MH Daily Bulletin: September 30

News relevant to the plastics industry:

At M. Holland

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference on Oct. 2-5 in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland will host panelists from Maersk and Bank of America to discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register.

- M. Holland Company, a leading international distributor of thermoplastic resins and ancillary materials, is offering up to 100% PCR content resin that helps brands utilize sustainable innovation in the plastics industry. Click here to read the full press release.

Supply

- Oil fell 1% Thursday as U.S. firms laid out plans to quickly bring back Gulf Coast production after Hurricane Ian.

- In late-morning trading today, WTI futures were off 0.5% at $80.79/bbl, Brent was down 0.3% at $88.25/bbl, and U.S. natural gas was up 0.5% at $6.91/MMBtu.

- New York joined California in banning the sale of new gas-powered cars by 2035.

- Most new power generation planned in the U.S. is now renewable, according to new research.

- A chunk of France’s nuclear generation went offline Thursday amid a nationwide strike by workers across industries, which also shut down over 60% of the nation’s refining capacity.

- OPEC+ may decide to cut group output at its next meeting on Oct. 5. Russia will likely push for a 1 million bpd reduction.

- China gave refiners their biggest increase in fuel export quotas of the year, a bid to revive activity in the nation’s faltering oil industry.

- More oil news related to the war in Europe:

- Another leak on the Nord Stream 1 and 2 natural gas pipelines was discovered Thursday, bringing the total number of ruptures to four. Three-hundred thousand tons of harmful methane could escape, as Western nations ramp up protections against energy infrastructure.

- EU nations will today unveil a windfall tax on energy companies along with several other market interventions to address the bloc’s energy crisis heading into winter.

- Germany unveiled a nearly $200 billion relief package Thursday that will put a brake on gas prices until spring 2024 and remove some fuel taxes.

- The IEA says the global LNG market could be even tighter next year without Russian gas flowing into Europe.

- European diesel will rise sharply in the coming weeks as the EU moves forward with a ban on the import of Russian refined petroleum by February.

- Long-term debt tied to Europe’s energy crisis poses a threat to at least one-third of the bloc, central bank officials say.

- Britain will extend the lifespan of two nuclear plants beyond a planned shutdown in 2024, the third extension.

- Poland, Europe’s biggest coal producer, scrapped a ban on heating homes with brown coal until next year to ease the energy crisis.

- Italy’s household electricity prices will likely rise almost 60% in the fourth quarter alone, economists say.

- The EU is exploring a change in LNG’s pricing mechanism due to imbalances created by market volatility.

- Canada’s Enbridge acquired No. 3 U.S. renewable energy developer Tri Global Energy for $270 million.

- The U.S. hit firms in China, the UAE, India and Hong Kong with new sanctions Thursday over efforts to help Iran evade oil export bans.

- Methane emissions from oil and natural gas wells are far higher than initially thought due to inefficient flaring techniques, researchers say.

Supply Chain

- In extreme weather news:

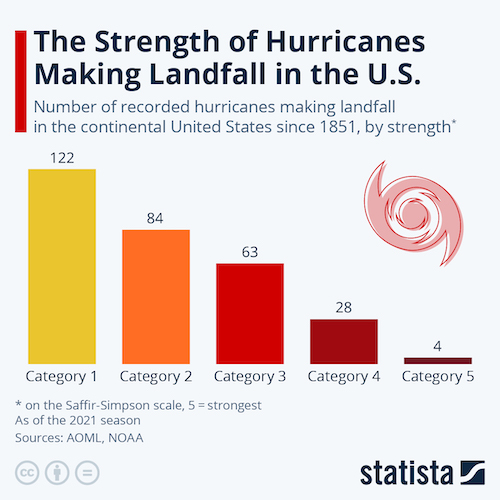

- Hurricane Ian caused catastrophic damage in Florida, knocking out power for millions of people and spurring widespread flooding well into the state’s interior. Dozens of fatalities are now being reported as officials work to tally damages.

- Hurricane Ian crossed the Florida peninsula and is now barreling up the U.S. East Coast toward Georgia and the Carolinas, leading several governors and the federal government to declare states of emergency.

- Wide swaths of Cuba remain without power for a third day after the landfall of Hurricane Ian.

- Hurricane Ian likely worsened what was already expected to be the smallest U.S. orange crop in 55 years.

- Tens of thousands of French workers protested in major cities Thursday, demanding higher wages to cope with inflation.

- A labor dispute between dockworkers and employers is slowing cargo operations at the ports of Seattle and Oakland.

- The Port of New York and New Jersey became the U.S.’s busiest port in August handling 843,191 TEUs for the month.

- Georgia’s Port of Savannah is toughening penalties for the storage of empty containers.

- Maersk is slowing the pace of its container ships to save on fuel costs.

- The market for bulk vessels is improving as sellers accept more realistic valuations and buyers are buoyed by stabilizing rates.

- Cargill Ocean Transportation’s chief executive does not expect falling bulk shipping rates to return to last year’s high levels.

- The logistics arm of Koch Industries says U.S. rail service has improved since railroads resumed hump operations at several yards, but challenges remain from persistent and sporadic crew shortages.

- The average age of U.S. trucking fleets has increased about 10% over the past year.

- Major U.S. retailers are marking down goods to pare back stockpiles after miscalculating consumer demand earlier this year.

- Micron Technology’s quarterly profits sank 45% on a 20% decline in sales of its semiconductors, a further sign that demand for consumer electronics is slumping. The U.S. firm plans to cut capital expenditures by 30% next fiscal year.

- In the latest news from the auto industry:

- Toyota’s global output grew a record 44.3% year over year in August as supply shortages in Asia eased. Toyota executives also said pursuing an all-electric vehicle lineup would be too narrow an approach for its global markets.

- Used-car retailer CarMax saw profit fall over 50% in the most recent quarter on a mere 2% gain in sales, its slowest of the pandemic.

- Apple supplier Foxconn started building electric vehicles for Ohio-based Lordstown Motors, which aims to deliver 50 pickups by the end of the year.

- India delayed a new law requiring six airbags in all cars, citing supply shortages.

- Volkswagen says it reaped over $9 billion from this week’s IPO of Porsche, putting the automaker in a good position to fund its long-term electrification.

- Experts say Europe’s mobile phone networks could go dark this winter if energy rationing knocks out enough power supply.

- Russia is banning some Western freight trucks from crossing Russian territory.

- Crop-carrying vessel traffic on the Mississippi River is slowing due to a steep drop in water levels.

Domestic Markets

- The U.S. reported 83,217 new COVID-19 infections and 693 virus fatalities Thursday.

- U.S. senators passed a stopgap funding bill Thursday that will keep the government running into next fiscal year, as the House readies a vote on the bill today.

- Consumer spending rose a higher-than-expected 0.4% in August, as a drop in gasoline prices freed consumer cash for spending on services and leisure. Spending for goods, including fuel, fell 0.5%.

- The Commerce Department revised upward U.S. GDP growth to 5.9% last year as the economy rebounded faster than initially thought.

- Many U.S. employers say they continue to struggle with staffing shortages and are reluctant to cut headcount despite recessionary concerns, new surveys show.

- In its first major budget cut since the founding of Facebook in 2004, U.S. tech giant Meta will freeze hiring and further restructure in the face of uncertain macroeconomic conditions. Meta joins a string of tech firms slashing headcount ahead of a possible recession, while the value of tech IPOs this year hit a 22-year low.

- Bed Bath & Beyond posted a larger-than-expected quarterly loss but said its plans to clear excess inventory are working, with cash flow on track to break even in the fourth quarter.

- Amazon will close all but one of its U.S. call centers and shift hundreds of office employees to remote work to save on real estate.

- Peloton will start selling its exercise machinery at Dick’s Sporting Goods, the firm’s first brick-and-mortar partnership.

- U.S. regulators fined the Chinese affiliate of Deloitte $20 million for letting some clients, including foreign companies listed on U.S. exchanges, conduct their own audit work.

- The Federal Reserve will put six of the nation’s largest banks through a climate test next year, a first-ever bid to measure the impacts of climate change on U.S.-owned financial assets.

International Markets

- Taiwan will end mandatory quarantine for arrivals Oct. 13, a major step in its plan to re-open to the outside world.

- Australia is scrapping its mandatory five-day home quarantine for COVID-19-infected people.

- The U.K. lost over 150,000 working days to labor action in June and July, 7.5 times more than the monthly average.

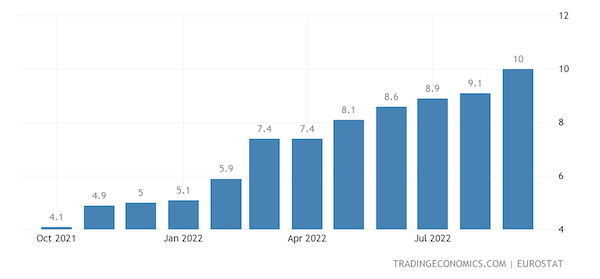

- Euro zone inflation hit 10% in September, the highest since records began in 1997. Central bank policymakers are voicing more support for another big interest-rate hike.

- German consumer prices rose a higher-than-expected 10.9% in September from a year ago, the highest rate of inflation in over 25 years.

- Spanish consumer prices rose 9.3% in the 12 months to September, the lowest inflation reading in four months.

- China’s state-owned banks are being asked to buy up the yuan in offshore markets to stem the currency’s steep decline.

- Manufacturing activity in Asia was mixed in September, showing gains for Japan and contraction in South Korea.

- China’s services activity slipped into contraction in September, according to the latest purchasing managers indexes.

- Canada’s economic activity unexpectedly rose in July while GDP in August was mostly flat, new data shows.

- Singapore’s factory output rose in August at the weakest pace in 11 months.

- The Bank of Mexico raised the country’s benchmark interest rate by 75 basis points to a record 9.25% on Thursday.

- Roughly 6% of British home sellers have reduced prices by at least 5%, a potential signal of a returning buyers’ market.

- Canadian home prices are up 44% the past three years, with the cost of housing now consuming 60% of typical household income.

- Finland closed its borders to Russian travelers, shutting off Russia’s last direct land route to the EU.

- Nike’s quarterly profit fell 20% to $1.47 billion as the apparel maker struggled with larger discounts and a rapidly strengthening dollar.

- H&M, the world’s No. 2 fashion retailer, launched a $177 million cost savings drive Thursday after posting weaker-than-expected quarterly profits.

- Wind turbine maker Siemens Gamesa plans to cut almost 3,000 jobs, mostly in Europe, as part of a plan to return to profitability. The number represents about 9% of the firm’s payroll.

- Amsterdam’s Schiphol airport will restrict daily passenger volumes by 20% until at least March due to persistent staffing shortages.

- Over 300 pilots marched on Swiss International Air Lines headquarters near Zurich airport on Thursday to press contract demands ahead of a possible walkout next month.

- Finnair will cut about 200 jobs globally in a move to restore profitability after the closure of Russian airspace.

- Canada’s WestJet Group placed a $5.67 billion order with Boeing for 42 MAX 10 jets.

- China certified its C919 narrowbody passenger jet, a milestone in the country’s ambitions to challenge Airbus and Boeing in commercial aerospace.

- EU regulators are considering whether to make potential losses from climate change a regular part of bank stress tests, an approach that could weigh on dividend distributions.

Some sources linked are subscription services.