MH Daily Bulletin: October 4

News relevant to the plastics industry:

At M. Holland

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference happening this week in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland will host panelists from Maersk and Bank of America to discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register!

- M. Holland’s latest press release features our post-consumer recycled (PCR) resins, which are cleaner and easier to color, enabling brand owners and OEMs to meet aggressive sustainability goals. Click here to read the full press release.

Supply

- Oil rose 5% Monday, its biggest rally since July, on fears that OPEC+ will cut November output by over 1 million bpd, what would be the largest cut since 2020.

- In mid-morning trading today, WTI futures were up 2.0% at $85.28/bbl and Brent was up 2.1% at $90.70/bbl. U.S. natural gas rose 2.9% to $6.66/MMBtu, but remained near three-month lows.

- Roughly 60% of French refining capacity remains offline as nationwide strikes across the country’s energy sector stretch into their eighth day.

- Chinese refiners are poised to ramp up exports of oil products into early 2023 after getting the biggest allocations from Beijing so far this year.

- China’s economic slowdown has allowed the sale of excess deliveries from long-term U.S. LNG contracts, creating a windfall for some Chinese energy companies.

- The U.K. is readying a new round of oil and gas exploration licenses for the first time in years, although boosted supplies likely won’t come for another decade.

- Israel and Lebanon are close to striking a U.S.-brokered deal on maritime borders that would allow Israel to export gas to energy-starved Europe.

- The White House is seeking feedback from a wide variety of industries on using the Defense Production Act to support investment in clean energy.

- The U.S. government is working on plans to distribute hundreds of millions of dollars to plug abandoned oil and gas wells in the coming years.

- Japan struck a deal with Malaysia’s Petronas to supply LNG to fill winter reserves.

- More oil news related to the war in Europe:

- European natural gas prices fell 10% Monday on signs the continent has sufficient inventories for the winter.

- European gas demand is down 10% from last year, driven by a 15% decline in industrial-sector use as firms curtail production due to soaring prices. EU gas use will drop an additional 4% next year, the IEA says.

- European officials are moving closer to a price-cap plan for Russian oil after meeting in Brussels Monday. They also pledged to soon unveil support measures aimed at shielding against soaring energy costs.

- Financially strained Hungary won a three-year extension from Gazprom on Russian gas bills coming due in the next six months. It is the only member of the EU still receiving natural gas from Russia.

- Britain deployed two defense ships to monitor its underwater cables and pipelines in the aftermath of last week’s Nord Stream ruptures.

- Russian crude shipments to Europe and Britain are down 60% from pre-war levels ahead of an all-out ban later this year.

- Britain’s energy regulator says there is a significant risk that gas shortages will lead to power outages this winter.

Supply Chain

- In extreme weather news:

- Multibillion-dollar upgrades to Florida’s electric grid in recent years mostly withstood the destruction of Hurricane Ian, although distribution networks to homes and businesses were widely disrupted. Roughly 560,000 Floridians remain without power due to the storm, while its death toll rose above 100.

- Lingering rain and flood risks from Hurricane Ian still posed problems for Virginia Monday.

- Tropical Storm Orlene dumped heavy rains across Mexico’s west-central Pacific coastline Monday after making landfall as a Category 1 hurricane and then dissipating.

- The U.S. will provide over $60 million in aid to help Puerto Rico’s recovery efforts from Hurricane Fiona. More than 120,000 of the island’s homes and businesses remain without power two weeks after the storm’s landfall.

- Declines in the container shipping market accelerated in September, according to Clarksons Research.

- Long-term contract container freight rates began to follow lower spot rates, dropping an average of 1.1% from August to September, the first monthly decline since January while remaining 112% higher than a year ago.

- Long-foundering dry-bulk shipping demand gained steam in September. Dry bulk rates may have hit bottom after two months of steady falls in July and August, analysts say.

- Railroad BNSF is building a $1.5 billion container-handling facility outside Los Angeles to expedite shipments inland.

- Volumes are surging at small container ports on Canada’s east coast as more terminal capacity comes online.

- Rental rates for floating LNG terminals have doubled to over $200,000 a day on surging demand for mobile fuel storage in Europe.

- Air cargo charter demand softened over the past month as airfreight markets weakened, leading some carriers to consider capacity reductions.

- Boeing and Airbus are months behind deliveries of new single-aisle jets to U.S. carriers, tightening capacity at a time of resurgent demand for air travel.

- The U.S. will announce new measures this week restricting Chinese companies from gaining access to high-performance computing technology, according to reports.

- Samsung, in a technology race with rival Taiwan Semiconductor Manufacturing, unveiled multiyear production targets for cutting-edge computer chip development.

- In the latest news from the auto industry:

- GM posted a 24% jump in third-quarter U.S. sales on easing supply-chain issues. The automaker was a performance outlier among competitors, including Toyota (-7%), Stellantis (-6%) and Nissan (-23%).

- GM regained its top spot for U.S. sales in the third quarter after Toyota last year displaced it in the lead for the first time since 1931.

- GM plans to sharply ramp up production of its Bolt electric vehicle after selling a record 14,709 units in the third quarter.

- Tesla shares dove almost 9% Monday after the automaker posted lower-than-expected deliveries in the third quarter due to supply-chain issues.

- Rising interest rates are dampening car-buying sentiment just as more new cars and trucks finally trickle into dealerships.

- Spurred by electric vehicle adoption, lithium demand is forecast to almost triple by mid-decade from last year’s level.

- Auto sales in France rose 5.5% in September, a robust turnaround from plummeting sales earlier this year.

- IKEA aims to have all its home deliveries made using electric vehicles by 2025.

- Stellantis luxury brand Maserati unveiled its first fully electric vehicle on Monday and plans for fully electric options for all its vehicles by 2025.

- Venture investment in supply-chain startups has receded this year, with financial backing down 39% and deals down 35% in the second quarter from a year earlier.

- Spice-maker McCormick & Co. trimmed its full-year guidance on persistent supply-chain challenges.

- McClellan Trucking and Duran Transfer, two Pennsylvania-based trucking companies, filed for Chapter 11 bankruptcy protection.

- Werner Enterprises acquired Indiana-based truckload carrier Baylor Trucking.

- China, the world’s biggest corn importer, is curbing exports of corn starch in a signal of growing food shortages.

- Mexico’s government made a new deal with dozens of companies to waive regulatory requirements on some food products, a bid to quell surging prices.

Domestic Markets

- The U.S. reported 40,841 new COVID-19 infections and 261 virus fatalities Monday.

- The U.S. Supreme Court declined to hear a case brought by several states challenging the federal government’s COVID-19 vaccine mandate for some healthcare workers.

- Two-thirds of U.S. adults don’t plan on getting an Omicron-tailored booster shot anytime soon, according to a Kaiser Family Foundation survey.

- Norwegian Cruise Line is the first major cruise line to end all COVID-19 testing, masking and vaccination requirements. The company’s stock sank 18% following the announcement.

- With fewer countries tracking and publishing COVID-19 data, the CDC dropped its country specific travel notices.

- In a sign that the labor market may be cooling, job openings in the U.S. fell 10% in August to 10.1 million, the lowest in more than a year.

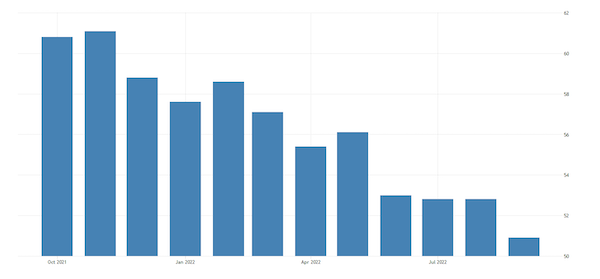

- U.S. manufacturing activity grew at its slowest pace in 2.5 years in September as new orders contracted amid aggressive interest-rate hikes, according to the ISM’s Purchasing Managers Index.

- U.S. home prices took a downward turn in August, declining almost a full percentage point from July for the biggest monthly decline since 2009. Big U.S. banks expect home prices to continue falling through next year.

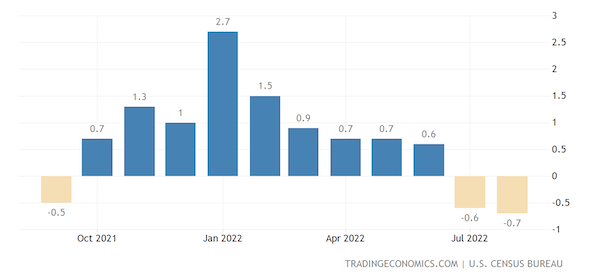

- Big U.S. home builders are walking away from contracts and unloading unfinished projects at a discount to investors as high mortgage rates push individual buyers out of the market. U.S. construction spending fell by 0.7% in August, the most in 1.5 years.

- U.S. retail vacancy fell to 6.1% in the second quarter, the lowest level in 15 years as brick-and-mortar stores emerge from the pandemic with surprising strength.

- U.S. air regulators are boosting rest periods for flight attendants in a move opposed by carriers due to the current labor shortage.

- Meatpacker JBS is closing its Planterra Foods plant-foods business in the U.S. after about two years, citing weak demand for plant-based meats.

International Markets

- COVID-19 infection rates are rising in 15 countries across Europe, raising concern about a pending virus wave.

- The United Nations is urging the U.S. Federal Reserve and other central banks to ease aggressive interest rates hikes due to the threat of recession.

- S&P Global’s index of European manufacturing activity fell to a 27-month low of 48.4 in September on soaring energy costs.

- The British pound regained some ground Monday after the U.K. government modified its extensive tax-cut plans that sent the currency to a record low. The currency remains down about 17% from a year ago.

- S&P Global’s index of Canadian manufacturing activity rose from a two-year low in August to 49.8 in September, narrowly remaining in contraction territory.

- Canadian consumer confidence has dropped for five straight weeks to a near-record low as households buckle under the weight of inflation, rising interest rates and a steep housing correction.

- Mexico’s manufacturing sector inched back into expansion territory in September following 2.5 years of contraction due to the economic fallout of the pandemic.

- Vietnam’s economy expanded 13.7% in the latest quarter on strong growth in exports.

- Israel’s central bank raised interest rates by 75 basis points to 2.75% Monday, the highest level in a decade.

- After four consecutive monthly 50-basis-point rate hikes, Australia eased its pace of increases with a 25-basis-point increase for October to 2.6%.

- Turkey’s inflation climbed to a 24-year high of 83.45% in September after the country’s central bank surprised markets by cutting rates twice in the last two months.

- London Heathrow will lift its 100,000-cap on daily passenger volumes later this month, the first easing since the cap was imposed in July.

- U.S. chipmaker Nvidia is ceasing all activities in Russia just months after suspending shipments to the country.

- U.S. and European regulators are working to tighten rules on sustainable investment products amid criticism over lax disclosure standards.

- The IMF says up to 20 countries, mostly in Africa, could need emergency aid to cope with worsening food shortages spurred by the pandemic.

Some sources linked are subscription services.