COVID-19 Bulletin: January 27

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were higher in mid-day trading today, with the WTI up 1.1% at $53.18/bbl and Brent up 0.6% at $56.25/bbl. Natural gas was up 3.4% at $2.75/MMBtu.

- U.S. oil inventories fell by a higher-than-expected 5.3 billion barrels last week, according to the American Petroleum Institute.

- The White House is expected to halt new oil and gas leasing on federal territory today.

- Canadian crude oil exports transported by rail soared nearly 90% in November due to a shortage of pipeline capacity in the country.

- The Port of Corpus Christi, Texas, is deepening two waterways with hopes of increasing oil shipments to China.

- Two of New York City’s pension funds announced plans to divest from fossil-fuel related companies, an expected $4 billion divestment among the world’s largest.

- BP venture Lightsource BP is building two solar installations near Dallas, Texas, with combined output of over 300 megawatts.

- Three years after divesting its upstream oil assets in Ireland, Shell is taking a majority interest in an Irish floating wind project in the Celtic Sea with 300 megawatts of power.

Supply Chain

- Eight million Californians are under flood alerts and more than 400,000 have lost power as violent winter storms cross the state, bringing fears of mudslides in burn spots from the summer’s historic wildfires.

- After a hectic 2020 and in contrast to other shipping markets, container demand will remain high for the next six months, Hapag-Lloyd forecasts.

- The South Korean government is working with the nation’s leading shipper to deploy at least five vessels by the end of February, a bid to support domestic exporters amid soaring freight rates.

- A global semiconductor shortage is prompting Taiwanese chipmakers to consider a round of price increases, mainly in automotive chips.

- VF Corporation, the parent company of The North Face, Timberland and Vans, is using digital mapping to trace the supply chains of more than 100 of its products by December 2021, with resulting data expected to improve sustainability and labor-related goals.

- Hundreds of containers are being held up at the Chinese port of Dalian as local authorities test fish cargoes for coronavirus before allowing them to clear customs.

- Instead of expected truck gridlock at British ports following Brexit, truckers are shunning land crossings due to the paperwork and bureaucracy involved.

- Government antitrust probes are delaying the mega-merger of two Korean shipbuilders, a combination aimed at improving their competitive position with China’s industry.

- An internet outage caused by a surge in traffic hit most parts of the eastern U.S. Tuesday, with complaints focused on Verizon and Comcast.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

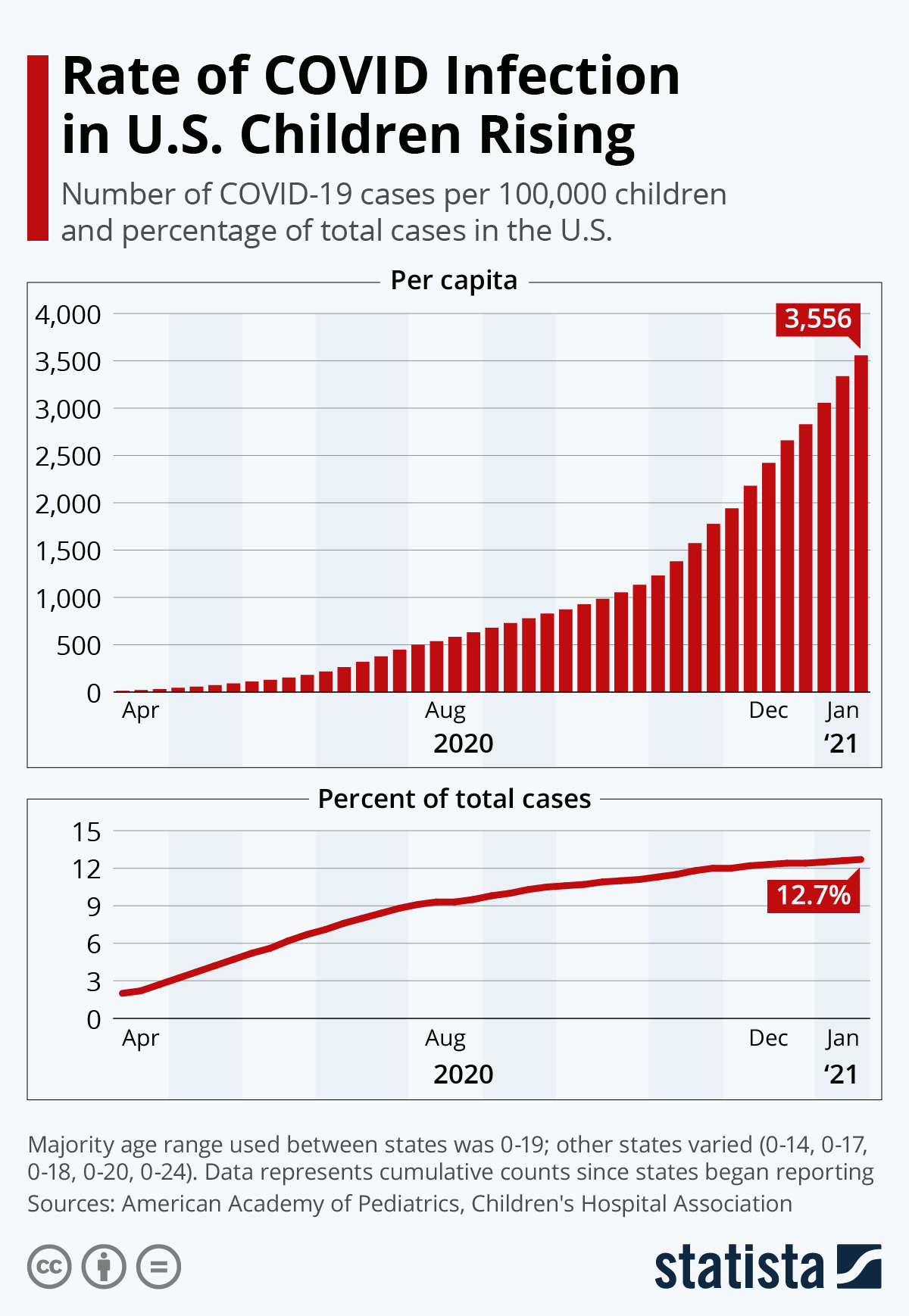

- U.S. COVID-19 fatalities more than doubled yesterday from Tuesday to 4,087. There were 146,640 new infections.

- U.S. infection rates are improving: the seven-day average of new COVID-19 cases fell to 167,240, the lowest since Dec. 2, and no state had more than 1,000 average daily cases per million residents for the first time since October.

- Several states, including California, New York, Illinois, Michigan and Massachusetts, are easing pandemic restrictions amid modest declines in case counts and hospitalizations, although new variants of the virus are setting off alarms.

- New Jersey’s governor is considering easing some of the state’s virus restrictions amid declining cases.

- A greater number of younger people and women showing up in hospitals with COVID-19 symptoms gives evidence to the U.K. strain’s higher transmissibility, now backed by early statistical data.

- The spread of COVID-19 in schools appears limited when masking and other social distancing procedures are followed, new data from the CDC shows.

- The pandemic has taxed nurses and doctors to a degree never experienced, with high death tolls and physical and emotional demands leaving them burned out and sometimes feeling hopeless.

- Music-industry companies are banding together to offer thousands of venues, workers and resources to the federal and state governments to aid in distributing vaccines.

- Pfizer will be able to supply the U.S. with 200 million COVID-19 vaccine doses by the end of May, two months sooner than expected, as the company updates its labels to instruct healthcare providers to extract an additional dose from each vial. Becton Dickinson, the world’s largest syringe supplier, is scaling up production of specialized “low dead space” syringes that are able to extract an extra COVID-19 vaccine dose out of shipping vials.

- The White House is purchasing 100 million doses each of Pfizer/BioNTech’s and Moderna’s COVID-19 vaccines, boosting the supply of doses sent to states by about 16% over the next three weeks and potentially allowing the government to vaccinate most Americans by the end of summer.

- Regeneron Pharmaceuticals’ antibody cocktail, now touted as a “passive vaccine,” reduced COVID-19 cases by half and prevented symptoms in people at high risk of catching the virus, the company said.

- GlaxoSmithKline and Eli Lilly are teaming up to develop an antibody cocktail to treat COVID-19 using their respective technologies.

- After nearly a year of study and testing, scientists are beginning to identify the most successful business tactics for limiting COVID-19, focusing on mask-wearing, worker pods and good airflow over surface cleaning, temperature checks and plexiglass barriers.

- Americans saved twice as much money in the first three quarters of 2020 as in the year-ago period, a trend expected to help fuel the continued economic recovery this year.

- U.S. consumer confidence rose in January on news of further fiscal aid and increased vaccine distribution, with the Conference Board’s index increasing to a better-than-expected 89.3, compared to 87.1 in December.

- Global air travel remains severely depressed due to a maze of constantly changing restrictions and travel bans.

- Southwest Airlines is offering employees another round of voluntary leaves as staffing levels remain too high for current flight schedules. Nearly 800 pilots have agreed to take off one to three months so far, the airline said.

- Corporate earnings reports reveal the varying impacts of the pandemic:

- Boeing reported a fourth-quarter loss of $8.4 billion and pushed the launch of its 777X wide-body plane until 2023 due to the collapse of international travel.

- A surge in power and renewable energy orders brought General Electric’s year-end cash flow to $4.4 billion, beating its own projection and ending 2020 a year ahead of schedule.

- American Express reported improving fourth-quarter results with travel and entertainment spending flattening from prior-quarter drops and a rise in other credit-card spending.

- Johnson & Johnson beat analysts’ revenue expectations in the fourth quarter on strong sales growth in pharmaceuticals and consumer-health products, while sales of medical devices lagged as people continue to defer elective surgeries. The company is expected to announce key testing results regarding its COVID-19 vaccine next week.

- After a chaotic year of volatile sales in different business units, N95-mask maker 3M expects revenues across its product lines to grow in 2021 as vaccinations spread and more people use its products in the workplace and schools.

- Microsoft posted record quarterly sales in the fourth quarter on increased demand for video games, cloud-computing services and home offices products, including Surface laptops.

- Olive Garden’s parent company will give workers up to four hours of paid time off to get the COVID-19 vaccine.

- Ford expects to sell 50,000 Mustang Mach-E models in its first year as the company shifts its focus toward electrical vehicles under pressure from governmental incentives and regulatory pressure.

- Owners of multifamily buildings are starting to fall behind on loan payments, as banks increasingly view a larger number of rental loans as high risk due to eviction protections, lower rent collections and declines in asking prices.

- Manhattan’s famous Fifth Avenue retail corridor is showing signs of life after asking rents tumbled 18% from a 2017 peak, as more businesses attempt to take advantage of the lower prices and owners expect fewer disruptions from protesters and police barricades.

- New York state is considering Extended Producer Responsibility (EPR) legislation that would make plastic product producers pay for end-of-life disposal costs of their products.

International

- Global COVID-19 cases topped 100 million Tuesday, doubling in less than three months.

- COVID-19 deaths in the U.K. topped 100,000.

- South Korea reported 599 new cases of coronavirus infections Tuesday, a 10-day high.

- A cluster of at least 15 cases near the Taiwanese capital of Taipei prompted officials to impose a strict lockdown affecting more than 3,000 people.

- Overcrowded hospitals with few resources are increasingly calling for emergency resupplies of oxygen, with shortages causing higher COVID-19 death rates in many of the world’s hardest hit regions.

- Ambulances in Mexico City, where hospitals are at capacity, sometimes spend hours searching for a hospital to take sick COVID-19 patients.

- A Colombian presidential hopeful has died of COVID-19, the government said.

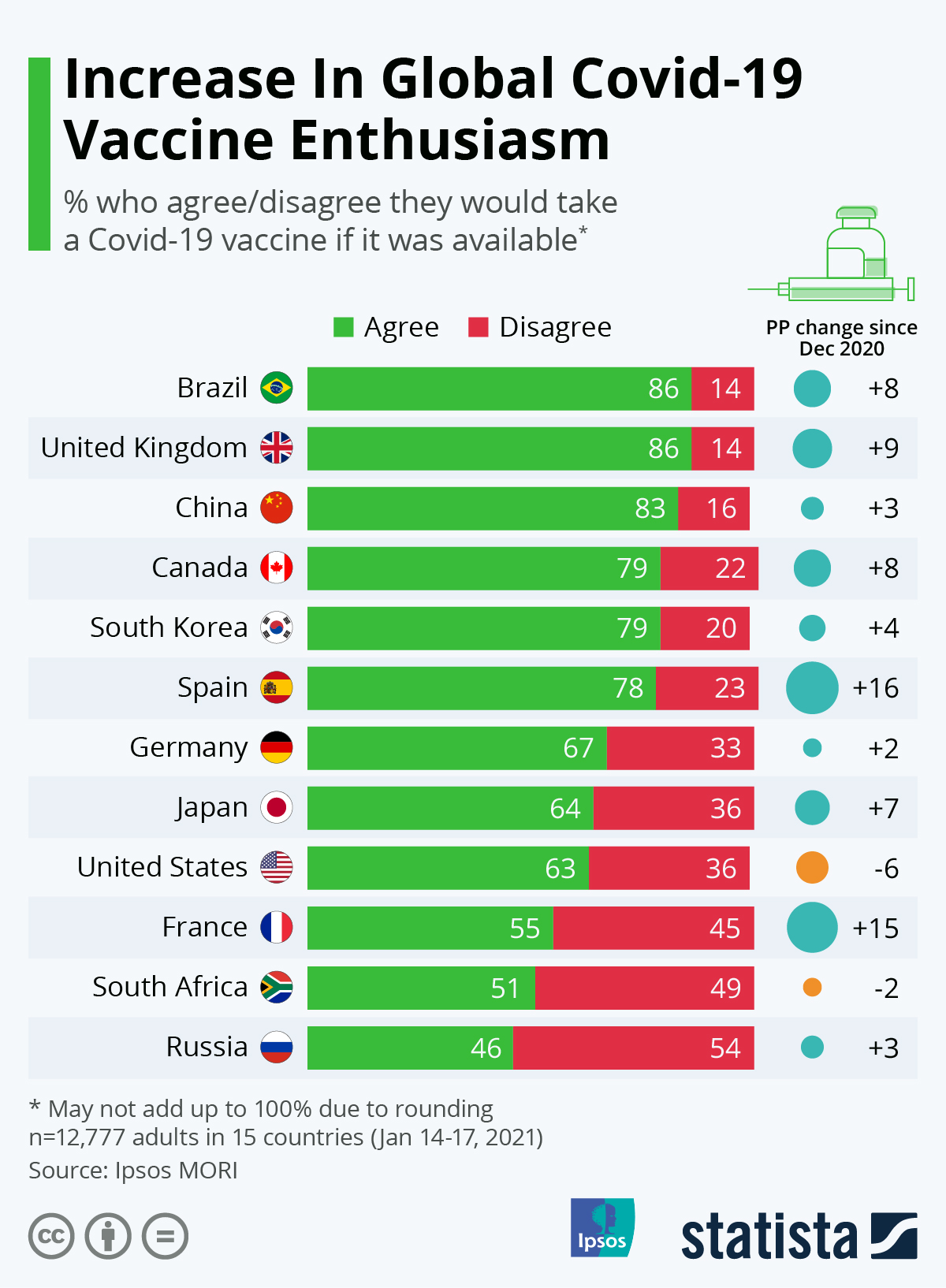

- Resistance to vaccines is waning as the pandemic continues to take its deadly toll:

- Only 56% of eligible people have received India’s homegrown vaccine so far, with hesitation mounting over a shot that has yet to complete Phase III trials.

- The U.K. is implementing a hotel quarantine system for inbounding air passengers from high-risk countries.

- New Zealand will keep its borders closed to the world for most of 2021 amid uncertain vaccine rollouts, government officials predict.

- The European Union is removing Japan from a “white list” of countries whose passengers are permitted to visit the bloc during the current pandemic phase.

- Of 128,000 Israelis who received both doses of a COVID-19 vaccine, just 20 people contracted the virus one week after the second dose, providing early indications of a world after mass vaccinations.

- Competition among nations for approved COVID-19 vaccines has led German officials to back European Union proposals to flag exports of the shots, which could disrupt deliveries. Health officials in the U.K., where the AstraZeneca/Oxford vaccine is manufactured, warned against European Union “protectionism” after the announcement.

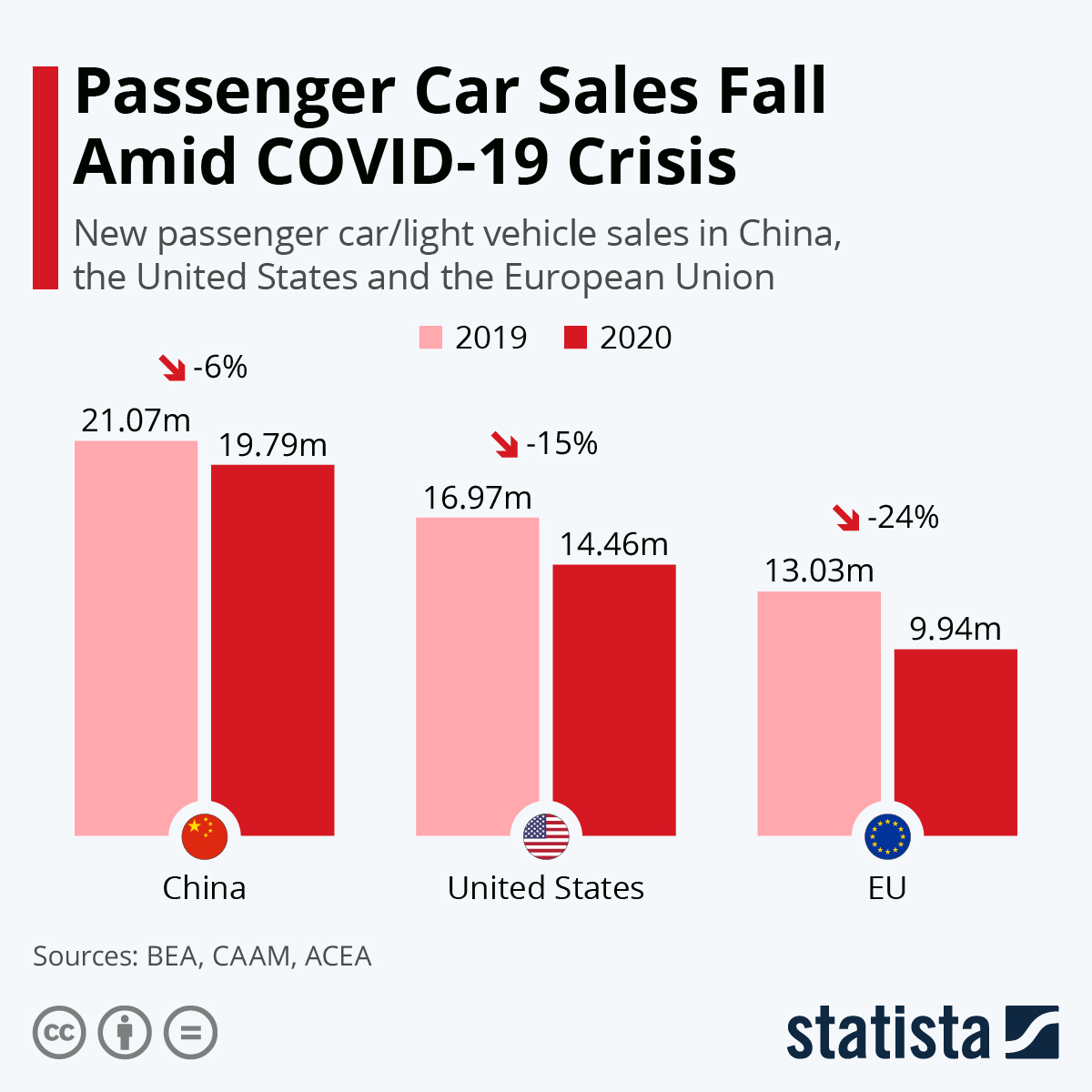

- No auto market was spared from the impact of COVID-19 in 2020:

- South Korea’s 2020 GDP is expected to shrink 1%, one of the smallest contractions among major economies, a result of strong exports and success in containing COVID-19.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.