MH Daily Bulletin: October 24

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s recent Plastics Reflections webinar, our panelists discussed the macroeconomic factors influencing global and domestic economies — including what it means for suppliers, distributors and manufacturers in the plastics industry. In case you missed it, click here to gain access to the full recording.

- A recent Plastics News article focuses on M. Holland’s distribution of Purell medical-grade resins from LyondellBasell. Click here to read the article.

Supply

- Oil rose Friday, with Brent ending the week higher and WTI ending the week slightly down. U.S. natural gas fell over 25% in its ninth straight weekly decline.

- In mid-morning trading today, WTI futures were down 0.1% at $84.94/bbl, Brent was down marginally at $93.48/bbl, and U.S. natural gas was up 3.9% at $5.15/MMBtu.

- Active U.S. drilling rigs rose by two last week, with oil rigs at their highest level since March 2020.

- Refined fuel exports from China rose 36% year over year in September, while crude imports fell by 2%, indicating continuing weakness in the domestic economy. Refinery output was up 1.9% year on year to 56.81 million tonnes, its first year-on-year rise since last November.

- Oil market volatility will dampen incentives for U.S. producers to boost crude output in order to refill government reserves, experts say.

- France is falling behind in its winter energy preparation, with almost half its nuclear reactors offline for maintenance and over 10% of gas stations still short on supply due to worker strikes.

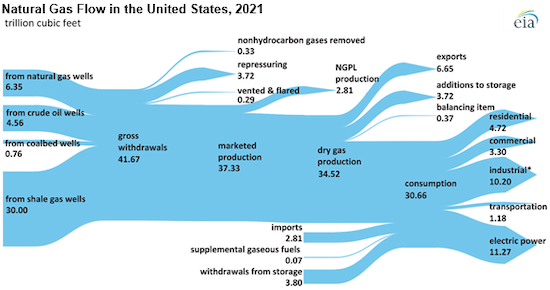

- U.S. natural gas production and exports hit record highs in 2021:

- More oil and gas news related to the war in Europe:

- With Europe’s embargo on Russian oil exports just six weeks away, traders, investors and governments are scrambling to predict possible consequences on the global petroleum supply chain.

- Ukraine is working to restore electricity after persistent Russian shelling knocked out one-third of its power stations and other crucial heating systems.

- Tens of thousands of people gathered in major German cities last weekend to protest skyrocketing energy prices and the impact on living costs.

- Israel’s top court upheld a landmark U.S.-brokered deal that sets a maritime border with Lebanon, opening the door for royalties for offshore energy exploration for the two countries.

- Shell has resumed oil flows after months of disruption at a major terminal in Nigeria.

- China’s Guangdong province is moving forward with plans to build a massive 43.3 GW offshore wind farm, roughly equal to the total power production of countries such as Poland and Argentina.

Supply Chain

- Category 4 Hurricane Roslyn delivered deadly storm surges to west-central Mexico Sunday, leaving at least two people dead.

- California briefly cut power to tens of thousands of homes and businesses over the weekend due to heightened wildfire risks from gusty winds.

- Heavy rain continued to batter flooded portions of south and east Australia over the weekend, the region’s third La Niña weather event in a row.

- The massive backup of container ships off the coast of California is now nearly nonexistent, with sharply declining imports leading to expanded domestic capacity for overland transport.

- Soaring diesel prices have overtaken driver shortages as the primary concern in the trucking industry, new polls show.

- The National Motor Freight Traffic Association (NMFTA), which oversees pricing in the less-than-truckload industry, is overhauling its rating system in a bid to simplify and more accurately reflect shipping costs.

- A freight payment index developed by U.S. Bank dropped to its lowest level in 1.5 years last quarter as freight volume returned to levels seen in the first quarter, off 4.9% from a year ago.

- Real spot rates for containerized freight from Asia to the U.S. West Coast are back down to pre-pandemic levels, according to some analysts.

- Container export markets are destabilizing as contract shippers fail to meet minimum volume commitments, forcing carriers to fill vessels with discounted spot business from China or cancel bookings.

- Many carriers and shippers agree that fourth-quarter profits will look worse than the third quarter despite the holiday surge, according to surveys.

- Throughput at the Port of Rotterdam, Europe’s largest, was flat during the first nine months of 2022 as rising coal and LNG volumes offset the loss of container traffic with Russia.

- U.S. authorities have limited vessel activity near the key export hub of Baton Rouge due to low water levels on the Mississippi. Although barge rates fell last week, they remain much higher than a year ago.

- Taiwanese chipmaker TSMC has suspended production for one of China’s most promising semiconductor designers to ensure compliance with U.S. regulations.

- In the latest news from the auto industry:

- Toyota says full-year production will fall short of targets due to computer chip shortages.

- Automakers built more profitable SUVs and trucks as computer chip shortages forced them to selectively manufacture, leading to a large shortage of sedans.

- Analysts say the U.S. electric-vehicle market will expand almost 400% by 2028.

- A U.S. startup raised over $1 billion to build an electric charging corridor for trucks between Long Beach, California, and El Paso, Texas.

- BMW will spend $782 million to boost electric vehicle production in Leipzig, Germany.

- Intellectual property is a major sticking point between Renault and Nissan as the pair negotiate an overhaul of their decades-old partnership.

- China’s Guangdong province reportedly has more electric-vehicle chargers than the entire U.S.

- Tesla is lowering the prices for its Model 3 and Model Y vehicles by as much as 9% in China due to softening demand in the auto market.

- Some small U.S. businesses are building their own domestic supply chains to cope with growing global uncertainty.

- China’s dominance in global manufacturing supply chains is weakening.

- German lawmakers are divided over whether to allow China’s state-owned Cosco Shipping to take a stake in a Port of Hamburg container terminal.

- China is advancing efforts to build a freight rail line through Myanmar to the Indian Ocean.

- Saudi Arabia earmarked over $2.7 billion for incentivizing global suppliers to invest in the kingdom’s growing industrial sector.

- EU trade flows to the U.K. have fallen 20% since Brexit.

- Amazon will use Hawaiian Airlines to fly its first Airbus freighters on primary cargo routes in the second half of 2023.

- Startup Bettaway Supply Chain Services launched an online pallet-trading marketplace in the U.S.

- Chilean telecoms giant Entel is selling the assets of its fiber optic business for $358 million in the first half of 2023 to avoid the costs of expanding its fixed network.

Domestic Markets

- The U.S. averaged 37,258 new COVID-19 infections last week, down from 37,808 the prior week. The seven-day average for virus deaths rose to 367 from 332 a week ago.

- Cases of COVID-19 stemming from the BQ.1 and BQ.1.1 Omicron subvariants are estimated to account for 16.6% of cases in the nation as of last Friday, nearly doubling from a week earlier.

- Pfizer’s plan to potentially quadruple U.S. prices for its COVID-19 vaccine next year could spur strong revenue for years despite falling booster demand.

- The pandemic took a toll on learning; results from the first national academic proficiency test since 2019 indicate math scores fell at the highest pace on record and reading scores fell to 1992 levels.

- Policymakers see U.S. interest rates rising to a median of 4.6% next year, with a 75 basis-point hike expected at the Federal Reserve’s next meeting on Nov. 1-2. U.S. stock markets jumped higher last week on word that the central bank may consider softening its interest-rate increases.

- Quarterly earnings are projected to fall 3.5% from a year ago for the S&P 500, excluding the energy sector. Nearly one-third of the index is due to report this week, including the nation’s largest tech firms.

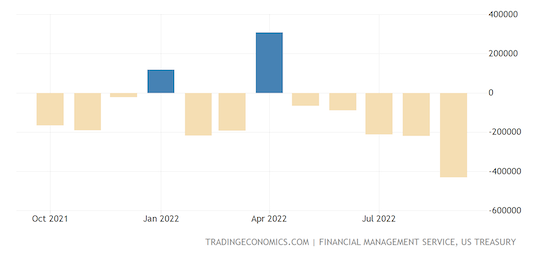

- The U.S. budget deficit shrank almost 50% from FY 2021 to FY 2022 on lower COVID-19 relief spending and surging receipts.

- September saw the highest number of CFO departures at major U.S. firms since the beginning of the year amid mounting pressure from high inflation.

- The Teamsters ratified the first-ever national labor contract with wholesale retailer Costco.

- American Express posted a 24% gain in quarterly revenue led by a surge in consumer spending.

- Appliance maker Whirlpool cut its planned production output by 34% in the third quarter on expected softer demand.

- Steelmaker Nucor’s third-quarter profit shrank on lower shipping volumes in its steel mills segment.

- Growing sales at luxury retailers are defying the impact of inflation and other economic headwinds.

- The Nasdaq exchange has quietly halted listings of small-cap Chinese companies after a series of suspicious trading in initial public offerings this year.

- The U.S. government is asking for more details on CVS Health’s proposed $8 billion takeover of Signify Health, indicating the companies face a longer antitrust investigation than initially thought.

- U.S. air traffic between Thanksgiving and New Year’s will set an all-time high this year, building on the momentum of surging travel demand over the summer.

- U.S. airlines are rallying against a government proposal that would require carriers to reveal how much passengers are compensated for flight delays.

International Markets

- The IMF warned that the global wave of interest-rate hikes will not have their peak effect on inflation until three or four years from now.

- A new survey shows that 71% of European consumers across six key markets are cutting back spending on everyday items, including food, in an effort to manage surging inflation throughout the bloc.

- Eurozone business activity contracted for a fourth straight month in October, with S&P Global’s composite purchasing managers index falling to 47.1, down from 48.1 in September.

- Consumer confidence in both the euro area and Britain rose slightly in October but remained near record lows.

- British retail sales dropped a larger-than-expected 1.4% from August to September. Ratings agency Moody’s lowered the nation’s outlook from “stable” to “negative” due to ongoing political turmoil.

- Japan intervened in the foreign exchange market for the second time in a month on Friday to prop up its currency, while lawmakers separately considered a stimulus package of $100 billion or more to cushion fuel and raw material prices.

- South Korea is expanding its corporate bond-buying program and taking other liquidity supply measures amid growing worries about a credit crunch.

- Mexican inflation likely slowed in the first half of October, but not enough to slow its central bank’s monetary tightening policy.

- Argentina’s central bank kept its benchmark interest rate at 75% last week following better-than-expected inflation data for September.

- China’s president secured a precedent-breaking third leadership term Sunday, cementing power in one of the strongest administrations since Mao Zedong. China’s stock markets fell to a 14-year low on concerns about the concentration of authority.

Some sources linked are subscription services.