COVID-19 Bulletin: April 8

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The U.S. crude price fell 9.4% yesterday to close at $23.63; Brent fell 4.3% to close at $31.87; prices opened higher today, a day before Russia, Saudi Arabia and other oil-producing nations meet.

- LyondellBasell has slowed construction of its propylene oxide (PO) and tertiary butyl alcohol (TBA) expansion at its Channelview, Texas, complex, joining other major producers in curtailing new expansions.

- COVID-19 is expected to change the landscape for the petrochemicals industry as companies retrench to preserve liquidity.

- Gasoline demand last week was down nearly 47% from the prior-year period, echoing global demand declines.

Supply Chain

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

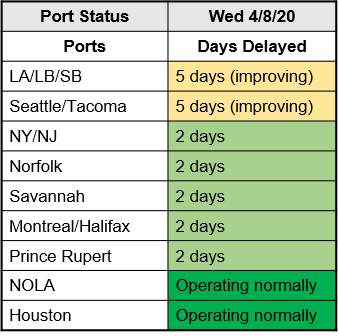

- There’s been no status change with ports:

Markets

- U.S. stock markets opened on the upswing Tuesday, then the Dow surrendered a 900-point gain to end down slightly in volatile trading.

- The $350 billion Paycheck Protection Program (PPP) is struggling with administrative confusion and overwhelming demand for the first-come-first-serve loans. Through Tuesday, the SBA had issued 220,000 loans worth about $66 billion.

- The White House and Congress are discussing expanding PPP by another $250 billion.

- The Federal Reserve is lifting its asset cap on Wells Fargo to allow the bank to make more loans under Coronavirus Aid, Relief, and Economic Security (CARES) Act programs.

- Expanded unemployment benefits are prompting some companies to furlough or lay off employees.

- Honda joined Nissan in furloughing U.S. workers, adding more than 14,000 to unemployment rolls. Nissan furloughed 10,000 workers yesterday, and Ford, GM and Fiat Chrysler have laid off more than 150,000 autoworkers.

- Tesla will temporarily cut salaried wages and furlough hourly employees.

- BMW furloughed workers when it idled its Spartanburg, South Carolina, plant in late March.

- Medical device and technology companies may face slack demand in an economic recovery as patients defer elective procedures and healthcare providers put off equipment purchases to shore up strained finances.

- More states and municipalities are suspending single-use bag bans as a defense against the spread of COVID-19.

- Johns Hopkins tracks the global spread of COVID-19.

International

- Colombia extended its quarantine two additional weeks until April 26.

- As Wuhan, China, emerges from its lockdown, reports have surfaced of additional asymptomatic cases of COVID-19.

- France’s central bank estimates the French economy contracted by 6% in the first quarter.

- Austria, Denmark and Italy are poised to begin easing social-distancing restrictions and reopening idled factories.

Our Operations

- NOTICE TO CLIENTS: M. Holland Company will be closed on Good Friday, April 10. Our Mexico operations will be closed on Thursday and Friday.

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.