COVID-19 Bulletin: February 3

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices moved higher yesterday on an unexpectedly large 4.3 million barrel draw in crude oil inventories last week, with WTI breaking $55 per barrel intraday for the first time since January 2020.

- Oil prices were higher in early trading today, with the WTI up 2.7% at $56.21/bbl and Brent up 2.4% at $58.83/bbl. Natural gas was down 0.2% at $2.84/MMBtu.

- The Louisiana Offshore Oil Port, the only U.S. port capable of loading supertankers, saw record export volume in January as Asia stocks up on oil for an expected acceleration in economic activity.

- Crude stockpiles in China have fallen to their lowest level since last February.

- The pandemic sapped oil demand and profits for oil majors last year, with multibillion-dollar net losses reported by Exxon Mobil ($22 billion), BP ($18.1 billion) and Chevron ($5.5 billion) in one of the industry’s worst-performing years.

- BP’s 20% stake in Russia’s top oil producer stands as an obstacle to attracting green investors as the company shifts from fossil fuels to clean energy and convenience retailing.

- China is expected to add 140 gigawatts of renewable power generation this year to help accommodate a 6% to 7% projected rise in electricity use, according to the China Electricity Council.

Supply Chain

- A shortage of cardboard caused by a surge in online shipments and economic recovery is disrupting supply chains and forcing some retailers to shift from cardboard to plastic packaging. Wood pulp prices are soaring due to increased demand and speculation in China.

- The U.S. Postal Service is considering raising postage prices by 5.5% to 9% this year for letters, magazines, catalogs and other items, leading a group of commercial mailers and printers to seek federal injunctions on the service’s pricing powers.

- Nissan suspended some truck production in Mississippi due to a global semiconductor chip shortage, the latest in a series of such production disruptions.

- The White House ordered a government-wide review of critical U.S. supply chains, part of an effort to reduce reliance on countries such as China for essential medical supplies and minerals.

- China bought almost $32 billion of computer chip making equipment from Japan, South Korea and Taiwan last year, a 20% increase from 2019 as the nation seeks to protect itself from widening U.S. technology bans.

- Contract rates for transpacific shipping are 15% above prior levels for the same period, a sign that rates could remain high for the foreseeable future.

- California is calling on the Federal Maritime Commission to take immediate steps to review carrier export policies after shipments of U.S. agricultural exports were shunned in favor of sending empty containers back to Asia, where outgoing rates are higher.

- Swedish truck maker AB Volvo reported better-than-expected fourth quarter results but warned supply chain challenges could impact results in the current quarter.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 114,437 new COVID-19 cases in the U.S. yesterday and 3,530 fatalities.

- Illinois’ COVID-19 case count fell to 2,304 on Tuesday, the lowest daily figure since Oct. 6 for one of the nation’s most improved states for pandemic figures.

- Four hundred National Guard troops deployed to Washington to secure the presidential inauguration have tested positive for COVID-19.

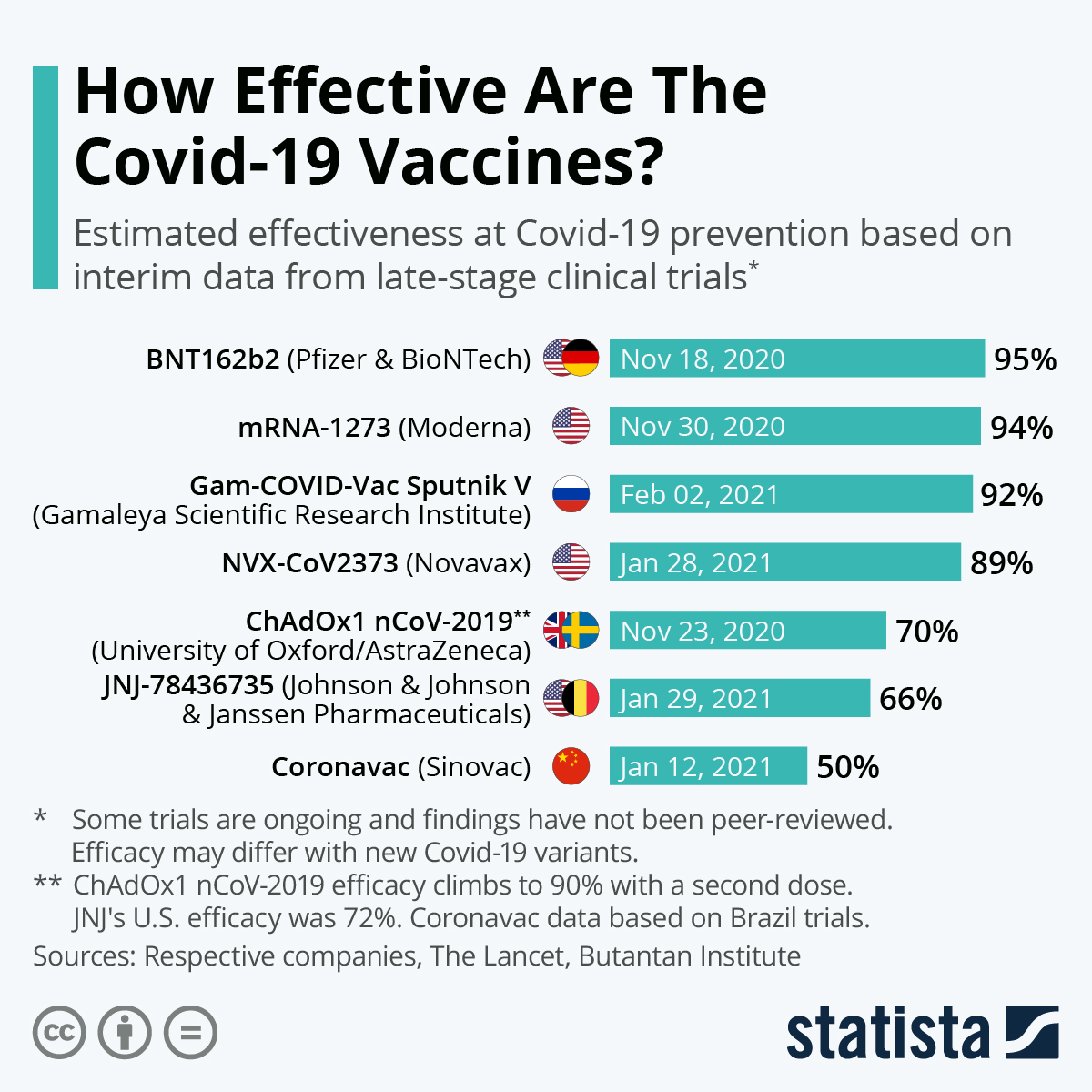

- There is a growing list of vaccines approved or in late-stage trials:

- The federal government is sending 5% more COVID-19 vaccines to states over the next three weeks, an announcement that came on the heels of a previous 16% increase in shipments.

- With more COVID-19 doses available, New York state is allowing local governments to open eligibility to restaurant employees, taxi drivers and other front-line workers.

- Nearly half of states have added teachers to the list of people eligible to receive vaccines, helping to mitigate resistance against a return to physical classrooms.

- New research results show AstraZeneca/Oxford’s COVID-19 vaccine is 76% effective after a single dose. Its effectiveness is heightened to 82.4% by spreading the second required shot out by as much as three months, researchers say.

- A study by Oxford University of AstraZeneca/Oxford’s COVID-19 vaccine provides the first evidence that vaccines can cut transmission of the virus.

- Private employers added 174,000 jobs in January, according to ADP, more than three times estimates.

- More fourth quarter earnings reports reflect the pandemic’s impact on the economy:

- Amazon’s fourth quarter revenues surged 44% to $126 billion as the company also announced that its founder is stepping down as CEO to become Executive Chairman and spend more time on philanthropy.

- Google parent Alphabet reported record revenue of $56.9 billion, up from $43.2 billion a year ago, on greater sales in the company’s advertising unit primarily due to higher search activity and YouTube viewership. The company’s cloud business, however, suffered an operating loss of $1.2 billion as the relatively nascent unit seeks expansion over profitability.

- Pfizer reported a 12% increase in revenue last quarter compared with the year-ago period, with the company forecasting $15 billion in sales in 2021 from its COVID-19 vaccine.

- Brookfield Property Partners, which manages offices and malls, reported $2 billion in losses for 2020.

- Hospitals giant HCA saw a rise in profits in 2020 despite a drop in patients as large hospitals overcame pandemic disruption and many smaller and rural hospitals struggled or closed.

- A group of U.S. senators is urging executive action to address the shortage of computer chips that is disrupting automotive production lines.

- Kia shares jumped on reports that it will manufacture electric vehicles for Apple with a commercial launch planned for 2024.

- Edmunds predicts that electric vehicle sales will grow to 2.5% of U.S. car sales this year, up from 1.9% in 2020.

- Many automakers joined GM in embracing California’s emission standards, ending their resistance as the White House endorses national emission reduction goals.

- Coca-Cola’s European unit will switch all its cars and vans to electric or ultra-low emission vehicles by 2030.

- RV maker Thor Industries is catering to the growing ranks of “digital nomads” with the introduction of an Airstream model with beds that convert into office desks.

- Emirates airline, the biggest customer for Boeing’s delayed 777X jet, is considering swapping a third of its orders to smaller 787 Dreamliner jets. Boeing sold $9.9 billion in bonds yesterday to shore up its stressed balance sheet.

- Loop launched its reusable packaging platform in Canada.

- Nearly 50 U.S. cities could be undercounting their CO2 pollution by as much as 20%.

International

- Czechia became the 20th nation to tally over 1 million COVID-19 infections.

- The United Kingdom is investigating a mutation in its highly infectious COVID-19 strain that could reduce vaccine efficacy, with 11 cases reported in Bristol and 32 in Liverpool.

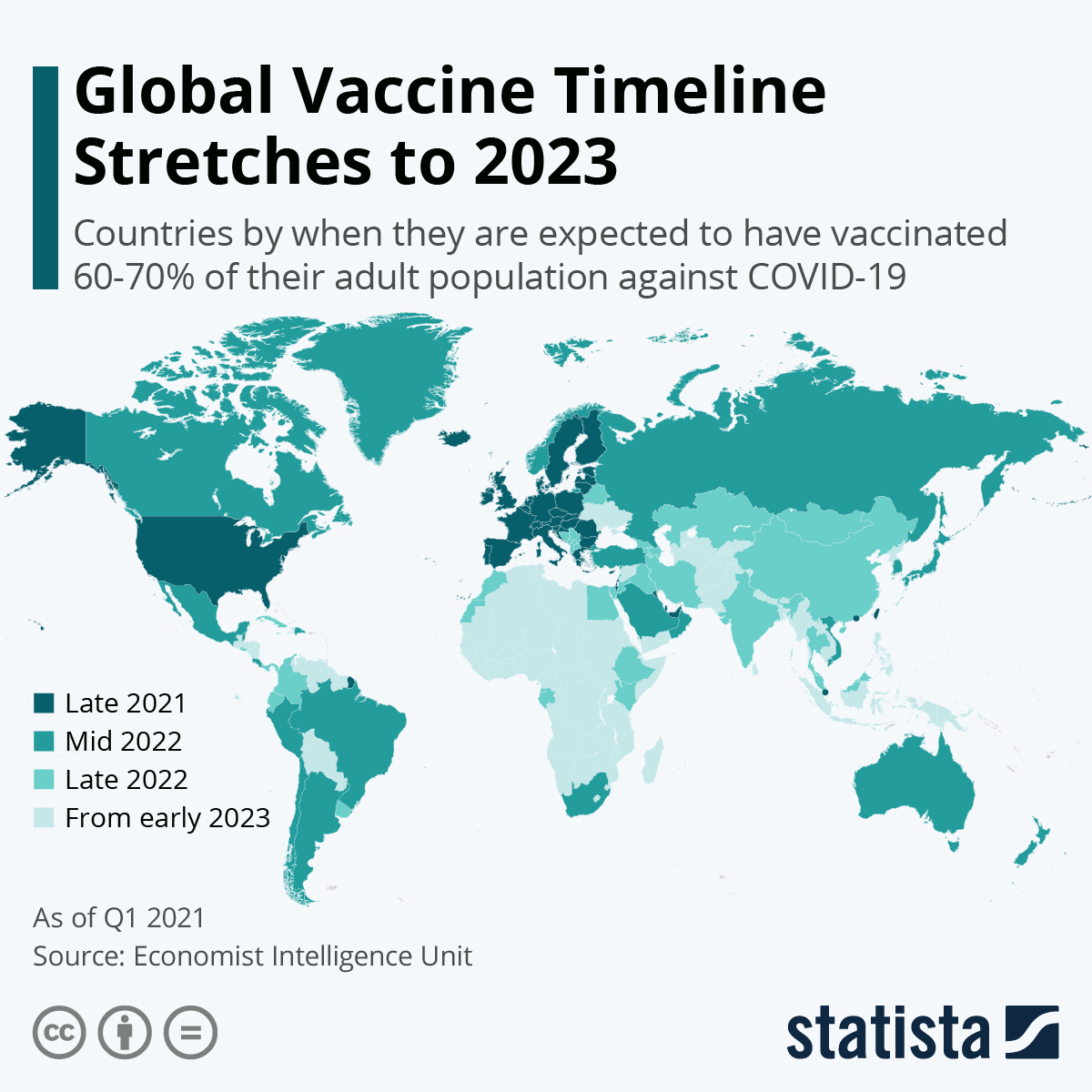

- Global vaccine rollouts are expected to take until 2023:

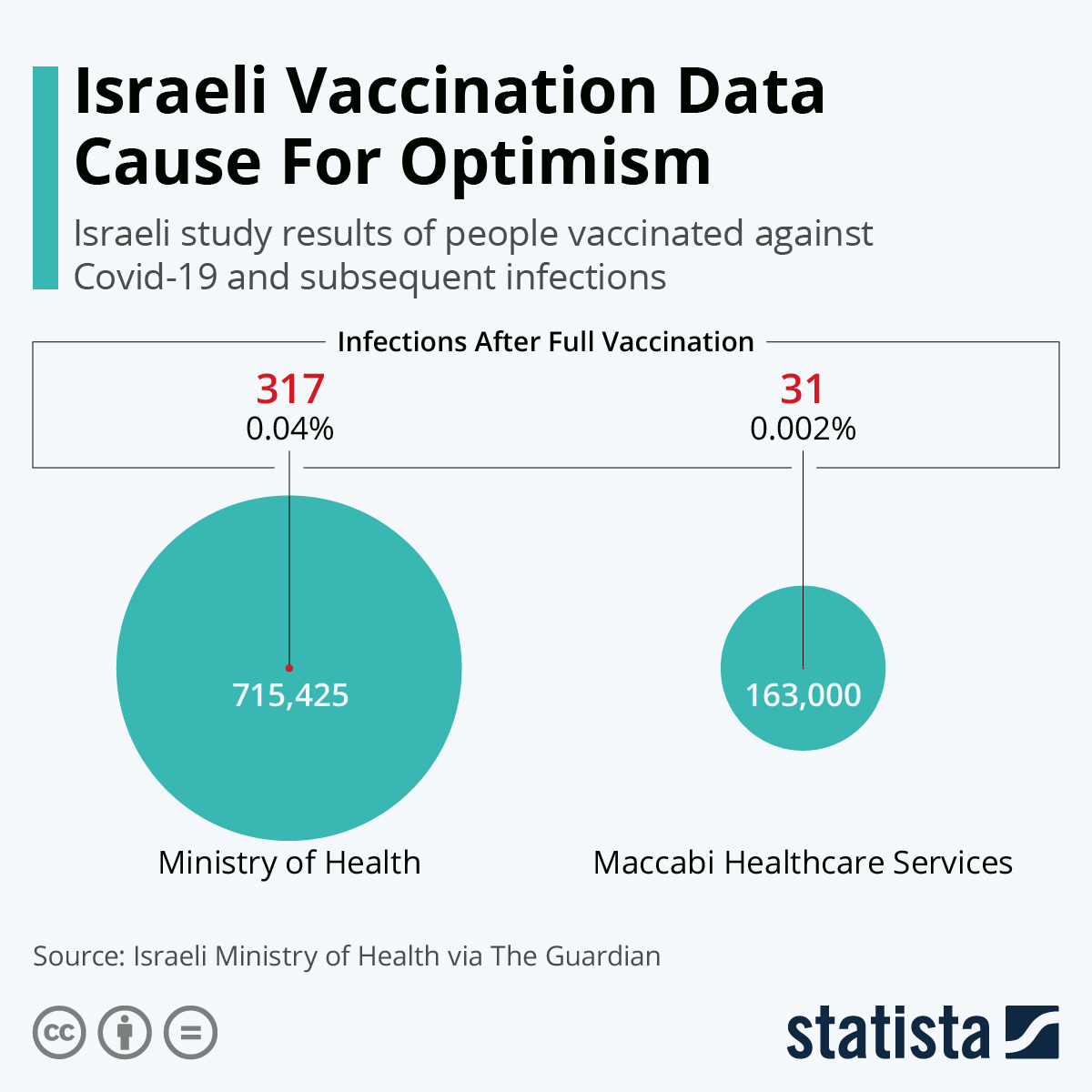

- Encouraging results from Israel’s world-leading vaccination effort indicate vaccinations are effective in stopping COVID-19 infections:

- Russia’s two-shot Sputnik V COVID-19 vaccine was 91.6% effective in preventing symptomatic COVID-19 and offered complete protection against severe cases, according to a peer-reviewed study.

- Canada struck a deal with Novavax Inc. to manufacture the company’s COVID-19 vaccine in-country.

- France is limiting the use of AstraZeneca/Oxford’s COVID-19 vaccine to those under age 64, the latest nation to limit the shots’ use over a lack of efficacy and safety data for older populations.

- New Zealand approved Pfizer/BioNTech’s COVID-19 vaccine, the first shot given authorization in the country. Recent data showed an unexpected drop in the nation’s jobless rate in the fourth quarter.

- The eurozone’s economy is faltering under the weight of persistently high COVID-19 infections, lockdowns and slow vaccine rollouts, causing the bloc’s GDP to contract 0.7% in the three months through December when other economies were rebounding.

- The European Union Central Bank welcomed a 0.9% rise in inflation in January, the first increase in six months.

- A Purchasing Managers Index in Japan shrank from 47.7 in December to 46.1 in January, the lowest reading since August, indicating sector contraction.

- South Korea was ranked the world’s top innovator for the seventh of the last nine years, according to the latest Bloomberg Innovation Index, while the U.S. dropped out of the top 10.

- Chinese seat capacity on domestic and international flights fell more than 20% from the end of September, as COVID-19 waves dent Asia’s aviation recovery.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.