MH Daily Bulletin: November 30

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

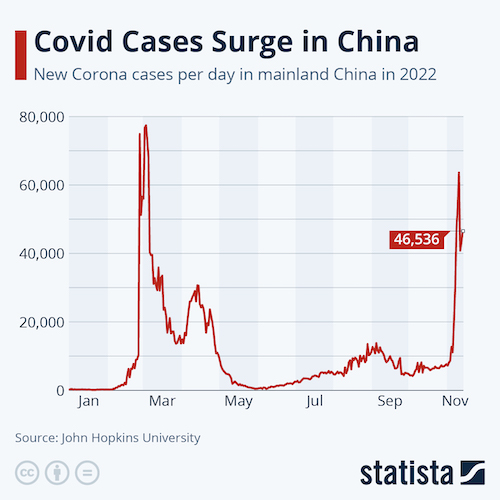

- Oil rose slightly Tuesday after Chinese health officials began softening their message on COVID-19, leading some to believe the nation will ease its tight pandemic controls.

- In mid-morning trading today, WTI futures were up 3.5% at $80.90/bbl, Brent was up 2.8% at $85.37/bbl, and U.S. natural gas was down 0.7% at $7.28/MMBtu.

- OPEC+ will likely decide to keep output levels flat at its meeting this Sunday, according to some delegates. In contrast, Goldman Sachs predicts the consortium will cut output targets and that crude will reach $110/bbl next year.

- U.S. crude stocks fell by a larger-than-expected 7.85 million barrels last week. Government data is due today, according to the American Petroleum Institute.

- The U.S. government says it will start refilling historically low emergency crude reserves when prices stay around $70/bbl.

- Venezuela is working to expand joint ventures between public and private oil firms in a move that will benefit Chevron’s new operating license in the country.

- Norway scrapped plans to issue some oil and gas exploration licenses through 2025 over climate concerns.

- Nigeria, Africa’s most populous country, plans to stop importing petroleum by fall 2023 as it builds out domestic refining capacity.

- More oil news related to the war in Europe:

- The EU is inching toward breaking its gridlock over a price cap on Russian oil, according to reports, with some countries asking for the price cap to be set barely above Russia’s production costs.

- Europe and Britain’s reliance on Russian diesel shows no sign of abating with just 10 weeks to go before sanctions block most trade in the fuel.

- Russia’s pipeline oil exports to China have been mostly flat this year even as seaborne shipments surged.

- Germany signed a 15-year LNG supply agreement with Qatar.

- Warm temperatures are reducing the chance that Britain will suffer a gas shortage this winter, officials say.

- The U.S. announced over $53 million in aid to help Ukraine rebuild its power grid.

- U.S. senators introduced a bill that would expand nationwide sales of high-ethanol E15 gasoline into the summer months.

- The U.S. government is floating new rules to curb gas flaring on public lands in a bid to slash methane emissions.

- Australia’s methane emissions are set to surge as it builds out domestic coal capacity.

- Africa will need $190 billion of energy investments each year between 2026 and 2030 to meet expected demand, power operators say.

- After years of development, consumer products made with captured greenhouse gases are starting to reach commercial sale.

Supply Chain

- Schools and some businesses were closed in Houston yesterday due to a shutdown of the city’s water system.

- U.S. lawmakers will take up legislation today in an effort to circumvent a possible nationwide strike by rail workers.

- Texas’ grid operator says the state should have sufficient capacity for the winter but rolling blackouts could still be required in the event of extreme weather like last February’s deadly “Texas Freeze.”

- Inadequate power supplies are starting to pose major risks to South Africa’s financial stability, according to the nation’s central bank.

- A wave of strikes by civil servants in the U.K. will start in mid-December and affect over 120 government departments.

- Widespread protests against Beijing’s COVID-zero policies will accelerate plans by companies to diversify away from China, experts say.

- Foxconn is resorting to large bonuses to entice COVID-weary workers back to the world’s largest iPhone factory in the Chinese city of Zhengzhou.

- U.S. legislation aimed at cracking down on labor abuse in China is holding up thousands of containers of solar panels at ports in California and Asia.

- Global container volumes fell 8.6% in September, according to maritime group Container Trade Statistics.

- German shipping groups say congestion at European ports is easing.

- Iowa-based Mid-Continent Trucking is closing after 24 years in business, citing weak economic conditions and tumbling freight rates.

- Hong Kong International Airport moved 341,000 metric tons of cargo in October, down 25% from a year ago.

- Ryanair says Boeing is falling behind on jet deliveries and could hamper the airline’s growth next year.

- Atlas Air took delivery of the first of four Boeing 777-200 freighters it will operate for MSC.

- Freight forwarder Kuehne + Nagel added a 747 freighter to its international operations.

- Amtrak reached a settlement with freight railroads over its plan to restore service along the Gulf Coast. The move comes as Amtrak’s passenger volumes return to pre-pandemic levels, some 90% higher than the same time in 2021.

- In the latest news from the auto industry:

- Some automakers are scaling back plans for self-driving technology after years of expensive and unfruitful development.

- New automakers in the electric-vehicle market are starting to chip away at Tesla’s dominance by offering more affordable cars.

- Tesla and Germany’s Annex Semiconductor are reportedly setting up a joint venture to make automotive chips in China.

- Volkswagen is in talks with Taiwan’s Foxconn about a partnership to build vehicles for the off-road Scout brand to sell in the U.S.

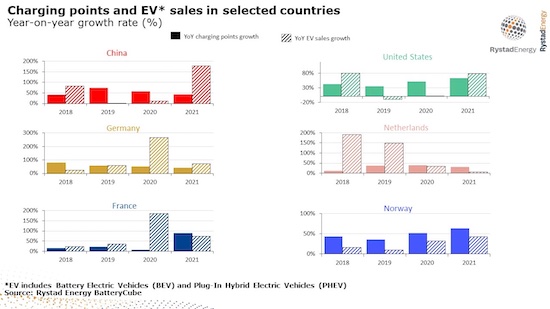

- Disagreements over who should reap the gains of selling electricity to drivers have stunted U.S. development of electric-vehicle charging infrastructure.

- Hyundai is on the hunt for a lithium-ion battery cell supplier in North America as the automaker prepares to build electric vehicles at plants in Georgia and Alabama.

- Indonesia plans to subsidize sales of electric vehicles and motorcycles starting next year as it also builds production capacity for key battery metals.

- Chinese electric-vehicle-maker BYD will launch its cars in Mexico next year.

- Renault and Nissan could start overhauling their alliance as early as next month as Renault looks to carve out its electric-vehicle business.

- The wait list for Ferrari’s new Purosangue SUV surpassed two years, prompting the automaker to halt accepting new orders.

- Light-vehicle output in the U.K. will rise 15% next year as chip shortages ease, industry groups say.

Domestic Markets

- The U.S. reported 45,422 new COVID-19 infections and 393 virus fatalities Tuesday.

- Around 90% of COVID-19 fatalities in the U.S. are among adults over age 65.

- Only about 10% of the U.S. population has received an updated COVID-19 booster shot against the Omicron variant.

- U.S. consumer confidence slipped to a four-month low in November, according to The Conference Board research group.

- More U.S. banks are tightening loan terms for large businesses and commercial real estate, a trend typically seen during recessions, according to the Federal Reserve.

- A leading index of home prices fell for the third straight month in September, with prices up 10.4% from September 2022, the lowest year-over-year increase in over a year:

- The nation’s housing market could slow for the next two years as higher borrowing costs dent demand, according to bankers.

- The U.S. government will back mortgages of over $1 million in expensive parts of the country, boosting last year’s price ceiling to keep up with higher home prices.

- Americans spent an average of $325 on holiday purchases over Thanksgiving break, up 8% from 2021, while a record 196.7 million shoppers made their purchases either online or in-store, according to the National Retail Federation.

- Steep discounts from companies with excessive inventories are putting pressure on firms to discount big this holiday season even if they don’t need to.

- AMC Networks plans to lay off one-fifth of its U.S. staff as the firm struggles to generate revenue amid the switch from cable to streaming.

- Drugmaker Horizon Therapeutics is fielding takeover interest as large pharmaceutical companies compete for fast-growing medicines to fuel sales.

International Markets

- China reported 38,645 COVID-19 infections Tuesday, slightly down from Monday’s record high. Authorities sent university students home and flooded streets with police in an attempt to disperse widespread anti-government protests.

- COVID-19 infections are up 40% the past month in France.

- Eurozone year-over-year inflation fell to 10% in November from 10.6% in October, the first decline since mid-2021, driven by lower energy costs.

- German consumer prices rose 11.3% year over year in November, cooling slightly from the month before but remaining near record highs.

- JPMorgan Chase expects Britain’s economy to contract 0.6% next year as it enters a lengthy period of stagnation.

- The Canadian economy expanded 0.7% from the second to third quarter, the fifth straight quarter of growth.

- Cash-strapped governments across much of the developing world are cutting spending and freezing investments due to a wave of higher borrowing rates spurred by the U.S. Federal Reserve’s battle with inflation.

- Nestle, the world’s largest packaged food company, raised its 2022 sales guidance for the third time this year.

- Budget U.K. airline easyJet saw record financials in the latest quarter as passenger demand remains strong.

- Canadian plane maker Bombardier secured a $312 million deal to supply four business aircraft to the world’s largest fleet of private jets.

- The EU updated its drone rules to encourage rapid adoption of the machines in industries ranging from agriculture to urban planning.

Some sources linked are subscription services.