COVID-19 Bulletin: January 13

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices reached an 11-month high just under $57 per barrel Tuesday, helped in part by crude draws of 5.821 million barrels for the week ending Jan. 8, more than double analyst expectations.

- In mid-day trading today the WTI was off 0.7% at $52.51/bbl and Brent was down 0.9% at $56.05/bbl. Natural gas was up 0.7% at $2.77/MMBtu.

- Oil production by OPEC+ member nations have exceeded compliance limits set in their production-constraint agreement, with the compliance rate falling to 75% in December, the lowest level since the pact was forged in May.

- The Energy Information Administration predicts renewable energy will account for more than two-thirds of new U.S. power capacity in 2021, with most coming from solar and wind.

- South African oil refineries are withering after nearly a year of depressed fuel demand, with two of the nation’s sites expected to be offline until at least 2022.

- Shell is cutting 330 jobs in its North Sea operations over the next two years, part of a cost-cutting effort shared by many oil majors hit hard by the pandemic.

- Angola, Africa’s second-largest oil exporter, was approved for the first $480 million of a $3.7-billion loan agreement with the International Monetary Fund as the nation continues to struggle with low prices and weak exports.

Supply Chain

- Nitrile gloves are in short supply across the globe, the latest item of personal protective equipment suffering under supply chain snags and COVID-19 outbreaks at warehouses.

- Ocean carriers are beginning to ramp up low-sulfur fuel surcharges in a bid to capitalize on extraordinary demand, adding significant extra cost to already high rates due to a recent rise in oil prices.

- Capesize spot rates, the rates for the largest dry bulk carriers, soared nearly 50% in the past week to a three-month high, a result of a “perfect storm” of strong demand, limited supply and bad weather at Chinese ports.

- Warehouse rents are expected to rise at a slower pace this year than in 2020. Vacancy rates are still relatively low but more industrial supply is hitting the market.

- Post-Brexit effects on trade are starting to show real-world consequences as big employers struggle with fine print and red tape in the U.K.-EU trade deal, with some opting to give up exporting.

- German courier DHL Express placed an order for the last four of Boeing’s iconic humpbacked 777 freighters as the pandemic promises continued demand for air cargo shipments.

- General Motors unveiled a new brand, BrightDrop, that will supply EV delivery vans for last-mile delivery services, sending the company’s stock to a 52-week high on Monday. The company’s first customer is expected to be FedEx, which agreed to purchase 500 of the vehicles this year.

- French automaker Renault is partnering with U.S. hydrogen energy firm Plug Power to develop hydrogen-powered light commercial vehicles.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

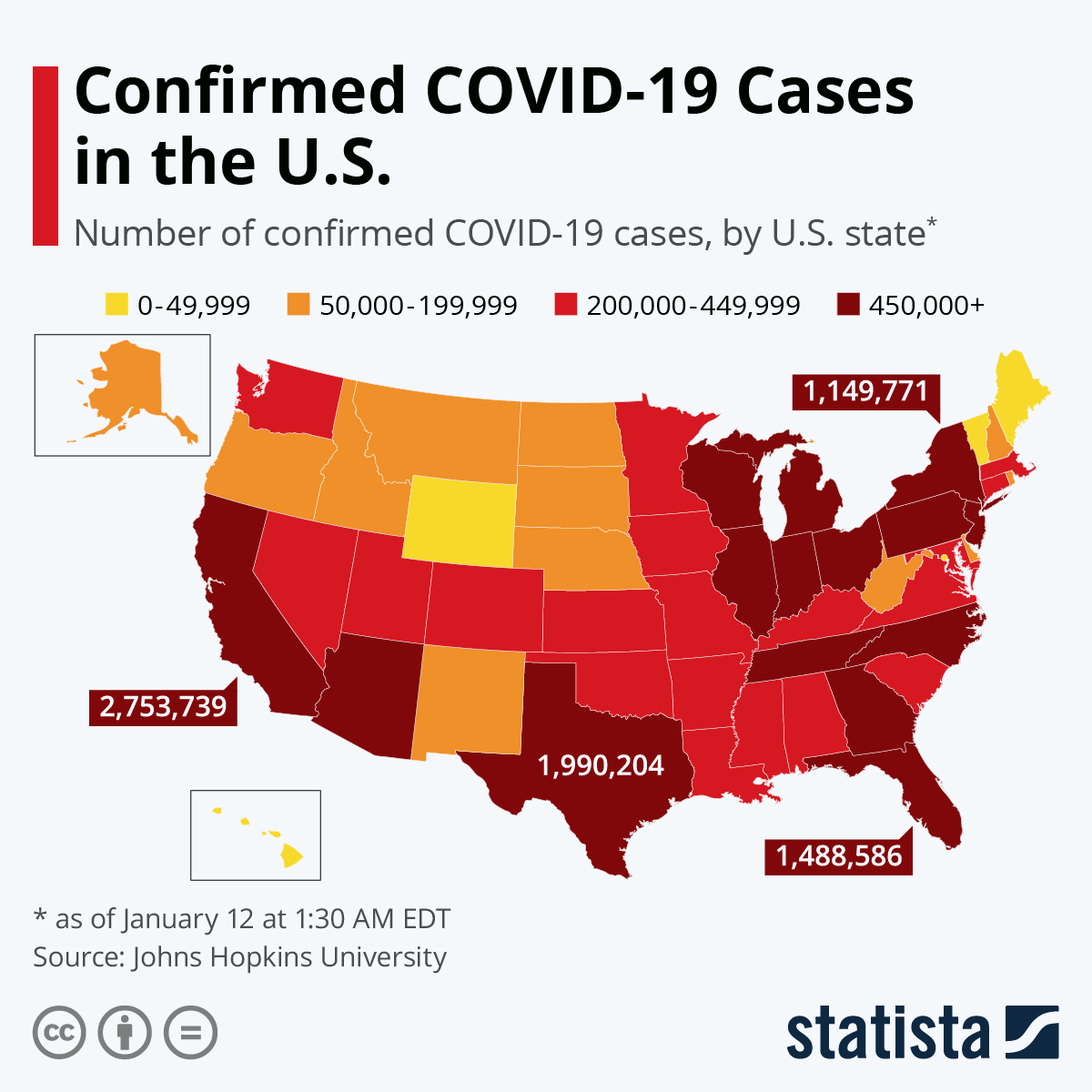

- The U.S. suffered a record 4,336 COVID-19 fatalities yesterday and 216,647 new infections.

- Predictive models show American COVID-19 fatalities rising by 80,000 in the next four weeks.

- Arizona reported a record 335 one-day fatalities from COVID-19.

- Austin, Texas, has opened a convention center field hospital to contain the surging number of COVID-19 patients overwhelming the region’s hospitals.

- A second and third lawmaker announced positive COVID-19 tests after being locked up in hiding with Congressional colleagues during last week’s riot at the Capitol.

- The federal government shifted its COVID-19 vaccine policy to speed up distribution, releasing held-back second doses for use on anyone over the age of 65 and people with pre-existing conditions.

- MLB ballparks are becoming ideal sites for setting up COVID-19 mass vaccination sites, with two stadiums in New York being the latest to convert.

- New York City and local landlords are exploring opening COVID-19 testing sites in buildings to expedite the return of office workers.

- A new CDC policy will require proof of a negative COVID-19 test before visitors can fly into the country.

- Ride-sharing giants Uber and Lyft are lobbying the federal government for a greater role in COVID-19 vaccine distribution and safety, including dedicated services to transport people for appointments and providing reminders for booster shots.

- Small business optimism sank to a seven-month low in December.

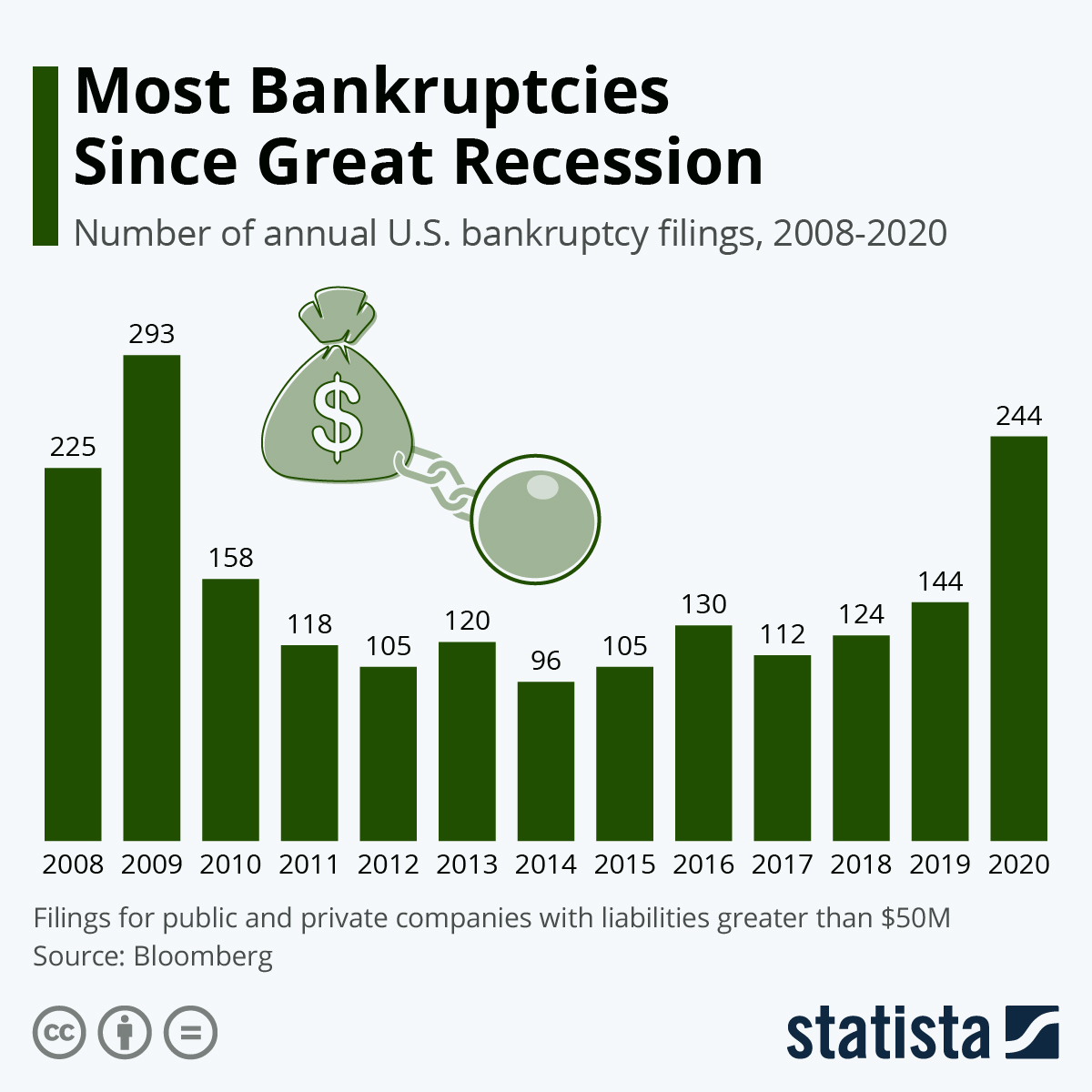

- Last year, U.S. large-company bankruptcies were at the highest rate since the Great Recession:

- The leisure and hospitality industry lost 498,000 jobs in December.

- Some economists are hopeful about the nation’s recovery over the next several years, arguing COVID-19, more like a natural disaster than a financial shock, will release unprecedented amounts of pent-up demand once vaccines take effect.

- Leaders of the financial industry have three predictions for the “next big risk”: cybersecurity lapses, rising unemployment due to a lack of skilled workers, and policies more focused on building GDP to provide humans with living wages.

- The Securities and Exchange Commission reported tips of white-collar malfeasance were up 31% last year as employees, encouraged by whistleblowing rewards and enabled by video recordings, were more apt to report infractions while working remotely.

- The White House will delay penalties imposed on automakers that fail to meet fuel efficiency requirements, potentially saving the industry hundreds of millions in fines and lost sales.

- Airline traffic fell 61% in November compared to the year-ago period, with a spike in holiday traveling insufficient to make up for pandemic-induced hits to passenger travel.

- Year-end results show Boeing’s aircraft deliveries fell 40% in 2020 from the previous year, the lowest in 43 years and less than a third of the deliveries of European rival Airbus.

- BMW reported an 8.4% drop in vehicle sales in 2020, with COVID-19 restrictions early in the year outweighing a pickup in customer demand in the fourth quarter. Similarly, Volkswagen reported a 15% drop in sales alongside a pickup in December, suggesting a recovery continuing into the new year.

- Valvoline introduced new flexible packaging— FlexFill — for its lubricants.

- The pandemic’s effects on daily work routines has spotlighted breakfast, with big producers betting that strong demand on sausage, waffles and cereal will stick around long after the virus is contained.

- The pandemic’s remote work boom has led to high demand for short-term, fully furnished housing in warmer, cheaper places, spawning many real estate startups.

- Walmart is stepping up online shopping efforts with the testing of a service that provides temperature-controlled containers for doorstep deliveries.

- Tax season this year promises to be messy, with many filers forced to deal with stimulus payments, remote work rules and unemployment benefits.

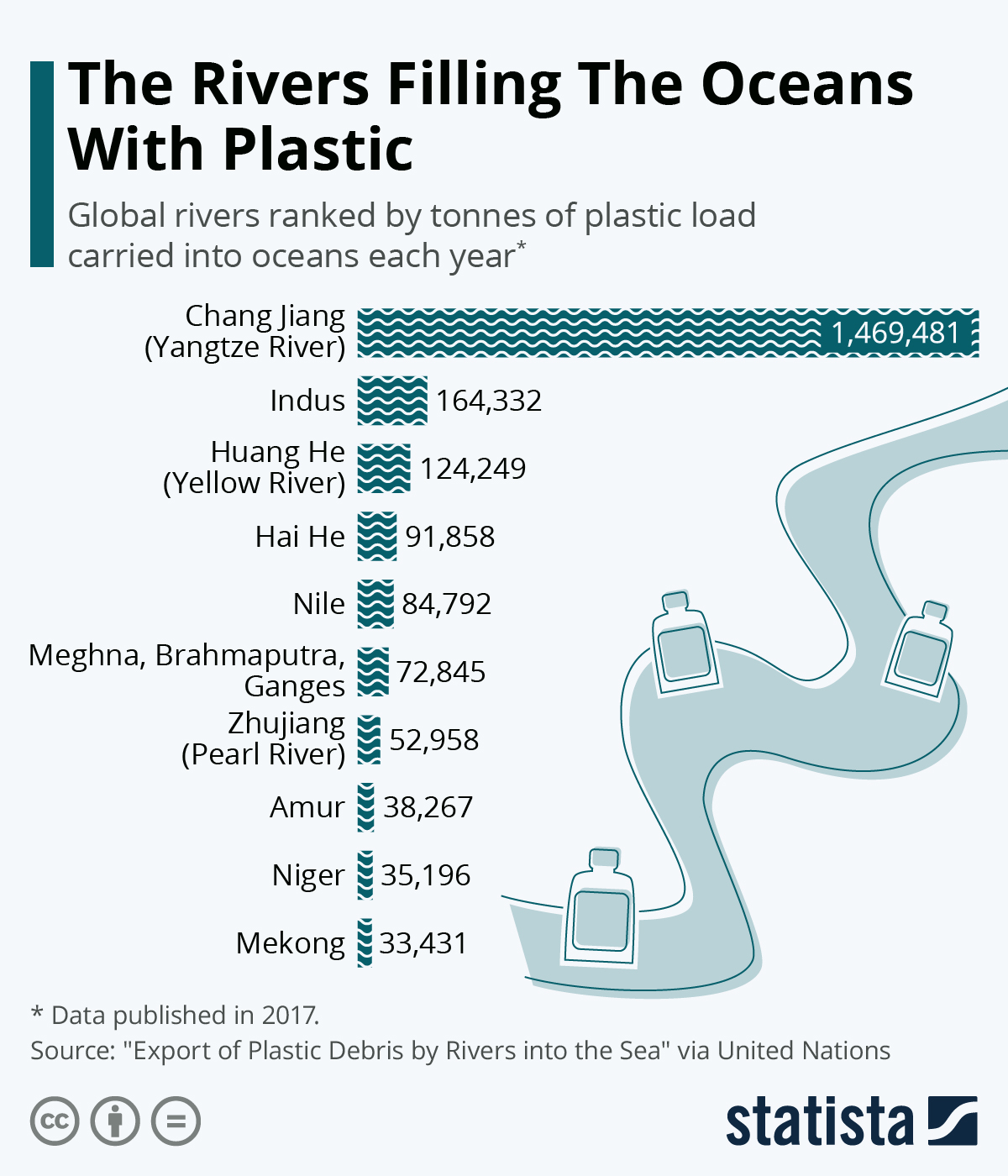

- Rivers account for 90% of plastic pollution that finds its way into oceans:

International

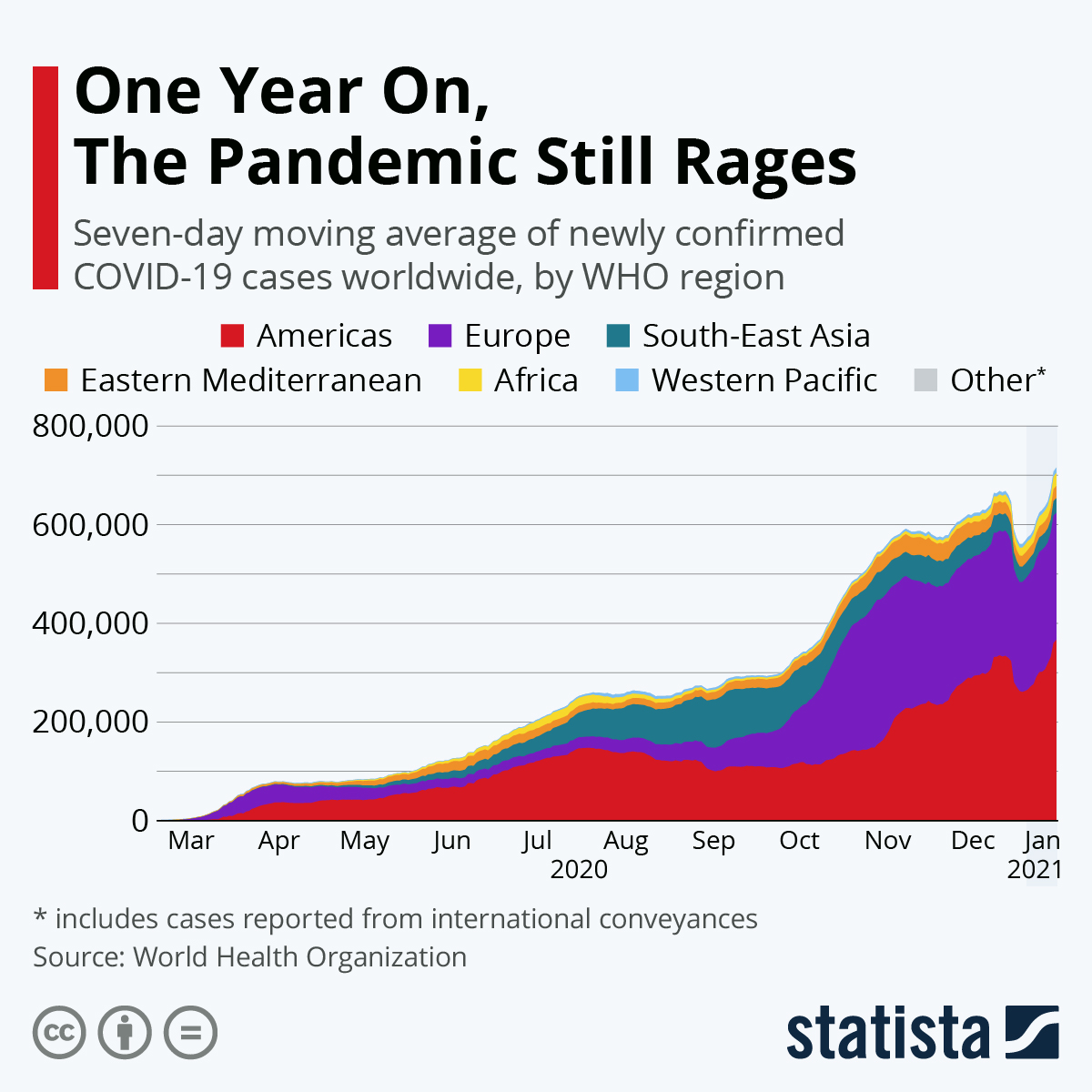

- Today marks the one-year anniversary of when Thailand made the first official confirmation of a case of COVID-19 outside of China:

- Ontario, Canada, issued a stay-at-home order starting Jan. 14 as hospitalizations in the province soar and new daily cases are expected to reach 20,000 by mid-February.

- Ireland is reporting record numbers of COVID-19 patients hospitalized in intensive care. The country has the worst per capita rate of infection in the world.

- Germany’s chancellor warned the country may need strict COVID-19 lockdowns for 10 more weeks, a potential expansion into March.

- The Netherlands is extending a five-week lockdown by another three weeks amid concerns over persistently high infection rates.

- Sweden, which initially pursued herd immunity as a response to COVID-19, is now enforcing strict restrictions as cases, hospitalizations and fatalities soar and public trust in the government wanes.

- The United Arab Emirates posted a one-day COVID-19 record of 3,243 new infections.

- One possible explanation for the current crisis in U.K. hospitals overwhelmed with COVID-19 patients is that better treatments, combined with updated policies to keep senior citizens out of nursing homes, is paradoxically increasing the length of time patients stay hospitalized.

- China is urging citizens not to travel and warning rural hospitals to prepare for a potential rise in COVID-19 cases in advance of the Lunar New Year break in February, the busiest travel period of the year.

- Greece is calling for a continent-wide COVID-19 vaccination certificate that could ease cross border travel and provide a boost for economies.

- Late-stage Brazilian trials of a China-developed COVID-19 vaccine show the doses are much less effective than initially thought, dampening hopes for low-cost inoculations in low- and middle-income nations.

- British college students are threatening rent strikes after government restrictions forced them to stay home after holiday break yet continue to pay for unoccupied dorms and apartments.

- South Korea reported the biggest loss of jobs in two decades in December, its 10th straight month of job losses, as the unemployment rate hit a 10-year high.

- Car sales in China, the world’s largest market, fell 6.8% in 2020, what will likely be counted as a success compared to other auto markets around the world hit by the pandemic.

- An updated trade deal between the U.S. and U.K. was slowed by riots at the Capitol last week. At issue in negotiations are American tariffs on Scotch whisky and wool.

- China is one step closer to semiconductor-chip independence, using U.S.-developed technology to break America’s dominance in the industry.

- Tesla is beginning sales of a locally made Model Y luxury SUV in China, with the potential to disrupt the market with a steep 10% discount over similar models from competitors including Mercedes and BMW. The company is also inching closer to launching operations in India after registering a company in the country Tuesday.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.