MH Daily Bulletin: September 23

News relevant to the plastics industry:

At M. Holland

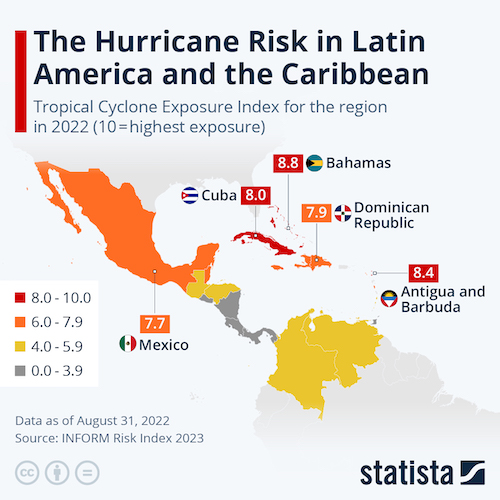

- M. Holland’s Puerto Rico office is closed this week due to the impact of Hurricane Fiona.

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference on Oct 2-5 in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

Supply

- Oil rose 1% Thursday as the market focused on short supplies in the face of rebounding Chinese demand.

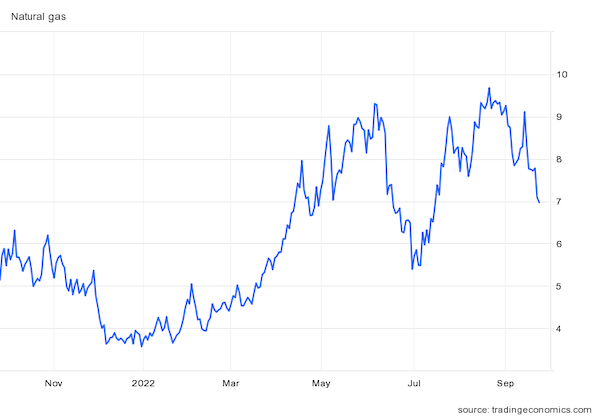

- U.S. natural gas prices hit a six-week low Thursday on news that U.S. production topped 100 billion cubic feet per day for the first time ever.

- In mid-morning trading today, WTI futures were down 5.8% at $78.65/bbl, Brent was down 5.1% at $85.89/bbl, and U.S. natural gas was down 1.4% at $6.99/MMBtu.

- Britain and Turkey are looking to secure more long-term LNG deals with U.S. suppliers amid an energy crunch that shows no sign of slowing.

- Exxon Mobil is gradually shutting down its 235,000-bpd refinery in France due to an ongoing worker strike.

- Argentina’s largest oil union began striking Thursday after an explosion at a refinery in the western province of Neuquen killed three.

- Crude oil demand in China, the world’s largest oil importer, is picking up quickly from lows seen during COVID-19 lockdowns.

- More oil news related to the war in Europe:

- The EU will likely join a G7 plan to cap the price of Russian oil in response to Russia’s recent escalation of the war in Ukraine, officials said.

- Britain lifted a three-year-old ban on shale fracking in a bid to increase domestic energy supply.

- The EU’s securities watchdog says a temporary brake on energy derivatives when prices spike could improve how markets operate.

- Poland is restricting oil supply to Germany’s PCK Schwedt refinery until Russia’s Rosneft is removed as a shareholder, raising pressure on Germany to completely nationalize the refiner.

- Spain bumped up the capacity of a natural gas facility near the French border by 18%, a boon for France.

- Poland is distributing iodine tablets to regional fire departments as it prepares to respond to a potential nuclear incident at the Russian-held Zaporizhzhia power plant in Ukraine.

- U.S.-based Sempra Infrastructure is considering exporting blue hydrogen to Japan. The emerging energy source is produced from LNG and conducive to carbon capture and storage.

- Sustainable fuel startup Air Company signed multi-year agreements to sell green sustainable aviation fuel (SAF) to JetBlue and Virgin Atlantic.

- A total of 14 coal-fired plants with Chinese backing have entered operation since the country vowed to end support for coal capacity construction overseas last year.

- In a pilot program, Japan started trading carbon credits on the Tokyo Stock Exchange this week.

- U.K.-based insurer Marsh will start accepting payments from U.S. clients in carbon offset credits or renewable energy certificates, part of a drive to meet its net-zero climate goals.

Supply Chain

- Nearly 1 million Puerto Ricans don’t have power and nearly half a million don’t have running water five days after Hurricane Fiona made landfall on the island. The White House declared a major disaster for the island, opening access to federal aid for temporary housing, repairs and debris removal.

- Workers at the U.K.’s Port of Liverpool started a two-week strike this week.

- Loaded container imports at the Port of Houston rose 13% year over year in August and 17% in the first eight months of the year.

- Global trucking executives are pointing to signs of market normalcy after three years of pandemic-induced chaos.

- Container ship utilization rates are declining sharply as spot prices fall on main trading routes.

- Increasingly advanced camouflage technology is helping “dark fleets” of oil-carrying vessels go undetected, industry experts say.

- Cathay Pacific’s cargo traffic fell 23.3% year over year in August after demand was flat for most of the summer, the Hong Kong carrier said.

- Coal stockpiles at major European ports are falling as traffic on the Rhine River rises alongside water levels.

- FedEx plans to raise shipping rates by an average of 6.9% across most of its services in January as the delivery giant copes with a global slowdown in business.

- U.S. companies are expanding production of offshore wind vessels after the federal government designated them “vessels of national interest” earlier this year, speeding up project reviews and approvals.

- Portugal continues to expand its offshore wind ambitions as it raises the gigawatt target for its first-ever project auction.

- In the latest news from the auto industry:

- Ford announced plans to shake up management and restructure its supply chain days after the automaker reported $1 billion in unexpected supplier costs this quarter.

- Toyota cut its global output target by 100,000 units in October and 50,000 in November due to computer chip shortages.

- Volkswagen says it may only have five to six more months of steady production in Germany if the country fails to fill its gas reserves.

- China’s CATL, the world’s biggest maker of electric-vehicle batteries, is considering a third factory in Europe, executives said.

- PetroChina, China’s top oil and gas producer, joined leading auto group SAIC Motor and battery firm CATL in a joint venture to produce swappable batteries for electric vehicles.

- Renault expects to control 80% of its electric vehicle value chain well ahead of a 2030 target as it expands partnerships in batteries, electric motors and power electronics.

- U.S. highway regulators are calling on 100 truck drivers to test distraction levels in simulated autonomous driving.

- AutoZone launched a new California-based direct import facility this month to distribute its foreign supplies more efficiently. The retailer’s quarterly sales jumped 6.2% on rising demand for car parts.

- The average age of a U.S. warehouse is 43 years, with 25% more than 50 years old.

- Walmart will roll out a new holiday service allowing some subscribers to get their returns picked up for free starting in October.

- The U.S. Postal Service plans to consolidate 21% of its delivery units into large-scale sorting and delivery centers across the country, as the agency continues its aggressive streamlining efforts.

- Walmart is expanding its use of computer vision artificial intelligence tools to manage inventory in its Canadian stores.

- Fashion brands are using specialized logistics services to make their shipping and packaging more sustainable.

- Kittyhawk, an air-taxi company backed by Google’s co-founder, will shut down as safety concerns rise following several machine crashes in recent months.

- China Southern Airlines ordered 40 A320neo-family aircraft from Airbus for roughly $5 billion.

- Mushrooms and seaweed are growing as bio-based alternatives to plastic packaging.

- Butter prices are soaring in U.S. supermarkets, surpassing increases from most other foods as labor shortages cripple processing plants.

- Vegetable producers across northern and western Europe are considering halting their operations due to the financial hit from Europe’s energy crisis.

- India is considering allowing the overseas shipment of some rice cargoes that were trapped at ports after the world’s biggest exporter imposed restrictions earlier this month to protect domestic supply.

Domestic Markets

- The U.S. averaged 54,186 daily new COVID-19 infections and 347 virus fatalities over the past seven days.

- Goldman Sachs will lift its COVID-19 vaccination requirement for its New York City employees starting Nov. 1.

- Fraudsters stole an estimated $45.6 billion in pandemic aid by making fake unemployment insurance claims, nearly triple the estimated level of fraud from last year, a government watchdog said.

- People who had COVID-19 are at higher risk for a host of brain disorders a year later, according to new research.

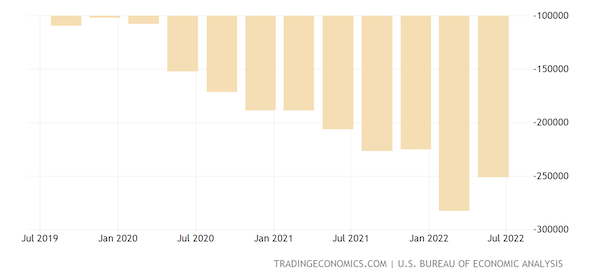

- The U.S. current account deficit contracted 11.1% to $251.1 billion last quarter, narrowing sharply amid a surge in goods exports.

- The Conference Board’s gauge of future U.S. economic activity declined for a sixth consecutive month in August, potentially signaling a recession.

- JPMorgan Chase, Citigroup and Wells Fargo are raising their prime lending rates to the highest levels since 2008 after the Federal Reserve’s hefty interest-rate hike on Wednesday.

- U.S. growth funds are seeing massive outflows this year as interest rates rise, while value funds attracted over $4.3 billion in August, the most in three months.

- The U.S. House of Representatives could consider a stop-gap government spending bill as soon as next week, an effort to keep the government operating beyond the current fiscal year that ends on Sept. 30.

- U.S. luxury home sales dropped 28.1% in the three months through August, the biggest decline since at least 2012, according to Redfin.

- The U.S. median asking rent rose 11% year over year to a record-high $2,039 in August, according to Redfin.

- Target plans to hire up to 100,000 seasonal workers in U.S. stores and warehouses this year, consistent with last year.

- U.S. flight cancellations fell to 1.8% of total flights in July, down from 3.1% in June, although service complaints rose by 16.5%.

International Markets

- Japan will allow visa-free, independent tourism and scrap its daily arrival cap on Oct. 11, a major policy shift after 2.5 years of strict travel restrictions.

- Hong Kong will scrap its controversial COVID-19 hotel quarantine policy starting early October.

- Pfizer began providing 132 low- and middle-income countries with 6 million courses of its Paxlovid antiviral treatment for COVID-19.

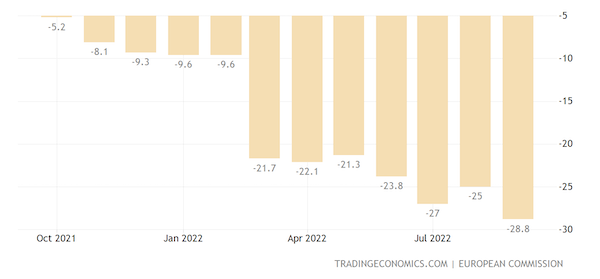

- Euro zone consumer confidence fell by a larger-than-expected 3.8 points from August to September.

- In a major policy shift, the U.K.’s new government announced sweeping tax cuts and energy subsidies intended to spur its beleaguered economy.

- British consumer confidence fell to a record-low in September as households continued to grapple with rising costs for food, fuel and homes.

- Canada is joining a group to boost economic ties with Pacific island nations that already includes the U.S., Australia, Japan, New Zealand and the U.K.

- The EU is looking to tighten curbs on high-tech exports to Russia in response to Moscow’s recent escalation of the war in Ukraine, officials said.

- Major central banks across the globe unleashed another 350 basis points of interest-rate hikes after the U.S. Federal Reserve raised its benchmark rate on Wednesday:

- Notably, Britain hiked rates by a lower-than-expected 50 basis points on forecasts of lower peak inflation.

- Japan remained an outlier, keeping its ultra-low rates unchanged.

- Turkey imposed a surprise 100-basis-point rate cut Thursday, sending the lira tumbling to an all-time low even as inflation rises above 80%.

- Switzerland instituted a 0.75% rate hike, emerging from negative rate territory.

- Norway raised rates by 0.5% and signaled future increases will be smaller.

- Indonesia increased rates by a higher-than-expected 0.5%.

- Vietnam raised rates by 100 basis points in an effort to keep inflation below 4%.

- South Africa raised rates by 75 basis points.

Some sources linked are subscription services.