COVID-19 Bulletin: August 11

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The Brent crude price broke above $45/bbl, trading early today at $45.37/bbl, while the WTI price was at $42.45/bbl.

- The EPA plans to rescind rules requiring oil and gas drillers, pipelines and storage facilities to monitor and fix releases of methane, which accounts for an estimated 10% of greenhouse gases.

- Marathon is among companies taking advantage of a temporary provision in the March relief bill that permits companies to apply this year’s losses against profits earning in prior years, when tax rates were higher. The company looks to receive a tax refund of $1.1 billion.

- Delta’s foray into the energy business with its 2012 acquisition of a Pennsylvania oil refinery to secure fuel supplies has proven to be a liability during the pandemic.

Supply Chain

- We’re seeing the truckload freight market continuing to tighten with some LTL shippers resorting to truckload quantities due to capacity constraints in the LTL freight market. Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

- We’re seeing rising spot freight pricing due to capacity constraints in the industry.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- The national average for new COVID-19 infections has trended down for the past two weeks, with just 13 states experiencing rising case counts, down from 42 states a month ago.

- Florida set a record for hospitalizations with 3,355 COVID-19 patients admitted between Sunday and Monday.

- There’s been a 90% increase in COVID-19 cases among children in the past four weeks. Deaths among U.S. children in the past few months number 90, nearly as many as the 100 annual deaths typically experienced among children from the flu.

- Talks in Washington on a fourth recovery package remained stalled, while governors voiced concern about the cost and administrative burden the White House’s recent executive orders will impose on states.

- The $600 supplemental unemployment benefit that expired last month cost the government $250 billion. Loss of the supplement could significantly impact consumer spending.

- The U.S. budget deficit fell to $61 billion in July as the government collected record receipts on delayed income tax payments. Through 10 months of the fiscal year, the deficit stands at $2.8 trillion, twice the previous record set during the Great Recession.

- The White House is considering cuts in income and capital gains taxes for middle-income earners.

- Employers posted more job openings in June as closed bars and restaurants reopened, but overall hiring remained tepid. Workers quitting their jobs rose 25% from May, an unusual trend during recessions, possibly due to health risks of working.

- U.S. small business optimism fell in July in response to COVID-19 spikes around the country.

- Russia registered a COVID-19 vaccine it calls Sputnik V without conducting Phase 3 human trials, prompting skepticism and safety concerns in the West.

- Johnson & Johnson’s vaccine candidate, while still not in human testing, showed promise in providing “complete or near-complete protection” in the lungs of animals with a single dose.

- TSA passenger screenings were down 75% in July compared with the prior-year period but were the highest since early in the pandemic.

- The pandemic is permanently reshaping the economic landscape, with some firms thriving, some adapting and some facing imminent extinction.

- The White House hopes to accelerate the growth of 5G internet technology by freeing segments of the wireless spectrum from military to commercial use.

- Electric truck startup Nikola received an order for 2,500 refuse trucks from waste manager Republic Services.

- Online used car dealer Carvana, known for its multi-story, glass vehicle dispensers, reported a 25% increase in vehicle sales in the second quarter, boosted by increases in online sales and used car demand during the pandemic.

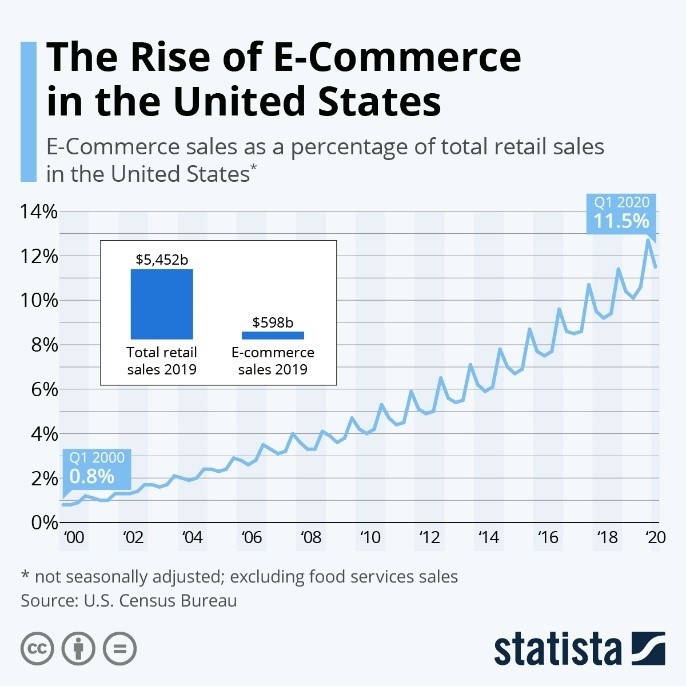

- Online sales now constitute over 11% of total retail in the U.S.:

- The Association of Plastics Recyclers’ certification program for post-consumer recycled plastics for packaging is gaining traction.

- Confusion reigned about the future of college football, as the Big Ten said it will decide today whether to cancel the 2020 season after initial reports yesterday that it made such a decision over the weekend. The initial report prompted outspoken reaction from coaches, players and fans.

- COVID-19 deaths in the U.S. are nearing 165,000.

International

- The White House is considering immigration rules to bar citizens and legal residents from entering the country if they are suspected of having COVID-19.

- New Zealand, which over the weekend celebrated 100 days without a community transmission of COVID-19, reported three new cases yesterday.

- Alternative data such as credit card usage, travel and location information suggest that economic activity is plateauing in many developed countries at below pre-pandemic levels.

- Passenger car sales in China increased 7.7% in July compared with the year-ago period, the biggest increase in two years.

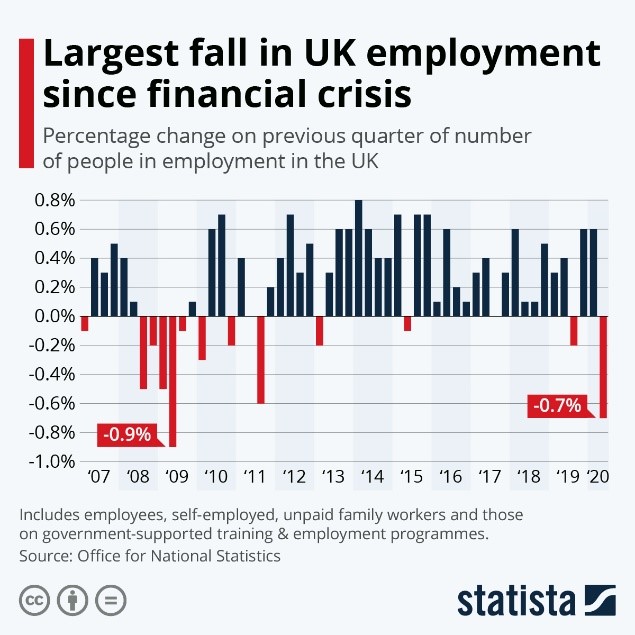

- The number of people employed in the U.K. fell by the most since the Great Recession in the quarter ended June 30 as unemployed workers face a cliff when government jobless benefits end in October. The country only counts those looking for work as unemployed, which significantly undercounts actual job losses.

Our Operations

- We are proud that Crain’s Chicago Business has ranked M. Holland as one of its Top 100 Best Places to Work.

- Join us for our next Fireside Chat on August 19. Panelists from M. Holland and Plante Moran will discuss the new USMCA and how it will impact businesses, the economy and the plastics industry. For more information and to register, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.