MH Daily Bulletin: September 27

News relevant to the plastics industry:

At M. Holland

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference on Oct. 2-5 in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

Supply

- Oil fell 2.5% Monday, settling at the lowest level in nine months after central banks around the world hiked interest rates, threatening demand.

- In mid-morning trading today, WTI futures were up 2.7% at $78.78/bbl, Brent was up 2.8% at $86.42/bbl, and U.S. natural gas was down 0.6% at $6.87/MMBtu.

- The average U.S. gasoline price rose 3.2 cents to $3.67 a gallon Monday, the first increase in 14 weeks.

- At 12.1 million bpd, U.S. oil production remains nearly 1 million bpd below the monthly record set in November 2019.

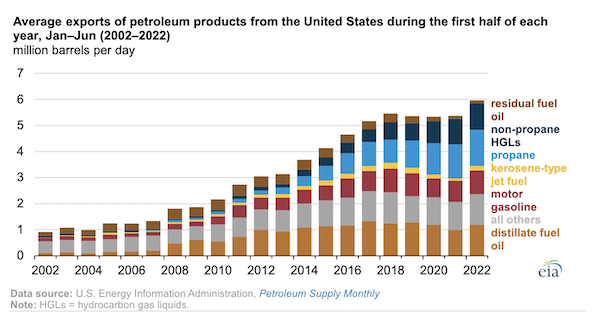

- U.S. exports of petroleum products jumped 11% to a record 6 million bpd in the first half of 2022, the fastest growth in five years.

- China’s solar capacity rose 1.9% in August, putting it on track to overtake the nation’s wind power generation by the end of this year.

- Britain’s new government says it will review the country’s 2050 net-zero plan amid recent challenges to energy security.

- Australia’s new government is setting the nation up to be the next big market for offshore wind developers, with recent investment interest coming from Shell, Orsted and Equinor.

- Skyrocketing LNG cargo prices have squeezed out smaller traders, concentrating business in a handful of energy majors and top global trading houses in a trend that could last until 2026.

- More oil news related to the war in Europe:

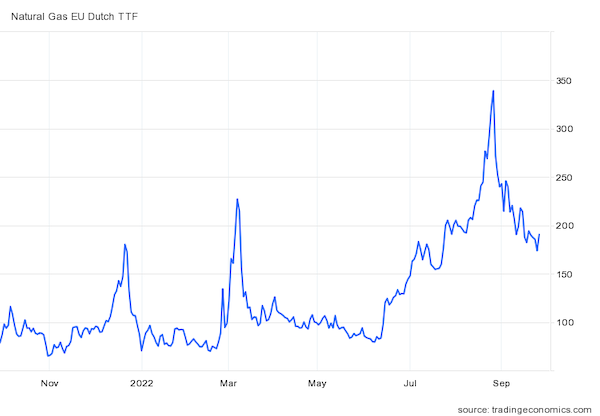

- European gas prices have fallen 50% from record highs last month as the continent builds gas inventories ahead of schedule.

- The EU’s executive arm tomorrow will put forward a plan to cap natural gas prices in the bloc. A separate proposal to cap Russian oil prices has been delayed.

- The U.S. administration is reportedly working to tighten a price-cap plan for Russian oil as diplomatic tensions with the country rise.

- Oil markets are bracing for massive shifts in global trade flows when nearly 3 million bpd of Russian oil will need to be diverted after the EU’s embargo takes effect in December. Russia’s seaborne crude exports to Europe have already declined sharply to about half of pre-invasion levels.

- Germany is signing more agreements with the UAE to supply LNG to the country’s new floating import terminals.

- TotalEnergies could announce an exit strategy from Russia as soon as this week, becoming one of the last Western oil majors to do so.

Supply Chain

- In the latest extreme weather news:

- Forecasters say Hurricane Ian could hit Tampa, Florida, which would be the first direct strike on the city in a century. The Category 3 storm is currently lashing western Cuba with heavy winds and rain and remains set for a midweek landing in Florida.

- Ports and freight railroads in the southeastern U.S. are ramping up efforts to safeguard operations ahead of Hurricane Ian. Florida has temporarily waived hours, size and weight restrictions for trucks carrying emergency supplies.

- NASA will roll its giant moon rocket off a Florida launchpad due to risks posed by Hurricane Ian.

- About 40% of Puerto Rico is still without power after Hurricane Fiona caused an island-wide outage a week ago.

- Canada will scrap its remaining COVID-19 border restrictions Oct. 1, ending policies that have slowed cross-border traffic with the U.S. for much of the pandemic.

- Strikes at British ports are likely to trigger congestion at European gateways as shipments are diverted.

- Ships are being asked to steer clear of Danish waters following an overnight gas leak from the now defunct Nord Stream 2 pipeline.

- Containers at the ports of Los Angeles and Long Beach waited an average of 5.1 days in August, down from 5.6 days in July for the lowest average dwell time since May 2021.

- Container dwell times at the Port of Houston have doubled as imports surged to a new record of 382,842 TEUs in August.

- Charter rates for cargo ships are falling sharply as congestion eases and volumes decline across the board.

- Maersk says it will not renegotiate freight contracts despite sharp declines seen in the spot market in recent weeks.

- The U.S. Federal Maritime Commission is proposing new standards for determining whether ocean carriers can reasonably turn away shipments, a response to months of carriers sending shiploads of empty containers back to Asia to fulfill strong U.S. import demand.

- Protests over water shortages shut down parts of South Africa’s longest highway Monday.

- A federal judge in Rhode Island sided with the long-haul trucking industry by striking down the state’s truck tolling system last week.

- U.S. lumber prices ended Monday at $410.80 per thousand board feet, near pre-pandemic levels and down more than 70% from their March peak. The decline points to a sharp slowdown in construction activity.

- Roughly 75% of manufacturing executives believe supply-chain disruptions will continue through the end of this year, according to surveys.

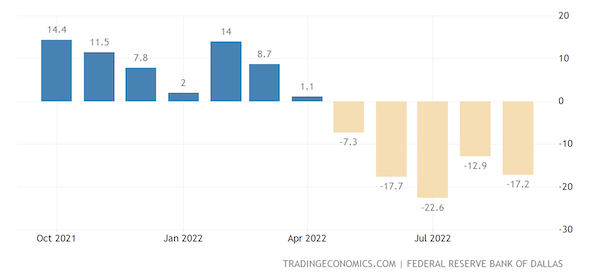

- The Dallas Fed’s survey of Texas manufacturing activity fell almost five points to -17.2 in September, the fifth consecutive month in negative territory:

- In the latest news from the auto industry:

- BMW expects global deliveries of its fully-electric vehicles to jump more than 70% next year as it reaches the top end of its margin targets.

- Electric car owners have seen a 42% hike in the cost of using public rapid charging stations in the last four months.

- Almost three-quarters of electric vehicle shoppers would prefer to buy their vehicle at a dealership, according to surveys.

- Luxury automakers including Rolls-Royce, Bentley, Lamborghini, Maserati, Aston Martin and McLaren each rolled out plans to start offering electric vehicles or phase out combustion engines.

- Luxury electric-vehicle startup Rivian is working on smaller versions of its pickup and SUV to attract mainstream buyers.

- U.S. startup Fisker could start producing electric vehicles in India within the next few years.

- Volkswagen plans to build a $2.9 billion battery parts joint venture with Belgian materials firm Umicore, the latest automaker to bring battery supplies closer to home.

- Supply chain issues are frustrating attempts by automaker Stellantis to create new retail schemes.

- Competition is heating up to secure market share in the fast-growing auto market of southeast Asia.

- Investment firm A.P. Moller Capital is setting up a $1 billion fund to invest in logistics.

- Apple has started making its new iPhone 14 in India as the tech giant looks to diversify its supply chain away from China.

- China’s rapid build-up of clean energy is claiming more copper, supporting the market at a time when traditional sources of demand such as housing are faltering.

Domestic Markets

- The U.S. reported 45,224 new COVID-19 infections and 373 virus fatalities Monday.

- The CDC eased its universal masking recommendation for nursing homes and hospitals unless there are high rates of COVID-19 transmission in the area.

- A New York City judge overturned the city’s COVID-19 vaccine mandate for its police force, a deviation from prior court rulings supporting mandates.

- Pfizer and Moderna are seeking regulatory approval for their Omicron-tailored COVID-19 vaccines in the youngest eligible age groups.

- More than half of U.S. schools are struggling with teacher and staffing shortages, new research shows.

- More than one-third of small businesses said hiring challenges worsened in the three months ended Sept. 1, according to Goldman Sachs.

- The Dow Jones Industrial Average slid into bear territory yesterday, marked by a 20% dip from its most recent high.

- Durable goods orders fell 0.2% in August from the prior month, the second consecutive monthly decline. Excluding defense, durable goods orders were down 0.9%.

- The shift to working from home drove more than half of the increase in U.S. housing prices during the pandemic, according to the San Francisco Fed.

- U.S. consumer debt soared $300 billion to an all-time high over the last year among the bottom 90% of earners, primarily driven by inflation.

- Nearly 70% of workers responding in a recent survey say they are looking for extra work to combat inflation.

- Analysts expect S&P 500 Q3 earnings to be up just 4.6% from a year ago, less than half the forecast of just two months ago.

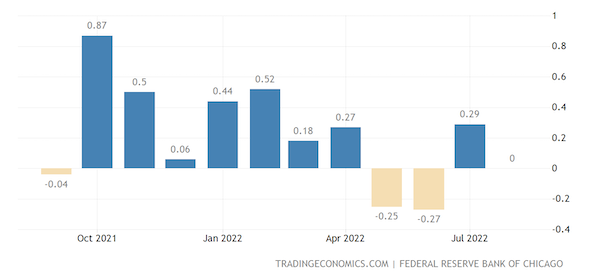

- The Chicago Fed’s index of U.S. economic activity fell to zero in August from a five-month high of 0.29 in July, pointing to moderating growth overall:

- The U.S. administration wants to force airlines to disclose upfront all cancellation, baggage and seating fees in a bid to spur competition.

- Macy’s plans to hire 41,000 seasonal employees this year, roughly in line with 2021.

- Software provider Salesforce is launching a marketplace for carbon credits in October, a bid to compete with various trading platforms it says are not transparent.

- Industrial parts supplier W.W. Grainger expects to grow from about $15 billion in sales this year to up to $20 billion by 2025.

- The U.S. government is appealing a court ruling allowing U.S. Sugar to buy rival Imperial Sugar despite antitrust concerns.

International Markets

- China reported 999 new COVID-19 infections Sunday, an increase from a day before.

- Airline bookings out of Hong Kong are surging after the island eased pandemic travel restrictions, including highly disruptive hotel quarantines. Beleaguered carrier Cathay Pacific has also resumed passenger flights.

- A stop-gap spending bill to keep the U.S. government running beyond this fiscal year could include billions more dollars for aid to Ukraine.

- The World Bank expects developing economies in East Asia to grow faster than China this year for the first time since 1990, as the country continues to struggle with a real-estate crunch and its key Belt and Road foreign investment program stumbles.

- Profits at China’s industrial firms shrank 2.1% in the first eight months of the year, with declines in 25 of 41 major sectors.

- The Bank of Mexico is expected to raise its key interest rate by 75 basis points to a record 9.25% this week.

- British home sellers boosted asking prices by 0.7% this month, the strongest pace in four months as buyer demand remains well above pre-pandemic levels.

- EasyJet is dropping its carbon-offset program in favor of reaching emissions targets through sustainable fuels and more efficient planes.

- Japanese McDonald’s stores are raising prices by 60% to cope with the nation’s depreciating currency.

Some sources linked are subscription services.