MH Daily Bulletin: October 14

News relevant to the plastics industry:

At M. Holland

- Plastics News interviewed experts at M. Holland about how material and chemical suppliers are working to meet automotive OEM demands for both electric and internal combustion vehicles amid an ongoing market shift. Click here to read the article!

- M. Holland, in collaboration with LyondellBasell, will boost medical packaging manufacturers’ access to medical-grade resins and help ensure regulatory confidence for OEMs. Click here to read the full press release.

Supply

- Oil broke a three-day losing streak on Thursday, settling 2% higher on signs of low diesel inventories.

- In mid-morning trading today, WTI futures were down 3.3% at $86.13/bbl, Brent was down 2.7% at $91.98/bbl and U.S. natural gas was down 3.8% at $6.48/MMBtu.

- U.S. crude stocks rose by nearly 10 million barrels last week after another big release from strategic reserves, according to the administration.

- U.S. oil and gas producers have slashed debt by more than $26 billion since the end of 2019 amid a shift from boosting production to strengthening balance sheets.

- OPEC’s decision to cut output in November has driven up prices and could push the global economy into recession, the IEA says.

- BlackRock, the world’s biggest asset manager, says it is ready to start investing in U.S. energy pipelines once more projects get the greenlight from federal regulators.

- One of four unions negotiating with TotalEnergies in France walked out of talks today, vowing to continue a three-week strike that has shut 60% of the nation’s refining production.

- European gas prices spiked briefly Thursday after a hoax bomb threat at a Norwegian gas plant.

- America’s largest coal producer, Peabody Energy, is in talks to combine with Australian rival Coronado Global Resources, potentially creating a new global giant worth $6 billion.

- Institutional investors are surging back into the Canadian oil and gas sector after shunning the industry over environmental concerns in recent years.

- More oil and gas news related to the war in Europe:

- Europe’s largest refinery in the Netherlands malfunctioned late Wednesday with the potential to worsen the continent’s tight fuel situation.

- France began sending natural gas directly to Germany on Thursday to ease prices in Europe’s biggest economy.

- EU ministers could propose a new plan to cap gas prices bloc-wide at a meeting next week, according to reports.

- Russian oil revenues fell by $3.2 billion to $15.3 billion in September, the lowest of the year.

- European electricity use is falling to the lowest levels of the pandemic despite some countries still needing to curb demand further ahead of winter.

- Power has largely been restored across Ukraine following this week’s attacks by Russia on Ukrainian energy facilities. Ukrainian officials are urging people to stock up on batteries and blankets in preparation for more attacks this winter.

- German officials are gathering today to break an impasse over extending the life of the country’s remaining nuclear plants beyond their planned phaseout.

- Goldman Sachs predicts hydrogen generation could eventually grow into a $1 trillion-per-year market.

- Air Products and Chemicals, Inc., plans to invest about $500 million to build a large green liquid hydrogen production facility in Massena, New York.

- Utilities are tapping into machine learning and weather forecasting to better predict output from wind and solar farms.

- Mexico’s deputy economy minister was asked to resign this week, stripping the country of its last key negotiator amid an escalating energy dispute with the U.S. government.

- Citing environmental concerns, Spain is withdrawing from a major European treaty that seeks to protect energy investments.

Supply Chain

- Drought continues spreading across the U.S. Midwest, drying up the Mississippi River and its key tributaries that serve freight transportation.

- The U.S. Gulf Coast and its critical refineries have largely been spared from this year’s hurricane season.

- Hundreds of homes in Australia were without power Thursday as the latest weather system associated with La Niña flooded the nation’s east coast.

- South African miners are losing $44 million in export revenue per day due to an ongoing strike at state-owned logistics firm Transnet.

- The average U.S. cost of diesel rose to $5.22 a gallon last week, the highest level since late July.

- Container shipping rates from Asia to the U.S. West Coast have dipped below $2,500, sharply down from last year’s peak over $10,000. HSBC analysts expect container rates to bottom around mid-2023.

- Container ship values are plummeting as freight rates fall.

- Phoenix is emerging as one of the fastest-growing logistics hubs in the U.S. due to its affordability compared with California’s Inland Empire.

- Chinese chipmaker TSMC, squeezed between slowing demand and rising costs, cut its capital expenditure forecast by 10%.

- Samsung Electronics was granted a one-year exemption from new U.S. restrictions that block exports of advanced chips and related equipment to China.

- U.S. regulators are set to ban approvals of new telecom equipment from China’s Huawei Technologies and ZTE on national security grounds.

- China’s export growth is expected to have slowed further in September as overseas demand weakened.

- In the latest news from the automotive industry:

- Stellantis is cutting one of three shifts at its truck plant in Warren, Michigan, due to computer chip shortages.

- A joint venture between Sony and Honda aims to deliver its first electric vehicles by 2026 and will sell them online in the U.S. and Japan.

- Passenger vehicle sales in India nearly doubled in September from a year ago, while production rose 88%.

- Siemens signed a $7 billion deal with a joint venture of Stellantis, Mercedes-Benz and TotalEnergies to supply equipment and technology for electric-vehicle battery plants.

- Stellantis signed a framework agreement to begin car production in Algeria.

- Volkswagen’s $2 billion joint venture with Chinese tech firm Horizon Robotics will develop self-driving tech on a single chip that will be available only in China.

- U.S. and EU officials expect to reach agreement to grant EU companies, including electric-vehicle makers, the same status as U.S. makers in the U.S. market. Trade officials agreed to speed up talks on global steel issues and industrial subsidies.

- Amazon is shutting down warehouse robotics startup Canvas and reorganizing its robotics division.

- About 30 workers at an Amazon fulfillment center in Joliet, Illinois, walked off the job in a dispute over wages and workplace safety.

- The United Steelworkers ratified a contract with Cleveland-Cliffs, while rival U.S. Steel and the union remain divided.

Domestic Markets

- The U.S. reported 63,926 new COVID-19 infections and 653 virus fatalities Thursday.

- The U.S. administration extended the pandemic’s emergency status for another 90 days, preserving expanded Medicaid and higher payments to hospitals.

- Pfizer’s Omicron-tailored COVID-19 vaccine provides a strong immune response to the BA.4 an BA.5 subvariants, new data shows.

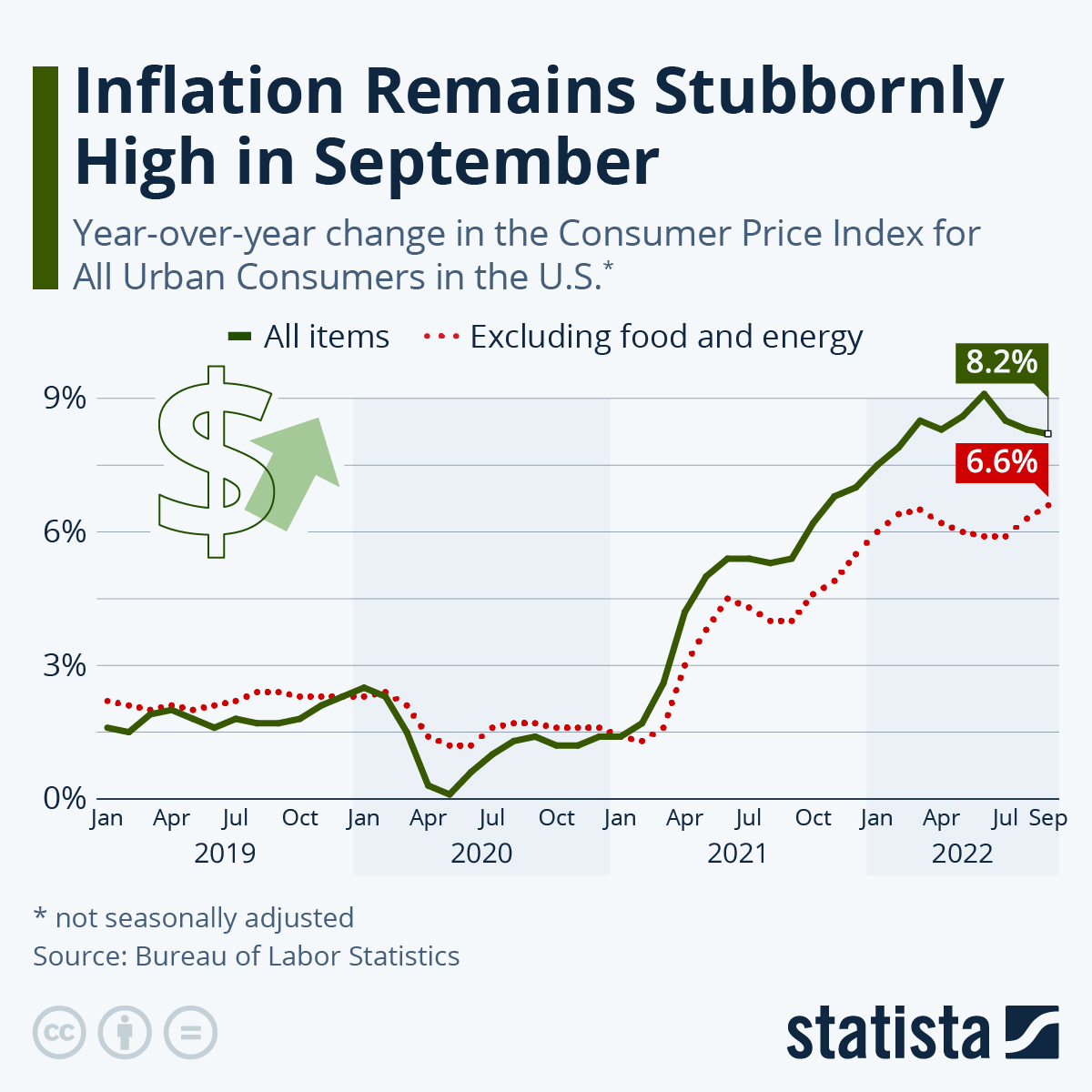

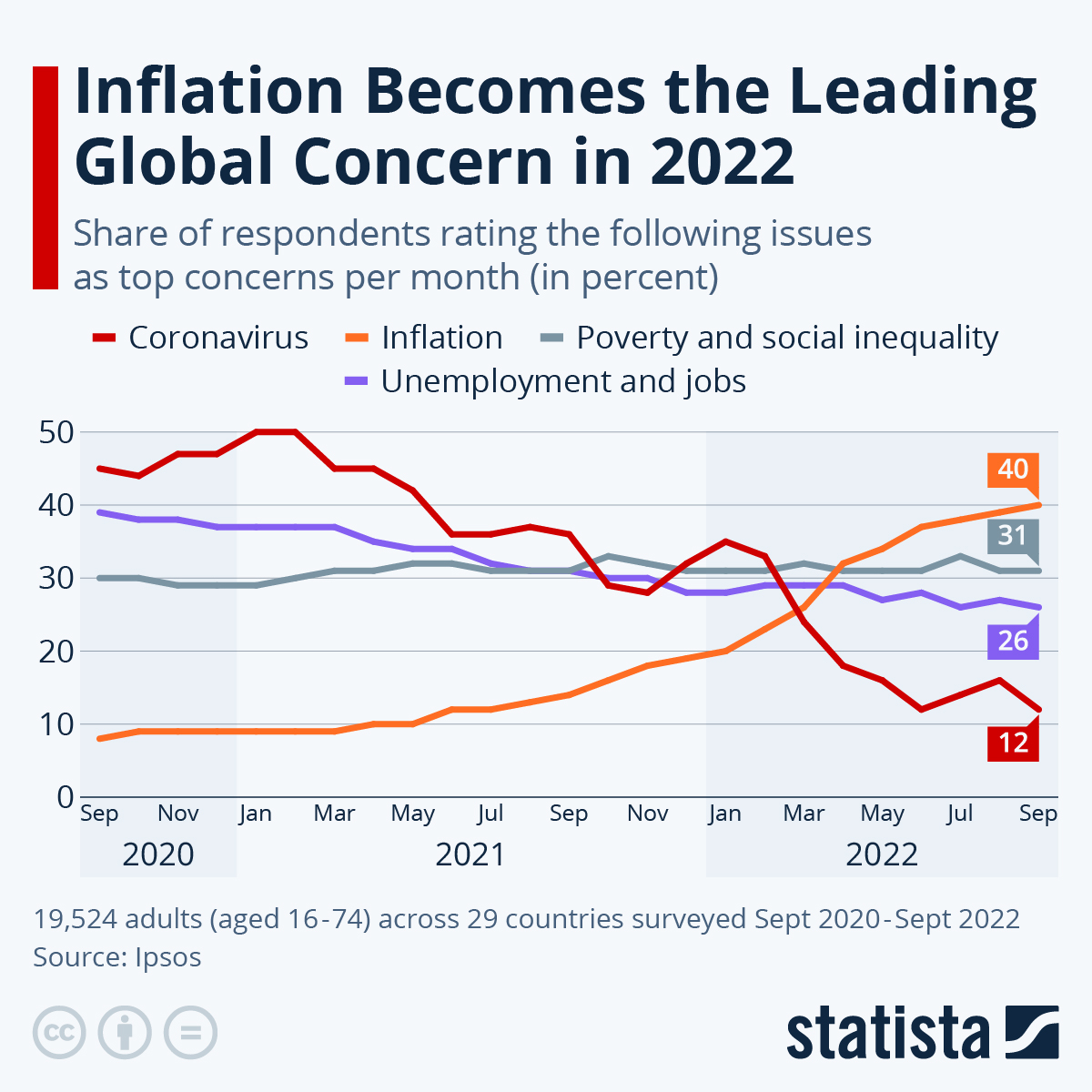

- September’s 40-year high inflation was led by the biggest surge in rent prices since 1990 and food prices rising a surprising 0.8%.

- Analysts say the inflation numbers have sealed the Federal Reserve’s plan to raise interest rates another 75 basis points at its next meeting in November.

- JPMorgan Chase leadership says the U.S. Federal Reserve could conceivably raise interest rates beyond 4.5% if inflation persists.

- Leaders from the largest U.S. banks are warning against the government’s possible tightening of capital requirements for large regional lenders, saying the move would constrain lending.

- Analysts now believe third-quarter earnings for S&P 500 firms will grow just 4.1%, down from an 11.1% prediction made in July.

- While costs to transport goods have declined and supply-chain snarls are easing, prices are now rising rapidly in the U.S. services sector, jumping 0.8% in September.

- Social Security checks will be 8.7% bigger in 2023, the largest cost-of-living adjustment in four decades.

- The average U.S. mortgage rate jumped to 6.92% this week, the highest in two decades, according to Freddie Mac.

- United Airlines is preparing to order more than 100 widebody jets, one of the largest-ever purchases of long-range aircraft, as it studies offers from Boeing and Airbus.

- Delta Air Lines raised its fourth-quarter profit forecast as travel demand remains robust despite growing risks of a recession and U.S. airfares that were 43% higher in September than a year earlier.

- Kroger is in talks with smaller rival Albertsons over a potential combination that could unite the two largest supermarkets in the U.S.

- Walgreens posted a 5.3% drop in third-quarter revenue but saw better-than-expected profit from higher sales in Britain.

- Domino’s Pizza beat quarterly sales estimates on steady demand for its “inflation relief” discounts.

- BlackRock, the world’s largest asset manager, saw profit fall 16% in the latest quarter on a broad decline in equities.

- Venture-capital firms are buying shares of high-profile tech companies for the first time in years as startup investment slows and stocks appear to be at a discount.

- Late-stage U.S. startups are scooping up talent unlocked by layoffs and hiring freezes at major tech companies.

International Markets

- Shanghai reported 47 COVID-19 cases Wednesday, a three-month high that has prompted school shutdowns and fears of rising infections. Several other major cities, including the port city of Tianjin and the manufacturing hub of Zhengzhou, have imposed regional lockdowns.

- Taiwan began welcoming back visitors this week after ending mandatory quarantines to control the spread of COVID-19.

- The rapid evolution of the COVID-19 Omicron variant makes it one of the fastest-spreading diseases known to humanity, with some 30 mutations being spotted across the world.

- The U.K. prime minister fired her treasury minister and reversed course on previously announced tax cuts that sent the pound crashing and forced the Bank of England to intervene.

- The EU central bank could start selling off its 3.3 trillion-euro asset bond portfolio, known as quantitative tightening, sometime in the second quarter of 2023.

- German consumer prices rose 10.9% year-over-year in September, officials said, confirming preliminary figures.

- British financial markets rallied Thursday as investors bet the government would reverse course on its recent tax-cutting plans, which drew public ire from the head of the IMF on Thursday.

- Lawmakers in France approved raising taxes on dividend payouts by large corporations making windfall profits.

- Positive impacts from Japan’s September currency intervention will likely be short-lived as the nation’s economic fundamentals remain uncertain.

- Tightening global financial conditions and stubbornly high inflation have clouded the outlook for Latin American and Caribbean economies, the IMF says. Consumer prices for the region are forecast to rise 14.6% by year’s end.

- Japanese wholesale prices rose 9.7% in September, the most in five months, putting pressure on business profits.

- India’s retail inflation rate likely peaked in September at 7.41%, analysts say.

- Canadian mergers-and-acquisitions deals in the third quarter dropped 52% to $37 billion, the lowest since 2020, as volatile stock markets and rising borrowing costs spooked sentiment for dealmaking.

- Local Chinese governments have begun buying up homes in bulk to prop up the nation’s ailing real estate market, as new data shows the central government’s massive stimulus is failing to spark housing demand.

- The Bahamas is putting price control measures on 38 staple goods as it seeks to help households brave mounting inflation.

- A Brazilian court fined Apple $19 million and ruled that its iPhones must come equipped with battery chargers.

- Qantas Airways surprised markets with a stronger-than-expected profit forecast that underscores how some Asian airlines are recovering sharply from the pandemic.

- Europe’s largest airlines say demand for travel is holding up, calming worries that inflation could stall aviation’s recovery from the pandemic.

- IKEA reported record-high annual sales of $43.3 billion.

- British officials say the use of cheap carbon offsets could reduce the need for companies to truly reduce emissions and slow the delivery of climate goals.

Some sources linked are subscription services.