MH Daily Bulletin: October 21

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s recent Plastics Reflections webinar, our panelists discussed the macroeconomic factors influencing global and domestic economies — including what it means for suppliers, distributors and manufacturers in the plastics industry. In case you missed it, click here to gain access to the full recording.

- A recent Plastics News article focuses on M. Holland’s distribution of Purell medical-grade resins from LyondellBasell. Click here to read the article.

Supply

- Oil settled unchanged in choppy trading Thursday.

- In mid-morning trading today, WTI futures were up 0.27% at $84.64/bbl, Brent was up 0.55% at $92.89/bbl, and U.S. natural gas was down 7.52% at $4.96/MMBtu.

- New England could see especially high natural gas prices this winter due to a regional shortage of the fuel.

- Over 80% of the U.S. population is concerned about high gasoline prices, according to new polls.

- No. 1 oil field services provider Schlumberger posted a 64.9% jump in third-quarter profit as a surge in oil and gas prices led to more drilling activity.

- A 955,000-bpd Venezuelan refinery shut down Thursday after a fire and resulting blackout at the site.

- More oil and gas news related to the war in Europe:

- EU officials are seeking the power to cap the price of natural gas on the bloc’s main trading exchange.

- Germany may have to pour another $39 billion into saving the country’s largest natural gas importer, Uniper, as its losses continue to mount. The government separately approved a $195 billion rescue package for soaring energy prices on Friday.

- Ukrainian officials say households and businesses need to cut electricity use by 20% to help manage fallout from Russian attacks on the nation’s energy infrastructure. The first rolling blackouts were imposed Thursday.

- U.S. firms developing a new generation of small nuclear power plants are asking the U.S. government for uranium as current suppliers are concentrated in Russia.

- Exxon Mobil will sell its Montana refinery for $310 million as part of a years-long effort to concentrate production in the U.S. Gulf Coast and Midwest.

- The U.S. will hold two more oil and gas lease sales in the Gulf of Mexico and Alaska early next year.

- Saudi Aramco is pushing ahead with plans for an initial public offering of its energy-trading business in Riyadh by early 2023.

- Net debt of S&P energy companies is down by more than $100 billion since 2020 as companies use strong profits to deleverage.

Supply Chain

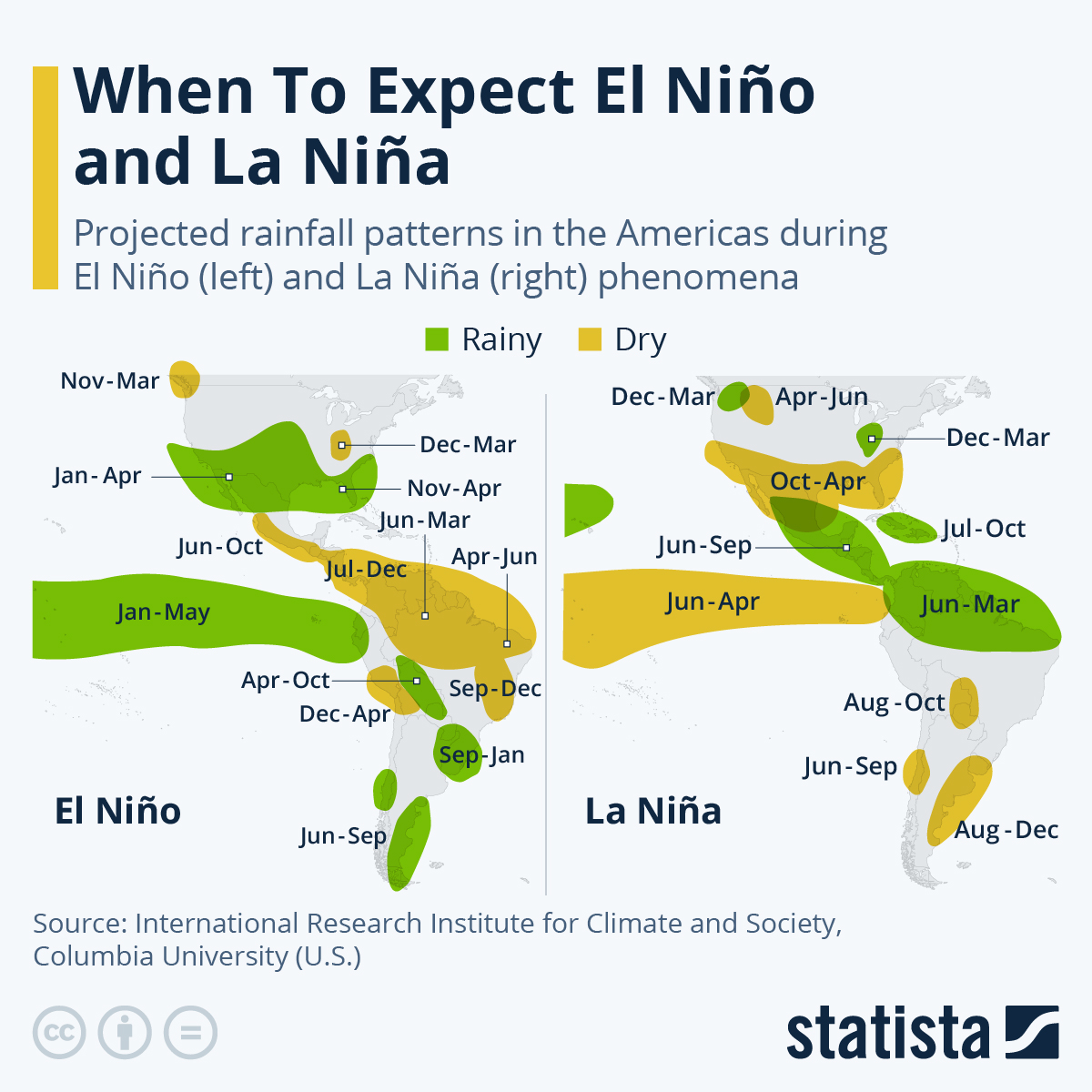

- La Niña will return to the U.S. for the third winter in a row, bringing warmer temperatures for the Southwest, Gulf Coast and Eastern Seaboard.

- Union Pacific’s CEO said a strike possibility remains as five labor unions prepare to vote on a tentative new contract that has been ratified by six unions so far and rejected by one.

- U.S. inventories of diesel fuel have dwindled to a 25-day supply, the lowest since 2008.

- Container imports coming through U.S. ports are tumbling sharply after more than two years of surging demand. Combined imports into the ports of Los Angeles and Long Beach fell 18.2% year over year in September.

- The American Trucking Associations’ truck tonnage index fell a sharp 3.8% from August to September.

- Higher prices lifted third-quarter profits for Union Pacific (+13%) and CSX (+15%), although executives say they are bracing for a slowdown in business. Union Pacific cut its annual volume forecast, citing staff shortages and weak intermodal demand.

- Air cargo demand is not likely to pick up in the fourth quarter after months of falling volumes, analysts say.

- United Airlines’ third-quarter cargo revenue fell 4% as passenger ticket sales rose sharply.

- Brokers and shipowners say nearly all gas carriers in the global fleet are currently in use, pushing rates up to record highs.

- South Carolina is investing $550 million to improve rail and barge operations at the Port of Charleston.

- The Port of Miami ordered a dozen electric cranes for the twin goals of boosting clean energy and handling larger ships.

- In the latest news from the automotive industry:

- Renault saw third-quarter revenue rise 20.5% as price increases more than offset lower sales compared to a year ago.

- Swedish truck-maker AB Volvo saw a 27% rise in quarterly bookings but cautioned about continued impacts from energy and material costs.

- Italy’s unions will meet with Stellantis and Ferrari next week to hash out a wage dispute for more than 70,000 domestic auto workers.

- Mercedes-Benz signed a lithium supply agreement with Canadian-German Rock Tech Lithium that will help the automaker ramp up production of electric vehicles.

- GM unveiled its first electric GMC Sierra truck on Thursday, which is expected to go on sale in early 2024.

- Electric truck-maker Nikola bought over 900 acres of Arizona land to build its first hydrogen production hub.

- IKEA is testing self-driving truck deliveries between Houston and Dallas.

- Electric-van startup Mullen Automotive won court approval to buy a defunct manufacturing plant in Indiana from Electric Last Mile Solutions.

- Australia’s Syrah Resources will expand its Louisiana graphite plant by fourfold after winning over $200 million from the U.S. government in its drive to boost production of electric-vehicle components.

- British electric-van-maker Arrival says it will restructure its business to focus on the U.S. market as it seeks to capitalize on new U.S. incentives.

- The White House is exploring new export controls that would limit China’s access to some of the most powerful emerging technologies including quantum computing and artificial-intelligence software.

- Chinese officials convened a series of emergency meetings the past week with leading semiconductor companies, seeking to assess damages from U.S. chip restrictions.

- TSMC is considering expanding production capacity in Japan to reduce geopolitical risk.

- U.S. exports of wood pellets expanded nearly 36% in August from a year ago.

- The financing arm of U.S. logistics firm Flexport received $200 million in financing to expand its working capital lending to firms impacted by supply chain delays and congestion.

- Appliance-maker Whirlpool will soon open a new factory in Buenos Aires, Argentina, which will export $50 million worth of products around Latin America per year.

- Low water levels on the Mississippi River could continue disrupting barge transport this winter on forecasts of drier-than-normal weather across the South and Gulf Coast.

- Plummeting prices for aluminum, stainless steel and carbon steel are proving a boon for manufacturers.

- Indonesia, the world’s largest tin exporter, is preparing for a potential ban on export of the metal as the government pushes to encourage more domestic processing.

- Talks on extending a U.N.-brokered deal that lets Ukraine ship grain out of Black Sea ports are stalling over Russian demands. The news comes just as Ukraine’s food exports have recovered to prewar levels.

Domestic Markets

- The U.S. reported 56,448 new COVID-19 infections and 532 virus fatalities Thursday.

- The CDC is being advised to add COVID-19 vaccines to the agency’s lists of regular immunizations, like the flu. At the same time, more Americans are delaying or skipping follow-up shots.

- The price for Pfizer’s COVID-19 vaccine could be as high as $130 once it hits private markets sometime next year.

- U.S. jobless claims unexpectedly fell to 214,000 last week, indicating the labor market remains tight.

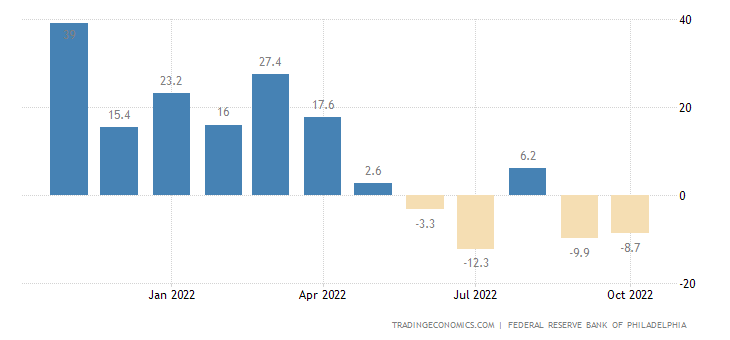

- Factory activity in the Fed district of Philadelphia contracted again in October despite a modest improvement from September.

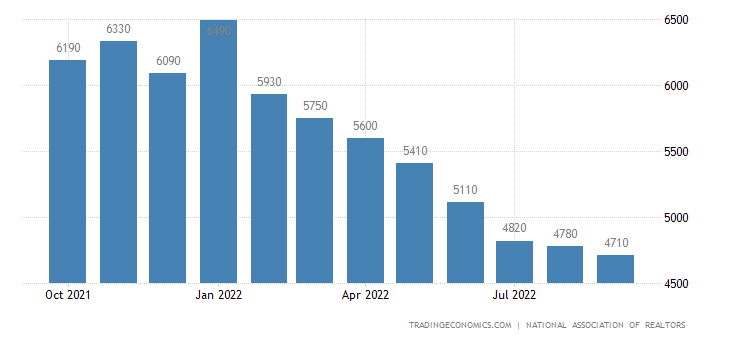

- U.S. sales of previously owned homes fell 1.5% in September, the eighth month of declines.

- U.S. airlines are coming out with impressive third-quarter results as the pandemic-related travel boom shows no sign of slowing.

- Verizon, the U.S.’s No. 1 wireless carrier, posted a 23% slide in third-quarter profit and missed subscriber targets as more people switched to cheaper plans from AT&T and T-Mobile.

- American Express saw a 24% gain in quarterly revenue to an all-time high, but the firm’s stock fell after it set aside larger-than-expected reserves for bad loans.

- Shares of Allstate fell over 10% Thursday after the insurer announced over a billion dollars of reserve claims and inflation-related charges in the third quarter.

- Chemicals giant Dow beat third-quarter profit estimates and outlined plans to cut costs by $1 billion next year to combat soaring European energy prices.

- Cosmetics group L’Oreal posted strong quarterly sales growth of 9.1% on brisk demand in Europe and the U.S.

- Adidas saw third-quarter sales rise 11% but cut its full-year guidance, citing weaker demand from China.

- Visa, Mastercard and American Express will benefit from a surge in cross-border transactions as people continue to ramp up traveling.

International Markets

- Beijing is ramping up public checkpoints and locking down residential buildings after COVID-19 cases quadrupled in recent weeks to a total of 18.

- German producer prices rose a higher-than-expected 2.3% in September, notching a 45.8% gain year over year.

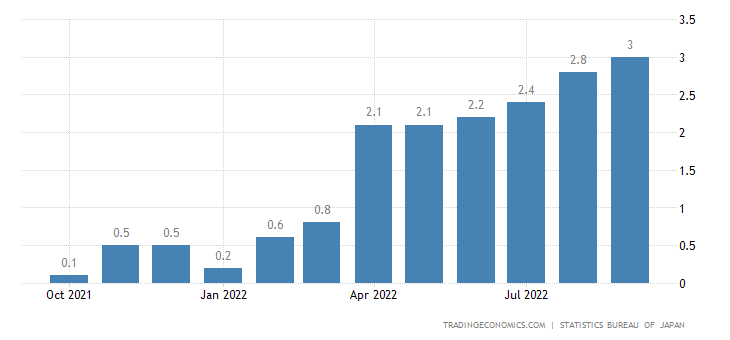

- Japan’s imports rose 45.9% year over year in September to a record high, while its core inflation rate hit 3%, the fastest pace in eight years:

- The Bank of Japan began emergency bond purchases on Thursday after the yen dropped to a 32-year-low against the dollar. Additional intervention could be in the works.

- Economic growth in the six-member Gulf Cooperation Council will remain strong but slow significantly next year as high oil prices hurt demand for the commodity, economists say.

- The U.K.’s prime minister resigned after just six weeks in office, the shortest tenure on record, after her failed tax cut plan sent the country’s currency crashing and forced Bank of England intervention.

- India’s economy will grow well below its potential over the next two years as the central bank’s rate hikes show little progress in easing price pressures.

- Canadian home prices fell by a record 3.1% from August to September, led by sharp declines in Ontario.

- Walmart’s Mexico unit posted a 10% jump in third-quarter profit despite rising logistics and labor costs.

- Mexico’s Grupo Financiero Banorte, which owns one of the country’s largest banks and pension funds, raised its full-year outlook after a 30% surge in third-quarter profit.

- Sweden’s Ericsson and Finland’s Nokia missed quarterly estimates as both companies were engaged in expensive patent litigation.

- Canada ranks highest among G-7 nations in greenhouse gas emissions, with the U.S. ranked second.

Some sources linked are subscription services.