COVID-19 Bulletin: February 2

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. oil futures, bolstered by a weak dollar, jumped 2.6% yesterday, the biggest increase in three weeks, to post their highest close in nearly a year.

- Natural gas spot rates rose more than 10% on Monday as cold weather swept across the Northeast and mid-Atlantic.

- Energy prices continued to climb in mid-day trading today, with the WTI up 2.2% at $54.70/bbl and Brent up 2.0% at $57.47/bbl, while natural gas was up 2.0% at $2.91/MMBtu.

- Goldman Sachs predicts global oil demand to recover to pre-pandemic levels of 100 million bpd by August.

- Eastman Chemical is building one of the world’s largest plastic-to-plastic recycling facilities in Kingsport, Tennessee, a two-year, $250 million investment that will use molecular recycling technologies to convert polyester waste into durable products.

- Siemens Energy is cutting 7,800 jobs from its gas and power business unit, one-sixth of the workforce, as the shift from fossil fuels upends the markets for its gas and coal-fired power stations.

- BP reported a small net profit in the fourth quarter and a near halving of operating cash flow from the prior-year period. The West’s third-largest oil company suffered a $5.7 billion annual loss, its first in a decade.

- BP is selling part of its stake in an Oman gas block to Thailand’s national oil company for $2.6 billion, part of the company’s plan to raise $25 billion in divestment proceeds by 2025.

- Exxon is creating a new business unit that will focus exclusively on technologies to lower carbon emissions, including a $3 billion investment through 2025 primarily on carbon capture and storage projects.

- China began its emissions trading scheme Monday to allow nearly 2,225 power companies to trade emissions quotas as part of an effort to create a carbon-neutral Chinese economy by 2060.

Supply Chain

- A major winter storm in the Northeast, which brought up to two feet of snow and prompted states of emergency in New Jersey and New York City, also caused several disruptions to vaccine distributions and appointments on Monday.

- UPS reported a 21% jump in revenues in the fourth quarter on a surge in volume coupled with higher fees.

- Taiwanese and U.S. officials are meeting next week to discuss a global shortage of chips used by automakers, which has caused car factories around the world to shut assembly lines.

- The nearly quadrupling of costs to ship goods from Asia is causing a shortage of consumer goods in Europe for importers of such items as home furnishings, bicycles, sports equipment, children’s toys and dried fruit.

- The value of containerships has soared alongside higher shipping rates, with one London-based shipbroker reporting the sale of a vessel at a 50% premium over the ship’s value just two months ago.

- Demand for robotic goods-to-person material handling systems is expected to quadruple over the next two years as manufacturers and distributors seek ways to enforce social distancing in warehouses.

- Three in four containers leaving Los Angeles for Asia are empty, creating significant disruptions in global food trade, with higher shipping costs likely to be passed on to consumers.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 134,339 new COVID-19 cases in the U.S. yesterday and 2,031 fatalities.

- In its latest projection, the University of Washington’s Institute for Health Metrics and Evaluation said U.S. COVID-19 fatalities could rise to 619,000 by May 1.

- The number of Americans vaccinated against COVID-19 (26.5 million) has surpassed the number of people infected with the virus, a milestone. About 1.34 million people are receiving shots each day.

- COVID-19 fatalities are declining in every region of the U.S., a trend that caps off three weeks of gradual declines in new cases and hospitalizations. However, January accounted for the highest number of virus fatalities during the pandemic.

- Moderna is proposing upping the number of doses in each vial of its COVID-19 vaccine from 10 to 15, subject to FDA approval. The company is now producing nearly 1 million doses a day.

- Women and people over the age of 50 made up substantial majorities of early COVID-19 vaccinations in the U.S.

- Johnson & Johnson’s one-shot COVID-19 vaccine could aid the U.S. in vaccinating difficult-to-reach populations, with regulatory approval of the shots expected in the coming weeks.

- About 78% of nursing home residents and 38% of staffers received at least one COVID-19 shot in the first month of the federal program to provide vaccines to long-term-care facilities.

- Retail pharmacies, including CVS, Walgreens, Walmart and Kroger, have stepped up to take a big role in the U.S. vaccine rollout, including giving tens of millions of shots a month once the supplies are readily available.

- Recovered COVID-19 victims who receive a vaccine often suffer more severe reactions and may not need a second dose.

- Researchers are beginning to look at whether COVID-19 can have long-term, internal effects on the body despite a person being asymptomatic. Fatigue, headaches, attention disorder and hair loss are just a handful of the 55 long-term symptoms identified in a new study.

- The federal government will invest $230 million to ramp up production of a rapid home test for COVID-19 made by Australia-based Ellume that can be sold without a prescription.

- Senate Republicans yesterday proposed a $618 billion coronavirus-relief alternative, which includes another round of $1,000 stimulus checks for many adults.

- U.S. GDP is expected to return to its pre-pandemic level by the middle of this year, while it could take several more years for output and employment levels to catch up, the Congressional Budget Office forecasts.

- U.S. manufacturing continued to recover in January, with two indexes of the sector’s activity remaining at growth levels similar to December’s readings.

- U.S. construction spending hit a record high in 2020.

- Thermo Fisher Scientific, a manufacturer of medical diagnostic equipment, software and services, saw revenues increase 54% in the fourth quarter.

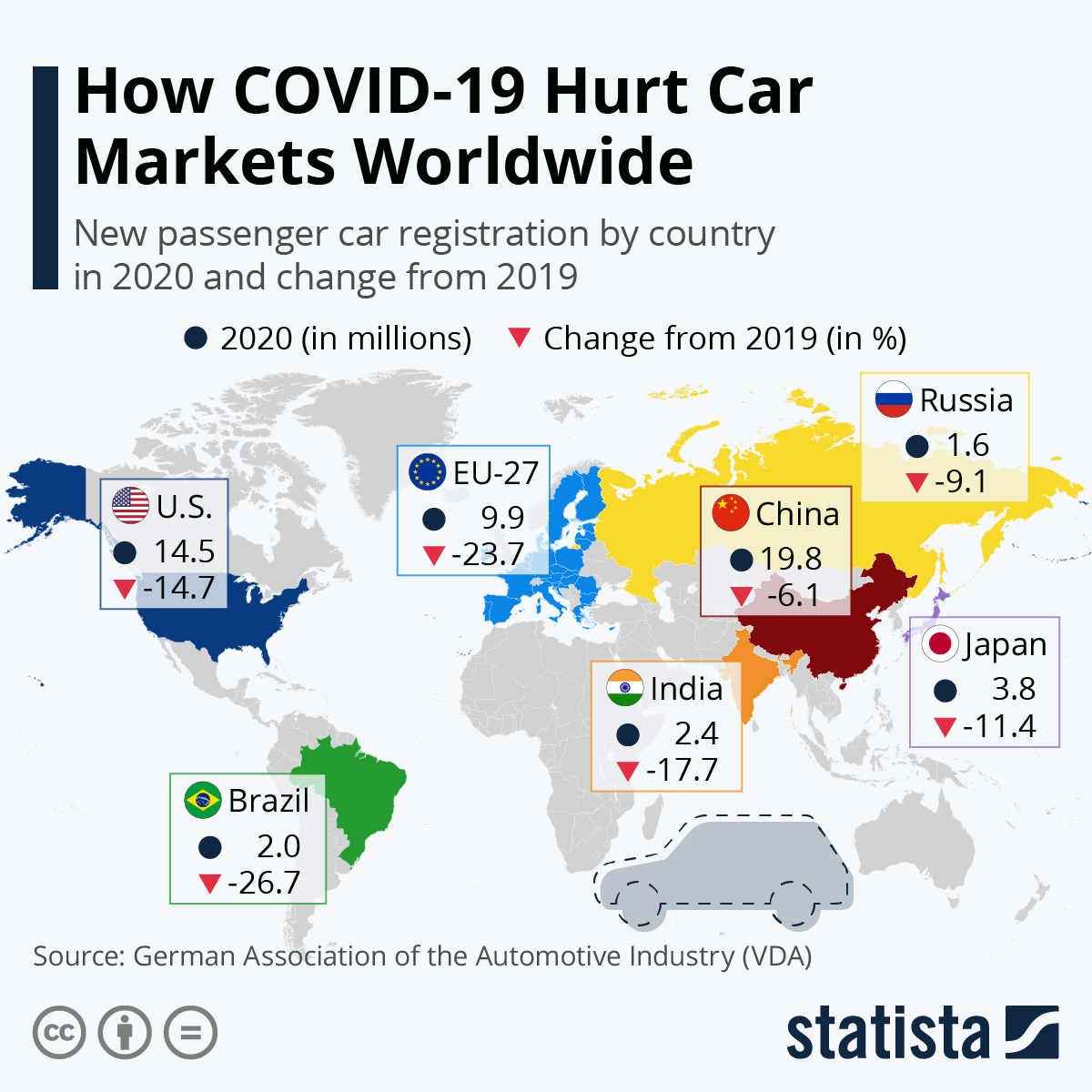

- COVID-19 lockdowns impacted all the world’s automotive markets:

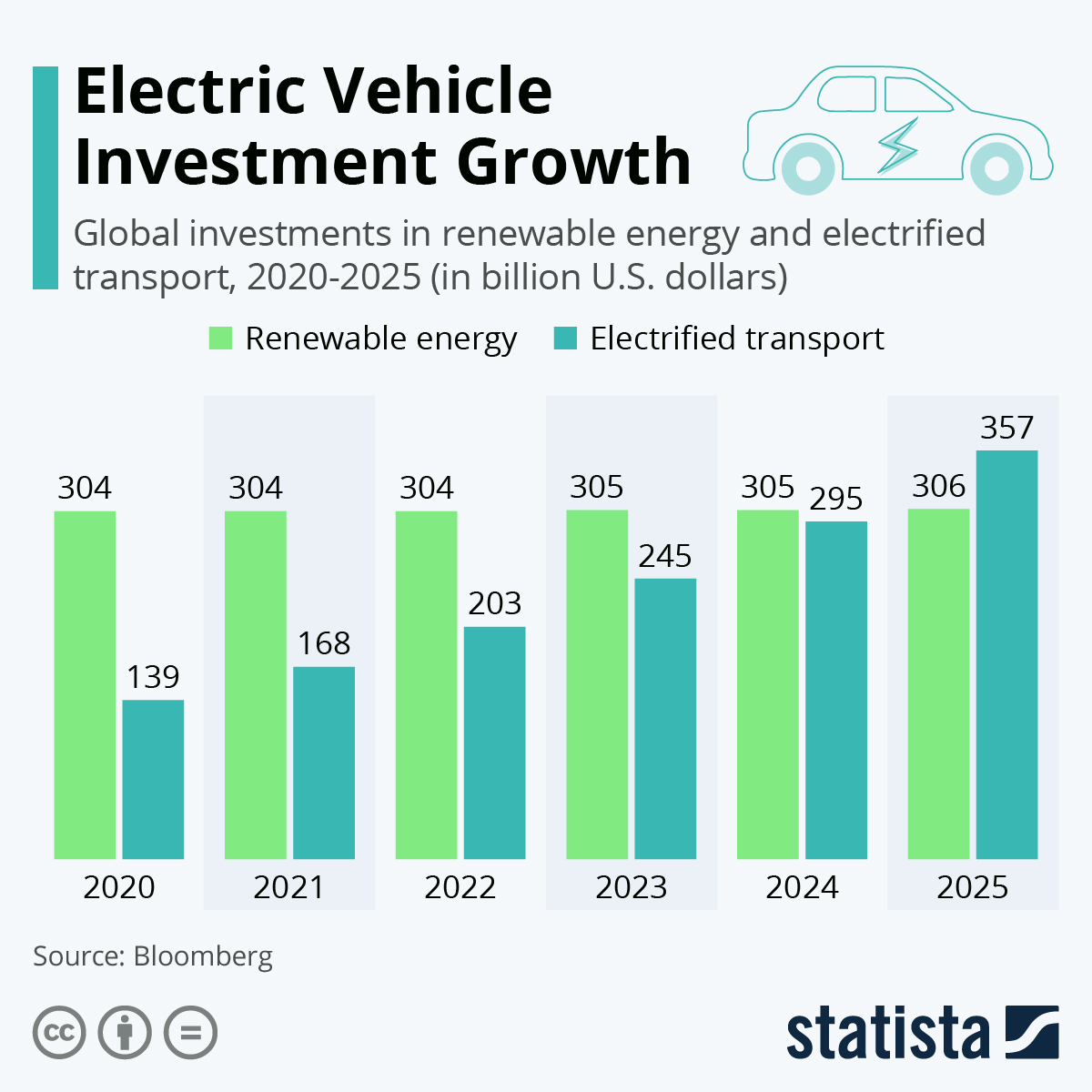

- Investment in the global electric vehicle industry is expected to nearly triple by 2025:

- Ford and Google are teaming up to reinvent how cars are designed, built and used, employing Android software and Google’s computing network to monitor and repair vehicles, automatically upgrade safety features, and allow owners to download new features and infotainment.

- Boeing signaled that over a third of orders for its new 777X jetliner could be at risk after the company announced it is delaying the plane’s launch until late 2023.

- Colgate introduced its new Keep toothbrush featuring a reusable aluminum handle and snap-on plastic heads, using 80% less plastic than traditional toothbrushes.

- The U.S. has experienced the opposite of the baby boom initially expected from couples isolated together during lockdowns. Early reporting on birth rates from five states show nearly 50,000 fewer births nine months into the pandemic than in the year-ago period.

International

- Global COVID-19 vaccinations surpassed 100 million, nearly matching total infections of 103.5 million.

- COVID-19 deaths in England and Wales reached their second highest level of the pandemic yesterday.

- Japan today is set to extend a virus emergency by a month until March 7.

- France shut its borders to non-EU travelers to curb the introduction of new, virulent virus strains.

- Germany’s government is promising to offer COVID-19 vaccines to every citizen by September.

- Italy reemerged from pre-Christmas lockdowns as the nation’s new virus cases hit their lowest levels since October.

- The European Union tightened travel rules for inbound passengers, requiring a COVID-19 test be taken within three days of departure to the bloc.

- Portugal’s ICU occupancy hit 94% of capacity as the nation faces one of the world’s worst COVID-19 outbreaks relative to its population size. Nearly half the nation’s virus fatalities came in January.

- Dubai is closing bars and pubs for the rest of February amid the nation’s worst wave of COVID-19 yet.

- Oman’s COVID-19 hospitalizations doubled at the end of January, prompting border closures, gathering bans and delayed school reopenings.

- Nestle, with commercial reach to 187 countries, plans to use its global footprint to help distribute COVID-19 vaccines to developing nations as more vaccines become available.

- India unveiled an ambitious budget for the fiscal year beginning in April that includes large spending on infrastructure projects, a bid to get people working again and return the nation to economic growth.

- U.K. lenders approved more mortgages in 2020 than in any year since before the Great Recession, as house hunters sought to take advantage of a temporary tax cut.

- Volkswagen launched a pilot plant for recycling electrical vehicle (EV) batteries in Germany as it anticipates the first wave of EV retirements late this decade.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.