MH Daily Bulletin: September 16

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil futures fell over 3% Thursday to a one-week low, led by expectations for weaker global demand. Futures are headed for their third weekly decline.

- U.S. natural gas fell as much as 9% Thursday after major railroads secured a tentative contract deal with unions, averting the chance that a walkout would boost demand for gas by threatening coal supplies to power plants.

- In mid-day trading today, WTI futures were up 0.3% at $85.37/bbl, Brent was up 0.7% at $91.44/bbl, and U.S. natural gas was down 5.2% at $7.89/MMBtu.

- The U.S. 3:2:1 crack spread, a measure of refining profit margins, is on track for its lowest price since early March.

- U.S. energy officials met with governors of six northeastern states Thursday to address the region’s soaring fuel costs heading into winter.

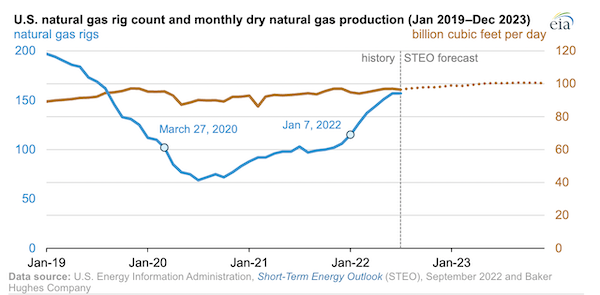

- U.S. utilities added a larger-than-expected 77 billion cubic feet of natural gas to storage last week as gas output is expected to hit a monthly record in September. More gas rigs are now operating than before the pandemic:

- Oil demand in China could climb if the nation approves broad requests from refiners to boost export quotas for fuels, which are currently 39% lower than last year.

- More oil news related to the war in Europe:

- European gas prices swung wildly Thursday, at one point surging 12% as traders weighed whether the bloc’s market intervention would be enough to stave off rationing this winter.

- Germany seized the local unit of Russian oil major Rosneft as Berlin moves to take sweeping control of its energy industry. The government is also in advanced talks to take over Uniper and two other major gas importers.

- Russian gas exports to Europe are expected to drop 33% this year.

- More European utilities have started cutting off electricity supply to big industrial users and sending out mass requests to households to curb usage.

- France and Spain are in talks to boost capacity on a cross-border gas pipeline that could help transport the equivalent of seven LNG tankers per month.

- Norway is now Europe’s biggest supplier of piped gas.

- The Netherlands received its first LNG shipments from the U.S. at a new import facility.

- Rates for LNG carriers on U.S.-Europe routes are up 50% over the past year.

- Energy companies in Australia are scrambling to build infrastructure for domestic LNG supply amid higher prices and rising demand.

- Russia’s largest oil producer Rosneft posted a 13% increase in first-half net income despite sanctions by Western governments.

- Shell’s chief executive stepped down Thursday, paving the way for the director of renewables to ramp up the firm’s strategy to achieve net-zero operations by 2050.

Supply Chain

- Major U.S. railroads and unions secured a tentative deal after 20 hours of intense talks brokered by the White House to avert a rail shutdown that could have hit food and fuel supplies across the nation. Leaders of 12 unions involved in the talks must now sell the agreements to members, who will vote to ratify or reject them over the next several weeks. U.S. passenger rail services are resuming operations preemptively shut down earlier this week.

- On Thursday, the Shanghai region’s ports began to reopen, airports resumed passenger flights and train services were restored as the city dropped its typhoon alert to the lowest level. Typhoon Muifa has weakened into a tropical storm as it heads north to Shandong province.

- Tropical Storm Fiona has formed in the Atlantic, becoming the sixth named storm of the 2022 Atlantic hurricane season and triggering storm watches in the U.S. Virgin Islands and Puerto Rico.

- Northern California’s Mosquito Fire has grown to 63,000 acres since sparking on Sept. 6, now the state’s largest wildfire of the year.

- Worse-than-expected quarterly revenue at FedEx will prompt the shipper to close offices and park aircraft amid declining package volumes worldwide. The firm’s shares fell almost 20% in late trading Thursday.

- Air cargo volumes fell 5% year over year in August, extending a months-long streak of reduced demand. Volumes were down a sharp 17% in Europe in July.

- A strike by tugboat operators is slowing vessel operations at Canada’s Port of Vancouver.

- The biggest names in U.S. heavy industry, including U.S. Steel, Alcoa and Nucor, have warned that demand for metals used in everything from automobiles to iPhones is slumping quicker than expected, while rising costs for energy and raw materials continue to weigh on margins.

- The chief executive of Corning, the world’s biggest fiber optic cable producer, says Europe needs a more robust supply chain for the telecommunications industry.

- U.S. plastics shipments are forecast to grow 1.8% this year, adding to last year’s gains after a 0.9% downturn in the first year of the pandemic.

- In the latest news from the auto industry:

- Magna, North America’s largest auto supplier, is testing a last-mile autonomous delivery robot for use on public roads in Michigan.

- Up to 95% of the lithium in lithium-ion electric vehicle batteries is not being recycled due to high costs, according to Germany’s Evonik Industries.

- MercadoLibre, a large Latin American e-commerce retailer, will double its electric-vehicle delivery fleet to over 1,000 by year’s end.

- Officials with the EU’s executive arm raised concerns with the U.S. that its tax incentives for domestically made electric cars could violate WTO rules.

- In consolidation news:

- Hapag-Lloyd announced plans to acquire a 49% stake in Italian logistics firm Spinelli Group for an undisclosed amount.

- Deutsche Bahn and the German government agreed to sell freight forwarding giant DB Schenker, with bids due in the next few months.

- Hong Kong-based EV Cargo acquired Spanish operator Air Express Cargo.

- Russia destroyed or commandeered 14% of Ukraine’s crop storage capacity since February, jeopardizing global food supply.

Domestic Markets

- The U.S. reported 59,855 new COVID-19 infections and 357 virus fatalities Thursday. The nation is currently averaging just under 400 daily virus deaths.

- U.S. health officials say this year’s flu season will be particularly bad as people’s immune systems weakened amid COVID-19 precautions.

- At least 800 U.S. school districts are using four-day weeks this year in a bid to entice more people into the pandemic-hit teaching profession.

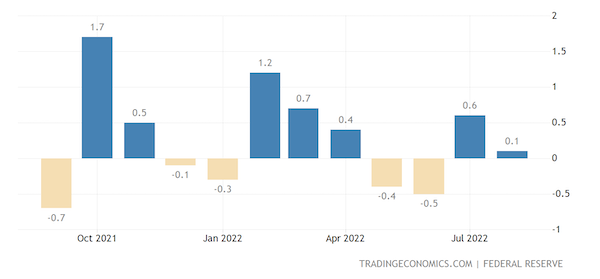

- U.S. factory production rose slightly by 0.1% in August as resilient business investment offset a pullback in the output of consumer goods.

- U.S. import prices fell for a second month in August, weighed down 1% by declining costs for petroleum products and a strong dollar.

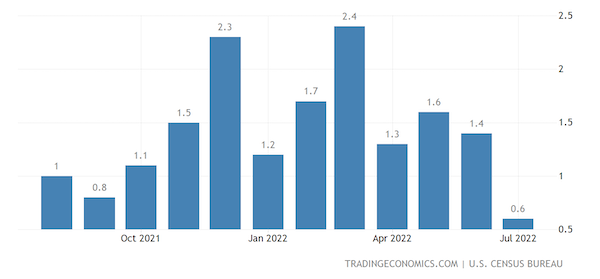

- U.S. business inventories rose 0.6% month over month and 18.4% year over year in July, a considerably slower pace from prior months as cooling demand forces companies to be cautious.

- Nearly 50% of Manhattan office workers are expected to return by the end of this year as efforts by large firms to reduce remote work gain traction.

- Bank of America is starting a paid sabbatical program to reward long-term employees, one of many large firms offering new ways to reduce burnout and retain talent amid labor shortages.

- New York City and Chicago are most vulnerable to home-price declines in a potential economic downturn, experts say.

- The median monthly mortgage payment in the U.S. was almost 1.5 times as much as the median asking rent in the second quarter, the largest differential in records going back to 2009.

- Boeing’s chief executive says there is still a chance that U.S. regulators could approve the long-stalled 737 MAX 10 before the end of the year when a new safety standard on cockpit alerts takes effect.

- Boeing says it will begin to remarket some 737 MAX jets earmarked for Chinese customers as political tensions snarl deliveries.

- Southwest Airlines’ revenue from leisure travels this quarter is exceeding expectations, underlining strong demand for travel despite high inflation.

- Cloud-computing firm Twilio is the latest tech company to announce a wave of layoffs and restructuring after expanding too rapidly during the pandemic.

- Adobe Inc. agreed to acquire cloud-based designer platform Figma for $20 billion, sparking investor concerns that led to a 17% drop in the Photoshop-maker’s stock price on Thursday. The move reflects an accelerated demand for remote tech tools.

- There were 180 labor strikes in the U.S. in the first six months of 2022, up from 102 a year ago as workers across a range of industries sought pay raises to catch up with inflation.

- U.S. recycling plants are amassing millions of tons of plastic bottles, the EPA said, raising the risk of toxic fires.

International Markets

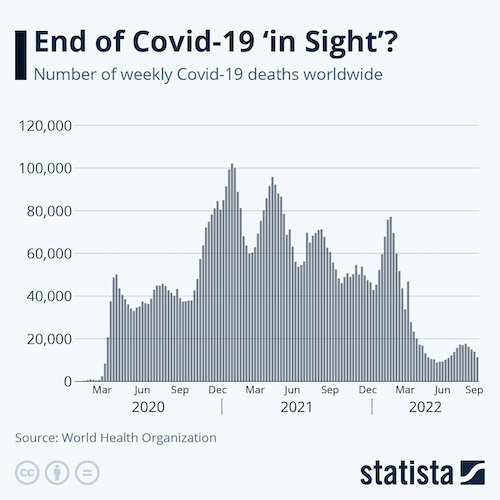

- Weekly COVID-19 fatalities across the globe are the lowest since the end of March 2020, new data shows.

- Moderna is in talks to begin supplying its COVID-19 vaccines to the Chinese government, what would be the nation’s first approved foreign vaccine.

- Downside risks continue to dominate the global economic outlook, but it is too early to say if there will be a widespread global recession, the IMF said.

- The World Bank pared forecasts for three-fourths of all countries amid the broadest interest-rate hikes in five decades.

- China’s economy showed modest signs of improvement in August as infrastructure investment picked up, but consumer spending and property prices remained weak.

- Growth in the French economy will slow sharply to just 0.5% next year due to Europe’s energy crisis, the Bank of France said.

- Brazilian officials updated their forecast for economic growth this year from 2% to 2.7%, after the latest data showed unexpectedly strong activity in July.

- Argentina’s central bank hiked the country’s benchmark interest rate by 5.5 percentage points to 75% on Thursday, a day after inflation overshot forecasts.

- Inflation dipped to 4.6% in Israel last month, easing from a 14-year high in July.

- Canada’s housing market is showing signs of stabilizing, with home resale prices falling 3.9% from a year ago in August.

- Ryanair is canceling hundreds of flights today due to an air traffic control strike in France that will limit overflights and more than halve Air France’s regional services.

- Scandinavian airline SAS was cleared for a $700 million financing package as part of a plan to emerge from Chapter 11 restructuring after pilots went on strike in August.

- Air Canada plans to buy electric planes for the first time with an order for 30 small aircraft from Sweden’s Heart Aerospace, which have capacity for 30 passengers and could be used as early as 2028. Scandinavian airline SAS also says it is considering buying electric planes.

- Hundreds of workers at an Amazon warehouse in England began a formal strike ballot this week, the latest in a string of labor actions in the nation.

Some sources linked are subscription services.