COVID-19 Bulletin: August 20

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices retreated yesterday after the Federal Reserve staff lowered its outlook for economic growth in the second half of the year.

- Crude prices were down in early trading today, with the WTI at $41.95/bbl and Brent at $44.41/bbl.

- Hot weather is driving natural gas prices higher with the price in early trading at $2.41/MMBtu.

- Oil tanker demand fell 18.6% in July, the steepest monthly drop during the pandemic, as OPEC+ nations reduced their production.

Supply Chain

- A tropical depression in the Atlantic is expected to be upgraded to Tropical Storm Laura today.

- Container shipping giant Moller-Maersk reported a year-over-year increase in profits in its latest quarter driven by increased demand, low fuel costs and a 20% reduction in its capacity. The company does not expect ocean freight to return to pre-pandemic levels until the first half of 2021.

- Some e-commerce retailers, frustrated by delivery delays by the U.S. Postal Service, are warning customers and looking for shipping alternatives.

- The pandemic is accelerating the adoption of blockchain technology to improve and speed information flow and decision making in the food industry.

- Uber and Lyft may end ride-sharing in California tomorrow over the state’s demand that they treat drivers as employees rather than contractors.

- While dry van capacity is improving, the bulk trucking sector has worsened, with rising manufacturing activity and low inventories expanding regional tightness into a national capacity shortfall. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- Freight pricing continues to rise due to capacity constraints and the higher cost of operations due to the pandemic.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- New COVID-19 infections in the U.S. increased yesterday to 47,408 but remained below 50,000 for the fifth day in a row.

- First-time unemployment claims rose to a higher-than-expected 1.1 million last week after breaking below a million last week.

- The Federal Reserve struck a cautionary tone in the minutes from its late July meeting, noting that, “Uncertainty surrounding the economic outlook remained very elevated…” Stock markets retreated on the news.

- U.S. companies recognized $261 billion in asset impairment charges in the first half of 2020, more than all of 2019.

- Consumers, flush with stimulus money, are consolidating their shopping at big box stores and online. While big box stores are soaring, retailing is on pace for record bankruptcies, with more than 40 so far, and mall-based stores are expected to lose $2.9 billion this year.

- Target joined other big box stores in reporting record results in the latest quarter, with year-over-year revenues up 24.3% on a tripling of online sales and a 10.9% jump in same-store sales.

- There are growing anomalies in the housing market, with prices diverging between urban and suburban areas, increasing delinquencies among entry-level mortgages and an unprecedented boom of activity in normally slow August.

- With fitness centers struggling during the pandemic, consumers are working out at home, driving a 200+% increase in online sales of sporting equipment in May and a 100+% increase in June.

- The pandemic is spawning specialized clinics dedicated to treating those suffering from the long-term effects of COVID-19.

- Radical design changes may be in store for airplane cabins, including new seating configurations, barriers between seats, no-touch video screens and chromatic fabrics that change color after sterilization.

- Several ongoing studies are proving that wearable devices can help in detecting COVID-19 and tracking the virus.

- An ingredient in Pepcid AC, a common heartburn remedy, could mitigate the effects of COVID-19 in patients, according to a recent study published in the American Journal of Gastroenterology.

International

- Spain and France both recorded more than 3,700 new infections yesterday, the highest daily rates in months, as Europe grappled with an alarming surge in new cases.

- Nearly 30% of the population in New Delhi has been infected by COVID-19 as India experiences the fastest spread of the virus globally.

- India’s middle class, the engine of the world’s fastest growing economy in recent years, has been hard hit by the country’s strict lockdown, with 100 million people at risk of falling into poverty.

- Puerto Rico, facing a spike in COVID-19 infections, added new restrictions, including a 24-hour lockdown on Sundays, $100 fines for individual violations and a 30-day suspension of operations for businesses that violate the rules.

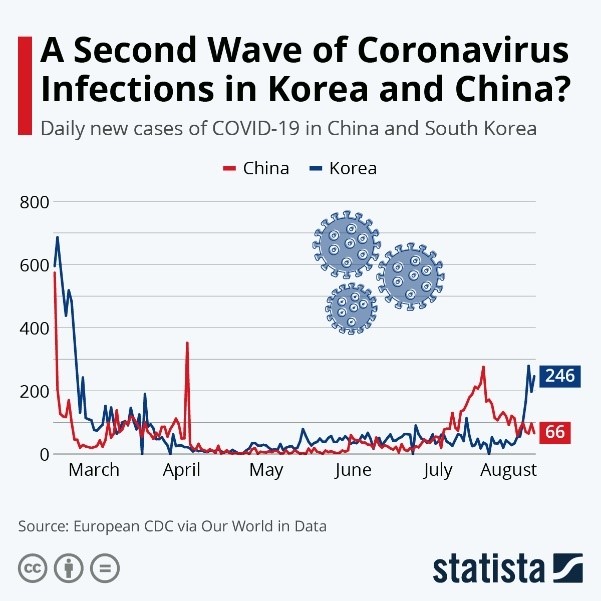

- South Korea has registered triple-digit new infections for the past week, prompting the nation’s health minister to warn, “This is a grave situation that could possibly lead to a nationwide pandemic.”

- While retail sales in China have fallen 9.9% through June, premium brands continue to grow as white-collar workers have been relatively insulated from the financial effects of the pandemic.

- Estée Lauder said it will cut up to 2,000 people and close up to 15% of its stores. The company announced sales in its latest quarter rose in Asia but fell in other regions of the world.

Our Operations

- As a follow-up to yesterday’s Fireside Chat on the new North American trade agreement, our regulatory team shared key considerations on reporting requirements related to USMCA.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.