COVID-19 Bulletin: April 7

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Volatility reigned in oil markets on Monday, as the U.S. crude price fell 8% to $26.08 and Brent fell 3% to $33.05.

- A group of the 20 largest industrial nations may meet virtually on Friday for an emergency energy summit, the day after Russia, Saudi Arabia and other oil-producing nations are scheduled to meet about a possible truce in the oil wars; Moscow and Riyadh both have indicated production cuts may require broad global agreement and compliance.

- Renewable energy sources, now comprising more than 20% of U.S. electricity production, should continue to gain share in energy markets, despite abundant supply and low prices for fossil fuels.

- Exxon joined other petrochemicals companies in announcing expense and capital spending cuts in response to the COVID-19 crisis and collapse of oil prices.

- All PE and PP suppliers are running strong with good backlogs. Assets have been rationalized to support essential product mix.

- Suppliers are reporting demand falling off in certain market segments.

- Orders continue to be closely vetted and managed.

- There is anticipation of a sharp demand decrease for late April and May.

Supply Chain

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

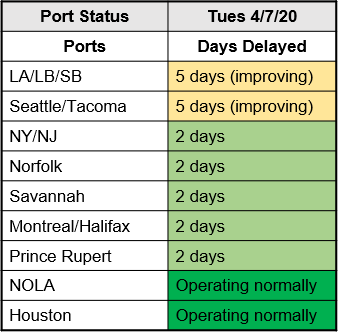

- Ports continue to operate steadily:

Markets

- U.S. stocks rallied 7% yesterday on hopes that the COVID-19 spread could be plateauing; international markets followed suit overnight. Credit markets have stabilized in response to massive governmental intervention.

- A surge in applications under the $350 billion Paycheck Protection Program could deplete the fund. Open to companies with fewer than 500 employees, larger firms in the restaurant and hospitality industries also are eligible and competing for the 1%-interest loans.

- The Federal Reserve and U.S. Treasury Department are working on a program whereby the Fed will buy SBA loans, freeing banks to do more PPP lending.

- Seventy-four percent of financial leaders surveyed indicate they plan to shift a portion of their workforces to remote work arrangements permanently.

- Michigan extended its stay-at-home restrictions through the end of April, which will leave automobile companies in the state idle.

- Fiat Chrysler plans to restart on May 4.

- Nissan will furlough 10,000 workers today at plants in Mississippi and Tennessee after closing the facilities on March 20.

- Tier 1 automotive supplier Lear has issued an Interactive Safe Work Playbook of practical recommendations for restarting operations when social-distancing mandates are lifted.

- COVID-19 is disrupting plastics recycling amid reductions in curbside pickup, suspensions of bottle bills (i.e., mandatory buyback programs) and hoarding of packaged goods by consumers.

- The Plastics Industry Association is mounting a campaign to end bans on single-use bags as a hedge against COVID-19.

- Apple plans to make up to one million face masks a week at factories in the U.S. and China.

- Airline Ravn Air of Anchorage, Alaska, filed for bankruptcy; Airbus suspended production at its Mobile, Alabama, factory until April 29 due to high inventories.

- Johns Hopkins tracks the global spread of COVID-19.

International

- China reported no COVID-19 deaths yesterday, the first time since January. Japan, Singapore and South Korea tightened social-distancing restrictions.

- While we are seeing international PE pricing under downward pressure, Chinese futures pricing has been rising in recent days.

- We are seeing demand for HDPE and PVC pipe grades stalled in international markets, while film grades for packaging and single-use bags remain steady.

Our Operations

- NOTICE TO CLIENTS: M. Holland Company will be closed on Good Friday, April 10. Our Mexico operations will be closed on Thursday and Friday.

- M. Holland is open for business, deemed essential and will continue to operate at full capacity. We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.