MH Daily Bulletin: September 28

News relevant to the plastics industry:

At M. Holland

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference on Oct. 2-5 in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

Supply

- Oil rebounded over 2% Tuesday after U.S. Gulf Coast producers shut down some output ahead of Hurricane Ian.

- Hurricane Ian has shut in about 11% of oil production in the U.S. Gulf of Mexico and could potentially take out more as it makes landfall in Florida today.

- In mid-morning trading today, WTI futures were up 2.1% at $80.12/bbl, Brent was up 1.4% at $87.45/bbl, and U.S. natural gas was down 1.4% at $6.56/MMBtu.

- U.S. crude inventories rose by a surprise 4.15 million barrels this week, according to the American Petroleum Institute. Government data is due today.

- Refinery workers that handle over half of France’s fuel-making capacity are striking over a pay dispute, disrupting fuel supplies in Europe’s third-largest economy.

- Mexico announced plans to build an LNG export hub worth up to $5 billion in the Gulf of Mexico to help serve European demand.

- South Africa will overhaul leadership of its national power utility after the country’s worst-ever power cuts dented confidence in the government’s ability to resolve a decades-old energy crisis.

- Shell says global aviation fuel demand will recover to pre-pandemic levels of around 300 million tonnes a year within one to two years.

- Shell and Exxon Mobil are launching a reported $2 billion sale of offshore natural gas assets in southern Britain and the Dutch North Sea, part of the two companies’ drive to dispose of aging assets.

- With 40% of Portugal suffering extreme drought and the rest in a state of severe drought, the nation expanded an order to restrict some hydropower dams from using shrunken water supplies for electricity production and irrigation, preserving it for human consumption instead.

- Guyana’s economic growth could reach close to 60% this year as the tiny South American nation benefits from surging oil production.

- More oil news related to the war in Europe:

- EU and U.S. authorities are investigating newly discovered leaks on the Nord Stream and Nord Stream 2 pipelines to Germany, sending European natural gas futures up 20% Tuesday over fears of new supply shortages. EU officials blamed Russia for deliberate sabotage to destabilize Europe’s economy.

- One in 10 German mid-size companies have cut or halted production because of high gas prices, according to a September survey.

- Some EU nations, including France, Italy and Spain, are stepping up pressure on the EU executive for a new plan to cap the price of gas, a proposal that has split the bloc’s 27 member states.

- Greece is pushing for a multibillion-euro fund partly financed by a gas levy on power producers to support households and businesses struggling with soaring energy costs.

- Leaders at the International Energy Agency are pressuring Japan to restart more nuclear power plants to help ease global LNG shortages.

- Italy says it has secured enough gas from Algeria and Egypt to make up for any shortfalls this winter if Russia were to immediately cut off all exports to the country.

- Eight countries around the Baltic Sea, including Germany, signed a new declaration pledging to phase out Russian energy imports and to decarbonize their energy sectors.

- Tens of thousands of solar panels are sitting unused in European warehouses due to a shortage of engineers needed to install them.

- Germany is poised to scrap a consumer gas levy planned to start Oct. 1 as the government seeks alternative funding to help importers replace Russian gas.

- European drugmakers suggested they may halt production of some generic drugs due to soaring electricity prices.

Supply Chain

- In extreme weather news:

- Hurricane Ian slammed into Cuba Tuesday, forcing evacuations, tearing roofs off homes and causing a nationwide blackout. More than 2.5 million Floridians have now been urged to evacuate ahead of the storm’s landfall this evening. The storm could cause tens of billions of dollars in damage.

- U.S. airlines canceled over 2,000 flights for Tuesday and Wednesday, and some Florida airports halted operations as they braced for the impact of Hurricane Ian.

- Vietnam closed airports, announced curfews and urged thousands of people to evacuate Tuesday as Typhoon Noru made landfall as a strong tropical depression.

- Over 500,000 homes and businesses in Puerto Rico remain without power after Hurricane Fiona made landfall last week. Thousands are still without power in eastern Canada as well.

- A large maintenance worker union says it reached a tentative contract with U.S. freight railroads after rejecting an offer and threatening to strike earlier this month.

- The average U.S. diesel price fell 7.5 cents last week to $4.90 a gallon, the lowest level since March.

- MSC, the world’s largest container line, will launch a cargo airline next year in partnership with Atlas Air. In related moves, Maersk and CMA CGM have announced plans to buy private airlines in recent months.

- Efforts by China’s Cosco Shipping to buy a stake in a Port of Hamburg container terminal are being delayed by rising geopolitical tensions.

- Ten more international shippers pledged to switch their ocean business to vessels powered by zero-carbon fuels by 2040.

- APM Terminals scrapped plans to expand a container terminal at the Port of Rotterdam, citing rising costs for materials and labor.

- Shanghai International Port Group will spend $7.2 billion to build a new port and container terminal at the Yangshan Deep Water Port in Zhejiang province.

- Adani Ports plans to build a $3.1 billion port in western India.

- U.S. aerospace employment is 8.4% below its pre-pandemic level as parts-makers are still recovering from deep cuts made when the pandemic grounded most of the world’s airplanes.

- The U.S. administration will hold high-level talks with Japanese executives this week to boost cooperation in semiconductor manufacturing.

- In the latest news from the auto industry:

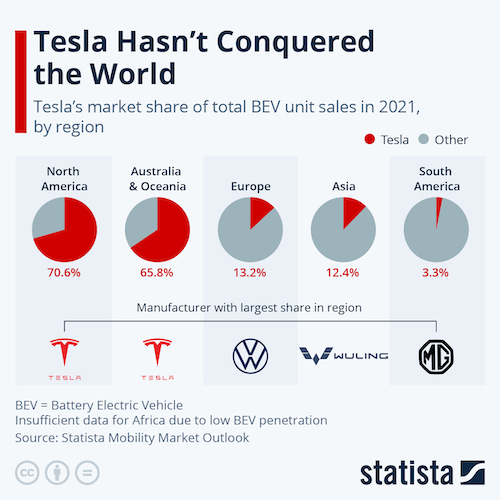

- U.S. regulators have approved electric-vehicle charging station plans for all 50 states, which will eventually cover about 75,000 miles of U.S. highways with charging stations every 50 miles.

- Hertz is working with BP on a plan to build and operate over 100,000 U.S. electric-vehicle chargers by 2030.

- Ford will invest $700 million and add 500 jobs at its Kentucky plant to support production of new F-Series trucks.

- Stellantis is making a $1,350 payment to most of its workers in France to help with soaring household expenses.

- Stellantis and Uber are partnering to convert 50% of Uber’s French fleet to electric vehicles by 2030.

- Tesla plans to hold production at its Shanghai plant at about 93% of capacity through the rest of the year, a surprising restriction after the automaker spent months on upgrades.

- Surging lithium prices are intensifying a race between carmakers to lock up supplies and raising concerns about a potential shortage.

- New research suggests electric-car owners who charge vehicles at night could put strain on the U.S. power grid.

- Harley-Davidson on Tuesday spun off its electric motorcycle division, LiveWire, in a special purpose acquisition company (SPAC), creating the first publicly traded electric motorcycle company in the U.S.

- Jaguar Land Rover will retrain 29,000 employees and staff at global retailers over the next three years to design, build and service electric vehicles ahead of the automaker’s shift away from fossil-fuel cars.

Domestic Markets

- The U.S. reported 46,703 new COVID-19 infections and 458 virus fatalities Tuesday.

- The FDA is narrowing the number of emergency authorization requests it will review for COVID-19 testing technology, a response to waning pandemic statistics and abundant testing supplies.

- Half the U.S. workforce in a recent survey believe they may leave their job in the next year to look for better remote-work flexibility, with only 10% of respondents preferring to work full-time on location.

- GM pushed back its return-to-office date until at least January 2023 following pushback from employees.

- New orders for U.S.-manufactured capital goods rose a larger-than-expected 1.3% in August, a seven-month high. Durable goods orders declined 0.2%, versus expectations of a 0.4% drop.

- The Conference Board’s consumer confidence index rose to 108.0 this month from 103.6 in August, beating expectations as households spent less on gasoline.

- The S&P 500 fell to its lowest level in almost two years Tuesday on worries about aggressive Federal Reserve monetary tightening. The index is down 20% from an early January high.

- The yield for 10-year U.S. Treasuries hit 4% this morning for the first time in a decade.

- The U.S. Senate voted Tuesday to move forward with a stopgap funding bill that would avoid a government shutdown on Saturday. Billions in COVID-19 funding was stripped from the bill.

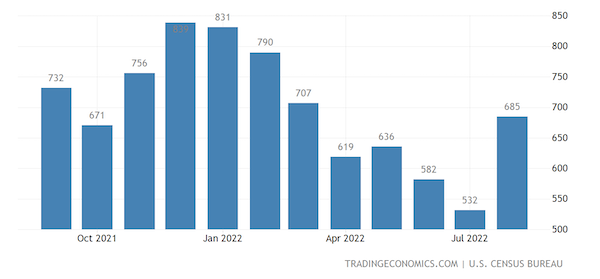

- U.S. new home sales unexpectedly rose by nearly 29% in August, a break in an otherwise steady downtrend this year, as buyers took advantage of price discounting by builders and fears of higher mortgage rates.

- The widely followed Case-Shiller index of U.S. home prices were up 15.8% in July, the smallest year-over-year gain since April 2021. Meanwhile, July metropolitan home prices fell 0.44% from the prior month, the first drop since March 2012.

- Wells Fargo rose its forecast for further rate hikes by the U.S. Federal Reserve, now expecting another 175 basis points of increases by early next year versus a prior forecast of 100 basis points. Reuters economists also predict higher rates than previously expected.

- Apple is backing off plans to boost production of its new iPhones this year after an expected surge in demand failed to materialize.

- A looming shortage of carbon dioxide threatens to raise costs for U.S. food and beverage suppliers.

- Chipotle Mexican Grill is testing autonomous kitchen assistants to make its tortilla chips, an effort to speed operations and reduce menial tasks for workers.

- Large U.S. retailers including Best Buy and Home Depot are locking up more inventory amid rising instances of theft.

- A federal antitrust trial over a partnership between American Airlines and JetBlue Airways began this week, roughly a year after U.S. officials filed suit.

- Over a thousand fast-food workers at San Francisco International Airport are striking in a dispute over pay.

- Surveys suggest more than half of U.S. shoppers are willing to pay extra for fresh food despite the worst food inflation in decades.

- The U.S. is in talks to form a coalition of countries to negotiate a global plastic pollution treaty in a model similar to the 2015 Paris climate accord.

International Markets

- New data shows COVID-19 cases rose 30% in Britain last week following several weeks of declines.

- Japan’s struggle against the Omicron variant of COVID-19 has led to up to 90% herd immunity in major cities.

- Morgan Stanley joined other major investment banks in predicting China will likely ease COVID-19 restrictions and reopen the country by spring next year.

- The Bank of England intervened to support sterling after the U.K.’s new government announced new spending plans and tax cuts, which plunged the nation’s currency to a record low against the dollar.

- JPMorgan analysts raised Mexico’s GDP growth forecast this quarter after August trade data signaled stronger-than-expected output from the country’s manufacturing sector.

- Economists surveyed by Bloomberg expect China’s GDP expansion to slow to just 3.4% this year, the slowest pace in more than four decades, excluding 2020.

- British supermarket prices rose 5.7% in September from a year ago, hitting the highest level since records began in 2005.

- Brazil’s consumer prices fell 0.37% the past month, extending their downward trend on sharply lower fuel costs.

- Morocco raised its key interest rate for the first time since 2008 this week in a bid to tackle decades-high inflation, becoming the latest African nation to reverse years of gradual monetary easing.

- The number of Russians entering the EU jumped 30% in a week following new enlistment orders by Moscow.

- Canada’s BlackBerry reported a 7.5% fall in annual cybersecurity revenue as customers reined in spending due to economic uncertainty.

Some sources linked are subscription services.