COVID-19 Bulletin: January 12

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- A further weakening of the U.S. dollar helped boost oil prices to a 10-month high in early trading today. The WTI was up 1.5% at $53.03/bbl and Brent was up 1.6% at $56.63/bbl. Natural gas was 3.1% higher at $2.83/MMBtu.

- Natural gas prices in Asia posted record highs Monday amid unusually cold weather in the region’s northeast alongside a shortage of ships for transporting gas.

- Shell is restarting LNG production at an Australian offshore site after suspending operations for almost a year, a response to rising LNG prices caused by the unusually cold weather in Asia.

- Bona fide bidders opted out of last week’s auction of oil rights on the Alaska Coastal Plains, with half of the 1.5 million acres not garnering a qualifying bid and the remaining bids largely from stalking horse bidders.

- The U.S. Supreme Court is set to review a rule allowing oil refineries to exempt themselves from federal biofuel-blending quotas that might cause them economic hardship, a potential blow to ethanol and biodiesel producers who have benefited from the exemption.

- A court determined that Chesapeake Energy’s value has soared to $5.13 billion since the company’s June bankruptcy filing, far above the company’s estimate.

- In India, fuel used for cooking and heating surpassed consumption of gasoline in 2020 for the first time in history.

- U.S. greenhouse gas emissions fell more than 10% in 2020.

- Last year tied 2016 as the warmest year on record globally.

- A growing number of companies are disclosing their impact on climate change in response to increasing public pressure.

Supply Chain

- Airfreight rates began 2021 on a decline after a 5% drop in year-over-year volumes in December.

- The number of new shipping vessels on order has declined by nearly half amid high uncertainty over looming environmental restrictions that could restrict fuel types on new ships.

- With new data showing U.S. retail imports up 25% year over year in November, total 2020 imports will likely reach record levels despite unprecedented supply chain challenges posed by the pandemic.

- New U.S. tariffs on French and German aircraft parts and wines took effect Monday, part of a 16-year trade dispute over government subsidies to airplane manufacturers.

- At this week’s Consumer Electronics Show, being held virtually, Verizon said it is collaborating with UPS to use 5G technology for drone delivery services.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. recorded 204,652 new COVID-19 cases and 1,731 fatalities yesterday.

- The Northeast registered its smallest week-over-week increase in COVID-19 hospitalizations last week, while hospitalizations are increasing the fastest in the Sun Belt.

- A record 1.25 million vaccines were administered in the U.S. yesterday, an encouraging improvement after a slow start for inoculations.

- The CEO of Rite Aid, a key cog in delivering COVID-19 vaccines, said the rollout will be chaotic in part due to the myriad of rules of the different states and counties.

- New York City expanded its vaccine rollout to include healthcare workers and the elderly, but bureaucracy and technical glitches are delaying shots and frustrating would-be recipients.

- California, where nearly 500 people a day are dying of COVID-19, is converting Dodger Stadium, Petco Park and Disneyland into super vaccination centers.

- Scientists are unsure whether people who have received a COVID-19 vaccine can still transmit the virus asymptomatically.

- Pfizer/BioNTech are upping COVID-19 vaccine output targets by more than 50%, aiming to produce 2 billion doses in 2021 to keep up with surging demand.

- Some healthcare workers are skeptical about receiving COVID-19 vaccines, citing concerns over expedited approvals.

- Municipal borrowing rose by $252 billion last year to $3.9 trillion, the highest level since 2013, as cities struggled to bolster strained finances due to the pandemic.

- Job postings in December were down 10.6% from the prior-year period as increased COVID-19 infections and renewed restrictions tempered jobs growth.

- Lenders expect greater losses on mortgage portfolios this year when jobless benefits expire and forbearance periods end.

- The president of the Federal Reserve’s Dallas branch expects strong economic growth in 2021 as more people get vaccinated against COVID-19, potentially allowing the central bank to pull back on several historic monetary support measures.

- New pandemic-inspired innovations and devices were on display at the virtual Consumer Electronics Show this week, including stick-on bio detectors, Wi-Fi boosters for the home, an indoor garden machine, smart face masks and even robotic comfort pets.

- General Motors is investing $27 billion to develop its presence in the electric vehicle sector, with a focus on boosting production capacity for a new battery system.

- Ford will write off $4.1 million on closures of three factories in Brazil as the company reorganizes its South American operations that have struggled for years.

- Cruise line operator Carnival expects to post another huge loss of $2.2 billion in Q4 after nearly a year of halted sailings, a stark contrast to the $423 million profit from the year-ago period.

- U.S. coffee chains suffered an $11.5 billion sales drop last year as the pandemic kept people from cafes, with estimates suggesting the industry could take two years to regain the near quarter of its market that was lost.

- Twice-before blocked by anti-trust authorities, Staples made an unsolicited offer to acquire Office Depot, which is struggling during the pandemic.

- Improving building ventilation is playing a key role in combating the pandemic, with more fresh air, better filtration systems and UV-light technology among the increasingly common features for venues, businesses and public buildings.

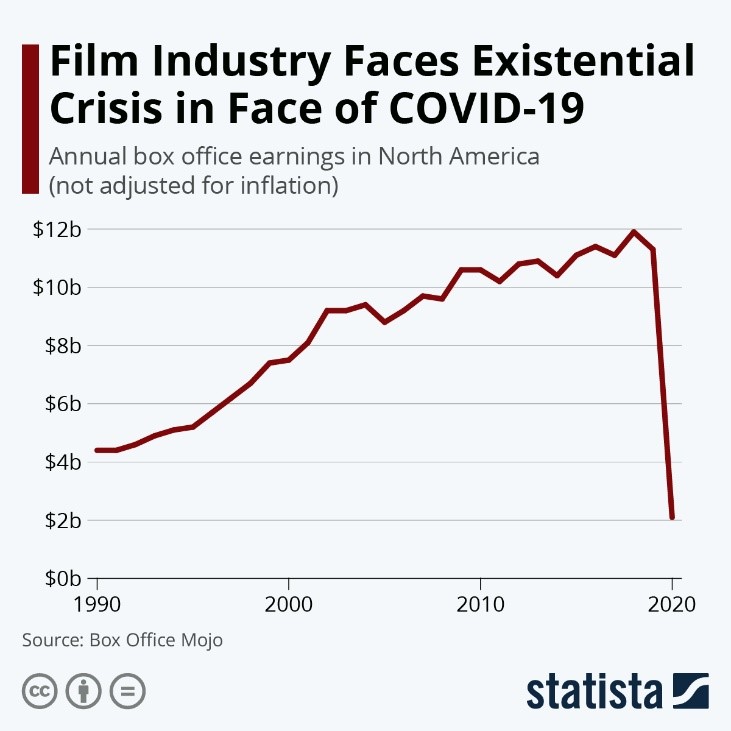

- The pandemic has been an existential threat to the North American film industry:

- Alabama beat Ohio State 52-24 to take the NCAA football title, ending an abbreviated season of COVID-19 schedule disruptions, nearly empty stadiums, and a lack of mascots and cheerleaders.

International

- Total COVID-19 cases in China rose by 40 to 500 yesterday, prompting more regions to impose restrictions. After a delayed response, China is allowing World Health Organization scientists to visit the country to investigate the origins of COVID-19.

- Portugal will impose a new lockdown after record COVID-19 fatalities.

- Lebanon is introducing a 24-hour curfew until Jan. 25 as surging COVID-19 cases overwhelm the nation’s hospitals.

- While leading Europe in its vaccine rollout, the U.K. warned its European neighbors about the dangerously rapid spread of the virulent new COVID-19 strain first discovered in Britain. U.K. hospitals are experiencing record-high hospitalizations with worse weeks ahead.

- Many Mexico City restaurants defied new government lockdown orders Monday, inviting back customers in a last-ditch effort to save their businesses.

- Mexico is asking the U.S. for an extension of restrictions on non-essential travel across the land border.

- Indonesia reported a record 302 COVID-19 fatalities yesterday, one day before starting its vaccination campaign.

- Malaysia’s king declared a national emergency and suspended parliament for the first time in half a century due to soaring COVID-19 infections.

- A surge in COVID-19 infections in Nigeria, Africa’s most populous nation, has hospitals at capacity.

- South Africa extended its ban on alcohol sales and border restrictions even as it announced that it has secured 20 million COVID-19 vaccine doses.

- Lower healthcare spending after the 2008 financial crisis put several European nations with nationalized healthcare systems in a poor position to confront COVID-19, resulting in some of the highest per-capita death rates in the world.

- AstraZeneca applied for emergency use authorization in Europe for the COVID-19 vaccine it developed with Oxford University.

- Cadila Healthcare of India is entering phase 3 testing of its COVID-19 vaccine and expects to deliver up to 150 million doses this year.

- Europe’s economy is expected to contract by 4.1% in the current quarter due to the surging coronavirus and associated restrictions, which will officially demark the second recession of the pandemic after the 1.5% economic contraction in the fourth quarter.

- China’s currency, bolstered by the country’s world-leading economic recovery, has surged to a 2½ year high against the U.S. dollar, potentially helping U.S. exporters.

- Baidu, China’s “Google,” is partnering with China-based Geely to produce electric vehicles for the domestic market.

- Global personal computer sales were up 25% in the fourth quarter year over year.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.