MH Daily Bulletin: October 25

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s recent Plastics Reflections webinar, our panelists discussed the macroeconomic factors influencing global and domestic economies — including what it means for suppliers, distributors and manufacturers in the plastics industry. In case you missed it, click here to gain access to the full recording.

- A recent Plastics News article focuses on M. Holland’s distribution of Purell medical-grade resins from LyondellBasell. Click here to read the article.

Supply

- Oil fell 0.5% Monday on news of lackluster demand from China in September.

- In mid-morning trading today, WTI futures were up 1.5% at $85.82/bbl, Brent was up 1.0% at $94.19/bbl, and U.S. natural gas was up 3.2% at $5.36/MMBtu.

- The average U.S. gasoline price fell 10 cents last week to $3.79 a gallon.

- Natural gas prices in the U.S. Permian Basin are edging toward zero as booming production overwhelms pipeline networks, creating a regional glut.

- U.S. pipeline operator Kinder Morgan posted a 16.4% rise in quarterly profit on higher transport margins across all its fuels.

- Schlumberger, the world’s primary oilfield services provider, is rebranding itself as “SLB” with an eye toward its lower-carbon future, executives said.

- French refinery worker strikes have prevented the U.S. from sending any shipments of crude to the nation for the first time in four years.

- Despite a drop in China’s crude imports in September, exports of diesel surged, along with margins.

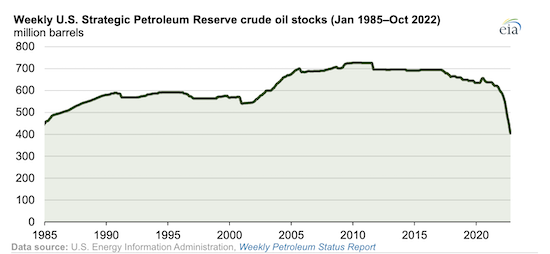

- The U.S. has sold off the last of its 180-million-barrel release of strategic crude reserves, leading to the lowest inventory level since 1984:

- Global LNG markets continue tightening, prompting the head of the International Energy Agency to declare the world is suffering “the first truly global energy crisis.”

- More oil news related to the war in Europe:

- On Monday, European natural gas dipped 13% to below 100 euros per MWh for the first time since June amid unusually warm weather and strong fuel reserves.

- Russia’s seaborne crude shipments fell to a five-week low on early impacts from looming European sanctions.

- Germany may start subsidizing natural gas for homes and businesses as soon as January, months earlier than the start date recommended by government advisers.

- The EU’s executive has warned that a bloc-wide cap on gas prices could cause an increase in subsidized electricity exports, leaving the continent with energy shortages.

- A recent study concludes that the carbon footprint for advanced recycling of hard-to-recycle plastics is lower than competing end-of-use processes, as well as production from virgin materials.

Supply Chain

- A labor deal between 22,000 U.S. West Coast dockworkers and their employers may take several more months, although service disruptions in the meantime are unlikely, port officials say.

- Inbound containers waited for transport an average of 4.25 days at the ports of Los Angeles and Long Beach in September, the shortest dwell time since May 2021.

- Container ship bottlenecks are starting to ease on the U.S. East and Gulf coasts, although inland congestion continues to slow shipments.

- Container shipping lines are shifting capacity from the trans-Pacific market to the Atlantic for higher rates.

- Charter rates for very large crude carriers have surged to their highest level in two years as Chinese refineries boost crude buying.

- UPS will raise rates another 6.9% on average in December, and FedEx will boost prices the same amount in January, as package carriers continue to pass along price increases even as demand softens and shipping costs decline across all modes except parcel transport.

- UPS saw healthy profits on a year over year revenue-per-unit rise of almost 10% in the third quarter, even as demand weakened in the broader e-commerce market.

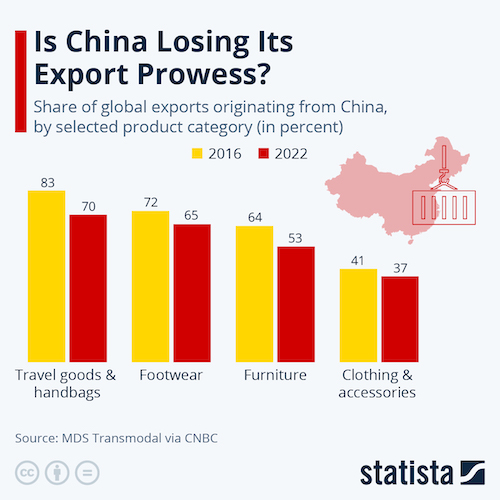

- China’s COVID-19 policies are quickening its declining share of global exports:

- In the latest news from the auto industry:

- Higher prices contributed to a 56% year over year jump in revenue and a 49% increase in adjusted earnings for General Motors in the third quarter, boosting the company’s stock price in premarket trading.

- The world’s top automakers have nearly $1.2 trillion of electric vehicle projects in the pipeline by 2030.

- Tesla will move forward building a lithium refinery on the Texas Gulf Coast, a bid to gain more control over its battery supply chain.

- Toyota, slow to follow major competitors toward electrification, is halting some electric vehicle projects as it executes a strategy revamp to become more competitive with Tesla and other automakers.

- Hyundai raised its full-year forecast but slashed its sales target by 7% due to supply chain issues and impacts from new U.S. limits on tax incentives for foreign-made electric vehicles (EVs). The automaker will break ground today on a $5.54 billion EV plant near Savannah, Georgia.

- Chinese electric vehicle battery giant CATL is slowing its North American expansion on fears that new U.S. export curbs to China will drive up costs.

- Amazon will spend over 1 billion euros to double the size of its electric van fleet in Europe over the next five years.

- Mexican officials are meeting with the U.S. climate envoy to discuss lithium, batteries and the auto industry this week.

- Ford and Hyundai are considering electric vehicle production sites in Indonesia.

- European Lithium, one of the continent’s only sources of the key battery metal, will list its shares in the U.S. in a $970 million initial public offering.

- MSC plans to acquire Rimorchiatori Mediterranei, the world’s third-largest harbor tug company.

- China’s Cosco Shipping is moving into the third-party logistics market for inland distribution, joining peers including MSC, Maersk and CMA CGM.

- British rail workers announced more strikes for the month of November, adding to disruption from summer walkouts.

- Proctor & Gamble is diversifying its production assortment to keep shoppers from switching to cheaper brands.

- Adidas held 63% more inventory in the third quarter than it did a year ago.

- Five key Walmart suppliers have teamed up to buy renewable energy from a Kansas wind farm, part of the retailer’s plan to slash a billion tons of emissions from its supply chain by 2030.

- Fastenal’s bet on online fulfillment is paying off, with almost half its sales driven by digital products and services in the third quarter.

- Coca-Cola is switching from trucks to rail for daily deliveries of millions of drinks in the U.K., a bid to reduce emissions.

Domestic Markets

- The U.S. reported 40,839 new COVID-19 infections and 196 virus fatalities Monday.

- COVID-19 cases have plateaued from their steady decline in California, leading some officials to warn of a new wave.

- The share of Americans getting COVID-19 boosters is ramping up quickly ahead of winter.

- Men died of complications from COVID-19 at a 50% higher rate than women in both rural and urban parts of the U.S. in 2020, new data shows.

- GM will push back its return-to-office date for salaried workers by several months to January.

- Nike dropped its COVID-19 vaccination mandate for employees.

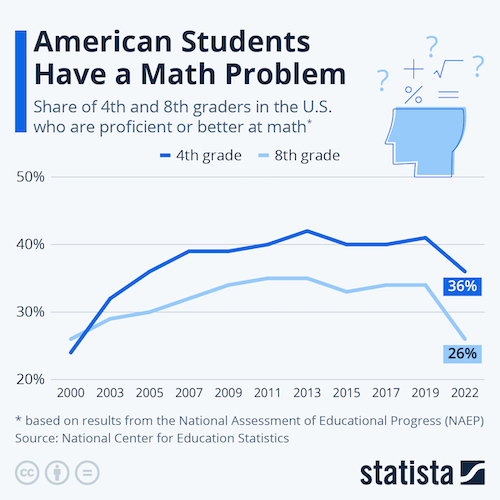

- Every U.S. state recorded substantial declines in math scores this year after the pandemic worsened a downward trend in academic levels nationwide:

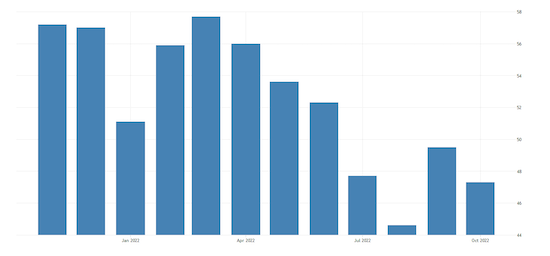

- S&P Global’s composite U.S. purchasing managers’ index fell from 49.5 to 47.3 in October, the fourth month in contraction territory led by a sharp slowdown in services activity:

- The Conference Board’s leading economic index fell in September for the seventh time in nine months, signaling recessionary conditions.

- Over half of working Americans say they have considered multiple jobs to pay for rising living expenses.

- Halloween candy prices are up more than 13% from a year ago, marking the largest-ever inflationary jump for candy, according to the Labor Department.

- Rent gains are starting to slow in many parts of the U.S., cooling a years-long boom that sapped affordability across the nation.

- U.S. telehealth demand is starting to shrink, forcing some firms to cut back on staff and operations.

- Medical equipment giant Philips will cut 4,000 jobs amid falling sales and poor market performance over the past year.

- Unilever recalled popular brands of dry shampoo, including Dove, after discovering they were contaminated with cancer-causing benzene.

- Instacart is pulling back plans for an initial public offering this year as turbulent financial markets hit demand for new listings.

International Markets

- Chinese authorities began imposing local COVID-19 restrictions in the southern manufacturing megacity of Guangzhou, raising fears of a city-wide lockdown.

- A new COVID-19 strain called “XBB” is spreading rapidly in India, although total case counts remain low.

- COVID-19 cases are ticking back up in South Korea, led by variants BQ.1 and BQ.1.1.

- Measles cases are rising in Africa after COVID-19 disrupted normal vaccine campaigns the past two years.

- The euro zone is likely entering a recession after business activity shrank at the fastest pace in nearly two years this month, according to S&P Global.

- German factories made their biggest output cuts since the early part of the pandemic in October, new business surveys show.

- China’s economy expanded a better-than-expected 3.9% in the third quarter as the country rebounded from crippling lockdowns in the spring.

- Stock markets in China and Hong Kong and U.S.-listed shares of Chinese firms fell sharply Monday as investors sold on fears that China’s economic growth will be sacrificed for ideology-driven policies from its new administration.

- On Monday, the yuan tumbled to its weakest since 2007 after China’s central bank set its currency fixing rate at the lowest in over a decade, a signal that Beijing will let the yuan further depreciate. The bank also moved to allow more foreign capital inflows as Beijing signaled it may loosen border restrictions for foreign business executives.

- Japan spent a record $36 billion in last Friday’s yen-buying intervention aimed at propping up its faltering currency.

- Mexico’s inflation rate likely slowed in early October to an annual pace near 8.5%.

- Ukraine’s post-war recovery tab could rise to $750 billion, rivaling the Marshall Plan after WWII, policymakers say.

- China’s exports to Russia rose at a double-digit pace for the third straight month in September.

- KFC parent Yum Brands reached a deal to sell its restaurants to a local operator in Russia.

- Switzerland’s UBS bank saw a 24% decline in third-quarter profit as corporate deal making slowed.

- Saudi Arabia is in talks to order 40 Airbus jets as part of a multi-billion-dollar drive to launch a new airline.

- EU nations agreed Monday to raise 2030 targets on curbing emissions under the Paris climate agreement.

Some sources linked are subscription services.