MH Daily Bulletin: October 31

News relevant to the plastics industry:

At M. Holland

- The use of recycled material was previously limited to plastic products that did not require color. Luckily, new products made from post-consumer recycled (PCR) materials, like carrier resins for masterbatches from M. Holland, can be colored. These resins enable companies to incorporate recycled plastics into their sustainability strategies. Click here to read the blog post.

- M. Holland is sponsoring the Association of Rotational Molders (ARM) Annual Meeting in Atlanta on Nov. 6-9! Please stop by Booth #19 to meet our team of Rotational Molding experts and learn more about our product offerings and grinding capabilities.

Supply

- Oil prices fell 1% Friday after top importer China widened its COVID-19 curbs.

- In mid-morning trading today, WTI futures were down 1.1% at $86.97/bbl, Brent was down 0.8% at $94.97/bbl, and U.S. natural gas jumped 10.2% to $6.26/MMBtu.

- Natural gas prices are down 40% since late-August highs amid unusually warm autumn weather.

- The number of active U.S. oil and natural gas rigs declined last week while notching their first monthly increase since July.

- Diesel prices in the U.S. northeast are at a significant premium to the national average due to low inventories in the region.

- Four of the five largest global oil companies combined for nearly $50 billion in profit last quarter, fueling support for a windfall tax.

- U.S. shale producer Pioneer Natural Resources says it will reshuffle its drilling portfolio next year after third-quarter output fell 9%.

- U.S. frackers in some parts of the Permian basin are butting heads with miners working to boost production of potash, a key crop nutrient.

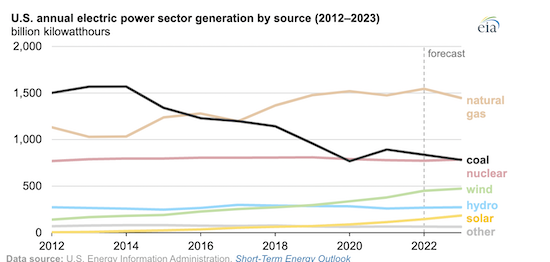

- U.S. coal-fired electricity generation is forecast to fall 6% from 2021 levels:

- Russia significantly cut forecasts for taxable oil production for 2023, surmising that upcoming sanctions will lead to a decline in output and refining volumes.

- Canada’s Imperial Oil reported a jump in third-quarter profit and raised its dividend.

- Brazilian electricity firm Electrobras offered buyouts to 22% of its workforce, or some 2,000 people, in a major cost-cutting move following its privatization.

- Researchers say South Africa will need to build wind and solar power nine times faster to reach its goal of phasing out coal plants over the next decade.

- Saudi Aramco launched a $1.5 billion sustainability focused venture capital fund, the largest such investment ever.

- U.S. copper producer Freeport-McMoRan is warning that a looming copper shortage could slow the global transition to a greener economy.

Supply Chain

- Hundreds of thousands of workers remain under closed-loop lockdown in Foxconn’s main factory in Zhengzhou, China. Some employees were seen jumping fences to escape the site, while it was reported that the restrictions could dent November iPhone shipments by 30%.

- Members of a third U.S. railroad union rejected a tentative contract agreement with carriers, reviving concerns over potential strikes.

- Freight companies are preparing for a muted peak season as lower shipping demand from overstocked retailers ripples across markets.

- The steep slide in global ocean shipping rates is slowing, falling just 3% per FEU last week.

- The Port of Houston will impose new fees on long-dwelling containers in a bid to reduce import backlogs.

- Schneider National’s third-quarter revenue rose 8% from a year ago to $1.44 billion.

- Canadian National Railway raised its profit outlook after third-quarter revenue jumped 26%.

- Canadian Pacific Railway’s third-quarter revenue rose 19% on strong gains in potash and intermodal transports.

- Maersk Air Cargo is preparing to enter the weakening trans-Pacific airfreight market.

- China’s Cosco Shipping Holdings will buy port assets from its parent for $2.7 billion as it aims to build up a global digital supply chain.

- In the latest news from the auto industry:

- Automakers are making changes to their 2023 production plans due to the ongoing semiconductor shortage, with experts predicting the industry to lose between 2 million and 3 million units of planned production next year.

- Volkswagen’s quarterly profit fell 29% due to fallout from the war in Ukraine and supply-chain issues.

- Toyota says global production jumped 30% in third quarter but will remain constrained due to component shortages.

- Ford narrowed its 2022 profit forecast due to parts shortages and higher payments to suppliers.

- Chrysler parent Stellantis offered voluntary buyouts to some of its 13,000 salaried employees in the U.S.

- Audi is considering a one-off payment to help employees combat rising living costs.

- Porsche’s operating profit rose 40.6% in the first nine months of 2022 as it raised prices to deal with supply-chain issues.

- Chinese electric-vehicle maker BYD saw quarterly profit rise 350% on surging sales in the world’s largest auto market.

- Grappling with sanctions and supply shortages, Russia’s remaining carmakers are struggling, building cars that lack basic components, such as air bags and antilock braking systems.

- Stellantis will file for bankruptcy for its loss-making joint venture producing Jeep vehicles in China.

- A unit of China’s heavily indebted Evergrande real estate developer began delivering its first electric vehicles.

- Ford will begin offering severance packages to some of its underperforming white-collar workers as the automaker makes changes to its talent-management policies.

- U.S. steel prices are down to the lowest level in two years, shrinking steel company profits but giving manufacturers hope for lower material costs.

- Airbus plans to ramp up production over the next year despite persistent supply-chain disruptions.

- Over 200 vessels are stuck at Ukrainian ports after Russia decided to suspend its participation in a grain export deal. Wheat futures surged on the news. Ukrainian food shipments are set to resume moving through a maritime corridor today, according to the United Nations, pushing back against Russia’s move.

- A major union for Britain’s Royal Mail called off strikes planned for the next two weeks.

Domestic Markets

- The U.S. averaged 37,985 new daily COVID-19 infections last week, up from 37,258 the prior week. The seven-day average for virus deaths rose to 378 from 367 a week ago.

- A “variant soup” is driving new COVID-19 cases in New York City and elsewhere.

- U.S. flu hospitalizations are at their highest level for this time of year in over a decade.

- A recent study suggests that AstraZeneca’s COVID-19 vaccine is 30% more likely to cause a rare blood clot among recipients compared to the shot made by Pfizer.

- U.S. equities received their biggest inflow in four months last week on hopes that the Federal Reserve will slow the pace of interest-rate hikes. Some bankers, including Goldman Sachs, see rates hitting 5% by March.

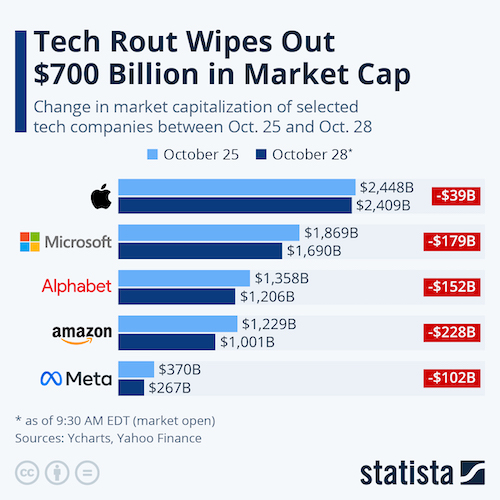

- Technology shares have led this year’s stock market rout in a performance similar to the tech bubble of 2000-2002:

- The level of distressed corporate debt in the U.S. has risen for five straight weeks as businesses that loaded up on cheap borrowings during the pandemic now must refinance at much higher rates.

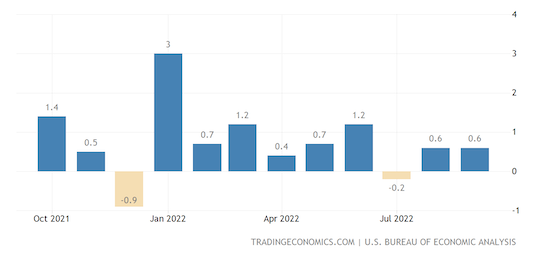

- U.S. consumer spending rose 0.6% in September, according to the Commerce Department:

- Wage and benefit costs rose 5% in the third quarter as employers competed for workers in a tight labor market. Real wages were flat when factoring for inflation.

- Almost a quarter of firms posting quarterly results are coming up short of expectations, new data shows.

- U.S. pending home sales fell 10.2% in September, the sharpest decline since early in the pandemic.

- U.S. credit-card debt hit $916 billion in September, reaching pre-pandemic levels for the first time.

- The Federal Reserve is a victim of its own rate hikes as interest outflows it pays on money market funds exceed income it receives from its bond portfolio.

- Bankrupt cosmetics giant Revlon is entertaining sale offers as a way to exit from Chapter 11 as soon as possible.

- Bed Bath & Beyond is seeking to win back brands after a failed overhaul under prior management that led to plunging sales.

- A drive to unionize new Starbucks cafes is slowing as the coffee chain doles out more pay and expanded benefits to non-unionized cafes.

International Markets

- China on Saturday reported a fifth straight day of more than 1,000 new COVID-19 cases, triggering more curbs and restrictions across the country. Shanghai locked down as it conducted mass testing for the 1.3 million people of its main business district.

- China abruptly locked down Shanghai Disney today, trapping visitors inside until they can test negative for COVID-19.

- China’s pandemic restrictions on business and social activity are impacting 9.2% of the nation’s GDP.

- Macau quarantined all staff and customers inside an MGM casino after a dealer tested positive for COVID-19.

- Brazil’s liberal opposition candidate narrowly won the presidency after the nation suffered among the worst COVID-19 fatality levels under his conservative predecessor.

- Fewer than 20% of Canadians have gotten updated COVID-19 boosters tailored to the Omicron variant.

- China’s factory activity took a surprise turn downward into contraction territory in October, according to official data. The nation’s services activity also fell for the first time since May.

- The International Monetary Fund expects China’s GDP growth to slow to 3.2% this year, a downgrade of 1.2 points from its April projection, after the nation saw an 8.1% rise in 2021.

- The Eurozone annual inflation rate rose to 10.7% in October. Inflation climbed to 11.6% in Germany, 7.1% in France, 7.3% in Spain and 12.8% in Italy.

- Germany’s economy saw a surprise expansion of 0.3% in the third quarter.

- Britain is widely expected to raise its benchmark interest rate by 75 basis points when its central bank meets this Thursday, Nov. 3.

- Japan’s factory output fell 1.6% from August to September, worse than expectations.

- The Japanese yen fell more than 1% Friday after the Bank of Japan bucked the trend among other major central banks and stuck with ultra-low interest rates.

- Japan’s cross-border e-commerce is booming as smaller companies join the market to take advantage of the yen’s sharp decline and technology advances.

- One million employees in Belgium will receive an automatic pay raise of 11.59% in 2023 due to the country’s record inflation.

- Ryanair ground handlers called off plans to strike at Spanish airports this month as contract negotiations advance.

- Finnair posted a $35.1 million third-quarter profit, its first of the pandemic.

- Mexico is making progress toward recovering its Category 1 aviation rating that was revoked 1.5 years ago, according to the U.S. FAA.

- China Southern Airlines canceled plans to fly Boeing 737 MAX jets over the weekend, what would have been the aircraft’s first return to China in over three years.

- Asian online apparel seller Shein, just a decade old, is on track to generate $24 billion in revenue this year and close its sales gap with fast-fashion giants Zara and H&M.

- Shopify’s third-quarter operating loss narrowed after posting a revenue jump of 22%.

Some sources linked are subscription services.