COVID-19 Bulletin: January 26

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices were flat in mid-day trading today, with the WTI at $52.57/bbl and Brent at $55.88/bbl. Natural gas was 1.7% higher at $2.65/MMBtu.

- U.S. gas prices are expected to rise to an average of $2.42 per gallon in 2021, according to Energy Information Administration forecasts.

- The U.S. shale industry is showing early signs of a recovery, with the number of drilled but uncompleted wells that accumulated in June subsiding to pre-pandemic levels in recent weeks.

- Saudi Arabia, the world’s largest oil exporter, is taking steps to gradually replace petroleum-liquid electricity generation with solar power and gas-fired capacity.

- For the first time in history, renewable sources surpassed fossil fuels for electricity generation in the European Community last year.

- Royal Dutch Shell is acquiring the U.K.’s leading electric vehicle charging network, adding to a growing stable of electric vehicle charging assets as the oil giant shifts investments toward sustainable technologies.

- The world’s largest diesel engine factory in France is shifting to producing electric motors, creating uncertainty for the labor force because electric motors have one fifth the number of parts as traditional diesel engines.

Supply Chain

- UPS announced plans to sell its freight business to rival TFI International for $800 million, a bid to exit the domestic trucking market to focus on its small-package-delivery businesses.

- The United States Postal Service continues to experience unprecedented volume increases and staff shortages due to COVID-19, the carrier says.

- Panasonic’s recently developed ultracold freezer boxes, capable of storing thousands of COVID-19 doses at -70°C, are in large demand around the world, as the company positions to take a significant slice of a growing vaccine storage and packaging market.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 151,112 new COVID-19 cases in the U.S. yesterday and 1,915 deaths.

- The number of U.S. COVID-19 hospitalizations declined to the lowest level since mid-December on Sunday, while patients requiring treatment in intensive care units remained high.

- New York City will delay opening vaccine mega sites at Yankee Stadium and Citi Field due to lower-than-expected shipments of doses from the federal government. On a broader scale, New York State announced plans to lift some restrictions in the coming days amid a decline in infection rates.

- The U.S. administration anticipates widespread vaccine availability to the public by spring, an ambitious target that will rely on vaccine makers boosting production. The White House will also begin holding regular coronavirus briefings led by public health officials three times a week.

- Minnesota confirmed the first recorded U.S. case of a more contagious COVID-19 variant originally found in Brazil.

- Moderna’s COVID-19 vaccine will protect against two highly contagious variants of COVID-19 from the U.K. and South Africa, though the South African strain will be more resistant, the company said, warranting development of a specifically tailored booster shot.

- U.S. health officials are working to verify the reportedly higher fatality rate caused by the U.K. virus strain, which is likely to be the predominant variant in America by March.

- The accuracy of COVID-19 tests will not be reduced by emerging new strains.

- Johnson & Johnson’s single-dose COVID-19 vaccine is expected to be more than 70% effective based on early trial data. The shot is highly anticipated due to its relatively easy distribution requirements.

- The latter half of 2020 brought a 2.4 percentage-point increase in the poverty rate, nearly double the largest annual increase in poverty since the 1960s.

- A White House directive issued Monday imposes tougher rules on government procurement practices to increase purchases of products made in the U.S.

- The White House announced plans to replace the 645,000 vehicles in the federal fleet with clean-energy versions made in the U.S.

- Owing in part to a temporary moratorium on travel due to the pandemic, migrants entering the U.S. fell to the lowest level in 40 years last year, according to the State Department.

- Sonoco Products announced it is raising prices on certain plastic packaging and thermoformed products by 8% due to raw material cost inflation.

- Kimberly Clark reported better-than-expected results in Q4 on renewed stockpiling of consumer goods as the pandemic and associated lockdowns spread. With consumer cupboards full and costs rising, the company expects more challenging conditions in 2021.

- Candymaker Godiva is closing all its 128 retail stores but will continue to do business online and through third-party retailers.

- AMC, the world’s largest movie theater chain, raised $917 million from investors to survive the next six months.

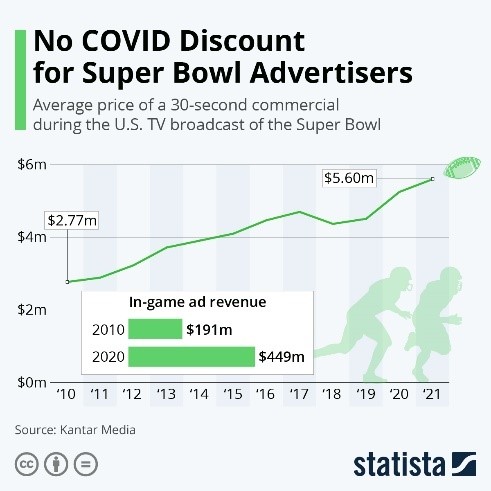

- Anheuser-Busch is forgoing a Super Bowl commercial for its flagship Budweiser beer this year, with plans to redirect airtime spending to marketing campaigns for COVID-19 vaccinations.

- Some major banks are lending at reduced rates for carbon-reduction assets and projects.

- Boeing announced plans for all commercial aircraft to be able to fly on 100% sustainable aviation fuels by 2030, which could reduce carbon emissions by up to 80%.

- Packaging trade association AMERIPEN is shifting its stance on extended producer responsibility, opening the door to support of legislation that would require producers to fund and manage the end-of-life stage for items they put on the market.

International

- Indonesia became the 19th country to surpass 1 million COVID-19 infections as global infections approached 100 million.

- COVID-19 fatalities in Mexico topped 150,000 Monday following a surge of infections in recent weeks. The nation is currently among the hardest hit by the pandemic, aggravated by a shortage of vaccines that have halted rollouts.

- COVID-19 deaths in England and Wales reached their highest levels since the spring.

- Multiple COVID-19 outbreaks in China totaled more than 263 infections last weekend, prompting abrupt lockdowns in several regions.

- Ireland is extending a shutdown of the economy until March 5, with plans to gradually ease restrictions thereafter.

- France is under pressure to increase lockdowns as a new, more contagious variant of COVID-19 spreads in the country.

- New COVID-19 cases in Italy fell by 3,000 yesterday alongside an increase in fatalities.

- Israel and the United Arab Emirates lead the world in inoculating against COVID-19, while New Zealand, Australia and Taiwan maintain the best overall resilience against the virus due to low community transmission and balmy weather. The U.S. ranks 35th on the resilience index.

- The World Health Organization is urging a different bar for success against the pandemic, warning the risk of continued transmission will continue even after large-scale vaccinations.

- The Bank of England is calling 2020 the nation’s largest economic slump in 300 years, as the U.K. economy shrank more than any other of the G7 member nations.

- Italy’s prime minister is set to resign today, a fallout of continued economic stagnation amid the pandemic.

- Across the European Union, delays in vaccine shipments and rollouts will likely force heavy restrictions through summer, threatening the bloc’s normally thriving travel and tourism sectors.

- A group of British lawmakers is advocating for the nation’s central bank to stop buying bonds from businesses whose activities accelerate global warming, including companies in the electricity, gas, industrial and transport sectors.

- Between 1994 and 2017, the Earth lost 28 trillion metric tons of ice, equivalent to a 100-meter-thick sheet of ice covering the U.K.

Our Operations

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- International: Director of Business Development Tracy Coifman.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.