MH Daily Bulletin: October 11

News relevant to the plastics industry:

At M. Holland

- Plastics News interviewed experts at M. Holland about how material and chemical suppliers are working to meet automotive OEM demands for both electric and internal combustion vehicles amid an ongoing market shift. Click here to read the article!

- M. Holland is a Gold Sponsor of the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, now through Oct. 13! If you are attending, don’t miss M. Holland’s presentation on new products and sustainability solutions this afternoon. Click here for more details.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland will host panelists from Maersk and Bank of America to discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register!

Supply

- Oil fell almost 2% Monday on fears of looming recessions hitting demand.

- In mid-morning trading today, WTI futures were down 1.5% at $89.73/bbl, Brent was down 1.4% at $94.82/bbl, and U.S. natural gas was up 0.3% at $6.46/MMBtu.

- At $3.919 a gallon, the average U.S. gasoline price is up 3% since OPEC+ announced its November production cuts last week.

- The average American’s heating bill is expected to rise 17.2% this winter as natural gas supply tightens.

- Some U.S. energy experts say domestic natural gas supply could exceed demand next year as growth in LNG exports slow awaiting needed infrastructure improvements.

- European natural gas prices fell to three-month lows on Monday thanks to mild weather and healthy import volumes.

- Saudi Aramco plans to maintain volumes to Asia despite OPEC’s planned output cuts next month, a move that could mitigate their impact.

- Iraqi officials indicated they may break with OPEC’s move to slash output in November due to pressing needs for cash.

- Some Iranian petrochemical workers went on strike Monday amid a wave of civil unrest in the nation.

- France began releasing fuel reserves for sugar producers after they warned a lack of diesel would force plants to shut down.

- Labor unrest in France has shut down two-thirds of the nation’s refining industry, forcing U.S. producers to divert shipments to Asia.

- A final investment decision on the world’s longest LNG pipeline from Nigeria to Southern Europe won’t come until next year, officials say.

- More oil and gas news related to the war in Europe:

- Europe will continue deliberating about a cap on gas prices over the coming weeks, a lingering issue that contrasts with the bloc’s swift approval of other measures, such as windfall taxes and curbs on electricity use.

- Germany will rapidly approve a $93 billion plan to pay consumer and business gas bills this winter and limit prices starting in March.

- Germany reversed course and began supporting the joint EU issuance of debt to cushion the blow of rising energy costs this winter.

- Britain is forging ahead with revenue limits on renewable power producers to help keep household bills down this winter. Nine out of every 10 Britons say they are concerned about energy bills.

- Britain’s grid operator warned it may have to impose three-hour power cuts this winter to preserve energy.

- Europe’s complicated new sanctions, including a price-cap on Russian oil, could end up shutting in large amounts of the nation’s crude, experts say. Russia has already lost 60% of seaborne crude sales to Europe since February.

- Companies across Europe are offering one-off employee bonuses to help with surging food and energy bills this winter.

- Germany joined Denmark and Sweden in investigating the origins of explosions that ruptured the Nord Stream 1 and 2 pipelines from Russia last month.

- Exxon Mobil is considering an acquisition of U.S. oil and gas producer Denbury, which specializes in using CO2 to extract oil from old wells.

- Honeywell says its new technology will allow it to boost production of ethanol-based jet fuel, a glimmer of hope for aviation’s intractable emissions problem.

- Tokyo Gas will sell stakes in four Australian LNG projects to a unit of U.S. private-equity firm EIG.

Supply Chain

- Central America’s death toll from tropical storm Julia rose to 25 Monday as the storm weakened and dumped heavy rain on southern Mexico.

- An 11,000-worker union of rail track builders rejected the latest contract offer from U.S. railroads, joining one of several others to reject the tentative deal brokered by the White House last month.

- U.S. container imports will fall 9.4% this month and 4% in the second half of the year, according to the Global Port Tracker.

- Deutsche Post will hike its full-year guidance in the coming weeks after easing logistics snarls helped it move more e-commerce shipments in the third quarter.

- Global air cargo tonnage was down 12% the past two weeks from a year ago, according to WorldACD.

- This year, online holiday sales in the U.S. are set to rise at their slowest pace since 2015 as inflation bites consumers.

- U.S. retailers are already starting Black Friday deals in a bid to clear out excess inventories that have piled up for months.

- U.S. restrictions on computer-chip equipment to China will hurt the nation’s fast-emerging semiconductor firms and could even halve growth in its largest chipmaker SMIC next year, analysts say.

- U.S. air transportation jobs increased by 3,000 in September, partially offsetting the 11,400 decline in trucking jobs.

- In the latest news from the auto industry:

- Shares of U.S. automakers fell Monday after Swiss bank UBS warned of “demand destruction” and an oversupply of vehicles next year.

- BMW’s third-quarter sales were flat with last year, a positive sign after the automaker suffered steep supply shortages in the first half of 2022.

- Unionized auto workers in Italy are heading into their negotiations with demands for an 8.4% boost in 2023 wages to offset rising household expenses.

- Rising electric-vehicle demand is pushing automakers toward more long-term deals with raw material suppliers and miners.

- Shares of Rivian Automotive fell sharply on Monday after the automaker recalled nearly all its vehicles due to a steering issue, throwing next year’s production targets into doubt.

- Chinese electric-vehicle battery-maker CATL, the world’s largest, could see profits surge by 200% in the third quarter.

- The global electric-vehicle market is expected to grow from $17 billion to more than $95 billion by 2028.

- The rumored reorganization of Nissan’s alliance with Renault, now confirmed, could see the Japanese automaker invest in Renault’s soon-to-be electric-vehicle unit.

- Tesla and its Chinese rival BYD both broke their monthly record for China deliveries in September.

- Electric-vehicle makers and their suppliers are rushing to capital markets to raise money to take advantage of surging demand.

- Amazon is ending field tests of its Scout autonomous delivery robot, which failed to meet customer expectations, forcing the reassignment of the business unit’s 400 employees.

- Peel Ports Group says it is considering layoffs at the Port of Liverpool site hit by dockworker strikes.

- The London Metal Exchange is floating a ban on Russian metal, a move that could harm the country’s huge aluminum industry and create problems for international supply chains.

- Container ship activity at Russia’s Far East ports grew sharply in the third quarter.

Domestic Markets

- The U.S. reported 21,876 new COVID-19 infections and 117 virus fatalities Monday. Yesterday, the seven-day average for new cases fell below 40,000 for the first time in six months.

- Nearly all Americans can stop wearing masks indoors as less than 1% of the country lives in an area with “high” COVID-19 spread, according to the CDC.

- Los Angeles reported its first case of the BA.2.75.2 variant of COVID-19 that is evading immunity in Asia and Europe.

- Webpages for some large U.S. airports were briefly shut down Monday due to alleged cyberattacks.

- The U.S. Federal Reserve is closely aligned on raising its benchmark interest rate to around 4.5% by March, according to reports.

- JPMorgan Chase’s chief executive says the U.S. and global economy will likely tip into a recession by the middle of next year.

- The U.S. unemployment rate fell below expectations to 3.5% in September, matching July’s 29-month low in a sign that overall labor market conditions remain tight.

- Third-quarter results for big U.S. businesses are poised to soften due to inflationary pressures, despite many being able to boost prices this year with limited pushback from consumers.

- U.S. startups continue taking on debt at similar levels to recent years despite rising interest rates, data shows.

- California-based diagnostics firm Bio-Rad Laboratories is in talks to merge with Qiagen NV in what would be one of the biggest mergers in the healthcare testing domain at over $10 billion.

- Ben Bernanke, the former chair of the U.S. Federal Reserve who oversaw its response to the 2008 financial crisis, won a Nobel Prize in economics along with two others.

International Markets

- China locked down parts of Xinjiang and Shanghai on Monday as daily COVID-19 cases neared 2,000, the most since August. Restrictions were also imposed in northern China and Inner Mongolia.

- COVID-19 cases are rising in Germany following the nation’s seven-day Oktoberfest celebration.

- Japan is reinstating visa-free travel for dozens of countries today, ending some of the world’s strictest border controls of the pandemic.

- A third of the global economy will see at least two straight quarters of contraction this year and next as the world tips into recession, the IMF and World Bank say.

- Investor morale in the euro zone has fallen for a third month and is now at its lowest point since May 2020.

- The Bank of England warned of “material risk” to the nation’s financial markets after it was forced to further intervene to prop up British sterling today. The crises of confidence following the governments ill-fated plan for unfunded tax cuts spread to the mortgage market, where interest rates topped 6% for the first time in more than a decade.

- Economists say Britain is poised to see the biggest shock to its housing market since the 2008 financial crisis as widespread variable mortgage rates reset higher. The nation’s lackluster consumer spending also suggests pending financial pain.

- U.K. unemployment fell to 3.5% in the three months through August, the lowest in five decades, as nearly 22% of eligible workers sit out of the active workforce, including a record number suffering long-term illness.

- Shares in China’s largest tech firms plummeted Monday as the U.S.’s new export control measures spooked investors.

- Renewed COVID-19 lockdowns in China are denting consumer spending and travel.

- Personal computer sales plummeted nearly 20% year over year in the third quarter, the biggest drop in records going back over two decades.

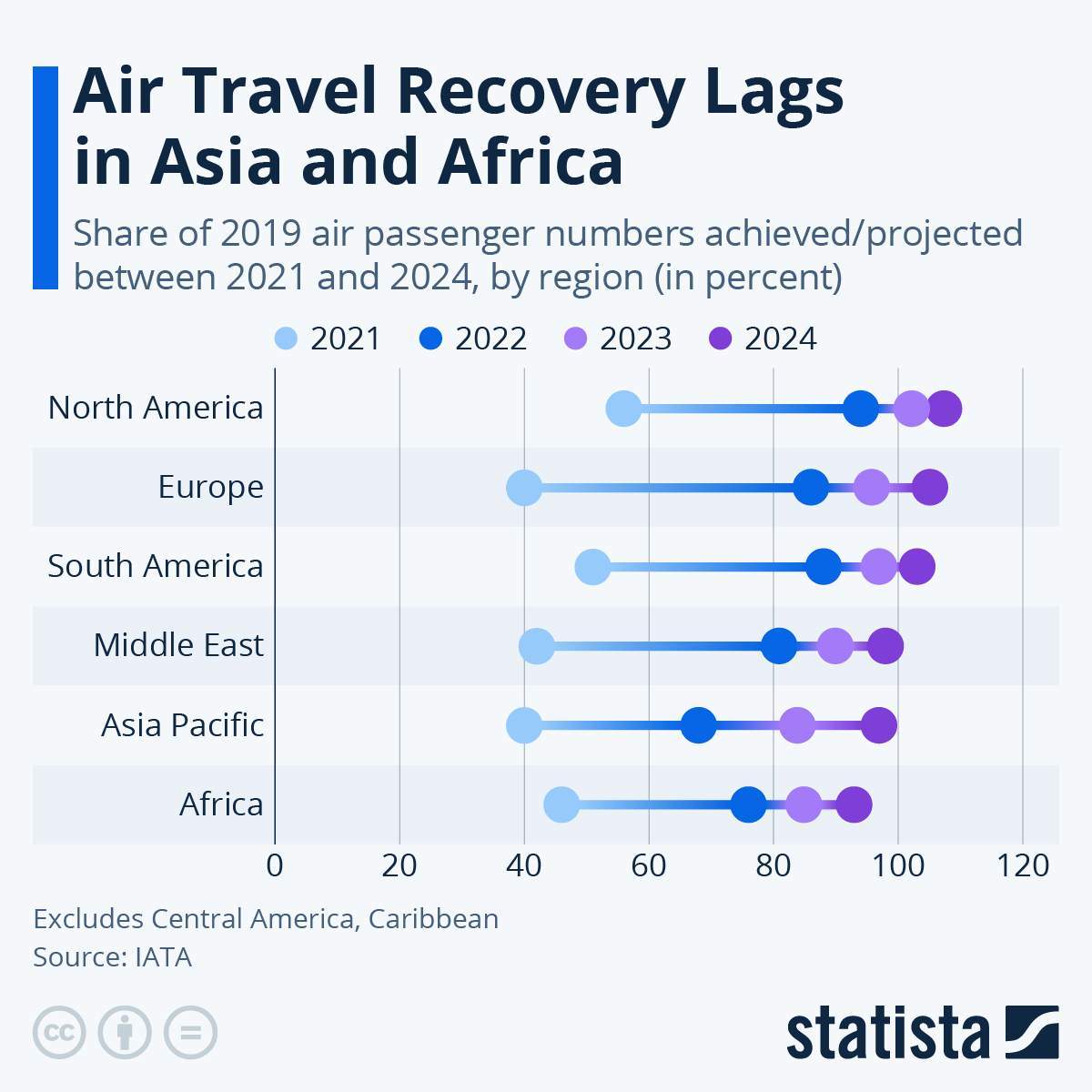

- Airbus is on track with its delivery targets this year, including 55 aircraft in September and 437 year to date.

- On Monday, a Boeing 737 MAX made the first commercial flight in Chinese skies since Beijing grounded the plane in 2019.

- Air traffic in India is strengthening, with passenger traffic approaching pre-pandemic levels this month.

- A Brazilian state-run bank started funding exports of Embraer aircraft to some regional carriers in the U.S.

- French luxury groups LVMH, Kering and Hermes are set to post double-digit third-quarter sales growth as demand for high-end fashion remains strong.

Some sources linked are subscription services.