MH Daily Bulletin: September 26

News relevant to the plastics industry:

At M. Holland

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference on Oct. 2-5 in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and capabilities for the wire and cable market.

Supply

- The WTI crude price plunged 5% Friday to below $80/bbl, an eight-month low, on fears that rising interest rates will tip major economies into recession, cutting demand. Futures were down for a fourth straight week.

- In mid-day trading today, WTI futures were down 2.7% at $76.62/bbl, Brent was down 2.6% at $83.92/bbl, and U.S. natural gas was down 0.1% at $6.82/MMBtu.

- U.S. efforts to revive a deal allowing Iran to sell more oil in the global market have stalled, officials say.

- The U.S. is not considering bans or restrictions on oil product exports even as inventories continue to fall sharply below five-year averages, officials said Friday.

- California utilities are offering incentives for electric vehicle (EV) owners to charge up at certain times as rising EV adoption puts more strain on the state’s power grid.

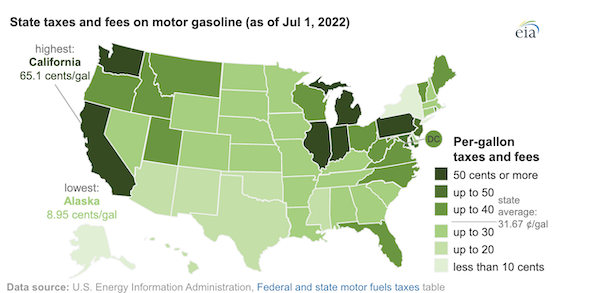

- Over a dozen U.S. states have changed their gasoline taxes year-to-date:

- India, the world’s biggest polluter, is expanding its coal power fleet by 25% through 2030 to meet rising energy demand. The move comes as coal buyers vie to pay top dollar from often remote mines in places such as Tanzania and Botswana.

- Inclement weather has driven electricity demand up while reducing Australia’s coal shipments down 7% year over year, driving coal prices up nearly three-fold and incentivizing investment in alternative energy.

- Puerto Rico is shipping coal ash through Florida to Georgia after banning storage of the toxic residue in 2019.

- More oil news related to the war in Europe:

- A modified EU energy plan set to be unveiled Wednesday will give leeway to member states to cut electricity use less than originally proposed in the coming months.

- In mid-October, Britain will open a $44 billion financial instrument to help protect energy firms from volatile prices and liquidity squeezes. Officials say U.K. gas and power prices will be “exceptionally high” this winter.

- Germany is requiring its 2,500 biggest gas users to register with the government ahead of a potential energy rationing scheme this winter.

- German crude oil imports rose 13.5% by volume but more than doubled in value the first seven months of 2022.

- Equinor inked a new deal to supply 15% of Poland’s yearly natural gas consumption as Russia’s war further upends normal trading patterns.

- Belgium is forging ahead with plans to close its remaining nuclear reactors despite Europe’s growing energy crunch.

- Russian natural gas exports to Europe have dropped more than 82% in a year.

Supply Chain

- In the latest extreme weather news:

- Much of eastern Canada was under emergency declaration over the weekend as Tropical Cyclone Fiona’s hurricane-force winds devastated parts of Newfoundland and Nova Scotia. Officials say it will take months for critical infrastructure to be restored in affected areas. Meanwhile, over half of Puerto Rico is still without power after Fiona touched down there a week ago.

- A state of emergency was declared for all of Florida over the weekend, as Tropical Storm Ian strengthened into a hurricane Monday, prompting many to flock to grocery stores to stock up on emergency supplies.

- Hundreds of thousands of people in central Japan lost power over the weekend after Typhoon Talas struck near Tokyo.

- More British rail unions are joining in strikes planned for October.

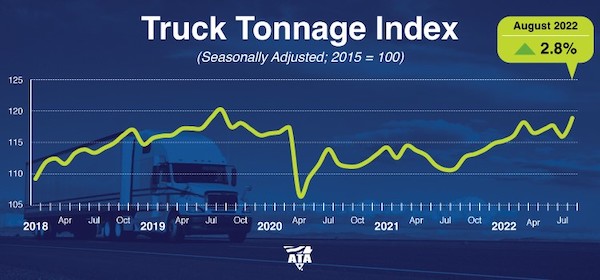

- The American Trucking Associations’ for-hire truck tonnage index hit 119 in August, up 2.8% from July and 7.4% year over year.

- Charter rates for bulk shipping’s largest vessels hit a seven-week high last week on rising export demand for iron ore.

- Values of secondhand tankers have gained around 30% year-to-date and are approaching their highest level in a decade.

- Shippers’ satisfaction with third-party logistics providers dropped by 7% the past year, according to a recent survey.

- Ikea sold the containers it bought last year and is resetting supply chain strategies that included chartering ships.

- Pfizer executives say supply chains were just as important as the company’s vaccine technology in successfully rolling out COVID-19 shots during the pandemic.

- In the latest news from the auto industry:

- Toyota will end all vehicle production in Russia due to the war-induced interruption of key material and parts supplies. Mazda is also in talks to end production at its Russian joint venture.

- India’s Mahindra & Mahindra is in talks with global investors to raise $500 million to start building electric vehicles.

- Volkswagen’s charging unit Ella hopes to integrate electric vehicles into Belgium’s power grid to boost grid reliability in times of strain.

- Volkswagen executives signaled Europe’s biggest automaker may move manufacturing outside the continent due to energy instability.

- Daimler Truck started making Mercedes-Benz branded trucks in China, adding competition to a market dominated by Chinese firms FAW Jiefang, Dongfeng Motor and Sinotruk.

- U.S.-based Qualcomm’s automotive unit has expanded to $30 billion as electric and autonomous vehicles gain more market share.

- Mercedes-Benz says it has cut gas use in production by 10% and could further reduce it by up to 50% if needed.

- European truck makers are stockpiling natural gas and preparing to shift to alternative fuels amid the threat of a winter shortage.

- Electric vehicles made up less than 1% of Toyota’s sales in the April-to-June quarter compared to nearly 6% for Volkswagen, the automaker closest to Toyota in scale.

- Ford broke ground on a new $5.6 billion electric vehicle manufacturing plant in eastern Tennessee that will be the automaker’s largest factory project in its history.

- Intel picked the northeast Italian city of Vigasio as the site for a new chip factory to be operational by 2027, part of a $77.5 billion plan to boost capacity in Europe over the next decade.

- China’s president issued a rare announcement pledging to protect supply chains from decoupling amid growing geopolitical tensions with the U.S.

- Japan’s Daikin Industries plans to establish a supply chain to make air conditioners without Chinese-made parts.

- Walmart is building its first fulfillment center in Quebec, Canada, at a cost of around $100 million.

- Renewable-powered microgrids are gaining popularity in California as firms look to bypass the state’s strained power grid.

- Many large U.S. agricultural firms say worldwide crop supplies remain tight with more than two years of good harvests needed in the Americas to ease the pressure.

- About 4.7 million tonnes of agricultural products have left Ukraine since the United Nations brokered a deal in July to unblock Black Sea ports.

Domestic Markets

- The U.S. reported a seven-day average of 53,376 daily new COVID-19 infections and 356 virus fatalities on Friday.

- Over 4.4 million Americans have received Omicron-tailored booster shots since their rollout three weeks ago, the CDC said, accounting for just 1.5% of eligible U.S. residents.

- The U.S. is substantially cutting back the number of Pfizer COVID-19 vaccine doses it plans to donate to other nations this year, a response to declining demand.

- Children and teens with COVID-19 were 60% more likely to develop Type 1 diabetes than uninfected peers, new research shows.

- Researchers say remote work could cut 28%, or $456 billion, off the value of offices across the U.S., with about 10% of the reduction coming from New York City alone.

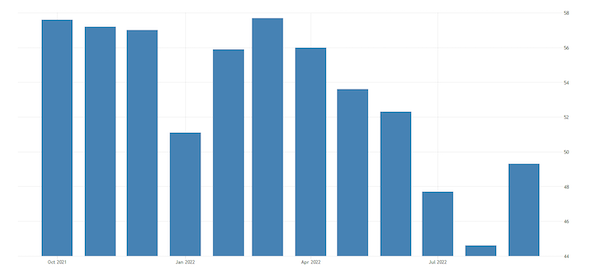

- S&P Global’s composite index of U.S. business activity rose to a three-month high of 49.3 in September, despite remaining in contraction territory.

- Manufacturing activity expanded slightly, and services activity rose but remained in contraction territory.

- The Federal Reserve chairman said the U.S. housing market needs a “difficult correction” to restore a supply/demand balance.

- The asking price for apartment rentals across the U.S. fell slightly in August from the month prior, marking the first monthly decline since December 2020.

- Costco beat expectations with a 15% gain in quarterly revenue, helped by stronger demand for food and fuel despite rising inflation.

- Trader Joe’s employees petitioned to unionize a New York City supermarket, extending a recent wave of organizing in the broader U.S. retail industry.

International Markets

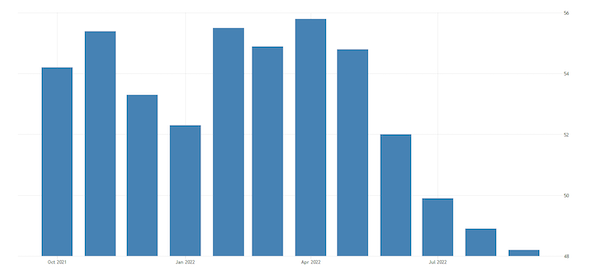

- A downturn in business activity across the euro zone deepened in September amid an intensifying cost-of-living crisis, according to S&P Global’s composite index.

- The war in Ukraine is set to cost the global economy $2.8 trillion in lost output by the end of 2023, according to a new report, with researchers warning that an energy crisis across Europe this winter could cause costs to rise even more.

- In global currency moves:

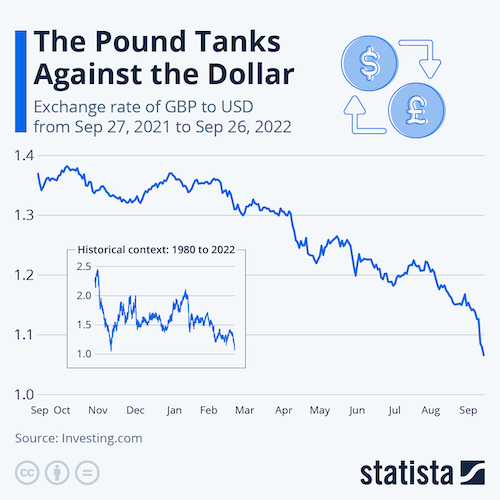

- Britain’s new government unleashed historic tax cuts and massive borrowing increases Friday in an economic agenda that surprised financial markets and sent the British pound to an all-time low today, near parity with the U.S dollar.

- With meager foreign reserves compared with its developed nation peers, the Bank of England has limited power to intervene to support its plunging currency.

- The euro plummeted to a 20-year low against the dollar to end the week.

- The yuan and the yen are tumbling due to the growing disparity between aggressive monetary tightening in the U.S. and comparatively weak intervention in China and Japan, threatening the region’s mantle as a destination for risk investors.

- The Bank of Japan intervened to support its plunging currency for the first time in over two decades on Thursday and warned of further intervention to quell speculative volatility.

- Ontario posted its first budget surplus in 14 years as resilient economic activity bolstered revenues this fiscal year, roughly six years ahead of schedule.

- Canadian retail sales fell a more-than-expected 2.5% in July, the first decline in seven months, suggesting that higher interest rates are impacting spending.

- Taiwan’s central bank raised its benchmark interest rate for the third time this year last week and cut its growth forecast due to rising economic uncertainty with China.

- Deutsche Bank lowered its 2023 growth projection for Europe to -2.2%, which would make it the third worst year since WWII.

- Russia’s banks have lost an estimated $25.5 billion as a result of fallout from Moscow’s invasion of Ukraine.

- Defying the economic turmoil in the U.K., asking prices for U.K. homes are rising at their quickest pace in four months, up 0.7% in September, amid a 20% increase in buyer demand from the pre-pandemic level.

- The U.S.-led Global Action Plan is working to build a clearinghouse for medical supplies with other nations to fight COVID-19.

Some sources linked are subscription services.