COVID-19 Bulletin: December 4

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- OPEC+ nations agreed to increase their collective output by 500,000 bpd next month on their path toward a restoration of at least 7.7 million bpd in production cuts during the pandemic. The cartel also agreed to meet on a monthly basis to decide further output levels.

- News of the agreement sent crude prices to a 9-month high yesterday. Crude was higher in early trading today, with the WTI up 1.0% at $46.09/bbl and Brent up 1.2% at $49.27/bbl. Natural gas was down slightly at $2.51/MMBtu.

- Chevron has slashed its long-term capital spending plans, reducing its exploration budget by 27% from 2022 to 2025.

- The measure of Brent crude, the international gauge for oil prices, will likely be changed in early 2022 to include WTI, evidence of the growing importance of U.S. exports in global energy markets.

- Denmark, Europe’s largest oil producer, will stop issuing new licenses for North Sea oil exploration and will cease drilling altogether by 2050 as it pursues a future without fossil fuels.

- Two more coal producers are heading into bankruptcy as the pandemic continues to take a heavy toll on the industry.

Supply Chain

- Thousands evacuated their homes in Southern California as strong Santa Ana winds spawned an eruption of wildfires.

- Carriers are dealing with maxed out capacity in part by having shippers use 20-foot containers instead of 40-foot containers where possible, reflected in a doubling of 20-foot container rates since August.

- Orders for new Class 8 North American trucks were up 30% in November compared to the previous month and nearly double orders in the year-ago period.

- Air freight forwarders are starting to see the effects of growing vaccine distribution efforts, with regular freight being bumped in favor of vaccine supplies and equipment.

- Transportation industry workers are set to be the second group in line to receive COVID-19 vaccines.

- We are seeing congested trucking and shipping conditions, backlogs at warehousing and packaging facilities, and tight packaging supplies. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. set records yesterday for new COVID-19 cases (217,664) and fatalities (2,879), with a death occurring every 30 seconds.

- New Jersey, Maine and Delaware reported record daily COVID-19 case counts yesterday.

- California yesterday announced strict lockdown measures that will affect most of the state.

- Puerto Rico is imposing strict, one-month restrictions beginning Monday that include lockdown Sundays, no Saturday liquor sales and a nightly curfew.

- Pfizer will distribute half of the originally planned doses of its vaccine this year — 50 million — due to supply chain issues.

- Moderna’s vaccine could provide COVID-19 antibodies for three months, a hopeful sign of the drug’s longevity.

- An experimental vaccine supported by GlaxoSmithKline is moving into wide-scale trials after promising early testing.

- With effective vaccines on the horizon, companies are beginning to ask whether they can mandate them for employees, an unprecedented labor law issue.

- Some healthcare workers cite disbelief in COVID-19 as a continuing barrier to treatment. Price gouging is emerging as another factor affecting successful treatment, with Gilead’s remdesivir treatment costing more than $3,000 despite questionable efficacy.

- Facebook will begin removing false claims about COVID-19 and vaccinations that could lead to imminent physical harm.

- The U.S. added 245,000 jobs in November, well below economists’ estimates of a 440,000 gain, marking the fifth consecutive month of decelerating jobs growth.

- The supply of people working or looking for a job has declined 2.2% since February, with young people and women most impacted by the pandemic, adding a caveat to recent numbers showing rebounding employment.

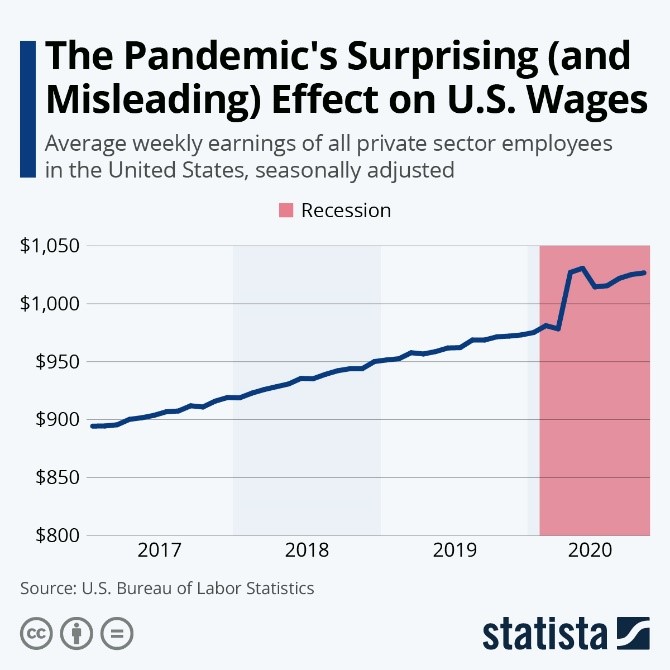

- The loss of lower-paid jobs during the pandemic has resulted in a spike in average worker pay in the U.S.:

- Support grew in Washington, D.C. for a $908 billion stimulus deal that could be passed before year end.

- Southwest Airlines is warning 6,800 employees that their jobs are at risk without labor union concessions or more federal aid, a potential first for the airline in its 53-year history without layoffs.

- 3M announced plans to cut 2,900 jobs on a slump in sales, even as the company’s N95 face masks experience a surge in demand.

- The U.S. economy picked up to a “modest or moderate” pace this fall, with growth only slowing in parts of the Midwest and Northeast where coronavirus cases continue to proliferate.

- IHS Markit’s U.S. services index rose to 58.4 in November, the fastest uptick in activity since March 2015. A reading above 50 indicates growth.

- Pharmaceutical companies ordered 21% more robotic units in the first half of 2020 compared to the year-ago period as more automation is needed to keep pace with surging development of COVID-19 vaccines and treatments.

- Demand for dry ice, a critical component of some COVID-19 vaccine supply chains, is surging.

- Mimicking rival Amazon, Walmart announced a round of nearly $400 million in bonuses to retain and reward staffers managing a surge in sales amid rising COVID-19 case counts.

- In a further blow to the theater industry, AT&T-owned Warner Bros. will release all 2021 films in theaters as well as immediately on its streaming service HBO Max.

- AMC, the world’s largest theater operator, hopes to raise $844 million in a stock sale and warned of a possible bankruptcy filing if the sale is unsuccessful.

International

- New global COVID-19 infections topped 700,000 yesterday, a record.

- Global COVID-19 fatalities have reached 10,000 per day, or one every nine seconds, claiming more than 1.5 million lives since the start of the pandemic.

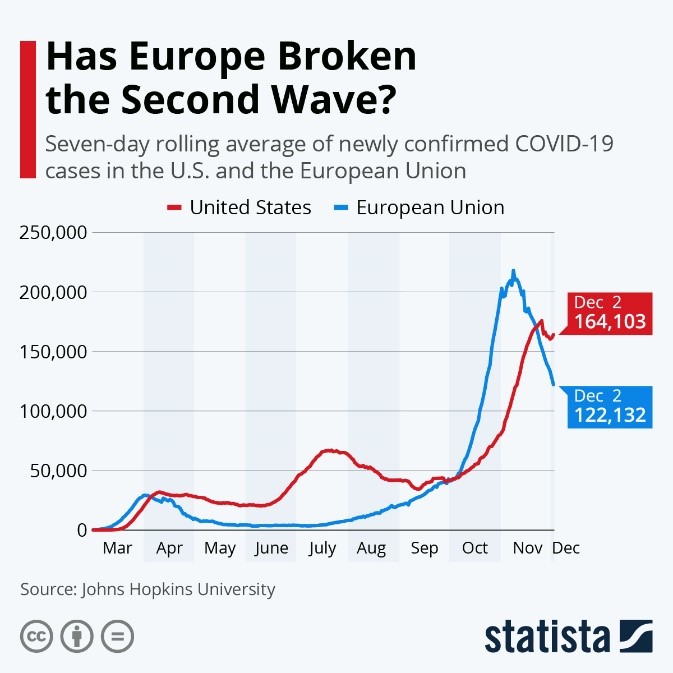

- Renewed restrictions in Europe appear to be reducing COVID-19 infection trends:

- Indonesia recorded its highest one-day tally for new COVID-19 infections yesterday, while Italy reported its highest daily COVID-19 fatality count.

- Eyes are on the U.K. as the country, the first Western nation to approve a COVID-19 vaccine, rolls out plans to inoculate everyone over age 50 within months.

- Japanese researchers developed an online tool that lets users punch in numbers to see the likelihood of COVID-19 transmissions at holiday gatherings this winter.

- German factory orders rose for the sixth straight month in October on rising demand for industrial goods and machinery.

- The Brazilian economy fell short of analysts’ expectations in the third quarter, even as it rose 7.7%, the largest increase in data going back to 1996.

- European budget airline Ryanair is buying 75 of Boeing’s troubled 737 MAX jets, the aircraft’s first major order since a prolonged grounding.

- The European Union is finalizing a plan to increase electrical vehicles on the road from 1.4 million today to 30 million by the end of the decade.

- Honda is offering buyouts to employees over age 55 to make room for younger engineers skilled in electric cars and software.

- Global airlines are pushing back against lawmakers’ mulling of mandatory COVID-19 vaccinations for passengers.

- Nestle announced plans to invest more than $3.5 billion over the next five years in pursuit of 100% renewable electricity at its global sites by 2025 and net zero carbon emissions by 2050.

- Germany is eliminating some taxes on producers of green hydrogen in a bid to encourage the technology’s development.

Our Operations

- Our 3D Printing group has partnered with Advanced Laser Materials (ALM) and EOS North America to distribute selective laser sintering (SLS) materials. Click here to read more.

- We are pleased to introduce M. Holland’s new Application Development Engineer for Sustainability, Debbie Prenatt. With 20+ years in the plastics industry, Debbie will focus on developing our portfolio and expanding our expertise in the Sustainability segment to better serve our clients.

- Our latest Founders Series video is a tribute to Joan Holland, co-founder and matriarch of M. Holland, who recently passed away.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.