Baltimore and Philadelphia delayed their single-use plastic bag bans for six months until July due to the persistent pandemic.

International

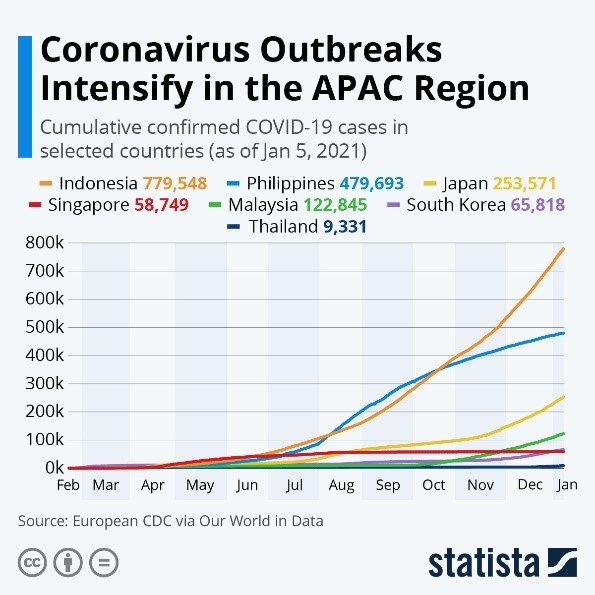

- COVID-19 infections are on the rise across the Asia Pacific region:

- Malaysia reported more than 2,500 new COVID-19 cases, a record.

- China reported 52 COVID-19 cases in Hebei province, prompting increased restrictions, the largest rise in more than five months.

- The U.K. reported the highest daily COVID-19 fatalities since April, as the nation relies on a strict third lockdown and accelerated vaccine programs to keep its health service afloat.

- New COVID-19 cases in Japan topped 7,000 for the first time, led by high infection rates in Tokyo where a state of emergency and new restrictions will be imposed from Friday to Feb. 7.

- Germany is facing criticism over a slow rollout of initial COVID-19 vaccines, while the German chancellor warned that the toughest months are still ahead.

- Germany and Israel are tightening restrictions in part to make do with dwindling vaccine supplies until more deliveries are made.

- Portugal recorded more than 10,000 new COVID-19 infections, prompting an extended state of emergency.

- Switzerland is set to extend closures of bars, restaurants and leisure venues until the end of February.

- Australia will begin vaccinating its population against COVID-19 in February as two of the nation’s states attempt to contain outbreaks. Nearly 40,000 Australians remain stranded in foreign countries by the nation’s strict COVID-19 restrictions.

- Zimbabwe’s health system is being overrun by COVID-19 patients just days after the nation imposed a strict new 30-day lockdown.

- Europe’s economic recovery appears more tenuous after a swift worsening of COVID-19 conditions since last month’s positive financial statistics were measured.

- Against health groups’ recommendations, some countries are delaying required second shots of COVID-19 vaccines to allow for inoculating more people faster with limited initial supplies.

- A highly contagious coronavirus variant in South Africa will likely make a COVID-19 vaccine less effective, but is unlikely to be totally resistant to the shots.

- Food prices are up 18% since May amid rising hunger globally.

- The Turkish lira is trading at its highest value against the dollar in nearly four months, a sign the country’s historically volatile markets have rebounded successfully in recent weeks.

- Home prices in Toronto hit a record high in 2020 amid increased demand for larger homes and low interest rates.

Our Operations

- As we enter a new year, our President and CEO shared this message and video with our Mployees and business partners.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.