MH Daily Bulletin: October 12

News relevant to the plastics industry:

At M. Holland

- Plastics News interviewed experts at M. Holland about how material and chemical suppliers are working to meet automotive OEM demands for both electric and internal combustion vehicles amid an ongoing market shift. Click here to read the article!

- M. Holland is a Gold Sponsor of the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, now through Oct. 13! If you are attending, please stop by booth 113 to discuss our materials and offerings serving the wire and cable market.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland’s expert group of panelists will discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register!

Supply

- Oil fell 2% Tuesday, the third day of declines as COVID-19 infections rose again in China.

- In mid-morning trading today, WTI futures were down 1.5% at $88.00/bbl, Brent was off 1.4% at $93.00/bbl and U.S. natural gas was up 1.0% at $6.66/MMBtu.

- Banker Standard Chartered lowered its forecasts for U.S. GDP and global oil demand next year, no longer expecting crude demand to exceed 2019’s historic peak.

- Tuesday marked the 22nd day of a strike among French refinery workers, prompting government intervention to recall or hire staff as the nation’s first regions began to ration fuel. Some two-thirds of France’s refining capacity remains offline.

- European and U.S. diesel refining margins have surged to all-time highs as France’s worker strike worsens the global shortage of distillate fuels.

- China’s crude imports rose in September but were 4.8% lower than the prior-year period.

- The U.S. administration says it is reevaluating its relationship with Saudi Arabia after OPEC+ imposed a sharp output cut for November.

- The White House indicated it may release even more crude from strategic reserves to counter OPEC’s looming production cuts.

- More oil and gas news related to the war in Europe:

- Driven by growing demand for gas in Europe, LNG carrier rates are up almost 500% this year to all-time highs nearing $400,000 a day.

- EU energy ministers are meeting today in Prague to potentially push ahead with a bloc-wide cap on natural gas prices. The news comes as joint European funding for emergency energy measures, once opposed by Germany, gains traction.

- Europe will likely be short 15% on natural gas this winter compared to average demand levels.

- Israel and Lebanon agreed to a U.S.-brokered deal on a maritime border issue Tuesday, paving the way for Israel to start exporting gas to Europe.

- Britons are stocking up on electric blankets and candles in preparation for gas shortages this winter.

- Russia’s fuel exports to India grew fivefold in July and August, and shipments to China were up 17%.

- Tunisia’s deepening fuel crisis is causing miles-long queues outside the nation’s gas stations.

- U.S. shale producer EOG Resources lost some $847 million in the third quarter on wrong-way bets on energy prices.

- Cameco and Brookfield Renewable Partners will buy Westinghouse Electric Co. in an $8 billion deal that could boost nuclear power capacity.

Supply Chain

- Tropical Storm Karl is expected to weaken before hitting southwest Mexico’s Atlantic coast on Thursday.

- The U.S.’s third-largest rail union rejected a deal with major railroads, renewing the potential of a strike.

- XPO Logistics named a new chief financial officer as it prepares to spin off its RXO freight brokerage business, part of a broader restructuring.

- Rates for bulk shipping’s largest capesize vessels rose 250% over the past month.

- The global air cargo industry is not seeing the pickup it expected as it enters its peak season.

- Chilean miners are looking for alternatives to rail to transport product amid a growing wave of crime in the country’s main mining region.

- Intel is planning a major reduction in headcount, likely numbering in the thousands, to cut costs and cope with slowing PC sales.

- Intel is restructuring to provide more separation between chip designers and chip-making factories, which it hopes to operate like other chip foundries in the coming years.

- U.S. chip toolmaker KLA will stop offering some supplies to China-based customers this week to comply with the White House’s new export restrictions. Shares of Asia’s largest chip makers continued falling Tuesday, erasing some $240 billion from the sector’s global market value.

- Adobe expects online sales during the holiday season to grow 2.5% this year to about $210 billion after expanding 8.6% last year.

- Amazon kicked off its second major sales event of 2022 this week, spurring a flurry of discounts at other retailers and websites trying to match the trend.

- A German trade union told its workers to strike at Amazon facilities during its major sales event this week.

- In the latest news from the automotive industry:

- GM is starting an energy business to sell power-storage units and services to homeowners and commercial clients, an offshoot of the automaker’s battery development for electric vehicles.

- Europe’s energy crisis could cut the bloc’s car production by 40% through the end of 2023, S&P Global says.

- Honda and LG announced plans for a $4.4 billion electric-vehicle battery plant in Ohio.

- Nissan is selling its Russian business for 1 euro and taking a $687 million loss.

- Renault is searching for a partner to help carve out its combustion-engine business and bring costs to scale, particularly for hybrid vehicles.

- Chinese electric-vehicle maker BYD launched its first passenger car in India this week as it works to capture 40% of the nation’s EV market by 2030.

- Volkswagen wants to automate up to 30% of production at a new German factory set to go live in 2025.

- Electric-vehicle sales in China rose at their slowest pace in five months in September as demand faltered.

- Stellantis announced a medium-term goal to use 35% recycled material in its vehicles.

- Electric-vehicle battery maker Britishvolt is in talks to sell its main factory site in the U.K.

- GM is investing $69 million to take an equity stake in Queensland Pacific Metals, a bid to secure nickel and cobalt for battery cells.

- Waymo completed autonomous-truck deliveries of Constellation Brands’ beers over several months under a test with C.H. Robinson Worldwide.

- Chinese e-commerce logistics provider Zongteng Group is starting an international air cargo service with delivery of its first Boeing 777 freighter.

- After four years of legislative debate, Chile has joined the 11-country Trans-Pacific Partnership trade pact, boosting access for other members to the world’s biggest miner of copper.

Domestic Markets

- The U.S. reported 51,155 new COVID-19 infections and 629 virus fatalities Thursday.

- Survey results suggest about half the U.S. population knows little or nothing about new Omicron-tailored COVID-19 booster shots.

- AstraZeneca is cutting some COVID-19 vaccine production due to waning demand.

- AstraZeneca’s attempt to create a nasal spray version of its COVID-19 vaccine suffered a setback Tuesday as initial human testing returned poor results.

- Sore throat is now the dominant symptom of COVID-19 infection, health experts say.

- Producer prices rose 0.4% last month, driven by food and home heating costs.

- U.S. households expect to pull back sharply on spending over the coming year even as year-ahead forecasts for inflation fall.

- The six biggest U.S. banks likely put aside $5 billion in the third quarter to cover future loan losses in the event of a global recession.

- The U.S. federal deficit was halved to $1.4 trillion in the just-ended fiscal year as tax revenues rose and pandemic spending fell sharply.

- U.S. small business confidence improved in September as labor shortages eased, according to the National Federation of Independent Business.

- A new proposal from the U.S. administration could upend the gig economy by requiring that “economically dependent” workers be considered employees, making it harder for companies to treat workers as independent contractors. Shares of Uber, Lyft and other gig companies tumbled on the news.

- Home flippers are experiencing sharp losses due to falling home demand and rising mortgage rates.

- American Airlines’ initial Q3 results show a 13% increase in revenue despite the carrier trimming its flight schedule by 10%.

- Delta Air Lines invested $60 million in an air taxi startup to bring service to and from airports in New York and Los Angeles.

- Tractor Supply Co. was able to move forward with its $320 million acquisition of Orscheln Farm & Home following a year and a half of regulatory negotiations.

International Markets

- Chinese authorities stepped up COVID-19 testing in Shanghai and Shenzhen after daily infections touched a two-month high of 2,089 Monday, more than tripling over the past week.

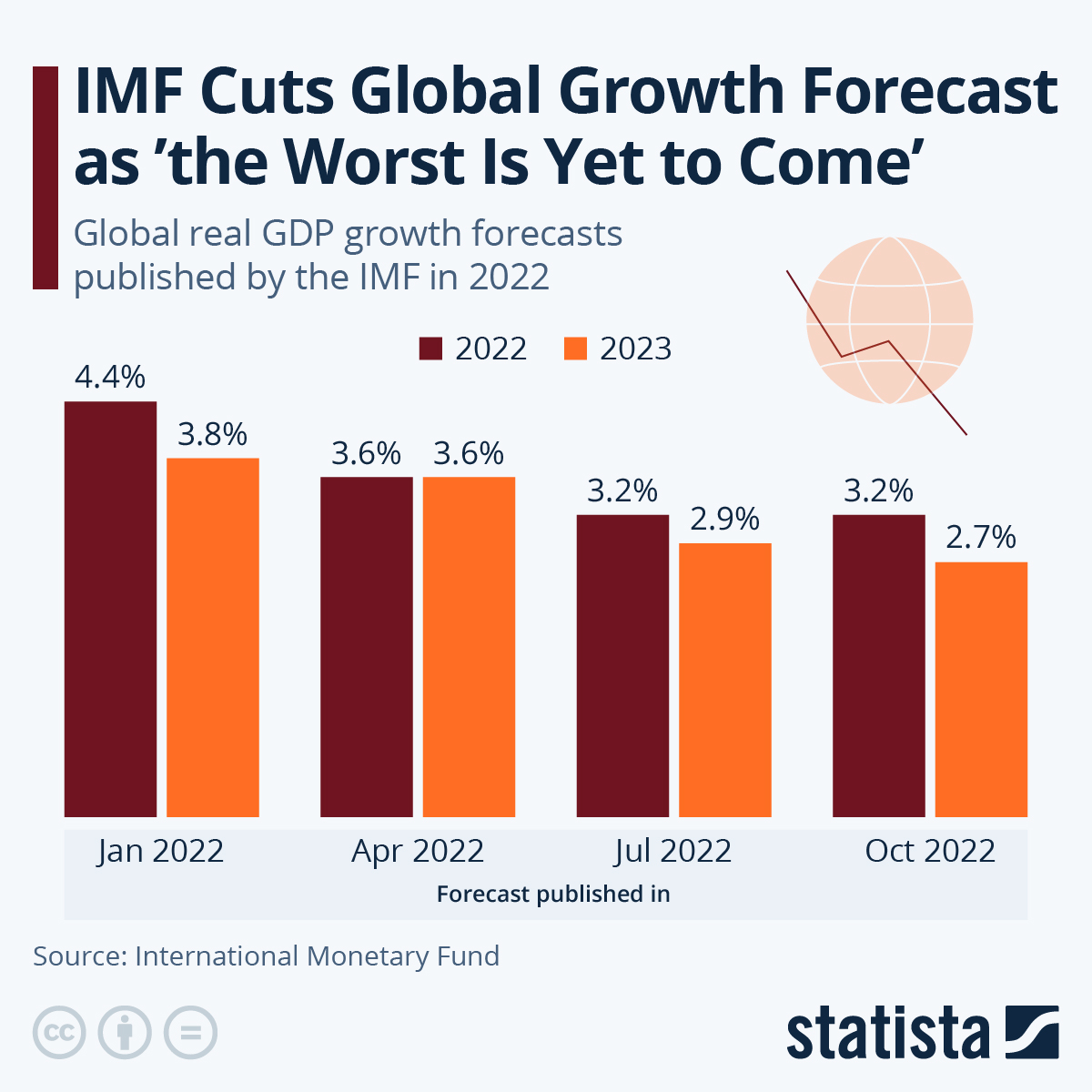

- Warning that the global economy “is experiencing a broad-based and sharper-than-expected slowdown,” the IMF said global financial stability is being increasingly threatened by inflation and rising interest rates that will slow growth from 3.2% to 2.7% this year. The IMF cut its growth forecast for Asia but raised its forecast for Latin America and the Caribbean.

- G7 nations issued a public declaration to support Ukraine indefinitely in its war against Russia.

- Russia’s currency slumped to a three-month low against the dollar on Tuesday. The nation’s economic activity pulled back sharply in September and will likely not bottom out until the first half of next year.

- South Korea’s central bank raised its benchmark interest rate by 50 basis points to 3% on Tuesday while signaling more policy tightening to come.

- U.K. grocery inflation set another record high of 13.9% in September, deepening the nation’s cost-of-living crisis.

- India’s retail inflation hit a five-month high of 7.30% in September, largely due to the rising cost of food.

- Consumer prices in Brazil contracted for a third month in September, benefiting from major tax cuts on fuels and electricity.

- Vietnam’s rising popularity as a manufacturing hub is prompting higher GDP growth expectations over the next year.

- Japanese machinery orders fell by the most in six months in August on a pullback in corporate spending.

- Business confidence among big Japanese manufacturers fell to a five-month low in September.

- The U.S. dollar rose to a fresh 24-year high against the Japanese yen Tuesday, above the level that triggered Japan’s central bank to intervene in markets last month.

- Chinese bank lending doubled from August to September after the central bank expanded support for infrastructure and manufacturing investments.

- London Heathrow airport says travel demand will slow this winter due to downbeat economic forecasts and possible new waves of COVID-19.

- Asia-Pacific flight volumes should recover to around 73% of pre-pandemic levels by year-end, officials say.

- Boeing expects travel activity to expand faster in Latin America than other parts of the world over the next two decades.

- Luxury fashion firm LVMH saw a 27% rise in third-quarter revenue on greater demand from the U.S. and China.

Some sources linked are subscription services.