MH Daily Bulletin: September 1

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s recent summer internship program, 15 bright college students worked both in-person and remotely across many departments. Click here to read more about their experiences at M. Holland and their perspectives on the plastics industry.

- M. Holland’s latest logistics outlook examines current challenges and industry trends that are impacting shipping, trucking and rail. Although the plastics industry is faring a little better than earlier this year, M. Holland’s experts predict disruption to continue well into 2023. Click here to read the full outlook for the remainder of 2022.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- M. Holland will be closed Monday, Sept. 5, in observance of the Labor Day holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell over 2% Wednesday on worries that new COVID-19 restrictions in China will further weaken demand. Prices fell almost 10% in August, the third month of declines.

- In mid-morning trading today, WTI futures were down 2.7% at $87.16/bbl, Brent was down 2.6% at $93.14/bbl, and U.S. natural gas was up 2.0% at $9.31/MMBtu.

- U.S. crude stocks fell by 3.3 million barrels last week and are about 6% below the five-year average for this time of year, according to the government.

- U.S. crude output rose to 11.8 million bpd in June, the highest since April 2020. Natural gas production also rose to a record 109.3 billion cubic feet per day.

- BP’s refinery in Whiting, Indiana — the Midwest’s largest — has restarted production after being idled last week due to an electrical fire.

- OPEC+ says underproduction among its members will leave a smaller-than-expected surplus this year of just 0.4 million bpd.

- OPEC’s oil output hit 29.58 million bpd in August, the highest of the pandemic despite being about 1.4 million bpd below targets.

- OPEC sources indicate output cuts floated by Saudi Arabia last week are likely not imminent.

- The Port of Gibraltar closed for several hours Wednesday after a bulk carrier collided with an LNG tanker, causing a fuel-oil leak.

- Exxon Mobil joined Shell in seeking to divest their California oil and gas joint venture, Aera, one of the state’s largest oil producers.

- Alberta is readying to pay off nearly $10 billion in debt, its biggest repayment ever, after surging oil prices boosted revenue in the Canadian province.

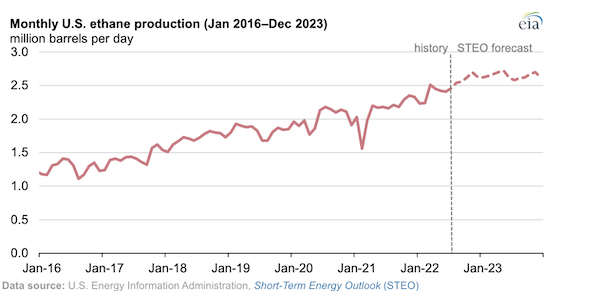

- U.S. production of ethane, a key feedstock for manufacturing plastics and resins, reached a monthly record of 2.5 million bpd in March and has remained at near-record levels since.

- More oil news related to the war in Europe:

- Top Western finance officials will meet virtually Friday to lay out a plan to cap the price of Russian oil.

- European natural gas prices continued their sharp descent Wednesday as traders reacted to well-stocked inventories ahead of winter.

- Russia shut down its key Nord Stream gas pipeline to Germany Wednesday for three days of scheduled maintenance. Questions loom over whether Russia will restart the pipeline as planned.

- Gazprom’s natural gas output rose by 7.1% in August to 829 million cubic meters per day, the first rise in seven months.

- Tanker rates could surge to over $250,000 per day when the EU’s embargo on Russian oil takes effect in February, according to Clarksons Securities.

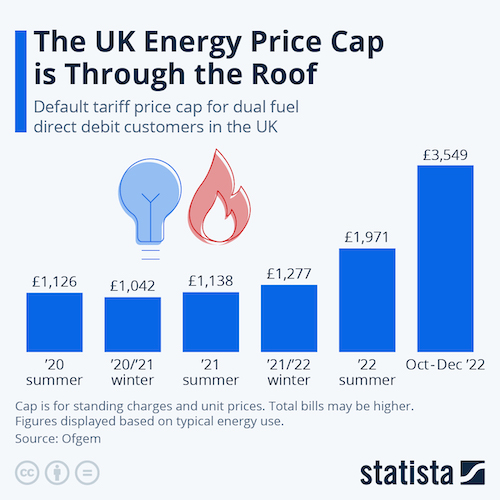

- Rising price caps on British energy are putting immense pressure on bill payers across the country:

Supply Chain

- Excessive heat warnings are in place for millions of people in California, Oregon, Washington, Nevada and Idaho, with high temperatures expected to last through Labor Day weekend. The heat is straining power supplies, with California’s grid operator warning Wednesday that the state could see organized blackouts.

- Severe drought conditions are focusing a spotlight on the high water consumption of data centers, among the top 10 industrial users of water, which can consume as much water as a thousand homes for cooling.

- Crop harvests across much of Europe are expected to drop by double-digit percentages this year due to widespread drought and excessive heat.

- UPS added peak-season surcharges extending through Jan. 14, aimed largely at high-volume customers.

- With U.S. freight demand easing, the pendulum is swinging to favor shippers in rate negotiations.

- Shell entered a 10-year agreement to supply Israeli shipping line ZIM’s new LNG-powered container ships operating between Asia and the U.S. East Coast starting next year.

- In the latest news from the auto industry:

- German engineering giant Bosch is spending over $200 million to boost electric vehicle fuel cell production in South Carolina.

- The U.S. Energy Department extended an $11 million grant to the University of Michigan as researchers work to develop ceramic components for electric vehicle batteries, a bid to boost range and lessen fire risk.

- BMW launched production of hydrogen fuel cells for its new iX5 SUV, making it one of the last automakers to continue pursuing the alternative fuel technology for passenger vehicles.

- GM announced plans to build a new “tiny” electric convertible in a joint venture with China’s SAIC-GM-Wuling Automobile starting in September.

- Subaru plans to release its next-generation autonomous driving technology in 2025.

- Tesla continues to slash waiting times for its Model Y in China as the automaker boosts production in Shanghai.

- Chinese electric-vehicle maker BYD more than tripled its first-half profit to $520 million as sales jumped 300%.

- A method under research to charge electric cars in 10 minutes could be available in five years, according to U.S. government researchers.

- GM and LG Energy, as well as Stellantis and Samsung SDI, are the latest tie-ups between automakers and battery suppliers seeking to expand capacity by sharing hefty upfront costs. The GM/LG battery joint venture in Ohio began production Wednesday.

- Volkswagen and Audi are stockpiling inventories of glass parts such as windshields as European glass-makers get squeezed by higher energy prices.

- Toyota plans to triple its investment in a new North Carolina battery plant from $1.29 billion to $3.8 billion, partly in response to rising consumer demand for electric vehicles.

- Over 1,500 workers at Canadian logistics firm Loomis Express agreed to a new contract Wednesday to avoid a strike that would have disrupted facilities across eight provinces.

- Robot sales are booming, with deliveries to the automotive industry comprising 59% of orders in the second quarter while the food and consumer-goods industry increased robot sales by 13%, according to the Association for Advancing Automation.

- London-based Taylor Maritime Investments is offering to take over Grindrod Shipping in a deal that values the bulk carrier at nearly $500 million.

- Intermodal provider RoadOne acquired Texas-based port trucking company Wilmac Enterprises.

Domestic Markets

- The U.S. reported 88,286 new COVID-19 infections and 383 virus fatalities Wednesday.

- Americans may have to turn to the private market as soon as January to buy COVID-19 vaccines and treatments as government stocks decline rapidly, officials say.

- The FDA authorized the first updated COVID-19 booster doses since the beginning of the pandemic Wednesday. The new shots will target the fast-spreading BA.5 subvariant of Omicron ahead of a possible virus surge this winter.

- New research shows Pfizer’s COVID-19 antibody drug Paxlovid greatly lowered the risk of hospitalization and death in people over age 65.

- U.S. stocks ended August with their fourth straight daily decline Wednesday, cementing the weakest August performance in seven years.

- First-time jobless claims fell to a lower-than-expected 232,000 last week, a nine-week low, down 5,000 from the prior week as the labor market remains tight.

- Private estimates of August U.S. job growth came in lower than expected, with payroll firm ADP saying the nation added just 132,000 positions, the smallest gain in 1.5 years.

- Manufacturers, hotels, warehouses and restaurants are increasingly letting new hires work just a few days a week on flexible schedules due to continued tightness in the U.S. labor market.

- The average U.S. mortgage rate rose from 5.65% to 5.8% week over week. Mortgage applications dropped 2% and were 23% lower than a year ago as the National Association of Home Builders suggests the nation may be in a housing recession.

- U.S. food prices rose 10.9% year over year in July, the biggest increase since 1979, according to the Labor Department.

- Restaurant traffic was up 10% year over year in the first three weeks of August to pre-pandemic levels, but the industry has been squeezed by rising food costs, absorbing about half of the 15% increase of the past year.

- Bed Bath & Beyond announced plans to close 150 stores and cut 20% of corporate and logistics jobs as part of a sweeping overhaul of its ailing operations.

- A U.S. bankruptcy court declined to give Chapter 11 protections to 3M based on a bankruptcy filing by its Aearo Technologies subsidiary, exposing the firm to more jury verdicts in faulty earplug lawsuits that have already yielded over $265 million in damages.

- The U.S. is suspending 26 flights by Chinese carriers next month in a dispute over Beijing’s strict COVID-19 policies.

- Labor Day air travel is expected to rebound to pre-pandemic levels this year as holiday spending is already up 17%.

- Delta has issued over $6 billion in refunds since 2020 for canceled or delayed flights.

- With flight costs soaring, Google Flights research shows travelers can save 12% on ticket prices by traveling during the week rather than on weekends.

International Markets

- Parts of China’s southern city of Guangzhou imposed COVID-19 curbs Wednesday, joining the tech hub of Shenzhen in battling new virus flare-ups. Meanwhile, impacts from the nation’s last major lockdowns three months ago in Shanghai are still rippling through the economy.

- Japan reported almost 1.4 million new COVID-19 cases last week, the most in the world for the fourth week in a row. The nation plans to accelerate its rollout of Omicron-tailored vaccines.

- South Korea is easing some COVID-19 measures for incoming travelers as infections steadily decline from mid-August highs.

- EU regulators will decide this week on whether to authorize Omicron-tailored updates to existing approved COVID-19 shots.

- Eurozone inflation rose to a fresh record of 9.1% in August, increasing pressure on the bloc’s central bank to respond with an aggressive interest-rate hike next week.

- China’s factory activity rose slightly in August while remaining in contraction territory, a result of new COVID-19 lockdowns, heat waves and a worsening property crisis that has also hit earnings for the nation’s top banks this year.

- India’s economy grew 13.5% last quarter from a year ago as COVID-19 worries eased and consumer spending rebounded.

- Canada’s GDP grew at a 3.3% annualized rate in the second quarter, well below forecasts despite gains in household consumption and business spending on inventories.

- Russia’s economy shrank by 4.3% year over year in July after contracting by 4.9% in June, officials said.

- EU ministers on Wednesday agreed to suspend a visa agreement with Moscow that gives Russian citizens inexpensive and easy access to the bloc.

- Lufthansa Airlines canceled about 800 passenger and cargo flights at airports in Frankfurt and Munich in advance of a pilot’s strike scheduled for Friday.

- China’s big three state-owned airlines saw total losses balloon to $18.5 billion in the pandemic through this July, a result of the nation’s zero-tolerance COVID-19 strategy.

- LATAM Airlines is getting closer to emerging from Chapter 11 after prevailing over two challenges to its reorganization plan in U.S. courts this week. Meanwhile, a judge declared regional Mexican carrier Interjet bankrupt almost two years after the airline stopped operating its low-cost flights in Latin America.

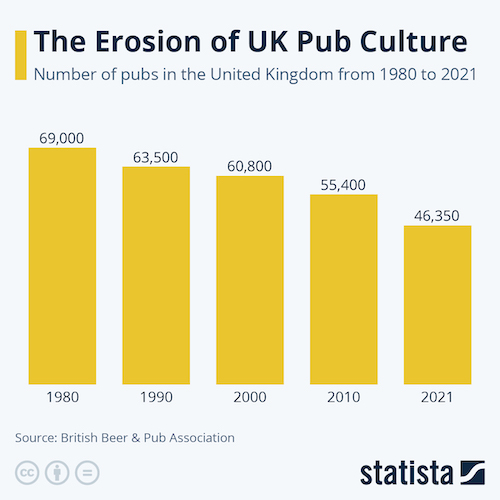

- Thousands of British pubs could be driven out of business as average energy bills rise over 150%, according to an industry group:

Some sources linked are subscription services.