M. Holland’s 2023 Plastics Industry Trends & Predictions

The pandemic has presented three distinct phases for the plastics industry. In 2020, the priority was human health as economic disruption created asymmetric demand for plastic products. Supply shortages were the challenge in 2021, exacerbated by Winter Storm Uri, which severely impacted production capacity. Supply returned in 2022, but supply chains became the dominant concern.

Entering 2023, odds favor an economic soft landing as opposed to a recession. We can expect steadily improving demand for the plastics industry as businesses work through excess inventories accumulated as a hedge against supply chain disruptions. Resin supply should be plentiful compared with the past two years. New PE and PP capacity in the U.S. and China should increase both domestic and export supply. Easing supply chain and energy costs should help with the availability and cost of imported resins.

The industry has demonstrated remarkable resilience during the past three years. Barring another “black swan” event, we can expect it to find a new and less disruptive “normal” as 2023 progresses.

– Dwight Morgan, Executive Vice President, Corporate Development

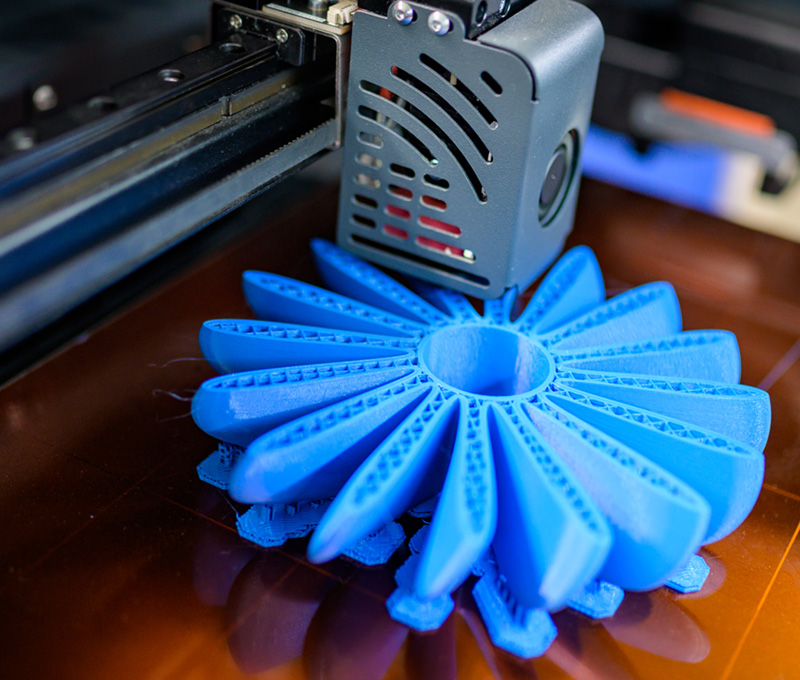

3D Printing

“Process and material innovation have made 3D printing a viable alternative for full production applications, allowing fast prototyping to extend beyond just form and fit evaluations. The expanded capabilities of new additive manufacturing applications will benefit the plastics market in multiple ways. It makes 3D printing a cost-competitive option that manufacturers are incorporating more broadly into their operations across the entire manufacturing process, from ideation and design through production. Many OEMs are now designing facilities around additive manufacturing as the technology gains functionality. 3D printing will only become more integrated into the manufacturing process as time goes on.”

– Carlos Aponte, Market Manager, 3D Printing

Global Market Size

$786.9M

in 2021 with 23.9% CAGR

Projected Market Size

$5.4B

by the end of 2030

Top Materials

Photopolymers

(Type)

Filament

(Form)

Top Applications

Industrial Applications in Automotive, Aerospace, Medical

M. Holland Predicts:

The 3D printing industry will see new additive manufacturing facilities open this year as OEMs take advantage of prototypes that have evolved to meet form, fit and functional testing requirements.

Source: grandviewresearch.com

Automotive

“Electrification is the most transformative technology we have seen in the automotive industry in recent years. The push and presence of electric vehicles (EVs) is not just a trend but an enduring part of the automotive fold going forward. New EV manufacturers are entering the market as recent government incentives have increased consumer demand. As EV production continues, so will sustainable material development and innovation. Getting in front of the sustainability wave will be extremely important. However, OEMs are actively looking for more ways to get sustainable materials into both EVs and internal combustion engines (ICEs), which place the focus on durability when it comes to material development and selection.”

– Matt Zessin, Director, Global Automotive

Global Market Size

$28.7B

in 2021 with 4.7% CAGR

Projected Market Size

$43.4B

by the end of 2030

Top Material

Polypropylene

Top Applications

Interior Furnishings, Electrical Components

M. Holland Predicts:

Electrification trends and incentives will significantly increase the popularity of electric vehicles in 2023. Automotive manufacturers will prioritize parts and applications made from sustainable materials for both electric vehicles and internal combustion engines.

Source: grandviewresearch.com

Color & Compounding

“In 2022, resin, additive and pigment shortages hindered the color and compounding space, but that hasn’t stopped private equity (PE) from making moves. While it’s great that PE investors see value in the industry, the consolidation is making sourcing difficult for smaller operations. Low-margin molders are struggling to find new compounding sources as compounders make a long-term play for bigger business opportunities and cut back on sales and support functions. Luckily actual material shortages are less problematic than they have been in recent months. Inventory has largely caught up to demand as warehouses have filled. In 2023, I expect customers to tighten their belts further to conserve cash due to recessionary fears and work to unload accumulated inventory. Despite recent availability improvements, dual-sourcing resin will remain an important backup plan for producers in the coming year.”

– Scott Arnold, Market Manager, Color & Compounding

Color Masterbatch

Global Market Size

$5.6B

in 2021 with 6.3% CAGR

Projected Market Size

$9.7B

by the end of 2030

Top Materials

Polypropylene, Polyethylene

Top Applications

Packaging, Automotive, Consumer Goods

Compounding

Global Market Size

$60.4B

in 2021 with 7.4% CAGR

Projected Market Size

$112.1B

by the end of 2030

Top Materials

Polypropylene, Polyethylene

Top Applications

Automotive, Packaging, Electrical & Electronics

M. Holland Predicts:

Recessionary planning will limit longer-term orders for resin in 2023, balancing supply chains after persistent material shortages encouraged compounders to fill their warehouses to ensure availability.

Sources: Color Masterbatch, Compounding

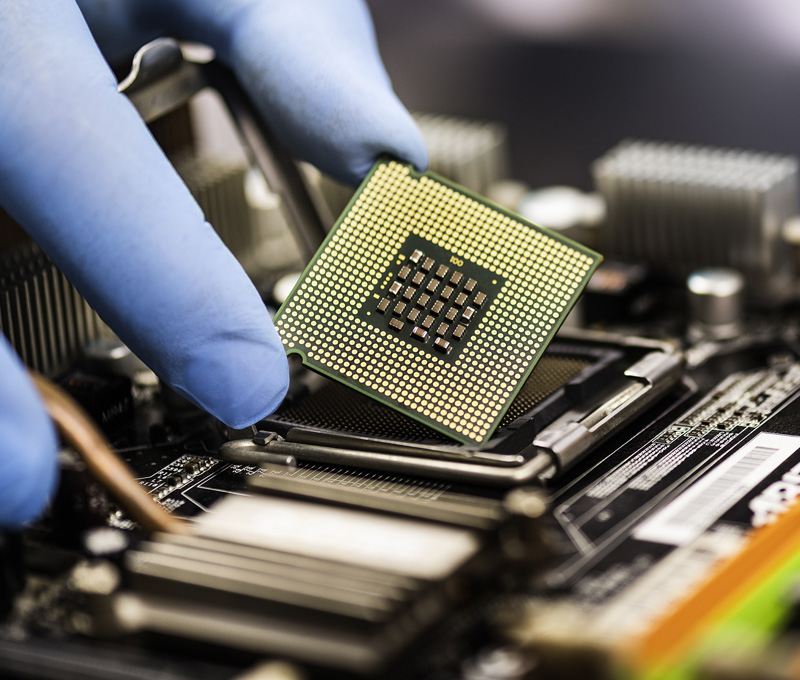

Electrical & Electronics

“Recent legislation promoting electric vehicles is increasing production and driving a host of new startups in the electrical and electronics market. Likewise, efforts to reshore and deglobalize supply chains have loosened the Asian stronghold on electrical manufacturing. U.S.-based corporations and foreign actors alike are bringing product development and manufacturing to North America. As electrical and electronics products are constantly becoming smarter, faster and more innovative, research and development (R&D) that takes place in the U.S. is also increasing the volume of domestically owned intellectual property (IP) rights. By controlling the IP and engineering through manufacturing, U.S.-based companies will be more competitive globally by increasing their speed to market.”

– Carlos Aponte, Market Manager, Electrical & Electronics

Global Market Size

$5.4B

in 2021 with 3.8% CAGR

Projected Market Size

$7.7B

by the end of 2028

Top Materials

Polycarbonate, Polyamides, Thermoplastic Elastomers

Top Applications

Appliances & White Goods, Enclosures

M. Holland Predicts:

Reshoring of electrical and electronics R&D and engineering processes will improve the time to market for U.S.-based corporations.

Source: grandviewresearch.com

Healthcare

“The healthcare industry continues to adapt to market challenges. We’ve seen many OEMs take inventory positions on plastic resins, so they have safety stocks for their various molders in a ‘never again’ effort to combat raw material shortages that have persisted throughout the pandemic. Nearshoring molds and manufacturing plants, qualifying secondary resins, plus taking inventory positions are a few examples of how the medical industry is attempting to remove supply chain risk going forward. Managing price and volume volatility will be a full-time job in 2023, but it will be the year we can get back to thinking about the future and creating new, next-level medical devices. Remote healthcare devices will see great growth and innovation in the coming year. Consumers have shown they are willing to pay for devices that track specific health markers, and device manufacturers are working to meet that demand.”

– Josh Blackmore, Global Healthcare Manager

Global Market Size

$46.1B

in 2021 with 7.5% CAGR

Projected Market Size

$88.4B

by the end of 2030

Top Materials

Polypropylene, Polycarbonate

Top Applications

Medical Components, Mobility Aids & Medical Device Packaging

M. Holland Predicts:

After a few reactive years, 2023 will see healthcare return to a more proactive position. Telehealth, patient monitoring and smart devices will grow while the number of newly approved medical devices increases.

Source: grandviewresearch.com

Packaging

“Sustainability continues to dominate the conversation throughout the packaging market. Worldwide brands are committed to sustainable materials in their packaging and are designing for recyclability or a better answer in waste management. Especially as inflation and a recessionary climate are driving companies to find other ways to add value or lower costs in single-use, multi-use and durable goods. Cash flow management is of the utmost importance right now; focus on what you can control, which includes the materials you buy and the goods you purchase. Spending time to hone your business case and service levels, in any stage of the supply chain, is critical.”

– Lindy Holland Resnick, Market Manager, Packaging

Global Market Size

$355B

in 2021 with 4.2% CAGR

Projected Market Size

$492.3B

by the end of 2027

Top Materials

Polyethylene Terephthalate,

Polyethylene, Polypropylene

Top Applications

Food & Beverage, Personal & Household Care, Cosmetics, Industrial Shipping & Packaging Materials

M. Holland Predicts:

Competition in the packaging market will intensify over the next 12 months and become more favorable to buyers despite a less-than-ideal economy.

Sources: grandviewresearch.com, statista.com

Rotational Molding

“The first three quarters of 2022 showed constrained material supply and high demand in the rotational molding space. However, we project an ebb in demand back to a pre-pandemic level, coupled with additional polyethylene capacity looming, which most molders view as a sense of price relief. That is a boon after economic conditions last year caused rotational molders to reevaluate their business, and many eliminated less profitable and more complex orders. OEMs that were displaced by those changes have opened new manufacturing facilities causing increased pressure on machine and equipment suppliers. Automation efforts have evolved to fill the gaps as new molders develop manufacturing processes without access to the volume of labor that supports more traditional methods.”

– Bill Christian, Product Manager for Rotational Molding

Global Market Size

$4.5B

in 2020 with 5.9% CAGR

Projected Market Size

$8.3B

by the end of 2031

Top Material

Polyethylene

Top Applications

Building & Construction, Sports & Recreation

M. Holland Predicts:

Worker scarcity will significantly impact business as processors embrace automation with primary machinery and secondary operational equipment to fill the gaps.

Source: transparencymarketresearch.com

Sustainability

“Sustainability was at the forefront at the largest plastic industry event — K 2022 in Dusseldorf, Germany. Attendees were inspired to take ownership and action to address issues surrounding climate change and a circular economy. This visibility on the world’s stage has proven every company should have a sustainability program, regardless of size, especially as large OEMs and brand owners push their sustainable procurement objectives further down the supply chain. As sustainable initiatives stay at the forefront, collaboration between non-traditional partners will be necessary to reduce greenhouse gases, landfill contributions, incineration and plastic pollution. It is critical for businesses and processors to know the sustainability goals of their customers or OEMs and align with them accordingly. Responsible product design, sustainable material selection and the circular economy should be central to product development.”

– Debbie Prenatt, Market Manager, Sustainability

Global Market Size for Sustainable Packaging

$90B

in 2021 with 8.7% CAGR

Projected Market Size for Sustainable Packaging

$127.5B

by the end of 2026

Top Materials

Bio-Based Polymers, Compostable Bioplastics, Recycled Plastics, Specialty Additives

Top Applications

Food & Beverage, Personal & Household Care, Cosmetics, Industrial Shipping & Packaging Materials

M. Holland Predicts:

Global policy, legislation and sustainability goals will continue to drive recycling infrastructure and influence product design, both for recyclability and material selection.

Source: statista.com

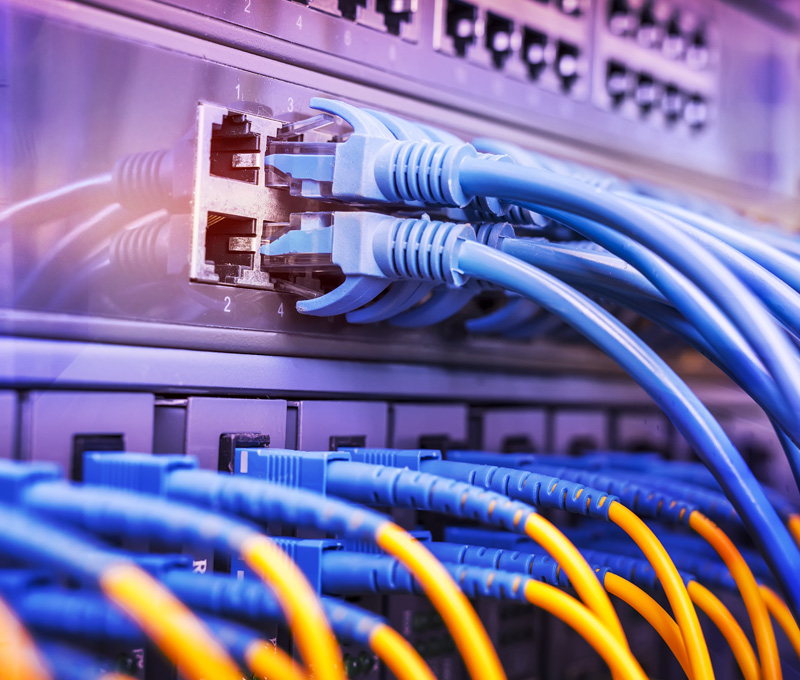

Wire & Cable

“As supply chains become more consistent across polymers and conductors in 2023, it will be critical for wire and cable manufacturers to optimize and automate production to allow room for growth. We’re in year three of a massive 10-year infrastructure investment cycle that focuses on two major industry trends — electrification and digitalization. Costs for clean energy like solar and wind power are coming down as they reach scale. This increased affordability, combined with tax incentives, a desire for more reliable energy and global sustainability initiatives, are accelerating adoption and positively influencing demand for power cables. Similar government funding efforts are driving network creators to invest heavily in digital infrastructure in 2023, especially in rural and low-income areas with minimal internet coverage.”

– Todd Waddle, Director, Wire & Cable

Global Market Size

$10.8B

in 2020 with 4% CAGR

Projected Market Size

$15B

by the end of 2027

Top Materials

Polyethylene, PVC, Nylon

Top Applications

Building & Construction, Telecommunications

M. Holland Predicts:

As electrification trends and network expansion efforts continue, legislation will drive increased investment in digital and renewable energy infrastructure in 2023.

Source: transparencymarketresearch.com