COVID-19 Bulletin: December 17

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were higher in mid-day trading today, with the WTI up 0.9% at $48.23/bbl and Brent up 0.6% at $51.37/bbl. Natural gas was 1.4% lower at $2.64/MMBtu.

- The International Energy Agency has reduced projections for 2021 global oil demand by 170,000 bpd to 5.7 million bpd, alongside predictions that it will be several months before COVID-19 vaccines start boosting demand.

- A wave of COVID-19 infections has struck Alberta, Canada’s oil industry, with 11 production sites suffering outbreaks. Chevron is the latest victim, reporting 13 employees at its Kaybob site have tested positive.

- Exports of liquefied natural gas out of the U.S. hit an all-time high in November on recovering global gas demand and prices, according to the International Energy Agency.

- French industrial gas supplier Air Liquide announced plans to spend billions of euros over the next decade on hydrogen production, which the company’s CEO predicts will account for 20% of worldwide energy consumption by 2050.

- Saudi Arabia announced an austere budget for 2021 with a 7% cut in government spending as it grapples with a rising budget deficit due to the drop in oil revenues during the pandemic. Third-quarter GDP in the kingdom fell 4.6% from the prior year, the fifth straight quarter of economic contraction.

- The Safer, an abandoned oil tanker in the Red Sea holding four times more oil than the Exxon Valdez, is rusting and leaking crude, threatening an environmental catastrophe in the region.

- Brazilian petrochemical company Braskem is collaborating with post-use plastic recycler Agilyx Corporation to explore developing an advanced plastics recycling project in North America that would produce polypropylene using mixed waste plastic for use in food packaging and consumer products.

Supply Chain

- Boston and New Jersey officials made emergency declarations after an abnormally large snowstorm arrived in the Mid-Atlantic and Northeast Wednesday afternoon. Airlines canceled over 1,200 flights between Wednesday and Thursday due to the storm, which is likely to cause more than a foot of snow in New York City alone.

- Port of Los Angeles import volumes increased more than 25% in November from a year ago, an unseasonably high level for the period.

- Congestion at British ports have caused supply chain disruptions for the likes of IKEA and Honda, as a flood of pre-Brexit business causes oversupplies in major U.K. gateways.

- Walmart will test autonomous middle-mile vehicles on a two-mile route in Arkansas in 2021, the company says.

- Logistics conditions continue to deteriorate, with trucking demand exceeding availability, growing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- Yesterday, the U.S. suffered record COVID-19 infections (247,403), fatalities (3,656) and hospitalizations (113,000).

- California, which reported 41,081 new COVID-19 cases Wednesday, smashing the state’s previous one-day peak by nearly 6,000 cases and setting a new national record, shattered the record again with 63,817 new cases announced this morning.

- COVID-19 hospitalizations increased nearly 61% over the past month, severely straining the capacity of hospitals and ICU units.

- Eighteen states reported declining COVID-19 cases on Wednesday when compared to the prior week, with another 20 states reporting flat case rates.

- The first round of shipments of Pfizer/BioNTech’s COVID-19 vaccine to 636 U.S. locations was completed yesterday, with the rest of the 2.9 million initial doses slated to arrive at more sites by Sunday. Some vaccine shipments to East Coast states were delayed by the region’s large snowstorm, while shipments in at least two states had to be returned after doses became too cold during the transportation process.

- COVID-19 vaccines carry the potential for side effects, including harsh reactions, such as fever, chills, fatigue and headaches.

- U.S. business activity slowed in the first half of December, with IHS Markit’s Composite Purchasing Managers Index falling to 55.7 from 58.6 in November. Any reading above 50 indicates growth in private sector output.

- U.S. consumers reigned in holiday spending in November, with retail sales dropping 1.1% from the prior month but up 4.1% from the year-ago period.

- For the fourth consecutive week, new jobless claims rose with a higher-than-expected 885,000 people filing last week.

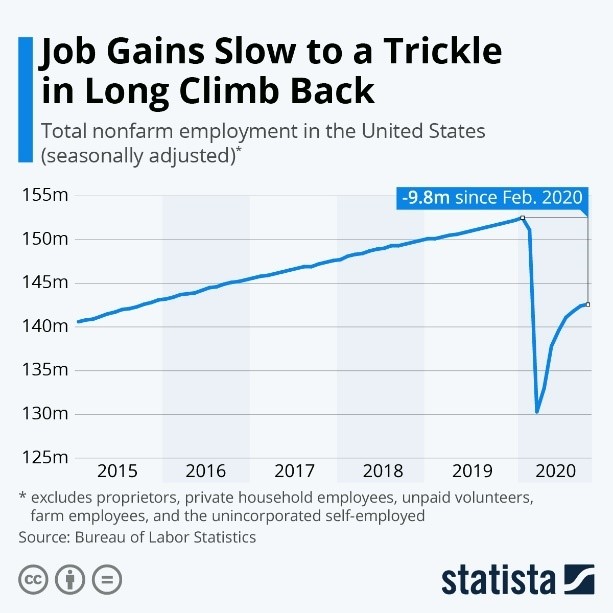

- Job gains have slowed as COVID-19 infections rise:

- Nearly 8 million Americans fell into poverty in the past five months, an unprecedented rate that largely stems from dwindling government aid.

- Congressional negotiators appeared close to agreement on a $900 billion relief bill without strict legal liability limits for businesses and sans aid for state and local governments.

- Federal Reserve officials predict interest rates will remain near zero for at least three years, as the central bank clarified plans to support the economy for longer than they have following prior downturns.

- Courts are starting to hear thousands of lawsuits against insurers who refuse to pay claims on business-interruption policies, saying they don’t cover pandemic-related losses.

- GM is quickly transforming into an electric vehicle leader with the scheduled launch of its electric Hummer in the fall after cutting the product development time in half. The company plans to introduce 30 electric models by 2025.

- Ride-hailing service Lyft expects customers to be able to hail cars without drivers as early as 2023 using vehicles developed in a joint venture between Hyundai and Aptiv Plc.

- Southwest Airlines further cut the number of 737 Max jets it will purchase next year and joined other carriers in reducing revenue forecasts amid continuing slumps in passenger demand.

- Citing shipping delays caused by the pandemic, Walmart is bumping up the deadline to December 19 for online orders to arrive by Christmas.

- Forty percent of retailers now enable shoppers to buy online and pickup in store, up from 25% last year, a shift accelerated by the pandemic.

International

- Germany suffered a record number of COVID-19 infections today, one day after a hard lockdown took effect.

- The president of France has tested positive for COVID-19.

- British lawmakers have agreed to keep relaxed COVID-19 restrictions over the holidays with as many as three households being able to gather between December 23 and 27. Nearly 140,000 people in the country have been vaccinated with Pfizer/BioNTech’s COVID-19 vaccine.

- Japan’s capital raised its alert level to the highest of four stages Wednesday as hospital beds filled up with rising infections.

- Brazil reported 70,574 new COVID-19 cases Wednesday, pushing the nation past 7 million total cases, second only to the U.S.

- Australia has reported its first COVID-19 case in two weeks after an airport worker tested positive.

- Indonesia will give the first COVID-19 vaccines to younger, working-age people in a contrarian strategy to more quickly build herd immunity.

- Germany plans to issue record amounts of government debt next year in a continuing battle to counter the effects of the pandemic on the economy.

- Amid fears of a no-deal Brexit at the end of the month, British officials have warned supermarkets to stockpile food and essential supplies.

- Retail e-commerce could account for 17% of global retail sales by year end, with potential double-digit growth over the next six years even after social distancing measures abate.

- The Arctic’s Northeast Passage was open for a record 88 days in 2020, as the region saw record breaking heat and less sea ice around Russia than usual.

Our Operations

- M. Holland will be closed on Thursday and Friday, December 24 and 25, for the Christmas holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.